1. Definitions of Capitalisation

Capitalization means the amount of capital invested in a business. The capital of the company may comprise various types of securities such as common and preferred stock, debentures, bonds and long term loans which are summed up in the capital account on a balance sheet.

This invested capital and debt, generally of the long-term variety, comprises a company’s capitalization, i.e., a permanent type of funding to support a company’s growth and related assets.

Capitalization defined by the various financial management experts mentioned below-

According to Guthman and Dougall, “capitalization is the sum of the par value of stocks and bonds outstanding”.

ADVERTISEMENTS:

“Capitalization is the balance sheet value of stocks and bonds out stands”. -Bonneville and Dewey.

According to Arhur. S. Dewing, “capitalization is the sum total of the par value of all shares”.

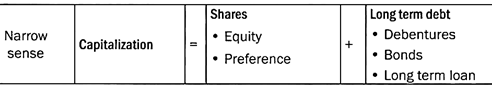

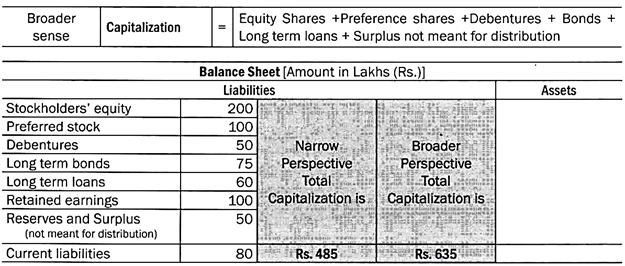

The capitalization can be defined in different perspectives. According to narrow perspective capitalization means total of shares and long term debt.

In a broader perspective, the term capitalization constitutes, sum of all long term securities such as equity, preference, debentures, bonds and also includes long-term loans and in addition to this it also comprises surplus which is not meant for distribution as dividend.

Thus, capitalization refers to the sum of all the sources of Long term funds used in an organization’s capital. Capital structure is a qualitative term that gives the ratio in which the total capital is contributed by different sources. On the other hand capitalisation is the quantitative measure that indicates capital employed by means of long term sources of funds.

2. Theories of Capitalisation

Once the concept of capitalization is explained and made clear, a natural question arises as how to ascertain the required capital for a newly-promoted concern (this is called the amount of Capitalisation).

Two theories have been propounded and used in this respect:

(A) Cost Theory of Capitalisation, and

(B) Capitalised Value of Earning Theory of Capitalisation.

ADVERTISEMENTS:

(A) Cost Theory of Capitalisation:

This is the traditional theory. According to this theory a projected Balance Sheet is prepared. The sum of amounts of all items to be shown on the assets side of the projected Balance Sheet is taken as the amount of capitalisation.

In other words, the total of the amount of preliminary expenses incurred in connection with the establishment of a business plus expenses incurred in the acquisition of fixed assets needed for the operations of business and the minimum amount of Working Capital for meeting the day-to-day expenses is called the Volume of Capitalisation.

Forecasts are to be made in respect of preliminary expenses, fixed assets and working capital. Such forecasts are made on the basis of past experience, or on the basis of financial statements of concerns engaged in the same line of activity or on the basis of consultancy from promotional or financial experts.

(B) Capitalised Value of Earning Theory of Capitalisation:

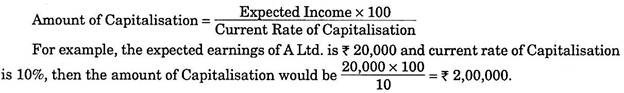

This theory is based on the fact that the amount of Capitalisation is deeply and intimately correlated with the amount of earnings.

As such, the earning capacity of the concern has to be considered, while determining the amount of Capitalisation. On the basis of this theory, the amount of Capitalisation is equal to the Capitalisation value of expected earnings at current rate of Capitalisation.

Thus:

3. Stages of Capitalisation

The amount of Capitalisation is computed by both cost theory and capitalized value of earning theory. However capitalized value of earning theory is considered to be more scientific and modern. One can highlight upon the justification of the amount of capitalization by considering the earning of the concern.

