Capital structure is a part of financial structure and refers to the proportion of various kinds of securities raised by a firm as long-term finance. In other words, it means the composition of a firm’s long term funds comprising equity shares, preference shares and long-term loans.

According to Gerstenberg, “Capital structure or financial structure of a – company refers to the type of securities to be issued and the proportionate amount that makes up the capitalisation”.

The term ‘capital structure’ refers to the composition or make up of the amount of long-term financing. According to Gerstenberg, “The type of securities to be issued and the proportionate amounts that make up the capitalisation is known as capital structure or financial structure.”

Capital structure of the firm is the combination of different permanent long term financing like debt, stock, preferred capital etc. It also refers to the long-term obligations, which are distributed between owners and creditors.

ADVERTISEMENTS:

It can be defined as the judicious use of different long term sources of financing such that the overall cost of capital of the firm does not increase and remains minimum and constant, thereby maximizing the value of the firm.

In other words, it is the determination of the ratio of capital to be raised from different sources. Equity and debt are the two principal sources of finance. The capital structure decision involves the proportion of equity and debt. It is frequently used to indicate long term sources of funds employed in a business enterprise.

What is Capital Structure: Definitions and Meaning

Capital Structure Definition

Capital structure is a part of financial structure and refers to the proportion of various kinds of securities raised by a firm as long-term finance. In other words, it means the composition of a firm’s long term funds comprising of equity shares, preference shares and long-term loans.

According to Gerstenberg, “Capital structure or financial structure of a – company refers to the type of securities to be issued and the proportionate amount that makes up the capitalisation”.

ADVERTISEMENTS:

The capital structure involves two decisions –

(i) type of securities to be issued (equity shares, preference shares and debentures), and

(ii) the relative proportion of securities, determined by the process of capital gearing.

Capital gearing determines the ratio between different types of securities and total capitalisation. The companies whose proportion of equity capital to total capitalisation is very small are highly geared companies, and low geared when the equity capital dominates the total capitalisation.

Capital Structure Definition

The term ‘capital structure’ refers to the composition or make up of the amount of long-term financing. According to Gerstenberg, “The type of securities to be issued and the proportionate amounts that make up the capitalisation is known as capital structure or financial structure.”

ADVERTISEMENTS:

Basically, it is determined by the mixture of long-term debt and equity used by the firm to finance its operations. The terms ‘capital structure’ and ‘financial structure’ are often used interchangeably.

However, there is a difference between these two terms. Financial structure refers to the way the firm’s assets are financed. It is the entire left hand side of the balance sheet. Capital structure is the permanent financing of the firm.

Thus, capital structure is only a part of financial structure. Capital structure should be differentiated from capitalisation. Capitalisation is a quantitative concept indicating the total amount of long-term finance.

Capital structure, on the other hand, shows the kind of securities issued to raise the total amount. It is a qualitative concept representing the form of long-term financing.

Thus, capital structure involves decision with respect to – (a) the type of securities to be issued, and (b) the relative proportion of each type of security. A company can issue three types of securities, namely, equity shares, preference shares and debentures.

The financial structure decision is a very important managerial decision. It influences the return and risk of equity shareholders. Decision with respect to financial structure or capital structure has an effect on the market value of the company’s shares.

Financial structure shows how the permanent assets of a company are financed. Designing of financial structure is a continuous process. The initial capital structure of a company is decided by promoters when the company is established.

Subsequently, the management of the company has to take the capital structure decision. Every change in the amount and forms of long-term financing brings into existence a new capital structure. The dividend decision also has a bearing on the capital structure. The decision to distribute or reinvest the company’s earnings influences equity or owners’ claim.

ADVERTISEMENTS:

The financing decision may affect the debt-equity mix of the company. The debt-equity ratio has an influence on the earnings and risk of the shareholders. Shareholders’ return and risk will in turn affect the cost of capital and market value of the company. The effect of debt- equity ratio on the earning and risk of shareholders can be known by studying financial leverage.

Capital Structure Definition

According to Gertenberg, capital structure refers to the makeup of a firm’s capitalization. In other words, it represents the mix of different sources of long term funds, (such as equity shares, preference shares long term loans or debts like debentures and bonds, and retained earnings etc.).

In the words of Weston and Brigham “Capital structure is the permanent financing of the firm, represented by long term debt, preferred stock, and net worth”.

Thus in its broader sense, capital structure includes all the long term capital resources including loans, shares issued, reserves etc., and the components of the total capital.

ADVERTISEMENTS:

While devising a capital structure of the company, a fair balance should be maintained between two types of securities –

(a) fixed cost bearing securities (Debentures and preference shares)

(b) Variable cost bearing securities (ordinary shares).

The security mix affects the financial stability of the company. If a company fails in its efforts in maintaining the security mix, its capital structure will be unbalanced which may affect its profitability.

