1. Introduction to Capital Structure

The term capital structure refers to the relationship between the various long-term source financing such as equity capital, preference share capital and debt capital. Deciding the suitable capital structure is the important decision of the financial management because it is closely related to the value of the firm.

A company may raise its total capital from various sources such as shares, debentures and other long term borrowings. There is no fixed charge on equity shares but on preference shares and debentures it is compulsory to pay dividend or interest respectively. Thus debentures and preference shares create fixed charge.

Capital structure refers to the kinds of securities and the proportionate amounts that make up capitalization. It is the mix of different long-term sources such as equity shares, preference shares, debentures, long-term loans and retained earnings.

2. Meaning of Capital Structure

Capital structure is that part of financial structure, which represents long-term sources. The term, ‘capital structure’ is generally defined to include only long-term debt and total stockholders’ investment. It is the mix of long-term sources of funds, such as equity shares, reserves and surpluses, debenture, long-term debt from outside sources and preference share capital.

ADVERTISEMENTS:

To quote Bogen, “Capital structure may consist of a single class of stock, or it may comprise several issues of bonds and preferred stock, the characteristics of which may vary considerably”. In other words, capital structure refers to the composition of capitalisation, i.e., to the proportion between debt and equity that make up capitalisation.

Capital structure is indicated by the following equation:

Capital Structure = Long-term Debt + Preferred Stock + Net worth (or)

Capital Structure = Total Assets – Current Liabilities

ADVERTISEMENTS:

Thus, the capital structure of a firm consists of shareholders’ funds and debt. The inherent financial stability of an enterprise and risk of insolvency to which it is exposed are primarily dependent on the source of its funds as well as the type of assets it holds and relative magnitude of such asset’s categories.

The above definitions have given different meanings of capital structure, and not about optimal capital structure. The following paragraph gives the meaning of optimum capital structure.

3. Definitions of Capital Structure

Capital structure refers to the mix of a firm’s capitalization i.e., mix of long term sources of funds such as – debenture, preference share capital, equity share capital and retained earnings for meeting total capital required.

The term capital structure refers to the relationship between the various long term sources financing such as equity capital, preference share capital and debt capital.

ADVERTISEMENTS:

Capital structure is one of the most vital and complex areas of decision making to any organization due to its relationship with other financing variable and its closely related to the value of the firm. Therefore it’s very important for a finance manager to understand the company’s capital structure and its relationship with returns and wealth maximization.

According to Gerstenbeg, “capital structure of a company refer to the composition or make-up of its capitalization and it includes all long term capital resources viz., loans, reserve, share, and bonds.

According to Schwartz, “The capital structure of a business can be measured by the ratio of various kinds of permanent loan and equity capital to total capital”.

Capitalization, Capital Structure and Financing Structure:

The term capitalization, capital structure and financial structure do not mean the same.

Capitalization

It refers to the quantitative aspect of the financial planning of an enterprise. It refers to the total amount of capital raised for its long term requirement by share, debenture, borrowing etc.

Capital structure

capital structure refers to the pattern and the proportion in which the composition of the capitalization is done.

ADVERTISEMENTS:

Financial structure

Financial structure describes the way in which short term and long term assets are included.

Financial structure refers to financial resources and the composition of percentage of short term and long term sources of funds. Capital structure is a part of financial structure.

4. Concept of Capital Structure

After determining the amount of capitalisation, another component of financial plan is related to a decision regarding the composition or structure of capital. In other words, a finance manager has to decide about the make-up of the total amount of capitalisation.

ADVERTISEMENTS:

If we look and analyse the balance sheet of any business concern (particularly the company), we find that its total capital is being distributed in equity shares, preference shares and debentures or bonds. Normally, the proportionate relationship between these securities is known as Capital Structure. However, financial experts differ in respect of composition of capital structure.

For example, Richard C. Osborn defines capital structure “as the financial plan according to which all assets of a company are financed. This capital is supplied by long-term and short-term borrowings, the sale of preferred and common (equity) stock (shares) and reinvestment of earnings.”

A similar view is also expressed by Walker and Baughn when they opine that the capital structure is synonymous with total capital; this term refers to the make-up of the credit side of the balance sheet or the division of claims among trade creditors, bank creditors, bond-holders, stock-holders, etc.

