Origins of the PPP Theory:

The term “purchasing-power-parity” was originated by Cassel (1918) but he presented his PPP theory nearly three years earlier using the equivalent term “theoretical rate of exchange” (1916).

While many credit Cassel as the originator of the PPP theory, some observers consider the founders to be the English economists writing at the time of the floating pound during the so called Bank Reconstruction period, 1997-1821.

Specifically they credit Wheatley, writing in 1803 with the earliest complete formulation of the theory. Other writers assert that the theory was anticipated even earlier.

Brisman claims that the PPP theory appeared first in Sweden more than 20 years prior to the Bank Reconstruction period. Einzig traces the origin of the theory to Spanish writers in the 16th and 17th centuries. Yet Cassel was the first economist to place PPP within a systematic framework so that it clearly became an operational theory. As noted by Viner, Cassel was the first to express the theory in terms of statistical averages of prices. Not only did Cassel make PPP an operational theory, he was also the first to test it empirically and he certainly was the most active proponent of PPP. Most impressive of all, Cassel’s theoretical analysis and empirical tests of PPP are remarkably similar to those current in later periods up to and including the present. Therefore, Cassel’s contributions and not those of preceding writers, are the earliest analyses and applications of PPP discussed here.

Absolute Price Parity:

ADVERTISEMENTS:

Cassel’s theory of PPP is appropriately named, for its foundation is the idea that the value of a currency and therefore the demand for it is determined fundamentally by the amount of goods and services that a unit of the currency can buy in the country of issue, that is by its internal purchasing power the later is defined as the inverse of the price level for goods and services. With this statement applying to two countries the value of one country’s currency relative to the other’s is the short-run equilibrium exchange rate; and the ratio of the internal purchasing powers or price levels defines the absolute PPP (PPPabs). Thus, a theory of absolute price parity results.

The internal purchasing power of a currency is sometimes referred to merely as it’s “purchasing power” and is called “buying power” or “paying powers” in Cassel’s early writings. It is clear that the price levels used to define the absolute FTP are general price levels of the countries, representing prices of all goods and services, available for purchase. Cassel is explicit on this point. Indeed he is emphatic that only a general price level can represent the purchasing power of money in a country and that price measures limited to traded goods (exports and imports) are unsuitable.

Cassel does not directly identify the kind of general price level that would be optimal in computing PPP, but the most logical interpretation would be a price measure of a country’s gross domestic produce (QDP). Cassel surely means to exclude import prices from the measure and include export prices. The purchasing power of a currency must refer Lo country’s own production of goods and services.

Moreover, Cassel describes the process whereby an exchange value for a country’s currency below (above) the PPP leads to an increase (decrease) in demand for the currency followed by an increase (decrease) in its commodity exports and a decrease (increase) in its commodity imports. Thus the ability to use currency to purchase goods and services in the country of issue is the foundation of Cassel’s PPP theory. So he notes that the theory works best as the short-run equilibrium exchange rate is expected to have minimum deviations from the PPP under conditions of free international trade. Cassel also states that the theory holds when trade restrictions are of equal severity in both directions, that is, on both imports and exports of a country.

ADVERTISEMENTS:

Cassel’s justification of absolute price parity has not been superseded to the present day. Both the critics and supporters exposit the theory in terms of virtually indistinguishable from those of Cassel. Thus, Yeager writes with approval: “people value currencies primarily for what they will buy and in uncontrolled markets tend to exchange them at rates that roughly express their relative purchasing powers”.

Under the extreme conditions outlines by Samuelson (and others before him) the existing exchange rate whether freely floating, managed floating or pegged cannot deviates even infinitesimally from the PPP, except to the extent that there are imperfections in the arbitrage process. This removes ail operational content from the theory.

In contrast, Cassel’s absolute price parity does not rely on the unrealistic assumption that all commodities are traded and without transport costs, tariffs or quantitative restrictions. In particular the theory accepts the fact that there are non-traded goods but notes that the prices of traded and non-traded goods are closely related through various links as described Yeager, for example.

Haberler, although critical of PPP, describes its basis correctly “The proposition, that general price levels in different countries are connected through the prices of internationally traded goods is the foundation of the purchasing power parity doctrine”.

ADVERTISEMENTS:

Although acknowledging the existence of both traded and non traded goods, proponents of PPP emphasize that these two groups are not unvarying collections of commodities.