Capital Structure Meaning

ADVERTISEMENTS:

Capital structure of the firm is the combination of different permanent long term financing like debt, stock, preferred capital etc. It also refers to the long-term obligations, which are distributed between owners and creditors.

It can be defined as the judicious use of different long term sources of financing such that the overall cost of capital of the firm does not increase and remains minimum and constant, thereby maximizing the value of the firm.

In other words, it is the determination of the ratio of capital to be raised from different sources. Equity and debt are the two principal sources of finance. The capital structure decision involves the proportion of equity and debt. It is frequently used to indicate long term sources of funds employed in a business enterprise.

In Simple capital structure is concerned with the qualitative aspect, capital structure refers to the kinds of securities and the proportionate amount that make up capitalization. A decision about the proportion among the types of securities refers to the capital structure of enterprises.

What is Capital Structure?

There are so many definitions of capital structure given by different authors some of the important definition is given below:

“Capital structure is the permanent financing of the firm represented by long-term debts, preferred stock and net worth.” Net worth is the equity shareholders’ interest and includes reserves and surpluses, retained earnings and net worth reserves.’— Weston and Brigham

ADVERTISEMENTS:

“Capital Structure of a company refers to the composition or make up of its capitalization and it includes all long-term capital resources”. — Gerstenberg

“The mix of a firm’s permanent long-term financing represented by debt, preferred stock, and common stock equity”. — James C. Van Home

“The composition of a firm’s financing consists of equity, preference, and debt”. — Presana Chandra

“The long term sources of funds employed in a business enterprise”. — R.H. Wessel

“The capital structure of business can be measured by the ratio of various kinds of permanent loan and equity capital to total capital.” — By Schwarty

Capital Structure Definitions

Many scholars have given various definitions of capital structure:

ADVERTISEMENTS:

Robert H. Wissel defines, “The term capital structure is frequently used to indicate the long term sources of funds employed in a business enterprise.”

John H. Hampton defines, “Capital structure is frequently used to indicate the long term sources of funds employed in a business enterprise.”

Husband and Dockery defines, “Capitalisation embraces the composition or the character of the structure as well as the amount.”

According to Gertensberg “capital structure refers to the make-up of a firm’s capitalisation i.e., the type of securities to be issued and relative proportion of each type of securities in the total capitalisation.”

In the words of John Hampton, “Capital Structure is the composition of debt and equity securities that comprise a firm’s financing of its assets.”

According to Weston and Brigham, “Capital structure is the permanent financing of the firm represented primarily by long-term debt, preferred stock and common equity but excluding all short-term credit. Common equity includes common stock capital, surplus and accumulated retained earnings.”

ADVERTISEMENTS:

According to John J. Hampton, “Capital structure is the combination of debts and equity securities that comprises a firm’s financing of its assets?”

Thus in its broader sense, Capital structure includes all the long term capital resources including loans, shares issued, reserves, etc.

So capital structure represents the ratio of each kind of security issued to the total capitalisation. It indicates preparations in which various kinds of securities such as equity shares, preference shares and debentures are mixed up together in the capitalisation.

Capital structure denotes proportionate relationship between various long-term sources of funds such as debentures, preference share capital, equity share capital including reserves and surplus. It is also called “Capital Gearing.” It refers to the permanent financing of a company consisting of long- term debt, preference share capital and equity share capital.

So while devising capital structure of the company a fair balance should be maintained between two types of securities –

(a) Fixed cost bearing securities (e.g., Debentures and Preference shares)

ADVERTISEMENTS:

(b) Variable cost bearing securities (ordinary shares).

The mixing of security affects the financial stability of the company. If a company fails in its efforts in maintaining the security mix, its capital structure will be imbalanced which may affect its profitability.

Capital Structure Meaning

Meaning of Capital Structure:

Capital structure planning focuses on the primary objective of profit maximisation with lowest cost of capital and maximum return to equity shareholders. Capital Structure is referred to as the ratio of different kinds of securities raised by a firm as long-term finance.

In simple words, capital structure relates to total assets minus current liabilities. The capital structure is the total of debt and equity securities. It is the permanent financing of a firm relates to long-term debt, preferred stocks and net worth.

Definitions of Capital Structure:

(a) According to Gerstenberg, ‘Capital structure of a company refers to the composition or mark¬up of its capitalisation and it includes all the long term capital sources, viz., loans, reserves, shares and bonds’.

(b) According to Weston and Brigham, ‘Capital structure is the permanent financing of the firm represented by long-term debt, preferred stock and net worth’.

(c) J.J. Hampton defines, ‘Capital structure is the combination of debt and equity securities that comprise a firm’s financing of its assets’.

