In this essay we will discuss about International Trade. After reading this essay you will learn about: 1. Introduction to Theories of International Trade 2. Theory of Mercantilism of International Trade 3. Theory of Absolute Advantage 4. Theory of Comparative Advantage 5. Factor Endowment Theory 6. Country Similarity Theory 7. New Trade Theory 8. International Product Life-Cycle Theory and Other Details.

Contents:

- Essay on Introduction to Theories of International Trade

- Essay on the Theory of Mercantilism of International Trade

- Essay on the Theory of Absolute Advantage of International Trade

- Essay on the Theory of Comparative Advantage of International Trade

- Essay on the Factor Endowment Theory of International Trade

- Essay on the the Country Similarity Theory of International Trade

- Essay on the the New Trade Theory of International Trade

- Essay on the International Product Life-Cycle Theory of International Trade

- Essay on the Theory of Competitive Advantage of International Trade

- Essay on the Implications of International Trade Theories

Essay # 1. Introduction to Theories of International Trade:

The exchange of goods across national borders is termed as international trade. Countries differ widely in terms of the products and services traded. Countries rarely follow the trade structure of other nations; rather they evolve their own product portfolios and trade patterns for exports and imports. Besides, nations have marked differences in their vulnerabilities to the upheavals in exogenous factors.

Trade is crucial for the very survival of countries that have limited resources, such as Singapore or Hong Kong (presently a province of China), or countries that have skewed resources, such as those located in the Caribbean and West Asian regions. However, for countries with diversified resources, such as India, the US, China, and the UK, engagement in trade necessitates a logical basis.

ADVERTISEMENTS:

The trade patterns of a country are not a static phenomenon; rather these are dynamic in nature. Moreover, the product profile and trade partners of a country do change over a period of time. Till recently, the Belgian city of Antwerp, the undisputed leader in diamond polishing and trade, had witnessed a shift of diamond business to India and other Asian countries, as given in Exhibit 2.1.

It is also imperative for international business managers to find answers to some basic issues, such as why do nations trade with each other?

Is trading a zero-sum game or a mutually beneficial activity?

Why do trade patterns among countries exhibit wide variations?

ADVERTISEMENTS:

Can government policies influence trade?

Theories of international trade provide the raison d’etre for most of these queries.

Trade theories also offer an insight, both descriptive and prescriptive, into the potential product portfolio and trade patterns. They also facilitate in understanding the basic reasons behind the evolution of a country as a supply base or market for specific products.

ADVERTISEMENTS:

The principles of the regulatory frameworks of national governments and international organizations are also influenced to a varying extent by these basic economic theories.

Essay # 2. Theory of Mercantilism of International Trade:

The theory of mercantilism attributes and measures the wealth of a nation by the size of its accumulated treasures. Accumulated wealth is traditionally measured in terms of gold, as earlier gold and silver were considered the currency of international trade. Nations should accumulate financial wealth in the form of gold by encouraging exports and discouraging imports.

The theory of mercantilism aims at creating trade surplus, which in turn contributes to the accumulation of a nation’s wealth. Between the sixteenth and nineteenth centuries, European colonial powers actively pursued international trade to increase their treasury of goods, which were in turn invested to build a powerful army and infrastructure.

The colonial powers primarily engaged in international trade for the benefit of their respective mother countries, which treated their colonies as exploitable resources. The first ship of the East India Company arrived at the port of Surat in 1608 to carry out trade with India and take advantage of its rich resources of spices, cotton, finest muslin cloth, etc.

Other European nations—such as Germany, France, Portugal, Spain, Italy—and the East Asian nation of Japan also actively set up colonies to exploit the natural and human resources.

Mercantilism was implemented by active government interventions, which focused on maintaining trade surplus and expansion of colonization. National governments imposed restrictions on imports through tariffs and quotas and promoted exports by subsidizing production.

The colonies served as cheap sources for primary commodities, such as raw cotton, grains, spices, herbs and medicinal plants, tea, coffee, and fruits, both for consumption and also as raw material for industries. Thus, the policy of mercantilism greatly assisted and benefited the colonial powers in accumulating wealth.

The limitations of the theory of mercantilism are as follows:

i. Under this theory, accumulation of wealth takes place at the cost of another trading partner. Therefore, international trade is treated as a win-lose game resulting virtually in no contribution to the global wealth. Thus, international trade becomes a zero-sum game.

