1. Meaning of Cash Flow Statement

Cash flow statement provides information about the cash receipts and payments of a firm for a given period. It provides important information that compliments the profit and loss account and balance sheet.

The information about the cash flows of a firm is useful in providing users of financial statements with a basis to assess the ability of the enterprise to generate cash and cash equivalents and the needs of the enterprise to utilize these cash flows.

The economic decisions that are taken by users require an evaluation of the ability of an enterprise to generate cash and cash equivalents and the timing and certainty of their generation.

The statement deals with the provision of information about the historical changes in cash equivalents of an enterprise by means of a cash flow statement which classifies cash flows during the period from operating, investing and financing activities.

2. Preparation of Cash Flow Statement

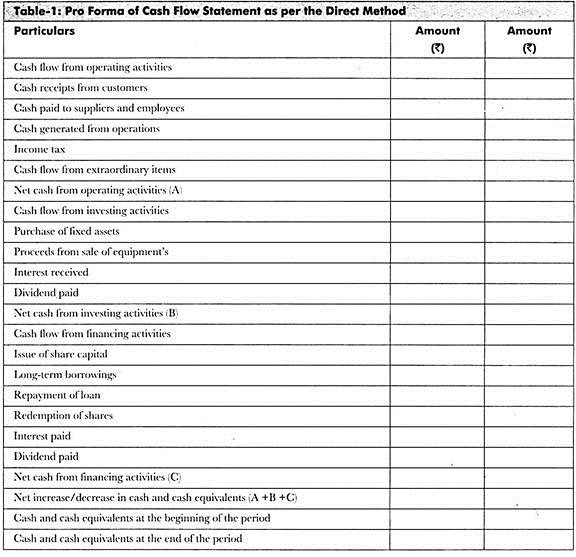

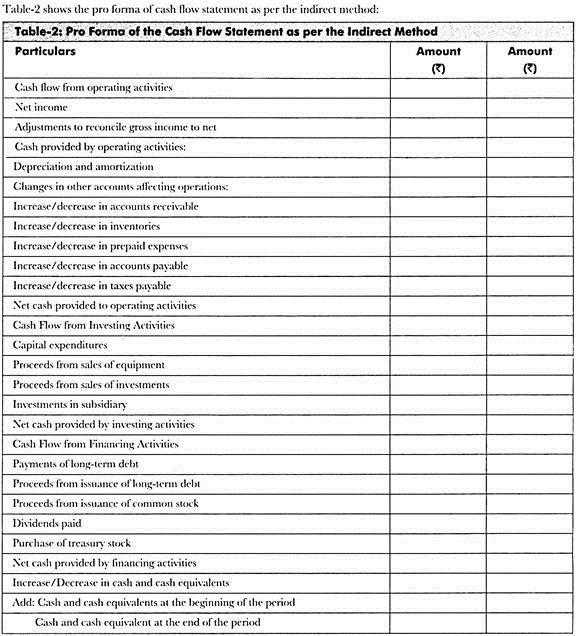

Institute of Chartered Accountants of India (ICAI) has provided 35 Accounting Standards, which should be followed while preparing any type of financial statement of an organization. Accounting Standard (AS)-3 laid down two formats, namely direct and indirect methods for preparing cash flow statements.

ADVERTISEMENTS:

The main difference between the two methods is that the data used to calculate cash flow from direct method is different from the data used in indirect method. Two different proforma are provided to show the different set of data used in the calculation of cash flow.

Table-1 shows the pro forma of cash flow statement as per the direct method:

The points to be considered while preparing the cash flow statement are as follows:

ADVERTISEMENTS:

i. Treat marketable securities as long-term investments. These securities appear in cash flow from investing activities.

ii. Treat all types of debt (whether short or long) as long-term debt. These debts appear in cash flow from financing activities.

iii. Treat the payment of dividends as cash outflow. Dividends are considered financing activities; whereas, interest payments are termed as operating outflow.

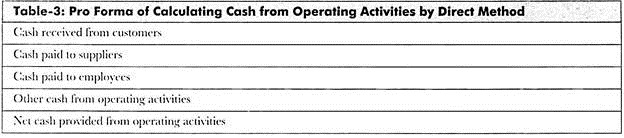

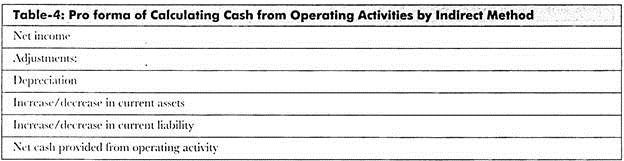

iv. Operating activities, such as cash receipts from customers and payment made to suppliers, are carried out on a day- to-day basis.

ADVERTISEMENTS:

Therefore, a separate pro forma is used to calculate cash from operating activities. However, investing and financing activities, such as issue of share capital and long-term borrowing, do not take place on a day-to-day basis.

The organization carries out these activities occasionally. Therefore, there is no separate proforma to calculate cash flow from investing and financing activities. Cash flow from operating activities can be calculated by two methods, namely direct and indirect.

Table-3 shows the pro forma of calculating cash from operating activity by using the direct method:

Table-4 shows the pro forma of calculating cash from operating activity by using indirect method:

3. Limitations of Cash Flow Analysis

The cash flow analysis is criticized for the following reasons:

I. Misleading Inter-Industry Comparison:

Cash flow statements do not measure the economic efficiency of one company in relation to another. Usually a company with heavy capital investment will have more cash inflow. Therefore, interindustry comparison of cash flow statements may be misleading.

II. Misleading Inter-Firm Comparison:

The terms of purchases and sales will differ from firm to firm. Moreover, cash inflow does not always mean profit. Therefore, inter firm comparison of cash flows may also be misleading.

ADVERTISEMENTS:

III. Misleading Comparison over a Period of Time:

Just because the company’s cash flow has increased in the current year, a company may not be better off than the previous year. Thus, the comparison over a period of time can be misleading.

IV. Influenced by Changes in Management Policies:

The cash balance as disclosed by the cash flow statement may not represent the real liquid position of the business. The cash can be easily influenced by purchases and sales policies, by making certain advance payments or by postponing certain payments.

ADVERTISEMENTS:

V. Cannot be Equated with Income Statement:

Cash flow statements cannot be equated with the Income statement. An Income statement takes into account both cash as well as noncash items. Hence, net cash flow does not necessarily mean net income of the business.

VI. Not a Replacement of Other Statements:

Cash flow statement is only a supplement of funds flow statement and cannot replace the Income statement or the Funds flow statement as each one has its own function or purpose of preparation.

ADVERTISEMENTS:

Despite the above limitations, a cash flow statement is a very useful tool of financial analysis. It discloses the volume and speed at which cash flows in various segments of the business and the amount of capital tied-up in a particular segment.