Cassel notes: ‘There is never a definite group of commodities that can be exported. Even a small alteration in the rate of Exchange may widen or restrict the group of exportable goods”.

This view is supported by Yeager:

“Actually, the line between domestic and internationally traded goods is a fuzzy and shifting one”.

Relative Price Parity:

Cassel’s theory of relative like that of absolute price parity is consistently, presented throughout his writings. The actual exchange rate in a base period, which for Cassel must be a “normal” period, is multiplied by the ratio of proportionate changes in price levels in the countries concerned. The result is the (relative) PPP in the current period. The ideal base period would be one in which the exchange rate is equal to the absolute PPP.

The question arises as to whether the PPP calculated in this fashion, that is, the relative PPP in the current period is equal to the absolute PPP newly calculated for this period. The answer is affirmative, according to Cassel, only if the changes in the economies that occurred since the base period were purely monetary in nature.

In this respect Cassel is at one with his critics. Viner writes, “The one type of case which would meet the requirement of exact inversely proportional changes in the price levels and in exchange rates would be a monetary change in one country which would operate to change all prices and money incomes in that country in equal degree, while every other element in the situation, in both countries, remained absolutely constant”. Similar discussions of the case of proportionate changes in exchange rates and price levels with no real changes are provided by Samuelson, Vanek and Stern.

Samuelson points out that this ideal result, founded on the neutrality of money, can occur only in the long-run. In the short-run (and also in the long-run if ideal conditions are not fulfilled) real changes will take place in the economies and the relative PPP theory will not hold exactly. However, if the monetary changes dominate the real changes, relative PPP still applies, although in an approximately fashion. This is certainly the position of Cassel.

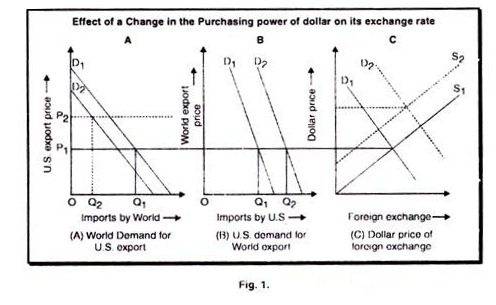

Let us discuss how a change in the internal value of dollar affects its external value. Effects of a change in the domestic purchase power of the dollar on the exchange value of that currency are illustrated in the following diagrams.

ADVERTISEMENTS:

In figure-A we have elastic demand curves (greater than unity) to indicate that the rest of the world has substitutes for American exports or alternative markets in which to purchase similar goods and services. This means that the rest of the world is rather sensitive to slight changes in American export prices.

It is assumed, that inflation has already occurred in the United States to send up general prices, including export prices. Before the inflation American export prices were P, and American exports to the rest of the world (imports by others) were OQ1, given the initial world demand for American exports, D1 as shown in Figure-A. After inflation American export prices go up to P2, in response to which the world demand for American exports decreases to D2, that is a downward shift of the demand curve to the left. As a consequence American exports (or imports by rest of the world) decreases to OQ2.

In Figure (B) the demand curves are drawn so as to have a price elasticity of less than unity, on the assumption that the United States does not find close substitutes for those goods and services offered by the rest of the world. It is also assumed that world export prices remain unchanged; no inflation abroad. Under these circumstances the U.S. finds the rest of the world a cheaper place in which to purchase, and consequently the American demand for world exports Increases from D1 to D2 at the old price level P1 as shown in (ii).

ADVERTISEMENTS:

Imports by the U.S. (or world exports to U.S.) increases from OQ, to OQ2 note that, while American imports have increased by Q1Q2 in (B), American exports have decreased even more, namely, by Q2Q1 in (A). In other words, the U.S. has a larger import surplus (an export surplus from the standpoint of others). This excess of imports over exports is reflected in the upward shift of the demand curve in (C), that is, in the rise of American demand for foreign exchange.

The American demand for world exports and therefore for foreign exchange far exceeds the world demand for American exports and therefore the dollar exchange. Accordingly, the domestic price for foreign exchange rises from P1 to P2 as shown in Figure (C). A rise in the dollar price of foreign exchange means a fall in the external value of the dollar, since Americans must now give up more dollars to get the same amount of foreign exchange.

