In the methodology of economics, techniques of economic statics and dynamics occupy an important place.

A greater part of economic theory has been formulated with the aid of the technique of economic statics.

However, during the last eighty years (since 1925) dynamic technique has been increasingly applied to the various fields of economic theory. J. M. Clark’s principle of acceleration and Aftalion theory of business fluctuations resulting from the lagged over-response of output to previous capital formation are some examples of dynamic models which appeared before 1925.

But prior to 1925, dynamic analysis was mainly confined, with some exceptions, to the explanation of business cycles. After 1925, dynamic analysis has been used extensively not only for the explanation of business fluctuations but also for income determination, growth and price theories. Economists like R. Frisch, C. F. Roos, J. Tinbergen, M. Kalecki, Paul Samuelson and many others have formulated dynamic models which give rise to cycles of varying periodicity and amplitude.

ADVERTISEMENTS:

English writers such as Robertson, Keynes, Haberler, Kahn, and Swedish economists such as, Myrdal, Ohlin, Lindahl and Lunberg have laid a great stress on economic dynamics in the sphere of income analysis. More recently, economists like Samuelson, Goodwin, Smithies, Domar, Metzler, Haavelmo, Klein, Hicks, Lange, Koopmans and Tinter have further extended and developed dynamic models concerning the stability and fluctuations around any equilibrium point or path and which cover the four important fields of economic theory, namely, cycles, income determination, economic growth and price theory.

We shall explain below the meaning and nature of economic statics, dynamics and comparative statics and shall bring out the distinction between them. There has been a lot of controversy about their true meaning and nature, especially about economic dynamics.

Nature of Economic Statics:

The method of economic statics is very important since, as noted above, a large part of economic theory has been formulated with its aid. Besides, the conception of economic dynamics cannot be understood without being clear about the meaning of statics because one thing which is certain about economic dynamics is that it is ‘not statics’. J. R. Hicks aptly remarks, “The definition of Economic Dynamics must follow from the definition of Economic Statics; when we have defined one, we have defined the other.

ADVERTISEMENTS:

In order to make the difference between the natures of economic statics and dynamics quite clear, it is essential to bring out the distinction between two sorts of phenomena, stationary and changing. An economic variable is said to be stationary, if the value of the variable does not change over time, that is, its value is constant over time. For instance, if the price of a good does not change as time passes, price will be called stationary.

Likewise, national income is stationary if its magnitude does not change through time. On the other hand, the variable is said to be changing (non-stationary) if its value does not remain constant through time. Thus, the whole economy can be said to be stationary (changing), if values of all important variables are constant through time (are subject to change).

It may be noted that the various economic variables whose behaviour over time is studied are prices of goods, quantity supplied, quantity demanded, national income, level of employment, the size of the population, the level of investment, etc.

It is worth mentioning that it is quite possible that whereas a variable may be changing from the micro point of view, but stationary from the macro point of view. Thus, the prices of individual goods may be changing, of which some may be rising and some falling, but the general price level may remain constant over time. Likewise, the national income of a country may be stationary while the incomes generated by various industries may be changing.

ADVERTISEMENTS:

On the other hand, the particular variables may be stationary, while the economy as a whole may be changing. For example, even if the level of net investment in the economy is stationary, the economy as a whole may not be stationary. When there is a constant amount of net positive investment per annum, the economy will be growing (changing) since addition to its stock of capital will be occurring.

It should be carefully noted that there is no necessary relationship between stationary phenomenon and economic statics, and the changing phenomenon and dynamics. Although economic dynamics is inherently connected with only a changing phenomenon but the static analysis has been extensively applied to explain the changing phenomena.