ADVERTISEMENTS:

If the amount of capitalization is more as compared to earnings, it will be called the stage of ‘over-capitalisation’; when the amount of capitalization is less as compared to earnings; it is a case of ‘under-capitalisation’. However, when the amount of capitalization is the same as warranted by the amount of earnings, it is a case of ‘Fair Capitalisation’.

(A) Over-Capitalisation:

It is quite clear that when any business concern continuously fails to earn as much income on the capital employed as not sufficient to give dividend at a reasonable rate to its shareholders, this is constantly a case of over capitalisation. According to Bonneville, Dewey and Kelly, “When a business is unable to earn a fair rate of return on its outstanding securities, it is over capitalised.”

In this connection, Gerstenberg opines that a “corporation is over-capitalised when its earnings are not large enough to yield a fair return on the amount of stocks and bonds that have been issued.” Hogland has to say on this point “Whenever the aggregate of par values of stocks or bonds outstanding exceeded the true value of fixed assets, the corporation was said to be over-capitalised.”

ADVERTISEMENTS:

It must be clear that a company is said to be over-capitalised only when it has not been able to earn fair income over a long period of time. In such a situation, the real values of a company’s total assets would be less than their book values. As a result, market value of equity shares declines.

(B) Under-Capitalisation:

Under-capitalisation is just the reverse of over-capitalisation but it should never be taken to indicate deficiency or inadequacy of capital. The stage of under-capitalisation arises when the concern starts earning at a rate higher than current rate. In fact, it is an index of proper and effective utilisation of capital employed in the concern.

In the words of Gestenberg, “A Corporation is under capitalised when the rate of profits, it is making on the total capital is exceptionally high in relation to the return enjoyed by similar companies in the same industry or when it has too little capital with which to conduct its business.”

ADVERTISEMENTS:

On the other hand, Hogland is of the opinion that under-capitalisation means excess of assets when compared with total share capital invested in the business. In fact, under-capitalisation is indicative of sound financial position and good management of the company.

(C) Fair Capitalisation:

In essence, there should neither be over-capitalisation nor under-capitalisation. It is very essential for a business entity to have fair capitalisation. Fair capitalisation is that stage of capitalisation where the amount of capitalisation is the same as warranted by the amount of earnings.

In other words, at fair capitalisation:

Actual Rate of Earning = Current Rate of Earning

Real Value of the Business = Book Value of the Business

ADVERTISEMENTS:

Real Value per Share = Book Value per Share

This stage of fair capitalisation is a very ideal situation. This can be achieved by debt and equity components in the capitalisation.

4. Over Capitalisation

Over capitalization is a situation when the company raises more capital than required for its level of business activity and requirements. Business activity here represents the routine operations of the business.

Overcapitalization occurs if total of owned and borrowed capital exceeds its fixed and current assets i.e., more capital used than actually required and the funds are not properly used, the excess capital is not used to its fullest and the only solution is to either expand the company or reduce the share capital.

Definition – Over Capitalization:

According to Beacham, over capitalization refers to “when securities in the company are issued in excess of its capitalized earning power”.

ADVERTISEMENTS:

“According to Bonneville, Dewey and Kelly, over capitalization means, “when a business is unable to earn a fair rate on its outstanding securities”.

In the words of Hoagland, “whenever the aggregate of the par values of stocks and bonds outstanding exceed the true value of fixed assets of the corporation, it is said to be over capitalized”.

5. Under Capitalisation

The concept of Under-capitalization is just the opposite of over-capitalization. Under capitalization is a situation when the company does not have sufficient capital to conduct normal business operations and pay creditors.

In other words an undercapitalized company lacks adequate cash to carry out its functions and usually fails to qualify for loans from financial institutions due its unacceptably high Debt-to-equity ratio.

Definitions:

Under capitalization defined by Gerstenberg, “a corporation may be under-capitalized when the rate of profit is exceptionally high in the same industry”.

ADVERTISEMENTS:

“Hoagland defined under capitalization as “an excess of true assets value over the aggregate of stocks and bonds outstanding”.