ADVERTISEMENTS:

ii. A favourable balance of trade is possible only in the short run and would automatically be eliminated in the long run, according to David Hume’s Price-Specie- Flow doctrine. An influx of gold by way of more exports than imports by a country raises the domestic prices, leading to increase in export prices.

In turn, the county would lose its competitive edge in terms of price. On the other hand, the loss of gold by the importing countries would lead to a decrease in their domestic price levels, which would boost their exports.

iii. Presently, gold represents only a minor proportion of national foreign exchange reserves. Governments use these reserves to intervene in foreign exchange markets and to influence exchange rates.

iv. The mercantilist theory overlooks other factors in a country’s wealth, such as its natural resources, manpower and its skill levels, capital, etc.

ADVERTISEMENTS:

v. If all countries follow restrictive policies that promote exports and restrict imports and create several trade barriers in the process, it would ultimately result in a highly restrictive environment for international trade.

vi. Mercantilist policies were used by colonial powers as a means of exploitation, whereby they charged higher prices from their colonial markets for their finished industrial goods and bought raw materials at much lower costs from their colonies. Colonial powers restricted developmental activities in their colonies to a minimum infrastructure base that would support international trade for their own interests. Thus, the colonies remained poor.

A number of national governments still seem to cling to the mercantilist theory, and exports rather than imports are actively promoted. This also explains the raison d’etre behind the ‘import substitution strategy’ adopted by a large number of countries prior to economic liberalization.

This strategy was guided by their keenness to contain imports and promote domestic production even at the cost of efficiency and higher production costs. It has resulted in the creation of a large number of export promotion organizations that look after the promotion of exports from the country. However, import promotion agencies are not common in most nations.

ADVERTISEMENTS:

Presently, the terminology used under this trade theory is neo-mercantilism, which aims at creating favourable trade balance and has been employed by a number of countries to create trade surplus. Japan is a fine example of a country that tried to equate political power with economic power and economic power with trade surplus.

Essay # 3. Theory of Absolute Advantage of International Trade:

Economist Adam Smith critically evaluated mercantilist trade policies in his seminal book An Inquiry into the Nature and Causes of the Wealth of Nations, first published in 1776. Smith posited that the wealth of a nation does not lie in building huge stockpiles of gold and silver in its treasury, but the real wealth of a nation is measured by the level of improvement in the quality of living of its citizens, as reflected by the per capita income.

Smith emphasized productivity and advocated free trade as a means of increasing global efficiency. As per his formulation, a country’s standards of living can be enhanced by international trade with other countries either by importing goods not produced by it or by producing large quantities of goods through specialization and exporting the surplus.

An absolute advantage refers to the ability of a country to produce a good more efficiently and cost-effectively than any other country.

Smith elucidated the concept of ‘absolute advantage’ leading to gains from specialization with the help of day-today illustrations as follows:

It is the maxim of every prudent master of a family, never to make at home what it will cost him more to make than to buy. The taylor does not attempt to make his own shoes, but buys them of the shoemaker. The shoemaker does not attempt to make his own clothes, but employs a taylor.

ADVERTISEMENTS:

The farmer attempts to make neither one nor the other, but employs those different artificers. All of them find it for their interest to employ their whole industry in a way which they have some advantage over their neighbors.

What is prudence in the conduct of every private family can scarce be folly in that of great kingdom. If a foreign country can supply us with a commodity cheaper than we ourselves can make it, better buy it of them with some part of the produce of our own industry. Thus, instead of producing all products, each country should specialize in producing those goods that it can produce more efficiently.

Such efficiency is gained through:

i. Repetitive production of a product, which increases the skills of the labour force.

ii. Switching production from one produce to another to save labour time.

iii. Long product runs to provide incentives to develop more effective work methods over a period of time.

ADVERTISEMENTS:

Therefore, a country should use increased production to export and acquire more goods by way of imports, which would in turn improve the living standards of its people. A country’s advantage may be either natural or acquired.

Natural:

Natural factors, such as a country’s geographical and agro-climatic conditions, mineral or other natural resources, or specialized manpower contribute to a country’s natural advantage in certain products. For instance, the agro-climatic condition in India is an important factor for sizeable export of agro-produce, such as spices, cotton, tea, and mangoes.

The availability of relatively cheap labour contributes to India’s edge in export of labour-intensive products. The production of wheat and maize in the US, petroleum in Saudi Arabia, citrus fruits in Israel, lumber in Canada, and aluminium ore in Jamaica are all illustrations of natural advantages.