The distinction between statics and dynamics is the difference between the two different techniques of analysis and not the two different sorts of phenomena. Prof. Tinbergen rightly remarks, “The distinction between Statics and Dynamics is not a distinction between two sorts of phenomena but a distinction between two sorts of theories, i.e., between two ways of thinking. The phenomena may be stationary or changing, the theory (the analysis) may be Static or Dynamic”

Static Analysis and Functional Relationships:

The test of economic theory is to explain the functional relationships between a system of economic variables. These relationships can be studied in two different ways. If the functional relationship is established between two variables whose values relate to the same point of time or to the same period of time, the analysis is said to be static. In other words, the static analysis or static theory is the study of static relationship between relevant variables.

A functional relationship between variables is said to be static if the values of the economic variables relate to the same point of time or to the same period of time. Numerous examples of static relationships between economic variables and the theories or laws based upon them can be given. Thus, in economics the quantity demanded of a good at a time is generally thought to be related to the price of the good at the same time.

Accordingly, the law of demand has been formulated to establish the functional relationship between the quantity demanded of a good and its price at a given moment of time. This law states that, other things remaining the same, the quantity demanded varies inversely with price at a given point of time. Similarly, the static relationship has been established between the quantity supplied and the price of goods, both variables relating to the same point of time. Therefore, the analysis of this price-supply relationship is also static.

Micro-Statics and Macro-Statics:

Generally, economists are Interested in the equilibrium values of the variables which are attained as a result of the adjustment of the given variables to each other. That is why economic theory has sometimes been called equilibrium analysis. Until recently, the whole price theory in which we explain the determination of equilibrium prices of products and factors in different market categories was mainly static analysis, because the values of the various variables, such as demand, supply, and price were taken to be relating to the same point or period of time.

ADVERTISEMENTS:

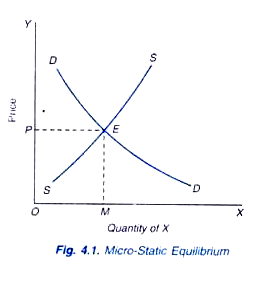

Thus, according to this micro-static theory, equilibrium at a given moment of time under perfect competition is determined by the intersection of given demand and the supply functions (which relate the values of variables at the same point of time). Thus in Figure 4.1 given the demand function as demand curve DD and the supply function SS, the equilibrium price OP is determined.

The equilibrium amount supplied and demanded so determined is OM. This is a static analysis of price determination, for all the variables such as, quantity supplied, quantity demanded and the price refer to the same point or period of time. Moreover, the equilibrium price and quantity determined by their interaction also relate to the same time as the determining variables.

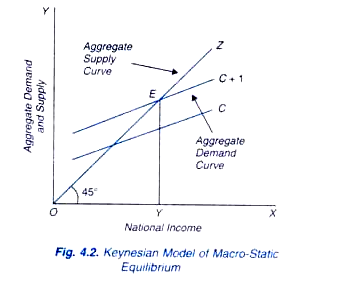

Examples of static analysis can also be given from macroeconomic theory. Keynesian macro model of the determination of level of national income is also mainly static. According to this model, national income is determined by the intersection of aggregate demand curve and aggregate supply curve (45° line) as is depicted in Figure 4.2 where the vertical axis measures consumption demand plus investment demand (C + l) and aggregate supply, and the X-axis measures the level of national income. Aggregate demand equals aggregate supply at point E and income OY is determined.

This is static analysis since aggregate demand (consumption and investment) and aggregate supply of output refer to the same point of time and element of time is not taken into account in considering the adjustment of the various variables in the system to each other. In other words, this analysis refers to instantaneous or timeless adjustment of the relevant variables and the determination of equilibrium level of national income.

ADVERTISEMENTS:

Professor Schumpeter describes the meaning of static analysis as follows: “By static analysis we mean method of dealing with economic phenomena that tries to establish relations between elements of the economic system—prices and quantities of commodities all of which have the same time subscript, that is to say, refer to the same point of time. The ordinary theory of demand and supply in the market of an individual commodity as taught in every textbook will illustrate this case: it relates demand, supply and price as they are supposed to be at any moment of observation.”

