I. Closed Economy;

II. Open Economy;

(i) Small open economy

(ii) Large open economy

ADVERTISEMENTS:

I. Closed Economy:

The economy has no relation with the rest of the world.

Closed economy arises if:

(i) Investors here and abroad are not willing to hold foreign assets whatever be the return, or

ADVERTISEMENTS:

(ii) The Government prohibits its citizens from transacting in foreign financial markets.

(iii) Interest rate is fixed where: domestic saving = domestic investment

II. Open Economy:

The economy has relation with the rest of the world. Open economy arises if the investors here and abroad buy an asset which yields the highest return:

ADVERTISEMENTS:

(i) Small open economy → Features of small open economy:

(1) The economy is too small, therefore, it cannot affect the world interest rate, world interest rate (r*) determines the real domestic interest rate (r) because it can borrow and lend at r*.

Therefore, r = r*

world interest rate (r*) is determined where : World saving = world investment

(2) Perfect capital mobility:

Residents of the country have full access to the world financial market. There is no restriction from the Government. Thus in small open economy with perfect capital mobility:

Domestic interest rate (r) = world interest rate (r*)

(ii) Large open economy:

Interest rate is not fixed by world interest rate because the country is large enough to influence the world interest rate, that is, the world financial market.

ADVERTISEMENTS:

e.g. USA and India.

USA is a large open economy.

India is a small open economy.

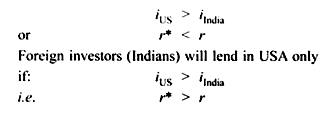

Investors in USA will lend abroad e.g. in India only if:

ADVERTISEMENTS:

interest rate in US < interest rate in India

(i) Features of large open economy:

Capital is imperfectly mobile. Funds will not flow freely to equalize interest rate in all the countries. Investors here and abroad may prefer to hold their wealth in domestic assets and not in foreign assets.

ADVERTISEMENTS:

(a) Due to imperfect information about foreign assets, or

(b) Restrictions imposed by the Government on lending or borrowing from abroad people prefer domestic assets.

(ii) Country is large enough to influence the world financial market:

If a large country lends abroad, the supply of loans in the world economy will increase and the interest rate in the world will decrease. Thus, CF becomes positive. Similarly, if the country borrows more from abroad the world interest rate will be high.

National Income Accounts Identity:

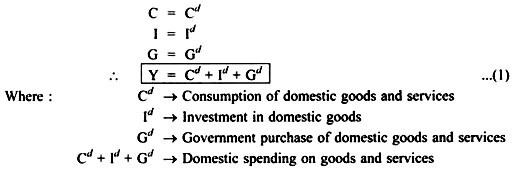

Closed Economy:

ADVERTISEMENTS:

In a closed economy all output is sold domestically.

Therefore, expenditure is divided into 3 components:

(i) Consumption (C)

(ii) Investment (I)

(iii) Government purchases (G)

Open Economy:

ADVERTISEMENTS:

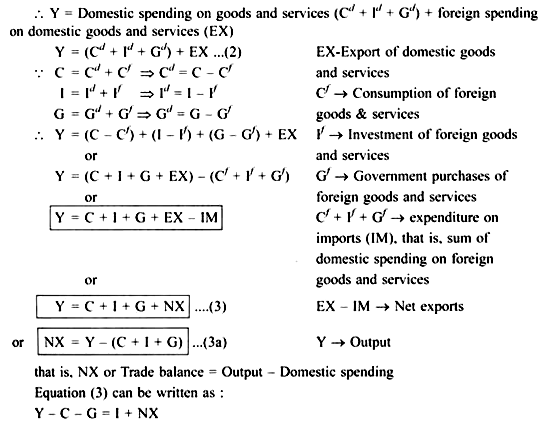

In open economy:

In an open economy some output is sold domestically and some output is sold abroad, that is, exported

Therefore, expenditure in an open economy is divided into 4 components:

(i) Cd (ii) ld (iii) Gd (iv) EX.

... Y-C-G = S (national saving)

ADVERTISEMENTS:

... S = I + NX

Or S – I = NX …(4)

Equation 4 shows that net foreign investment (S – I) is equal to the trade balance (NX)

Equation (3a) shows that in an open economy domestic spending may not be equal to the output of goods and services.

(i) If output exceeds domestic spending i.e, Y > C + I + G

ADVERTISEMENTS:

then: NX will be positive (NX > O)

(ii) If Y < C + I + G

NX < O, i.e., NX will be negative