Acquired Advantage:

Today, international trade is shifting from traditional agro-products to industrial products and services, especially in developing countries like India. The acquired advantage in either a product or its process technology plays an important role in creating such a shift.

The ability to differentiate or produce a different product is termed as an advantage in product technology, while the ability to produce a homogeneous product more efficiently is termed as an advantage in process technology.

Production of consumer electronics and automobiles in Japan, software in India, watches in Switzerland, and shipbuilding in South Korea may be attributed to acquired advantage. Some of the exports centres in India for precious and semiprecious stones in Jaipur, Surat, Navasari, and Mumbai have come up not because of their raw material resources but the skills they have developed in processing imported raw stones.

ADVERTISEMENTS:

To illustrate the concept of absolute advantage, an example of two countries may be taken, such as the UK and India. Let us assume that both the countries have the same amount of resources, say 100 units, such as land, labour, capital, etc., which can be employed either to produce tea or rice.

However, the production efficiency is assumed to vary between the countries because to produce a tonne of tea, UK requires 10 units of resources whereas India requires only 5 units of resources. On the other hand, for producing one tonne of rice, UK requires only 4 units of resources whereas India needs 10 units of resources (Table 2.1).

Since India requires lower resources compared to UK for producing tea, it is relatively more efficient in tea production. On the other hand, since UK requires fewer resources compared to India for producing rice, it is relatively more efficient in producing rice.

Although each country is assumed to possess equal resources, the production possibilities for each country would vary, depending upon their production efficiency and utilization of available resources.

All of the possible combinations of the two products that can be produced with a country’s limited resources may be graphically depicted by a production possibilities curve (Fig. 2.1), assuming total resource availability of 100 units with each country.

The slope of the curve reflects the ‘trade-off of producing one product over the other, representing opportunity cost. The value of a factor of production forgone for its alternate use is termed as opportunity cost.

For instance, if the UK wishes to produce one tonne of tea, it has to forgo the production of 2.5 tonnes of rice. Whereas in order to produce one unit of rice, it has to relinquish the production of only 0.40 tonne of tea.

Suppose no foreign trade takes place between the two countries and each employs its resources equally (i.e., 50:50) for production of tea and rice. The UK would produce 5 tonnes of tea and 12.5 tonnes of rice at point B whereas India would produce 10 tonnes of tea and 5 tonnes of rice at point A as shovra in Fig. 2.1.

This would result in a total output of 15 tonnes of tea and 17.5 tonnes of rice (Table 2.2). If both India and the UK employ their resources on production of only tea and rice, respectively, in which each of them has absolute advantage, the total output, as depicted in Fig. 2.1, of tea would increase from 15 tonnes to 20 tonnes (point C) whereas rice would increase from 17.5 tonnes to 25 tonnes (point D).

Thus, both countries can mutually gain from trading, as the total output is enhanced (Table 2.2) as a result of specialization.

The theory of absolute advantage is based on Adam Smith’s doctrine of laissez faire that means ‘let make freely’. When specifically applied to international trade, it refers to ‘freedom of enterprise’ and ‘freedom of commerce’.

Therefore, the government should not intervene in the economic life of a nation or in its trade relations among nations, in the form of tariffs or other trade restrictions, which would be counterproductive.

A market would reach to an efficient end by itself without any government intervention. Unlike as suggested by the mercantilist theory, trading is not a zero-sum game under the theory of absolute advantage, wherein a nation can gain only if a trading partner loses. Instead, the countries involved in free trade would mutually benefit as a result of efficient allocation of their resources.

Essay # 4. Theory of Comparative Advantage of International Trade:

In Principles of Political Economy and Taxation, David Ricardo (1817) promulgated the theory of comparative advantage, wherein a country benefits from international trade even if it is less efficient than other nations in the production of two commodities.

Comparative advantage may be defined as the inability of a nation to produce a good more efficiently than other nations, but its ability to produce that good more efficiently compared to the other good.

Thus, the country may be at an absolute disadvantage with respect to both the commodities but the absolute disadvantage is lower in one commodity than another.

Therefore, a country should specialize in the production and export of a commodity in which the absolute disadvantage is less than that of another commodity or in other words, the country has got a comparative advantage in terms of more production efficiency.

To illustrate the concept, let us assume a situation where the UK requires 10 units of resources for producing one tonne of tea and 5 units for one tonne of rice whereas India requires 5 units of resources for producing one tonne of tea and 4 units for one tonne of rice (Table 2.3). In this case, India is more efficient in producing both tea and rice. Thus, India has absolute advantage in the production of both the products.