Assumptions of Static Analysis:

ADVERTISEMENTS:

A point worth mentioning about static analysis is that in it certain determining conditions and factors are assumed to remain constant at the point of time for which the relationship between the relevant economic variables and the outcome of their mutual adjustment is being explained. Thus, in the analysis of price determination under perfect competition described above, the factors such as incomes of the people, their tastes and preferences, the prices of the related goods which affect the demand for a given commodity are assumed to remain constant.

Similarly, the prices of the productive resources and production techniques which affect the cost of production and thereby the supply function are assumed to remain constant. These factors or variables do change with time and their changes bring about shift in the demand and supply functions and therefore affect prices.

But because in static analysis we are concerned with establishing the relationship between certain given variables and their adjustment to each other at a given point of time, changes in the other determining factors and conditions are ruled out. We, in economics, generally use the term data for the determining conditions or the values of the other determining factors. Thus, in static analysis, data are assumed to be constant and we find out the eventual consequence of the mutual adjustment of the given variables.

It should be noted that assuming the data to be constant is very much the same thing as considering them at a moment of time or in other words allowing them a very short period of time’ within which they cannot change. Moreover, the crucial point about static analysis is that the given conditions or data are supposed to be independent of the behaviour of variables or units in the given system between which functional relationship is being studied.

Thus, in the above static price analysis it is assumed that variables in the system, that is, price of the good, quantity supplied and quantity demanded do not influence the determining conditions or data of incomes of the people, their tastes and preferences, the prices of the related goods, etc. Thus, the relationship between the data and the behaviour of the economic variables in a given system is assumed to be one-way relationship; the data influence the variables of the given system and not the other way around.

On the contrary, we shall see below that in dynamic analysis the determinant data or determining conditions are not assumed to be constant. In dynamic analysis, certain elements in the data are not independent of the behaviour of the variables in a given system. In fact, in a fully dynamic system, it is hard to distinguish between data and variables since in a dynamic system over time “today’s determinant data are yesterday’s variables and today’s variables become tomorrow’s data. The successive situations are interconnected like the links of a chain.”

ADVERTISEMENTS:

Since in static analysis, we study the behaviour of a system at a particular time, or in other words, in economic statics, we do not study the behaviour of a system over time. Therefore how the system has proceeded from a previous position of equilibrium to the one under consideration is not studied in economic statics. Prof. Stanley Bober rightly remarks.

“A static analysis concerns itself with the understanding of what determines an equilibrium position at any moment in time. It focuses attention on the outcome of economic adjustments and is not concerned with the path by which the system, be it the economy in the aggregate or a particular commodity market, has proceeded from a previous condition of equilibrium to the one under consideration.”

Relevance of Static Analysis:

Now, the question arises as to why the technique of static analysis is used which appears to be unrealistic in view of the fact that determining conditions or factors are never constant. Static techniques are used because it makes the otherwise complex phenomena simple and easier to handle. To establish an important causal relationship between certain variables, it becomes easier if we assume other forces and factors constant, not that they are inert but for the time it is helpful to ignore their activity.

According to Robert Dorfman, “Statics is much more important than dynamics, partly because it is the ultimate destination that counts in most human affairs, and partly because the ultimate equilibrium strongly influences the time paths that are taken to reach it, whereas the reverse influence is much weaker”.

To sum up, in static analysis we ignore the passage of time and seek to establish the causal relationship between certain variables relating to the same point of time, assuming some determining factors as remaining constant. To quote Samuelson who has made significant contributions to making clear the distinction between the methods of economic statics and dynamics, “Statics concerns itself with the simultaneous and instantaneous or timeless determination of economic variables by mutually interdependent relations.

ADVERTISEMENTS:

Even a historically changing world may be treated statically, each of its changing positions being treated as successive states of static equilibrium.” In another article he says, ‘Statical then refers to the form and structure of the postulated laws determining the behaviour of the system. An equilibrium defined as the intersection of a pair of curves would be statical. Ordinarily, it is ‘timeless’ in that, nothing is specified concerning the duration of the process, but it may very well be defined as holding over time.”