(d) R.R. Wessel defines, ‘Capital structure is frequently used to indicate the long term sources of funds employed in a business enterprise’.

The capital structure involves two decisions:

(a) Types of securities to be issued are equity shares, preference shares and long term borrowings (Debentures).

(b) Relative ratio of securities can be determined by process of capital gearing.

On this basis, the companies are divided into two-

(i) Highly geared companies:

Those companies whose proportion of equity capitalisation is small.

(ii) Low geared companies:

Those companies whose equity capital dominates total capitalisation.

For instance – There are two companies A and B. Total capitalisation amounts to be Rs. 200,000 in each case. The ratio of equity capital to total capitalisation in company A is 50,000, while in company B, ratio of equity capital is Rs. 150,000 to total capitalisation, i.e., in Company A, proportion is 25% and in company B, proportion is 75%.

In such cases, company A is considered to be a highly geared company and company B is low geared company.

What is Capital Structure?

Financing decisions are also called as the Capital Structure decision of the firm. The capital structure of a firm shows as to how the total capitalization of the firm is formed? It shows the mixture of various sources of funds in the capitalization of the firm.

Therefore, Capital Structure refers to a combination of various long term sources of funds in total capitalization of the firm.

In other words, Capital Structure refers to the proportionate amount of various sources of funds that makes up capitalization.

In simple words, Capital Structure refers to a mix of Equity Capital & Debt Capital.

Definitions of Capital Structure:

According to Gerstenberg “Capital Structure of a company refers to the composition or make up of its capitalization and it includes all long-term capital resources viz., loans, shares, reserves, and bonds”.

According to M.Y.Khan and PK Jain, “the Capital Structure is the proportion of debt, preference and equity shares on a firm’s balance sheet”.

According to Schwartz, “the Capital Structure of a business can be measured by the ratios of the various kinds of permanent loans and equity capital to total capital.”

We can put the Capital Structure in the form of an equation, which helps in easy understanding of the concept:

Capital Structure = Equity Capital + Preference Share Capital + Debt Capital.

The Capital Structure is a ratio of various sources of funds which forms the total funds.

Equity Capital here refers to the amount belonging to equity shareholders viz., Equity share capital and retained earnings (i.e. reserves & surplus) Preference Share Capital and Debt Capital here refers to the funds raised through bonds and term loans from financial institutions.

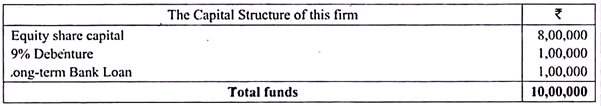

The Capital Structure can be better understood with an example:

A firms total funds are Rs.10,00,000. This Rs.10,00,000 fund is collected by issuing equity shares the tune of Rs.8,00,000, Rs.1,00,000 through 9% debentures and Rs.1,00,000 as term loan from banks.

Therefore the Capital Structure of the firm consists of:

Capital Structure Definitions

The term ‘capital structure’ refers to the composition or make up of the amount of long-term financing. It includes all the long-term securities such as shares issued, debentures outstanding, long-term loans and surpluses and reserves.

According to Gerstenberg, “The type of securities to be issued and the proportionate amounts that make up the capitalisation is known as capital structure or financial structure”. Thus, according to him, capital structure refers to the make-up of a firm’s capitalisation.

In other words, it refers to the make-up of a firm’s long-term funds such as equity shares, preference shares, long-term loans, debentures outstanding, retained earnings in the form of surpluses and reserves etc. which are the main items in the total capitalisation of the company.

For example, a company has equity shares of Rs. 2,00,000, preference shares of Rs. 2,00,000, debentures outstanding to the extent of Rs. 2,00,000 and the retained earnings of Rs. 1,00,000. The capitalisation is used to represent total long- term funds.

In this case, it is Rs. 7,00,000. But the term ‘capital structure’ is used for the mix of different sources of long-term funds in the capitalisation of the company. In this case, the capital structure of the company consists of Rs. 2,00,000 in equity shares, Rs. 2,00,000 in preference shares, Rs. 2,00,000 in debentures and Rs. 1,00,000 in retained earnings.

Thus, capitalisation is a quantitative concept which indicates the total amount of long-term finance but capital structure is a qualitative concept which shows the kinds and proportion of securities issued to raise the total amount.

Thus, capitalisation represents total amount of long-term capital while capital structure represents the form and structure of long-term capital. Capital structure relates to the decision as to (i) the types of securities to be issued and (ii) the relative proportion of each of these types of securities.

A company generally raises finance by issuing two kinds of securities viz. ownership securities and creditorship securities. The ownership securities consist of preference shares and equity shares.

The preference shares carry a fixed rate of dividend and enjoy a priority in the matter of payment of dividend every year out of profits available for distribution and repayment of capital at the time of winding up of the company.