Although the UK does not have an absolute advantage in any of these commodities it has comparative advantage in the production of rice as it can produce rice more efficiently. Countries also gain from trade by employing their resources for the production of goods in which they are relatively more efficient.

Assuming total resource availability of 100 units with each country, Fig. 2.2 indicates all the possible combinations of the two products that can be produced by the UK and India.

In case there is no foreign trade between India and the UK (Table 2.4) and both the countries are assumed to use equal (50:50) resources for production of each commodity, UK would produce 5 tonnes of tea and 10 tonnes of rice as shown at point A, whereas India would produce 10 tonnes of tea and 12.5 tonnes of rice at point B in Fig. 2.2.

If the UK employs all its resources in the production of rice in which it is more efficient than the other, India can produce the same quantum of tea, i.e., 15 tonnes (Point C) by employing only 75 units of its resources. It can utilize the remaining 25 units of its additional resources for producing 6.25 units of rice, which would raise the total rice production from 22.5 tonnes without trade to 26.25 tonnes after trade (Table 2.4).

Alternatively, the UK can employ its entire resources (i.e., 100 units) to produce 20 tonnes of rice and India can use only 10 units of its resources to produce 2.5 tonnes of rice so as to produce the same quantity of rice, i.e., 22.5 tonnes.

The remaining 90 units of resources may be used by India for the production of tea, resulting in an increase in tea production from 15 tonnes without trade to 18 tonnes with trade as shown at Point E. Hence, it is obvious from the illustrations that countries gain from trade even if a country does not have an absolute advantage in any of its products as the total world output increases.

Measuring Comparative Advantage:

The Balassa Index is often used as a useful tool to measure revealed comparative advantage (RCA) that measures the relative trade performance of individual countries in particular commodities.

It is assumed to ‘reveal’ the comparative advantage of trading countries, based on the assumption that the commodity patterns of trade reflects the inter-country differences in relative costs as the well as the non-price factors. The factors that contribute to the changes in the RCA of a country include economic factors, structural changes, improved world demand, and trade specialization.

RCA is defined as a country’s share of world exports of a commodity divided by its share in total exports. The index for commodity j from country i is computed as

RCAij = (Xij/Xwj)/(Xi/Xw)

Where,

Xij = i th country’s export of commodity j

Xwj = world exports of commodity j

Xi = total export of country i

Xw = total world exports

If the value of the index of revealed comparative advantage (RCAij) is greater than unity (i.e., 1), the country has a RCA in that commodity. The RCA index considers the intrinsic advantage of a particular export commodity and is consistent with the changes in the economy’s relative factor endowment and productivity. However, it cannot distinguish between the improvements in factor endowments and the impact of the country’s trade policies.

As indicated in Table 2.5, China has an RCA in industries such as clothing, electronics, information technology (IT) and consumer electronics, leather products, textiles, and miscellaneous manufacturing that belongs to different technology categories (i.e., low, medium, and high) but not in resource-base manufacture.

On the other hand, India has an RCA in resource-based and low-technological industries, such as fresh food, leather products, minerals, textiles, basic manufacture, chemicals, and clothing.

It is also observed that the US, Japan, and the UK have an RCA in high- and medium- technology categories, such as IT, consumer electronics, electronics, manufacturing, etc., whereas China’s main competitors such as Mexico, Hong Kong, and Thailand have RCA in low-, medium-, and high-technology categories.

This implies that countries specializing in medium- to high-technology products may explore opportunities of expanding bilateral trade with India and those in resource-based industries may stand to benefit substantially by an increase in demand of such products in China.

For example, Latin American countries mainly produce and export various commodities. The major producer of Latin America is copper, oil, soy, and coffee, as the region produces about 47 per cent of the world soybean crop, 40 per cent of copper, and 9.3 per cent of oil.

The rising demand for commodities in China and other countries presents opportunities to these countries for expanding their production and increasing foreign exchange revenues. Similarly, the rapid growth in economic activities in India and China opens up opportunity for oil exporting countries. Thus, revealed comparative advantage may be employed as a useful tool to explain international trade patterns.