Comparative Statics:

We have studied above static and dynamic analysis of the equilibrium position. To repeat, static analysis is concerned with explaining the determination of equilibrium values with a given set of data and the dynamic analysis explains how with a change in the data the system gradually grows out from one equilibrium position to another. Midway between the static and dynamic analyses is the comparative static analysis.

Comparative static analysis compares one equilibrium position with another when the data have changed and the system has finally reached another equilibrium position. It does not analyse the whole path as to how the system grows out from one equilibrium position to another when the data have changed; it merely explains and compares the initial equilibrium position with the final one reached after the system has adjusted to a change in data. Thus, in comparative static analysis, equilibrium positions corresponding to different sets of data are compared.

Professor Samuelson writes:

“It is the task of comparative statics to show the determination of the equilibrium values of given variables (unknowns) under postulated conditions (functional relationships) with various data (parameters) specified. Thus, in the simplest case of a partial equilibrium market for a single commodity the two independent relations of supply and demand, each drawn up with other prices and institutional data being taken as given determine by their interaction the equilibrium quantities of the unknown price and quantity sold.

ADVERTISEMENTS:

If no more than this could be said, the economist would be truly vulnerable to that he is only a parrot, taught to say ‘supply and demand.’ Simply to know that there are efficacious ‘laws’ determining equilibrium tells us nothing of the character of these laws. In order for the analysis to be useful it must provide information concerning the way in which our equilibrium quantities will change as a result of changes in the parameters— taken as independent data”.

It should be noted that for better understanding of the changing system, comparative statics studies the effect on the equilibrium position of a change in only a single datum at a time rather than the effects of changes in the many or all variables constituting the data. By confining ourselves to the adjustment in the equilibrium position as a result of alteration in a single datum at a time, we keep our analysis simple, manageable and at the same time useful, instructive as well as adequate enough to understand the crucial aspects of the changing phenomena.

To quote Erich Schneider:

The set of data undergoes changes in the course of time, and each new set of data has a new equilibrium position corresponding to it. It is therefore of great interest to compare the different equilibrium positions corresponding to different sets of data. In order to understand the effect of a change in the set of data on the corresponding position of equilibrium, we must only alter a single datum at a time. Only in this way it is possible to understand fully the effects of alterations in the individual data.

We ask, to start with, about set I of the data, and the equilibrium position corresponding to it, then study next equilibrium position corresponding to set II of the data, where set II differs from set I only in the alteration of a single datum. In this way we compare the equilibrium values for the system corresponding to the two equilibrium positions with one another. This sort of comparative analysis of two equilibrium positions may be described as comparative-static analysis, since it studies the alteration in the equilibrium position corresponding to an alteration in a single datum”.

Let us give some examples of comparative static analysis from the microeconomic theory. We know that given the data regarding consumer’s tastes, incomes, prices of other goods on the one hand and the technological conditions, costs of machines and materials, and wages of labour we have given demand and supply functions which by their interaction determine the price of a good.

ADVERTISEMENTS:

Now suppose that other things remaining constant, incomes of consumers increase. With the increase in incomes, the demand function would shift upward. With the change in the demand as a result of the change in the income, the supply would adjust itself and final new equilibrium position would be determined. To explain the determination of new equilibrium price and how it differs from the initial one is the task of comparative statics.

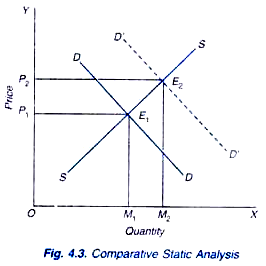

In Figure 4.3, initially the demand and supply functions are DD and SS and with their interaction price OP1 is determined. When the demand function changes to D’D’ as a result of changes in consumers’ income, it intersects the given supply function at E2 and the new equilibrium price OP2 is determined.