The low exchange value of dollar will stimulate American exports and discourage American Imports until equilibrium is restored in the American balance of payments. Thus, a change in the purchasing power of dollar due to domestic inflation can affect the external value of the dollar, and the balance of payments position will change with it.

Cassel’s Recognized: Limitations of PPP:

ADVERTISEMENTS:

Cassel’s recognized limitations of PPP are an integral part of his theory. The qualifications and exceptions are presented throughout his writings on PPP, so that a comprehensive citation of references is not manageable. However, the following reasons why a floating exchange rate may diverge from the PPP are gleaned from Cassel’s writings.

(i) Trade restrictions may be more severe in one direction than in another. For example, if a country’s imports are more restricted than its exports, the exchange value of the country’s currency may exceed the PPP.

(ii) Speculation in the foreign exchange market may be against a country’s currency and therefore may reduce its exchange value below PPP.

(iii) Anticipation of greater inflation in a country than abroad may lower the exchange value of its currency below PPP.

(iv) Changes in relative prices within a country are an indicator of real changes in the economy from the base period, and so involve a divergence between relative PPP and the exchange rate.

(v) Long-term capital movements can make the exchange rate away from the PPP. For example, a net long-term capital outflow may depress a country’s currency below the PPP.

ADVERTISEMENTS:

(vi) The government can intervene in the foreign exchange market, bidding up the price of foreign exchange above the PPP by demanding a certain amount of foreign currency irrespective of price. Cassel considers the purpose of the government intervention to be procuring foreign exchange as a replacement for capital inflows rather than influencing the course of the exchange rate.

Cost Parity:

Arguments in favour of cost over price parity theories have been presented even by critics and evaluators of PPP are outlined as follows:

(i) Costs of production are less subject to adjustment to exchange rate changes than are prices of traded goods.

(ii) Costs exclude the volatile component of profits and so are more likely than product prices to represent long-term prices (for absolute parity) and to reflect permanent rather than temporary changes in prices upon inflation or deflation (the relative parity). These arguments, however, do not justify cost parity as such, only its superiority in certain respects over price parity.

The earliest proponent of cost parity is Sven Brisman the rejects price parties mainly only on the grounds that they do not measure a country’s competitiveness (ability to complete) on the world market. In their place, he proposes absolute cost parity calculated from the “effective cost of production” at home and abroad. It is clear that Brisman has a UPC (unit factor cost) concept in mind, for he explicitly states that the elements of effective costs of wages, interest, rent (which can be ignored because of its small magnitude) and changes in productivity. Brisman notes that his parity concept cannot generally be employed in a quantitative fashion because UPC is impossible to calculate statistically owing to the unavailability of data.

Hansen also proposes an absolute cost parity but in vaguer terms than Brisman. Me calls it a “cost structure parity” and does not discuss its component cost measures. Further, unlike Brisman, Hansen does not reject the price parity concept outright. Rather he indicates that “cost structure parity” is a preferred way of stating PPP theory. The cost structure parity provides the correct exchange rate that assign factors of production to those export industries, and only those export industries where the country has a comparative advantage.

ADVERTISEMENTS:

A cost parity theory that reduces to price parity is offered by Houthakker. He begins with an absolute parity theory that is founded on UPC which (he states) may be approximated by ULC (unit labour cost), since labour is the most important factor of production. Again the justification is in terms of competitiveness. Houthakker mentions, however, that the existence of long-term capital movements and unilateral transfers may cause the long-term equilibrium exchange rate lo differ from the UFC parity. A net outflow would require greater competitiveness for the country’s exports, that is, a lower exchange value from the currency than that given by the parity, lie notes that I Ills modification is not required to the extent that the capital outflows are themselves caused by the deviation of the current exchange rate from the UFC parity.

Friedman and Schwartz offer the unique view point of rejecting price parity on the grounds that product price indices include the effect of changes in the productivity. They argue that the logic of PPP is that the indices used to compute the parity should refer to monetary changes alone and not incorporate changes in productivity, which are real (non-monetary) in nature. Implicitly, Friedman and Schwartz are also rejecting UFC or ULC parity, and indeed they advocate that the parity be constructed from indices of factor prices weighted by employment (and with no allowance, for changes in productivity). As a second best, a price parity may be calculated from product price Indices, where the prices of individual commodities are weighted by the volume of domestic production “as a proxy for volume of resources employed.