Limitation of Theories of Specialization:

Some of the most important limitation of theories of specialization are as follows:

i. Theories of absolute and comparative advantage lay emphasis on specialization with an assumption that countries are driven only by the impulse of maximization of production and consumption. However, the attainment of economic efficiency in a specialized field may not be the only goal of countries. For instance, the Middle East countries have spent enormous resources and pursued a sustained strategy in developing their agriculture and horticulture sector, in which these countries have very high absolute and comparative disadvantage, so as to become self-reliant.

ii. Specialization in one commodity or product may not necessarily result in efficiency gains. The production and export of more than one product often have a synergistic effect on developing the overall efficiency levels.

iii. These theories assume that production takes place under full employment conditions and labour is the only resource used in the production process, which is not a valid assumption.

iv. The division of gains is often unequal among the trading partners, which may alienate the partner perceiving or getting lower gains, who may forgo absolute gains to prevent relative losses.

v. The original theories have been proposed on the basis of two countries-two commodities situation. However, the same logic applies even when the theories experimented with multiple-commodities and multiple-countries situations.

vi. The logistics cost is overlooked in these theories, which may defy the proposed advantage of international trading.

vi. The sizes of economy and production runs are not taken into consideration.

Essay # 5. Factor Endowment Theory of International Trade:

The earlier theories of absolute and comparative advantage provided little insight into the of products in which a country can have an advantage. Heckscher (1919) and Bertil Ohhn (1933) developed a theory to explain the reasons for differences in relative commodity prices and competitive advantage between two nations.

According to this theory, a nation will export the commodity whose production requires intensive use of the nation’s relatively abundant and cheap factors and import the commodity whose production requires intensive use of the nation’s scarce and expensive factors.

Thus, a country with an abundance of cheap labour would export labour-intensive products and import capital-intensive goods and vice versa. It suggests that the patterns of trade are determined by factor endowment rather than productivity.

The theory suggests three types of relationships, which are discussed here:

(i) Land-Labour Relationship:

A country would specialize in production of labour intensive goods if the labour is in abundance (i.e., relatively cheaper) as compared to the cost of land (i.e., relatively costly). This is mainly due to the ability of a labour-abundant country to produce something more cost-efficiently as compared to a country where labour is scarcely available and therefore expensive.

(ii) Labour-Capital Relationship:

In countries where the capital is abundantly available and labour is relatively scarce (therefore most costly), there would be a tendency to achieve competitiveness in the production of goods requiring large capital investments.

(iii) Technological Complexities:

As the same product can be produced by adopting various methods or technologies of production, its cost competitiveness would have great variations. In order to minimize the cost of production and achieve cost competitiveness, one has to examine the optimum way of production in view of technological capabilities and constraints of a country.

The Leontief Paradox:

According to the factor endowment theory, a country with a relatively cheaper cost of labour would export labour-intensive products, while a country where the labour is scarce and capital is relatively abundant would export capital-intensive goods.

Wassily Leontief carried out an empirical test of the Heckscher-Ohlin Model in 1951 to find out whether or not the US, which has abundant capital resources, exports capital-intensive goods and imports labour-intensive goods. He found that the US exported more labour-intensive commodities and imported more capital-intensive products, which was contrary to the results of Heckscher-Ohlin Model of factor endowment.

Essay # 6. Country Similarity Theory of International Trade:

As per the Heckscher-Ohlin theory of factor endowment, trade should take place among countries that have greater differences in their factor endowments. Therefore, developed countries having manufactured goods and developing countries producing primary products should be natural trade partners.

A Swedish economist, Staffan B. Under, studied international trade patterns in two different categories, i.e., primary products (natural resource products) and manufactures.

It was found that in natural resource-based industries, the relative costs of production and factor endowments determined the trade. However, in the case of manufactured goods, costs were determined by the similarity in product demands across countries rather than by the relative production costs or factor endowments.

It has been observed that the majority of trade occurs between nations that have similar characteristics. The major trading partners of most developed countries are other developed industrialized countries.

The country similarity theory is based on the following principles:

i. If two countries have similar demand patterns, then their consumers would demand the same goods with similar degrees of quality and sophistication. This phenomenon is also known as preference similarity. Such a similarity leads to enhanced trade between the two developed countries.

ii. The demand patterns in countries with a higher level of per capita income are similar to those of other countries with similar income levels, as their residents would demand more sophisticated, high quality, ‘luxury’ consumer goods, whereas those in countries with lower per capita income would demand low quality, cheaper consumer goods as a part of their ‘necessity’.

Since developed countries would have a comparative advantage in the manufacture of complex, technology-intensive luxury goods, they would find export markets in other high income countries.

iii. Since most products are developed on the demand patterns in the home market, other countries with similar demand patterns due to cultural or economic similarity would be their natural trade partners.

iv. Countries with the proximity of geographical locations would also have greater trade compared to the distant ones. This can also be explained by various types of similarities, such as cultural and economic, besides the cost of transportation. The country similarity theory goes beyond cost comparisons. Therefore, it is also used in international marketing.