In comparative-static analysis, we are concerned only with explaining the new equilibrium E2 position comparing it with E1, and not with the whole path the system has traversed as it gradually grows out from to E2. As we shall study in the part of price theory, comparative static analysis was extensively used by Alfred Marshall in his time-period analysis of pricing under perfect competition.

Importance of Comparative Statics:

No doubt, more realistic, complete and true analysis of the changing phenomena of the real world would be the dynamic analysis nevertheless comparative statics is a very useful technique of explaining the changing phenomena and its crucial aspects without complicating the analysis.

To quote Schneider again. “This sort of dynamic analysis of the influence of a change in data is much more comprehensive and informative than the mere static analysis of two different sets of data and of the equilibrium positions corresponding to them. Nevertheless, the comparative static treatment provides some important insights into the mechanism of the exchange economy”.

Likewise, Professors Stonier and Hague write, “The construction of a truly dynamic theory of economics, where more continuous changes in demand and supply conditions, like those which occur in the real world, are analysed, is the ultimate goal of most theories of economics…. However, so far as the determination of price and output is concerned, simple comparative static analysis…. is as powerful an analytical method as we need”.

Economic Dynamics:

Now, we turn to the method of Economic Dynamics which has become very popular in modern economics. Economic dynamics is a more realistic method of analysing the behaviour of the economy or certain economic variables through time. The definition of economic dynamics has been a controversial issue and it has been interpreted in various different ways. We shall try to explain the standard definitions of economic dynamics.

The course thorough time of a system of economic variables can be explained in two ways. One is the method of economic statics described above, in which the relations between the relevant variables in a given system refer to the same point or period of time. On the other hand, if the analysis considers the relationship between relevant variables whose values belong to different points of time it is known as Dynamic Analysis or Economic Dynamics.

The relations between certain variables, the values of which refer to the different points or different periods of time, are known as dynamic relationships. Thus, J.A. Schumpeter says, “We call a relation dynamic if it connects economic quantities that refer to different points of time. Thus, if the quantity of a commodity that is offered at a point of time (t) is considered as dependent upon the price that prevailed at the point of time (t-l), this is a dynamic relation. In a word, economic dynamics is the analysis of dynamic relationships.

We thus see that in economic dynamics we duly recognize the element of time in the adjustment of the given variables to each other and accordingly analyse the relationships between given variables relating to different points of time.

Ragnar Frisch who is one of the pioneers in the use of the technique of dynamic analysis in economics defines economic dynamics as follows:

“A system is dynamical if its behaviour over time is determined by functional equations in which variables at different points of time are involved in a essential way. In dynamic analysis, he further elaborates, “We consider not only a set of magnitudes in a given point of time and study the interrelations between them, but we consider the magnitudes of certain variables in different points of time, and we introduce certain equations which embrace at the same time several of those magnitudes belonging to different instants. This is the essential characteristic of a dynamic theory. Only by a theory of this type we can explain how one situation grows out of the foregoing.

Many examples of dynamic relationships from both micro and macroeconomic fields can be given. If one assumes that the supply (S) for a good in the market in the given time (t) depends upon the price that prevails in the preceding period (that is, t – 1), the relationship between supply and price is said to be dynamic.

This dynamic functional relation can be written as:

St = f (Pt-1)

where St Stands for the supply of a good offered in a given period f and Pt-1for the price in the preceding period. Likewise, if we grant that the quantity demanded (D1) of a good in a period Ms a function of the expected price in the succeeding period (t +1), the relation between demand and price will be said to be dynamic and the analysis of such relation would be called dynamic theory or economic dynamics.

Similarly, examples of dynamic relationship can be given from the macro field. If it is assumed that the consumption of the economy in a given period depends upon the income in the preceding period (t – 1), we shall be conceiving a dynamic relation.