Since the preference shares carry a fixed rate of dividend, they are called fixed cost-bearing securities or ‘non-risk bearing securities’. But equity shares, on the other hand, do not enjoy any priority either in respect of dividend every year or in respect of repayment of their capital at the time of winding up of the company.

The rate of dividend on equity shares varies from year to year depending upon the amount of profit available for distribution. They may get even a higher rate of dividend than that on the preference shares when the company makes a large amount of profits. But they do not get any dividend in case the company makes little or no profits.

Again they may get a dividend lower than that on the preference shares when the company makes some profits. Hence the equity shares are also called ‘variable yield-bearing securities’ or ‘risk-bearing securities’.

Preference Shares, Debentures Outstanding, and Long-term Loans are known as Fixed Cost-bearing securities or Non-risky-bearing securities.

Difference between Capital Structure and Financial Structure:

The term ‘capital structure’ differs from the term ‘financial structure’. Financial structure refers to the way the assets of the firm are financed, In other words, it includes both long-term and short-term sources of funds.

Capital structure, on the other hand, refers to the permanent financing of the company represented primarily by long-term debt and the shareholders’ funds but excluding all short-term loans and advances. Thus, a company’s capital structure is only a part of its financial structure.

Capital Structure Meaning

The term capital structure refers to the employment of long-term funds by a firm. There are two major types of capital – Debt capital and equity capital. Capital structure is the mix of debt and equity capital used by a firm to finance its investment and operation needs. It involves an important decision as to how much of debt is to be employed by a firm.

Employment of more and more debt increases the financial risk for equity shareholders. However, at the same time it also increases the earning per share. Hence capital structure decision is one of the important decisions which decide the proportion of debt and equity in the overall capital structure of a firm with an objective of maximizing its value.

Company’s earnings are first utilised to pay the interest on debt capital, then tax is calculated on the income after deducting interest on debt. After paying tax the remaining amount is distributed among the shareholders.

Therefore, in order to fulfil the objective of wealth maximisation, capital structure should be designed in a way to bring the maximum value to the equity shareholders.

The investment and asset management decisions of the firm are held constant. Therefore, the earnings of the company are not expected to grow. With the same earning level, the financial manager will try to design the capital structure to raise the value of the firm.

This can be done by including the low-cost-debt capital in the capital structure. Debt is called low cost capital because it is tax-deductible.

Interest on debt is used to reduce the amount of tax going to the government. Interest on debt is a fixed financial obligation; therefore whatever is saved due to the use of debt in the capital structure is earned by the equity shareholders. Debt capital is used to enhance the earnings for the shareholders by reducing the firm’s overall cost of capital.

Our main concern is to find the effect on the total value of the firm and the overall cost of capital when the ratio of debt to equity or the relative amount of financial leverage is varied.

R.H. Wessel defines the term capital structure as long-term sources of funds employed in business enterprise.

According to Weston and Brigham “Capital structure is the permanent financing of the firm represented by long-term debt, preferred stock and net worth”.

The mix of debt and equity which brings maximum value to the firm is called optimum capital structure.

What is Capital Structure?

Capital structure or composition of capital or pattern of securities or the security mix is the second important aspect of financial planning. Once the financial manager has determined the firm’s financial requirements, his next task is to see that these funds are on hand.

This capital comes in many forms – long and short-term debts, secured and unsecured debts, preference shares, equity shares, retained earnings and other things. To decide upon the ratio of these securities in the total capitalization is termed as capital structure.

“Capital structure is the permanent financing of the firm represented by long-term debts, preferred stock and net worth.” Net worth is the equity shareholders ‘interest and includes reserves and surpluses, retained earnings and net worth reserves. —Weston and Brigham

“The long-term sources of funds employed in a business enterprise.” Thus, the term ‘capital structure ‘denotes the ‘financing mix ‘or composition of long-term sources of funds, such as debentures, long-term debt, preference share capital and ordinary share capital including retained earnings. —R. H. Wessel

Definitions of Capital Structure

Meaning and Definitions of Capital Structure:

Capital structure refers to the kinds of securities and the proportionate amounts of each security in the total capitalization of a firm. In other words, it means the composition of long-term sources of funds such as debentures, long-term loans, preference share capital and equity share capital including reserves and surplus. In simple words, it represents the mix of different sources of long-term funds in the total capitalization of the company.

“Capital structure of a company refers to the composition or make up of its capitalization and it includes all long-term capital resources viz., loans, reserves, shares and bonds”. -Gerstenberg

“The percentage share of each type of capital used by the firm-debt, preference share capital, and equity share capital and retained earnings”. – E.F. Brighani

Capital structure refers to the mix between owner’s funds and borrowed funds.

Capital structure refers to the composition or make up of the long-term sources of funds in the total capital of a company.