Essay # 7. New Trade Theory of International Trade:

Countries do not necessarily trade only to benefit from their differences but they also trade so as to increase their returns, which in turn enable them to benefit from specialization. International trade enables a firm to increase its output due to its specialization by providing a much larger market those results in enhancing its efficiency.

The theory helps explain the trade patterns when markets are not perfectly competitive or when the economies of scale are achieved by the production of specific products. Decrease in the unit cost of a product resulting from large scale production is termed as economies of scale.

Since fixed costs are shared over an increased output, the economies of scale enable a firm to reduce it’s per unit average cost of production and enhance its price competitiveness.

(i) Internal Economies of Scale:

Companies benefit by the economies of scale when the cost per unit of output depends upon their size. The larger the size, the higher are the economies of scale. Firms that enhance their internal economies of scale can decrease their price and monopolize the industry, creating imperfect market competition. This in turn results in the lowering of market prices due to the imperfect market competition.

Internal economies of scale may lead a firm to specialize in a narrow product line to produce the volume necessary to achieve cost benefits from scale economies.

Industries requiring massive investment in R&D and creating manufacturing facilities, such as branded software by Microsoft, microprocessors by Intel or AMD, and aircrafts by Boeing or Airbus, need to have a global market base so as to achieve internal economies of scale and compete effectively.

(ii) External Economies of Scale:

If the cost per unit of output depends upon the size of the industry, not upon the size of an individual firm, it is referred to as external economies of scale. This enables the industry in a country to produce at a lower rate when the industry size is large compared to the same industry in another country with a relatively smaller industry size.

The dominance of a particular country in the world market in a specific products sector with higher external economies of scale is attributed to the large size of a country’s industry that has several small firms, which interact to create a large, competitive critical mass rather than a large-sized individual firm.

However, external economies of scale do not necessarily lead to imperfect markets but may enable the country’s industry to achieve global competitiveness. Although no single firm needs to be large, a number of small firms in a country may create a competitive industry that other countries may find difficult to compete with.

The automotive component industry o India and the semiconductor industry in Malaysia are illustrations of external economies of scale. The development of sector-specific industrial clusters, such as brassware in Moradabad, hosiery in Tirupur, carpets in Bhadoi, semi-precious stones in jaipur, and diamond polishing in Surat, may also be attributed to external economies

The new trade theory brings in the concept of economies of scale to explicate the Leontief paradox. Such economies of scale may not be necessarily linked to the differences in factor endowment between the trading partners. The higher economies of scale lead to increase in returns, enabling countries to specialize in the production of such goods and trade with countries with similar consumption patterns.

Besides intra-industry trade, the theory also explains intra-firm trade between the MNEs and their subsidiaries, with a motive to take advantage of the scale economies and increase their returns.

Essay # 8. International Product Life-Cycle Theory of International Trade:

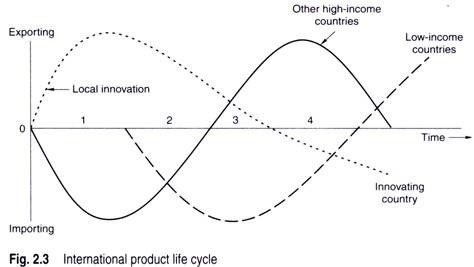

International markets tend to follow a cyclical pattern due to a variety of factors over a period of time, which explains the shifting of markets as well as the location of production. The level of innovation and technology, resources, size of market, and competitive structure influence trade patterns.

In addition, the gap in technology and preference and the ability of the customers in international markets also determine the stage of international product life cycle (IPLC).

In case the innovating country has a large market size, as in case of the US, India, China, etc., it can support mass production for domestic sales. This mass market also facilitates the producers based in these countries to achieve cost-efficiency, which enables them to become internationally competitive.

However, in case the market size of a country is too small to achieve economies of scale from the domestic market, the companies from these countries can alternatively achieve economies of scale by setting up their marketing and production facilities in other cost-effective countries.

Thus, it is the economies of scope that assists in achieving the economies of scale by expanding into international markets. The theory explains the variations and reasons for change in production and consumption patterns among various markets over a time period, as depicted in Fig. 2.3.

The IPLC has four distinct (Exhibit 2.2) identifiable stages that influence demand structure, production, marketing strategy, and international competition as follows.