In contrast, Guthman and Dougall state that the phrase ‘capital structure’ may be used to cover the total combined investment of bond-holders including long-term debts such as mortgages and long-term loans as well as total stock-holders investment including retained earnings as well as original investment. Thus, the term capital structure refers to the composition of the long-term sources of funds.

ADVERTISEMENTS:

It includes equity capital including retained earnings and long-term debts. Thus, short-term liabilities should be excluded from the formulation of capital structure. In a simple way, capital structure is used to represent the proportionate relationship between debt and equity. In other words, capital structure represents in what proportion the total amount of capitalisation is divided in different securities.

Capital structure is the mix of long-term sources and it includes owned capital, preference share capital and long-term debt capital. Owned capital is known as variable dividend security, preference share capital is considered as fixed-dividend security and debentures/bonds/long-term debts are known as fixed interest bearing securities.

The Financial Manager attempts to fix the proportion/ratio among all these securities on the basis of certain assumptions and with reference to particular situation. While determining the pattern of capital structure or capital mix, a number of factors are to be considered.

However, the capital structure must be one which may protect the owners’ interest by assuring an optimal return continuously. The capital structure which offers guarantee for optimum returns is called optimum capital structure.

But the determination of such an optimum capital structure is a formidable task in practice. That is why significant variations among industries and among different individual companies within an industry regarding capital structure are noted.

A number of factors like features of individual securities, average cost of each source, form of control over the concern, extent of risks involved, etc., influence the capital structure decision.

5. Features of an Appropriate Capital Structure

ADVERTISEMENTS:

The appropriate capital structure is designed in such a way that the balance is made between return, risk and control of the firm.

The following are main features of an appropriate capital structure:

1. Financial Leverage:

The appropriate capital structure should maximise the return on stocks. The return can be maximised by having the proper mix of debt and equity capital in the capital structure of the firm. The debt is the cheapest source of funds. Thus, by increasing the proportion of debt in the capital of the firm, return on stocks can be increased.

However, the use of debt in capitalisation will depend on expected profits of the firm. Financial risk factor is involved in the use of debt in the total capital of a firm. If profits are low, lower proportion of debt should be used so that interest burden on the firm does not pose a threat to the existence of the firm.

If profits are high, a higher level of debt can be used to maximise the earnings on shares. This will serve the objective of finance manager i.e., to maximise the wealth of shareholders.

ADVERTISEMENTS:

2. Financial Risk:

The capital structure of a firm should provide maximum return to equity shareholders at the minimum financial risk. As the degree of financial leverage increases, the financial risk increases in a firm. Financial risk increases in tandem to increased use of debt in the capital structure of the firm.

A firm can use debt in a larger proportion in the capital structure of a firm, if the level of expected profits is high. Otherwise, debt should be used in small proportion in the capital of a firm. An appropriate capital structure should strike a balance between financial risk and return.

3. Ownership Control:

If management wants to keep the control of the firm in a few hands, then a larger proportion of the capital should be raised by debt capital. The increasing proportion of debt will not dilute the control of the firm. The appropriate capital structure should maintain a proper mix of debt and equity capital so that management of the firm can function in the democratic way.

4. Flexibility in Raising Funds:

ADVERTISEMENTS:

The capital structure of a firm should be flexible. It should have some financial slack. The capital structure should provide a room for expansion or starting of new projects by raising debt and equity capital when need arises. An appropriate capital structure of a firm should have the scope for raising funds as need arises.

Thus, an appropriate capital structure should be such as to maximise the returns on stock at the minimum level of financial risk. Further, there should be scope for expansion of business by raising the capital as when required. The capital structure of a firm should not pose risk to ownership control.

6. Importance of Capital Structure

Capital structure decision is one of the strategic decisions taken by the financial management. Considerable attention is required to decide the mix up of various sources of finance. A judicious and right capital structure decision reduces the cost of capital and increases the value of a firm while a wrong decision can adversely affect the value of the firm.

Various sources of finance differ in terms of risk and cost. Hence, there is utmost need of designing an appropriate capital structure.

Capital structure decisions are of great significance due to the following reasons:

(i) Capital structure determines the risk assumed by the firm.

ADVERTISEMENTS:

(ii) Capital structure determines the cost of capital of the firm.

(iii) It affects the flexibility and liquidity of the firm,

(iv) It affects the control of owners of the firm.