This can be written as:

Ct = f (Yt-1)

When macroeconomic theory (theory of income, employment and growth) is treated dynamically, that is, when macroeconomic dynamic relationships are analysed, the theory is known as “Macro dynamics”. Samuelson, Kalecki, Post-Keynesians like Harrod, Hicks have greatly dynamized the macroeconomic theory of Keynes.

Endogenous Changes and Dynamic Analysis:

It should be noted that the change or movement in a dynamic system is endogenous, that is, it goes on independently of the external changes in it; one change grows out of the other. There may be some initial external shock or change but in response to that initial external change, the dynamical system goes on moving independently of any fresh external changes, successive changes growing out of the previous situations.

In other words, the development of a dynamic process is self-generating. Thus, according to Paul Samuelson, It is important to note that each dynamic system generates its own behaviour over time either as an autonomous response to a set of ‘initial conditions’, or as a response to some changing external conditions. This feature of self-generating development over time is the crux of every dynamic process. Likewise, Professor J. K. Mehta remarks.

“In simple words, we can say that an economy can be said to be in a dynamical system when the various variables in it such as output, demand, prices have values at any time dependent on their values at some other time. If you know their values at one moment of time, you should be able to know their values at subsequent points of time. Prices of goods in a causal dynamic system do not depend on any outside exogenous forces. A dynamic system is self-contained and self-sustained”.

It is thus clear that a distinctive feature of dynamic analysis is to show how a dynamic process or system is self-generating, how one situation in it grows out of a previous one or how one situation moves on independently of the changes in external conditions. As Schneider, a German economist, has aptly and precisely put it, “A dynamic theory shows how in the course of time a condition of the economic system has grown out of its condition in the previous period of time. It is this form of analysis which has the central importance for the study of the process of economic developments, be they short-run or long-run processes.

An illustration of dynamic analysis may be given. level of national income is determined by the equilibrium between given aggregate demand curve and the aggregate supply curve. Now, if the aggregate demand increases, due to the increase in investment, the aggregate demand curve will shift upward and as a consequence the new equilibrium point will be reached and level of national income will rise.

In static analysis, the new equilibrium is supposed to occur instantaneously (timeless) and no attention is paid how the new equilibrium position of income has grown out of the original through time when the increase in aggregate demand has taken place.

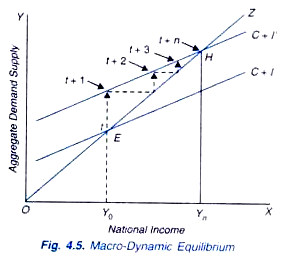

That is to say, the dynamic analysis traces out the whole path through which the system passes over time to reach the new equilibrium position. We present in Figure 4.5 the common macro model of income determination. Given the aggregate demand C + 1, the level of national income OY0 is determined y in time t. Suppose now the aggregate demand curve shifts upward due to the increase in investment in time period t.

As the investment increases in time-period t, the income will rise in time period t + 1 by the amount of the investment. Now, this increase in income will push up the consumption demand. To meet this increase in consumption, output will be increased with the result that income will further rise in period t + 2. This additional increase in income will induce further increase in consumption with the result that more output will be produced to meet the rise in demand and the income in period t + 3 will still further rise.

In this way, the income will go on rising; one increase in income giving rise to another till the final equilibrium point H is reached in the time period t + n in which the level of income OYn is determined. The path by which the income increases through time is shown in the figure by dotted arrow lines. This illustration of macro-dynamics makes it clear that the dynamic analysis is concerned with how magnitude of variables in a period (income and consumption in the present illustration) depends upon the magnitudes of the variables in the previous periods.

Hicks’ Definition of Economic Dynamics:

In the light of our above explanation of the meaning of the method of economic dynamics, we are in a position to examine the definition of dynamics given by J. R. Hicks in his book ‘Value and Capital’. Hicks says, “I call Economic Statics those parts of economic theory where we do not trouble about dating. Economic Dynamics those parts where every quantity must be dated.