(i) Introduction:

Generally, it is in high-income or developed countries that the majority of new product inventions take place, as product inventions require substantial resources to be expended on R&D activities and need speedy recovery of the initial cost incurred by way of market-skimming pricing strategies.

Since, in the initial stages, the price of a new product is relatively higher, buying the product is only within the means and capabilities of customers in high-income countries. Therefore, a firm finds a market for new products in other developed or high income countries in the initial stages.

(ii) Growth:

The demand in the international markets exhibits an increasing trend and the innovating firm gets better opportunities for exports. Moreover, as the market begins to develop in other developed countries, the innovating firm faces increased international competition in the target market.

In order to defend its position in international markets, the firm establishes its production locations in other developed or high income countries.

(iii) Maturity:

As the technical know-how of the innovative process becomes widely known, the firm begins to establish its operations in middle- and low-income countries in order to take advantage of resources available at competitive prices.

(iv) Decline:

The major thrust of marketing strategy at this stage shifts to price and cost competitiveness, as the technical know-how and skills become widely available. Therefore, the emphasis of the firm is on most cost-effective locations rather than on producing themselves.

Besides other middle-income or developing countries, the production also intensifies in low-income or least-developed countries (LDCs). As a result, it has been observed that the innovating country begins to import such goods from other developing countries rather than manufacturing itself.

The UK, which was once the largest manufacturer and exporter of bicycles, now imports this product in large volumes. The bicycle is at the declining stage of its life cycle in industrialized countries whereas it is still at a growth or maturity stage in a number of developing countries.

The chemical and hazardous industries are also shifting from high-income countries to low-income countries as a part of their increasing concern about environmental issues, exhibiting a cyclical pattern in international markets.

Although the product life cycle explains the emerging pattern of international markets, it has got its own limitations in the present marketing era with the fast proliferation of market information, wherein products are launched more or less simultaneously in various markets.

Essay # 9. Theory of Competitive Advantage of International Trade:

As propounded by Michael Porter in The Competitive Advantage of Nations, the theory of competitive advantage concentrates on a firm’s home country environment as the main source of competencies and innovations. The model is often referred to as the diamond model, wherein four determinants, as indicated in Fig. 2.4, interact with each other.

Porter’s diamond consists of the following attributes:

(i) Factor (Input) Conditions:

Factor conditions refer to how well-endowed a nation is as far as resources are concerned. These resources may be created or inherited, which include human resources, capital resources, physical infrastructure, administrative infrastructure, information infrastructure, scientific and technological infrastructure, and natural resources.

The efficiency, quality, and specialization of underlying inputs that firms draw while competing in international markets are influenced by a country’s factor conditions.

The inherited factors in case of India, such as the abundance of arable land, water resources, large workforce, round-the-year sunlight, biodiversity, and a variety of agro-climatic conditions do not necessarily guarantee a firm’s international competitiveness.

Rather the factors created by meticulous planning and implementation, scientific and market knowledge, physical and capital resources and infrastructure, play a greater role in determining a firm’s competitiveness.

(ii) Demand Conditions:

The sophistication of demand conditions in the domestic market and the pressure from domestic buyers is a critical determinant for a firm to upgrade its product and services. The major characteristics of domestic demand include the nature of demand, the size and growth patterns of domestic demand, and the way a nation’s domestic preferences are transmitted to foreign markets.

As the Indian market has long been a sellers’ market, it exerted little pressure on Indian firms to strive for quality up gradation in the home market. However, as a result of India’s economic liberalization, there has been a considerable shift in the demand conditions.

(iii) Related and Supporting Industries:

The availability and quality of local suppliers and related industries and the state of development of clusters play an important role in determining the competitiveness of a firm. These determine the cost-efficiency, quality, and speedy delivery of inputs, which in turn influence a firm’s competitiveness.

This explains the development of industrial clusters, such as IT industries around Bangalore, textile industries around Tirupur, and metal handicrafts around Moradabad.

(iv) Firm Strategy, Structure, and Rivalry:

It refers to the extent of corporate investment, the type of strategy, and the intensity of local rivalry. Differences in management styles, organizational skills, and strategic perspectives create advantages and disadvantages for firms competing in different types of industries. Besides, the intensity of domestic rivalry also affects a firm’s competitiveness.

In India, the management system is paternalistic and hierarchical in nature. In the system of mixed economy with protectionist and monopolistic regulations, the intensity of competition was almost missing in major industrial sectors.