7. Capital Structure Decision

A company’s financing decision or capital structure decision is concerned with the sources of funds from where long term finance is raised and the proportion in which the total amount is raised using these sources of funds. It involves determining how the selected assets / project will be financed.

Broadly, financing decisions involve the following three issues:

i. The amount of total long term capital requirement. This is related to the capital budgeting decision of the company.

ii. Sources of funds from where funds are raised.

iii. Composition of total funds i.e. the proportion of each specific source in total capitalization.

8. Patterns of Capital Structure

Firm’s capital structure may be arrived at by use of equity share capital or preference share capital or debt capital (debentures or loans) or combination of all of them. The use of any one of these sources does not help come up with an optimum capital structure. Construction of optimum capital structure is possible only when there is an appropriate mix of the above sources (debt and equity).

The following are the patterns of capital structure:

(i) Complete equity share capital.

(ii) Different proportions of equity and preference share capital.

(iii) Different proportions of equity and debenture (debt) capital and.

(iv) Different proportions of equity, preference and debenture (debt) capital.

Approaches to Determine Appropriate Capital Structure:

The following are the approaches available to determine a firm’s capital structure:

1. EBIT-EPS Approach – This approach is helpful to analyse the impact of debt on earnings per share.

2. Valuation Approach – It determines the impact of use of debt on the shareholders value and

3. Cash Flow Approach – It analyses the firm’s debt service capacity.

Apart from the above ROI-ROE analysis, ratio analysis is also used. But here we will discuss the EBIT-EPS approach.

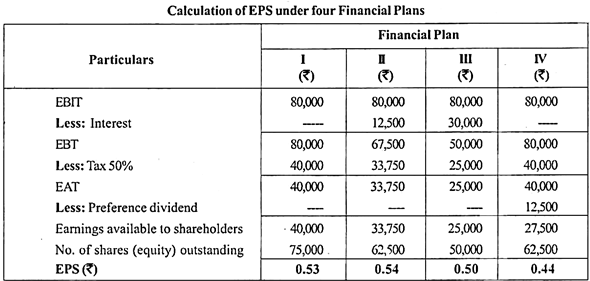

EBIT-EPS (Approach) Analysis:

Leverage affects shareholders’ return and risk that has been under leverages. But here we shall understand how sensitive is earnings per share (EPS) to the changes in earnings before interest and tax (EBIT) under different financial plans/capital structures. It is known as EBIT-EPS analysis. Use of fixed cost sources of finance in the capital structure of a firm is known as financial leverages or trading on equity.

The benefits are more when a firm uses debt as a source of finance, due to cheap and the interest is tax deductible source. Use of debt can be used to maximise shareholders’ wealth only when a firm has a high level of operating profit (EBIT). EBIT-EPS analysis is one way to study the relation between earnings per share (EPS) and various possible levels of operating profit (EBIT), under various financial plans.

Illustration:

VS International Ltd., has a capital structure (all equity) comprising Rs.5,00,000 each share of Rs.10. The firm wants to raise an additional Rs.2,50,000 for expansion programme. The firm has four alternative financial plans I, II, III and IV. If the firm is able to earn an operating profit at Rs.80,000 after additional investment and 50 per cent tax rate. Calculate EPS for all four alternatives and select the preferable financial plan.

Financial plans:

I. Raise the entire amount by issue of new equity capital.

II. Raise 50 per cent as equity capital and 50 per cent as 10 per cent debt capital.

III. Raise the entire amount as 12 per cent debentures.

IV. Raise 50 per cent equity capital and 50 per cent preference share capital at 10 per cent.

Solution:

Financial Plan II is preferable since EPS in that plan is high when compared to others.

9. Factors Influencing Capital Structure

1. Internal factors.

2. External factors.

1. Internal Factors:

(i) Financial Leverage:

The use of fixed interest bearing securities, such as – debt and preference capital along with owner’s equity in the capital structure is described as – ‘financial leverage’ or ‘trading on equity’. This decision is most important from the point of view of financing decisions.

By having debt and equity in the capital mix, the company will have an opportunity to employ a certain amount of debt with an intention to enjoy the benefits of reduction in percentage of tax. The benefits so enjoyed will be passed to the equity shareholders in the form of a high percentage of dividend.