This is a very simple way of defining dynamics. When the magnitude of variables does not change with time, the dating of the quantities of variables is not necessary. In the absence of change in the economic variables determining the system, an equilibrium position that applies to the present will apply equally well to the future.

But in our view, this is not a satisfactory definition of economic dynamics. A system may be statical, but still may be dynamic according to Hicksian definition if some dates are attached to variables. Thus, a statical system may be converted into Hicksian dynamics by merely assigning some dates to the variables. But this is not true meaning of economic dynamics, as is now generally conceived. Mere dating of variables is not enough.

As has been made clear by Ragnar Frisch, variables in the system must relate to different dates or different points of time, if it is to be a truly dynamic system. Secondly, as has been contended by Paul Samuelson, this “Hicksian definition is too general and insufficiently precise. According to Paul Samuelson, Hicksian definition of dynamics would cover a historical static system of variables. An historically moving static system certainly requires dating of the variables but it would not thereby become dynamic.

A system of variables to be called dynamic must involve functional relationships between the variables, that is, the variables at one point of time must be shown to be dependent upon the variables at other points of time. Thus, according to Samuelson,” a system is dynamical if its behaviour over time is determined by functional equations in which variables at different points of time are involved in an essential way.

Thus, Samuelson’s emphasis is on functional relationships as well as on different points of time. We therefore conclude that a dynamical system involves functional relationships between variables at different points of time. A historically moving system does not necessarily involve the functional relationships between the variables at different historical times.

The historical movement of a system may not be dynamical. For instance, as has been pointed out by Samuelson, if one year crop is high because of good monsoons, the next year low because the monsoons fail, and so forth, the system will be statical even though not stationary.

The concept or technique of economic dynamics which we have explained above was first of all clarified by Ragnar Frisch in 1929. According to his view, like static analysis, economic dynamics is a particular method of explanation of economic phenomenon economic phenomena themselves may be stationary or changing. Although technique of dynamic analysis has great scope in a changing and a growing system but it may also be applied even to stationary phenomena.

A system or phenomenon may be stationary in the sense that the values of relevant economic variables in it may remain constant through time, but if the values of the variables at a time are dependent upon the values at another time, then dynamic analysis can be applied. But, as stated above, the greater scope of economic dynamics lies in the field of changing and growing phenomena. Schneider aptly brings out the distinction between statics and dynamics on the one hand and stationary and changing phenomena on the other when he writes.

It is essential to understand that in modern theory ‘statics’ and ‘dynamics’ refer to a particular mode of treatment or type of analysis of the phenomena observed, while the adjectives ‘stationary’ and ‘changing’ describe the actual economic phenomena. A static or dynamic theory is a particular kind of explanation of economic phenomena, and, indeed, stationary and changing phenomena can be submitted either to a static or to a dynamic analysis.

Expectations and Dynamics:

We have described abovethat economic dynamics is concerned with explaining dynamic relationships, that is, the relationships among variables relating to different points of time. The variables at the present moment may depend upon the variables at other times, past and future. Thus, when the relationship between the economic variables belonging to different points of time is considered, or when rates of change of certain variables in a growing economy are under discussion, the question of future creeps into the theoretical picture.

The economic units (such as consumers, producers and entrepreneurs) have to take decisions about their behaviour in the present period. The consumers have to decide what goods they should buy and what quantities of them. Similarly, producers have to decide what goods they should produce, what factors they should use and what techniques they should adopt.

These economic units decide about their present course of action on the basis of their expected values of the economic variables in the future. When their expectations are realised, they continue behaving in the same way and the dynamic system is in equilibrium. In other words, when the expectations of the economic units are fulfilled, they repeat the present pattern of behaviour and there exists what has been called dynamic equilibrium, unless some external shock or force disturbs the dynamic system.

The expectations or anticipations of the future held by the economic units play a vital role in economic dynamics. In a purely static theory expectations about the future have practically no part to play since static theory is mainly concerned with explaining the conditions of equilibrium positions at a point of time as well as under the assumptions of constant tastes, techniques and resources.

Thus, in static analysis expectations about the future play little part since under it no processes-aver time are considered. On the other hand, since dynamic analysis is concerned with dynamic processes over time, that is, changing variables over time and their action and interaction upon each other through time, expectations or anticipations held by the economic units about the future have an important place.

But from the intimate relation between dynamics and expectations it should not be understood that mere introduction of expectations in static analysis would make it dynamic. Whether the analysis is dynamic or not depends upon whether the relationship between variables belonging to different points or periods of time is considered or not, or whether rates of change of certain variables over time are considered or not. German economist Schneider rightly says, “A theory is not to be considered as dynamic simply because it introduces expectations, whether that is the case or not depends simply on whether or not the expected values of the single variables relate to different periods or points of time.”

Moreover, it is important to note that a theory becomes truly dynamic only if in it the expectations are taken as a variable and not as a given data. In other words, in a really dynamic theory, expectations should be considered as changing over time rather than remaining constant. A dynamic theory should tell us what would happen if, the expectations of the economic units are realised and what would happen if they have not come true.

In Harrod’s macro-dynamic model of a growing economy that if the entrepreneurs expect the rate of growth of output equal to s/C (whereas S stands for rate of saving and C for capital-output ratio) their expectations would be realised and as a result the relevant variables in the system will move in equilibrium over time and there will be a steady growth in the economy. If their expectations about the rate of growth are smaller or larger than s/C, they will not be realised and as a consequence there will be instability in the economy.

When the expectations of the individuals turn out to be incorrect, they will revise or change their expectations. Because of the changing nature of these expectations they should not be taken as given data or given conditions in a dynamic theory. To take expectations as given data means that they remain constant even if they turn out to be incorrect.

That is to say, even when the individuals are surprised by the actual events because their expectations have not been fulfilled, they will continue to have the same expectations. But that will amount to be assuming irrationality on the part of the individuals. We, therefore, conclude that expectations must be taken as changing in the dynamic system and not as a given condition.

Need and Significance of Economic Dynamics:

The use of dynamic analysis is essential if we want to make our theory realistic. In the real world, various key variables such as prices of goods, the output of goods, the income of the people, the investment and consumption are changing over time. Both Frischian and Harrodian dynamic analyses are required to explain these changing variables and to show how they act and react upon each other and what results flow from their action and interaction.

Many economic variables take time to make adjustment to the changes in other variables. In other words, there is a lag in the response of some variables to the changes in the other variables, which make it necessary that dynamic treatment be given to them. We have seen that changes in income in one period produce influence on consumption in a later period. Many similar examples can be given fpm micro and macro-economics.

Besides, it is known from the real world that the values of certain variables depend upon the rate of growth of other variables. For example, we have seen in Harrod’s dynamic model of a growing economy that investment depends upon expected rate of growth in output. Similarly, the demand for a good may depend upon the rate of change of prices.

Similar other examples can be given. In such cases where certain variables depend upon the rate of change in other variables, the application of both the period analysis and the rate of change analysis of dynamic economics become essential if we want to understand their true behaviour.

Until recently, dynamic analysis was mainly concerned with explaining business cycles, fluctuations or oscillations. But, after Harrod’s and Domar’s path-breaking contributions, the interest in the problems of growth has been revived among economists. It is in the study of growth that dynamic analysis becomes more necessary. Now-a-days economists are engaged in building dynamic models of optimum growth both for developed and developing countries of the world.

Thus, in recent years, the stress on dynamic analysis is more on explaining growth rather than cycles or oscillations. Prof. Hansen is right when he says, “In my own view mere oscillation represents a relatively unimportant part of economic dynamics. Growth, not oscillation, is the primary subject-matter for study in economic dynamics. Growth involves changes in technique and increases in population. Indeed that part of cycle literature (and cycle theories are a highly significant branch of dynamic economics) which is concerned merely with oscillation is rather sterile.