It was only after the economic liberalization that the Indian industries were exposed to market competition. The quality of goods and services has remarkably improved as a result of the increased intensity of market competition. Two additional external variables of Porter’s model for evaluating national competitive advantage include chance and government, discussed below.

(v) Chance:

The occurrences that are beyond the control of firms, industries, and usually governments have been termed as chance, which plays a critical role in determining competitiveness. It includes wars and their aftermath, major technological breakthroughs, innovations, exchange rates, shifts in factor or input costs (e.g., rise in petroleum prices), etc.

Some of the major chance factors in the context of India include disintegration of the erstwhile USSR and the collapse of the communist system in Eastern Europe, opening up of the Chinese market, the Gulf War, etc.

(vi) Government:

The government has an important role to play in influencing the determinants of a nation’s competitiveness. The government’s role in formulating policies related to trade, foreign exchange, infrastructure, labour, product standards, etc. influences the determinants in the Porter’s diamond.

Assessing country competitiveness:

In order to facilitate the quantifiable assessment of competitiveness, the World Economic Forum has developed the Global Competitiveness Index. It presents a quantified framework aimed to measure the set of institutions, policies, and factors that set the sustainable current and medium-term levels of economic prosperity.

The US was ranked as the most competitive economy in the world, followed by Switzerland, Denmark, Sweden, Singapore, Finland, and Germany whereas China and India were ranked at 30th and 50th positions, respectively.

India has made remarkable progress in improving its global competitiveness during the recent years. The rapid rise in the share of the working age population for the last 20 years would add to favourable demographics to India’s competitiveness.

However, to benefit from this India will have to find ways to bring its masses of young people into the workforce, by spending on education and improving the quality of its educational institutions so as to enhance the productivity of its young.

Moreover, the country still has to take effective measures (Exhibit 2.3) to deal with its bureaucratic red-tape, illiteracy, and infrastructure bottlenecks, especially road, rail, seaports and airports, and electricity, among others, so as to boost its global competitiveness.

Essay # 10. Implications of International Trade Theories:

The trade theories provide a conceptual base for international trade and shifts in trade patterns. This article brings out the significance of developing a conceptual understanding of the trade theories as it deals with the fundamental issues, such as why international trade takes place, trade partners, shifts in trade patterns, and determinants of competitiveness.

The initial theory of mercantilism was based on accumulating wealth in terms of goods by increasing exports and restricting imports.

Trade was considered to be a zero-sum game under the mercantilism theory wherein one country gains at the cost of the other. However, a new form of mercantilism, known as neo-mercantilism, is followed by a number of countries so as to increase their trade surpluses. In 1776, Adam Smith advocated the concept of free trade as a means of increasing gains in world output from specialization.

The theory of absolute advantage suggests that a country should produce and export those goods that it can produce more efficiently. David Ricardo’s theory of comparative advantage was based on the international differences in labour productivity and advocates international trade even if a country does not have an absolute advantage in the production of any of its goods.

Although it is possible for a country not to have an absolute advantage in production of any good, it is not possible for it not to have a comparative advantage in any of the goods it produces. In the later case, the country should specialize in the production and export of those goods that can be produced more efficiently as compared to others.

The factor endowment theory highlights the interplay between proportions in which the factors of production such as land, labour, and capital are available to different countries and the proportions in which they are required for producing particular goods. Trade between countries with similar characteristics such as economic, geographic, cultural, etc. is explained by the country’ similarity theory.

The new trade theory explains the specialization by some countries in production and exports of particular products as international trade enables a firm to increase its output due to its specialization by providing much larger market that results into enhancing its efficacy.

The shifting patterns of production location are elucidated by the theory of IPLC that influences demand structure, production, the innovator company’s marketing strategy, and international competitiveness. The theory of competitive advantage comprehensively deals with the micro-economic business environment as the determinants of competitive advantage.

Earlier trade theories suggested the shift in comparative advantage in low-skilled production activities from advance economies to developing countries. The product life-cycle theory too heavily relied on such presumptions.

However, in recent years, the rapid shift of high-value activities such as R&D, technology-intensive manufacturing, and white-collar jobs to India and other Asian countries have evoked considerable apprehension among intellectuals in the US and other advanced economies about whether free trade is still beneficial for their countries or not.

This concern has been illustrated through Exhibit 2.4. It is likely to continue as a matter of serious debate and the upcoming economic thought may witness a significant deviation in terms of the support to theories based on free trade and, in him, globalization.