(ii) Risk:

Debt securities increase the financial risk while equity securities reduce it. A firm can avoid or reduces risk if it does not employ debt capital mix, but compromising with the returns to equity shareholder. Hence a financial manager must employ the debt capital in such a way that the benefits of that should maximize the returns to equity shareholders.

(iii) Growth and Stability:

In the initial stages, a firm meets its financial requirements through long term sources like equity. Once the company starts getting good response and cash inflow capacity increases, it can raise debt or preference capital for growth and expansion.

The company having high sales will opt for more debt for their financial requirements. A company having less sales revenue must reduce its burden towards debt, because of its inability to pay interest on debt.

(iv) Retaining Control:

The attitude of the management towards retaining the control over the company will have a direct impact on the capital structure. If the existing shareholder wants to continue the same holding on the company, they may not encourage the issue of additional equity shares.

In normal practical situations, the existing equity shareholder directs the management to raise the additional sources only through debentures or preference shares which are also influenced by the reputation that the company enjoys.

(v) Cost of Capital:

The cost of capital refers to the expectation of the suppliers of funds. A firm should earn sufficient profits to repay the interest and installment of principal to the lenders. It is the maximum rate of return a firm should earn on its investment, so that market value of the shares of the company does not fall.

Different types of sources of funds will have different types of costs. Comparatively debt is a cheaper source of funds. Careful decisions have to be made in selecting the size of debt as it increases the risk of the firm.

(vi) Cash Flow:

Cash flow generation capacity of a firm increases the flexibility of the financial manager in deciding the capital structure. Sound cash flow facilitates the raising of funds through debt, insufficient cash takes a company to a disastrous situation, it loses its creditworthiness and many times goes into liquidation. Yearly cash inflow matters much to decide the capacity of a company to borrow debt.

(vii) Flexibility:

It means the firm’s ability to adopt its structure to the needs of the changing conditions; its capital structure should be flexible so that without much practical difficulty, a firm can change the securities in capital structure. It mainly depends on flexibility in fixed charges, restrictive covenants, terms of redemption and the debt capacity.

(viii) Purpose of Finance:

The purpose of finance influences the capital structure. If a firm is engaged in a business transaction, it can make use of debt and equity mix or can enjoy leverage benefits. For non-profit organization funds may be raised through only equity. For existing company’s growth and expansion may be financed through retained earnings, debenture or preference capital.

(ix) Assets Structure:

Fixed assets investment can be met by longer sources like issue of equity, debenture etc. A portion of current assets are also financed through long term sources, short term sources are used for meeting the working capital requirement.

2. External Factors:

(i) Size of the Company:

If a company plans to raise a smaller amount of capital, it selects only few securities in its capital structure. If it needs more capital, a number of different securities will be selected to raise funds in the capital structure.

(ii) Factor of Industry:

A public utility company which has support from state and central government can raise funds through preference share or debenture. A capital intensive company engaged in manufacture may have high equity and less debt capital. A trading company having less assets structure has to depend mainly on equity or preference capital.

(iii) Investors:

Investors are cautious over all the investments. Capital market is moving from equity to debt and from debt to deep discount bonds. The finance manager must be careful in selecting the securities for capital structure.

(iv) Cost of Flotation:

It refers to the expenses of a firm incurred during the process of public issue. Cost of flotation of debt is comparatively less when compared to the cost of flotation of equity. One should try to reduce this cost by a proper mix of debt and equity in the capital structure.

(v) Legal Requirements:

The legal and statutory requirements of the government, SEBI guidelines on investor protection, equity ratio, promoter’s contributions etc., will have direct bearing on capital structure and also monetary and fiscal policies of the government.

(vi) Period of Finance:

Short term funds, required to meet working capital requirements can be raised through commercial banks. Medium term finance, required to meet expansion and diversification purpose, can be raised through issue of preference or debenture capital- Long term or permanent funds required to meet capital expenditure can be raised by issuing equity shares.

(vii) Lever of Interest Rate:

The rate of interest will have a direct impact on borrowed funds. If the expectation of the banker or financial institutions is to get a high rate of interests then the firm can postpone the mobilization of funds or make use of retained earnings. Hence it affects the capital structures.

(viii) Lever of Business Activity:

When the level of activity of a firm is rising, the additional funds required for expansion and diversification can be raised through issue of debentures, preference shares or borrowing terms loans.

(ix) Availability of Funds:

Free flow of money in the economy encourages a corporate to raise funds through securities without much difficulty. The finance manager has to study the flow and availability of funds before he decides about the capital structure.

(x) Taxation Policy:

High corporate taxes. Taxes on dividend and capital gains directly influenced the decision of capital structure. High taxes discourage the issue of equity and encourage issuing more debt instruments.

(xi) Level of Stock Prices:

If the general price level of stocks or raw material is constant over a period of time, management prefers to invest such funds through long term or medium term financing. If the prices are fluctuating widely Short term sources are the best alternative for investments.

10 .Financial Structure

Financial structure of a company is concerned with both long term and short term sources of funds. Hence financial structure is the mix of all sources of funds whether long term such as debt and equity or short term such as bank overdraft, short term loans etc.

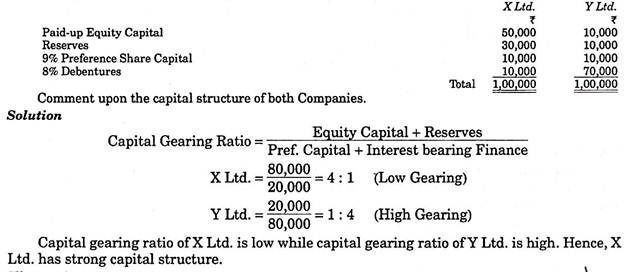

11. Capital Gearing

Capital gearing has great importance in maintaining a strong financial position and organised capital structure of a company. Capital gearing is defined as a ratio between equity share capital and fixed cost capital bearing securities i.e., long-term debts, debentures and preference share capital.

The formula is as follows:

Capital Gearing Ratio = (Equity Share Capital + Reserves and Surplus)/(Preference Share Capital + Interest bearing Finance)

Definitions:

According to J. Batty, “The relation of ordinary share to preference share capital and loan capital is described as the Capital gearing.”

According to Brown and Howard, “The term Capital gearing is used to describe the ratio between the ordinary share capital and interest bearing securities of a company.”

Types of Capital Gearing:

1. High Gearing:

When the ratio of fixed interest bearing securities, debentures, preference share capital, long-term debts etc., is more than equity share capital in the total capital of the company, it is known as high gearing. For example, the total capital of the company is Rs.1 crore out of this company collected Rs.25 lakh through issue of equity shares, Rs.20 lakh through issue of 10% preference shares and Rs.55 lakh through 8% debentures.

Thus capital gearing ratio will be:

25,00,000/(20,00,000 + 55,00,000) = 1:3 (High Gearing)

2. Low Gearing:

Low gearing is just opposite to the high gearing in the case of low gearing the ratio of ordinary share capital is comparatively more than the fixed interest bearing securities, debentures, preference share capital, long-term debts etc.

For example, the total capital of the company is Rs.1 crore out of this company collected Rs.60 lakh through issue of equity shares, Rs.20 lakh through issue of 10% preference shares and Rs.20 lakh through 8% debentures.

Thus capital gearing ratio will be:

60,00,000/(20,00,000 + 20,00,000) = 3:2 (Low Gearing)

Importance of Capital Gearing:

An optimum capital structure can be framed with the help of capital gearing. Usually in the beginning, a company should follow the policy of low capital gearing, and as the business and profits grow in future the policy of high capital gearing should be adopted. In fact a balanced and overall capital gearing is very helpful in successful operation of a business concern.

Effect of Capital Gearing during Trade Cycles:

1. Effect during Inflation or Boom Period:

During inflationary conditions a company can adopt high gearing and can increase the rate of dividend for equity shareholders. In this period fixed interest bearing capital is used more and more as the profits increased considerably.

In fact during the boom period the rate of interest or dividend payable on fixed cost securities is much lower than the rate of profitability. Therefore a company can manage to pay dividends to its equity shareholders at higher rates.

2. Effect during Deflation or Depression Period:

During the deflation period a company should adopt the policy of low gearing and should issue variable cost bearing capital i.e., equity share capital more and more. In this period the profits of the company fall and the rate of interest increases, hence a company will not be able to pay fixed interest cost out of the profit available. So a company should not issue the fixed cost capital but should prefer to maintain low gearing by issuing more and more equity share capital.

At the end it may be said without any doubt that all the policies regarding capital structure and financial management or administration of capital depends only on the balanced capital gearing.

Illustration:

The capital structure of two companies X and Y is as under:

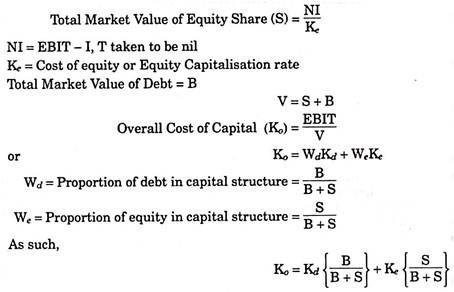

12. Capital Structure Theories

What is the relationship between capital structure, cost of capital and Company’s value? There are different theories to answer this question. One school of thought firmly believes that there is a relationship between value of the company and its overall cost of capital.

However according to another school of thought there is no relationship between the value of company and its overall cost of capital. Remember, overall cost of capital is the outcome of capital structure.

The following approaches are generally followed for examining the relationship between the value of company and its capital structure:

1. Net Income approach (N.I.)

2. Net Operating Income approach (N.O.I.)

3. Modiglliani-Miller approach (M.M.)

4. Traditional approach (T)

Before we take each approach separately for discussion, let us mention the basic assumptions regarding capital structure theories.

These assumptions are:

(i) There are only two sources of finances, viz., perpetual riskless debt and equity shares.

(ii) Corporate taxes are not in vogue.

(iii) Entire earnings are distributed as dividends i.e., dividend payout ratio is 100 percent.

(iv) In view of (iii) above, there are no retained earnings.

(v) The operating profit of the company is given and is not expected to grow.

(vi) All investors have the same subjective probability distribution of the expected future earnings before interest and taxes for a given company.

(vii) Total assets of a company are given and these are not expected to change over a period of time.

(viii) The company has a perpetual life.

(ix) Business risk is constant over time and it is independent of its capital structure and financial risk.

Before going into further discussion, the following formula should be taken into account:

13. Optimal/Optimum Capital Structure

In a financing decision, a financial manager’s job is to come out with an optimum capital structure. Optimum capital structure is that capital structure at that level of debt – equity proportion where the market value per share is maximum and the cost of capital is minimum.

The same to quote, Ezra, optimum leverage is that mix of debt and equity which will maximise the market value of the company and minimise the company’s overall cost of capital.

The study of capital structure involves a discussion of the nature of the industry and specific circumstances of the business enterprise in question besides the general theory of finance. It is difficult to define ideal capital structure.

A company’s capital structure is a function of the nature of its business and how risky the particular business is and therefore, a matter of business judgment.

As observed by Van Home, “In the optimum capital structure, the marginal real cost of each available method of financing is the same”. As Guthmann and Dougall rightly remark, from a strictly financial point of view, the optimum capital structure is achieved by balancing the financing so as to achieve the lowest average cost of long-term funds. This in turn produces that maximum market value for the total securities issued against a given amount of corporate income.

The optimum capital structure keeps a balance between share capital and debt capital. The primary reason for the employment of debt by an enterprise can be stated as that up to a certain point, debt is from the point of view of the ownership, a less expensive source of funds than equity capital. Hence, optimum capital structure keeps a balance between debt capital and equity capital.

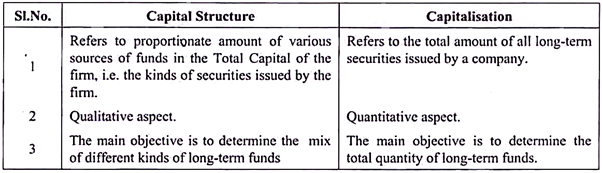

14. Difference between Capital Structure and Capitalization

The important differences between Capital Structure & Capitalization are as under:

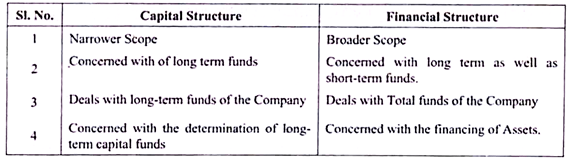

15. Differences between Capital Structure and Financial Structure

The important differences between Capital structure & financial structure are as under: