1. Meaning of Leverage

Leverage is used to describe the firm’s ability to use fixed cost assets or funds to magnify the return to its owners. James van Home has defined leverage, as “the employment of an asset or funds for which the firm pays a fixed cost or fixed return.” In other words, Leverage is the employment of fixed assets or funds for which a firm has to meet fixed costs or fixed rate of interest obligation irrespective of the level of activities or the level of operating profit.

When a firm uses fixed assets, it Results in fixed operating costs. Similarly when a firm uses those sources of finance in its capital structure on which it is required to pay fixed cost or fixed rate of interest, it results in fixed financial costs. Higher is the degree of leverage higher is the risk and higher is the expected return and vice versa.

The leverage can be favourable or unfavourable as the fixed cost or return has to be paid irrespective of the volume of sales, the amount of such cost or return has a significant effect on the profits available for equity shareholders.

2. Concept of Leverage

The term Leverage in general refers to a relationship between two interrelated variables. In financial analysis it represents the influence of one financial variable over some other related financial variable. These financial variables may be costs, output, sales revenue, earnings before interest and tax, earnings before tax, earning per share, etc.

ADVERTISEMENTS:

There are three commonly used measures of leverages in financial analysis. These are:

(i) Operating leverage,

(ii) Financial leverage, and

(iii) Combined leverage.

ADVERTISEMENTS:

(i) Operating Leverage:

Operating Leverage is defined as “the firm’s ability to use fixed operating costs to magnify effects of changes in sales on its earnings before interest and taxes”. In other words operating leverage is the tendency of the operating profit to vary disproportionately with sales. It is said to exist when a firm has to pay fixed cost regardless of volume of output or sales.

The operating leverage shows the relationship between the changes in sales and the changes in fixed operating income. Thus, the operating leverage has an impact mainly on fixed costs and also on variable costs and contribution. Of course, there will be no operating leverage if there are no fixed operating costs.

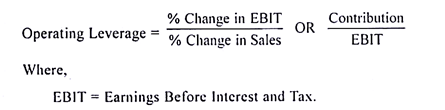

The operating leverage can be calculated by adopting the following formula:

(ii) Financial Leverage:

ADVERTISEMENTS:

The financial leverage is defined as the ability of a firm to use fixed financial charges to magnify the effects of changes in operating profits, on the firm’s earning per share. In other words, the financial leverage is the tendency of a residual net income to vary disproportionately with operating profit. It indicates the change that takes place in the taxable income as a result of change in the operating income.

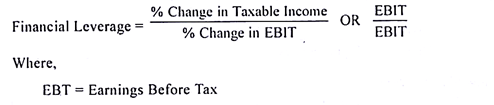

The financial leverage can be computed by adopting the following formula:

(iii) Combined Leverage:

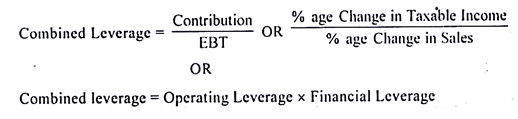

The operating leverage explains the operating risk and financial leverage explains the financial risk of the firm. However, a firm has to look into overall risk or total risk of the firm i.e., operating risk as well as financial risk. Hence, if we combine the operating risk and financial risk, the result is combined leverage. Combined leverage thus expresses the relationship between revenue on account of sales and the taxable income.

The combined leverage can be computed by adopting following formula:

3. Importance of Leverage

With the understanding of leverage, a finance manager can increase earnings per share and dividend per share to equity shareholders as well as market value of the firm. When the rate of return on investment is more than the cost of debt capital, it gives more rate of return on equity capital. This in turn maximises shareholders’ wealth, which is the basic objective of financial management. The leverage can help increase both the EPS and EBT.

The importance of leverage can be judged from the following points:

1. Leverage is an important technique in deciding the optimum capital structure of a firm. With the help of this technique, it is easy to determine the ratio of various securities comprising the capital structure of a firm at which the average cost of capital is minimum. If financial leverage is present in a firm, it is possible to increase EPS by increasing the EBIT in a firm.

ADVERTISEMENTS:

2. Leverage is also very helpful in taking a capital budgeting decision. If contribution in a firm is not able to meet the fixed operating costs, then business will suffer loss. In other words, the degree of operating leverage must be greater than 1 to make the project operationally profitable.

3. Leverage is most important in assessing the risk involved in a firm. Operating leverage measures the business risk of a firm. Financial leverage measures the financial risk in a firm. The combined leverage measures the total risk involved in a firm.

In leverage analysis, it is assumed that cost of capital always remains constant. But, after a certain limit, the cost of financing generally starts increasing.

The use of more debt capital increases the risk level in a firm which results in reduction in the value of shares. Thus, in leverage analysis, explicit cost of debt capital is considered, while its implicit costs are ignored. Leverage principle assumes that the required additional debt capital should.be raised till the expected rate of return on investment is higher than cost of debt capital.

4. Types of Leverages

ADVERTISEMENTS:

The leverage is of two types-

(i) Financial Leverage and,

(ii) Operating Leverage.

The leverage related to the activities (employment of fixed assets) is called operating leverage. The leverage related to financing activities (employment of fixed cost bearing sources of finance) is known as financial leverage.

ADVERTISEMENTS:

Here, it is noteworthy that earnings before interest and tax (EBIT) are an important item in the determination of operating and financial leverages. Earnings before interest and tax are also called operating profit.

5. Pattern of Leverage

From the shareholders’ point of view, the pattern of leverage depends upon the fact as to whether shareholders are benefitted or otherwise by the use of leverage.

If earnings after deducting variable costs (known as contribution) are more than fixed costs or if earnings before interest and tax (EBIT) are higher than fixed return charges (i.e., fixed interest and fixed dividend on preference shares), then it will be considered a case of favourable leverage.

In other words, if the increases in operating profit increase the taxable profit, earning per share, dividend per share and expected value of shares, then it will be termed as favourable or positive leverage.

As contrary to this, the leverage may be considered unfavourable or negative when the change in operating profit brings a decrease in taxable profit, earning per share, dividend per share and expected market value of shares.

Thus, we can say that leverage is such a tool which operates on both sides. While on the one hand, it increases the risk, it also provides opportunity, on the other hand raising the return on capital employed. Till sales revenue’s level is high, high leverage succeeds in yielding more than proportionate profit on owners’ capital.

ADVERTISEMENTS:

But as soon as sales revenue falls, it also reduces the profit on owners’ capital in more than proportionate rate. Thus, favourable leverage provides gains to shareholders and unfavourable leverage results into losses to shareholders. Thus, it can be said that for trading on high leverage, a high level of skill and prudence is desired.

6. Indifference Point

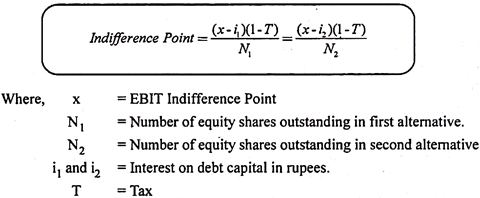

The indifference point refers to that level of EBIT at which EPS are the same regardless of leverage in alternative financial plans. At this level, all financial plans are equally desirable and the management is indifferent between alternative financial plans as far as the EPS is concerned.

In other words, it is that level of EBIT at which it is immaterial for the financial manager as to which capital structure or capital mix he adopts for the company. At this point, the use of debt capital or a change in this proportion in the total capital will not affect the return to equity shareholders or earning per share.

It is also called the debt-equity indifference point and can be determined mathematically in the following manner:

Relevance of Calculation of Indifference Point:

The determination of indifference points helps in ascertaining the level of operating profit (EBIT) beyond which the debt alternative is beneficial because of its favorable effect on earnings per share.

ADVERTISEMENTS:

In other words, it is profitable to raise debt for strengthening EPS, if there is likelihood that future operating profits are going to be higher than the level of EBIT as determined. On the other hand, it is advisable to issue equity shares for raising more funds if it is expected that EBIT is going to be lower than that determined.

7. EBIT-EPS Analysis

The EBIT-EPS analysis is carried out to assess the impact of different financial proposals on the value (EPS) of the company. Since the basic aim of financial management is to maximise the wealth of shareholders, the EBIT-EPS analysis is crucial in maximising the wealth of the company.

The financial proposal having the highest EPS is considered for the execution. The different financial proposals may be the use of, only equity, combination of equity and debt, combination of equity and preferential capital, or any combination of equity, debt and preferential capital. EBIT-EPS analysis shows the impact of financial leverage on the EPS of the company under different financial proposals.

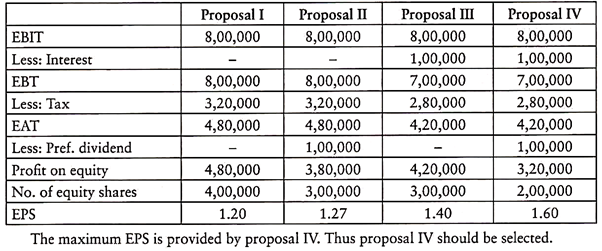

The example given below explains the concept of EBIT-EPS analysis:

Example:

Tulip Limited is planning to set up an industrial plant costing Rs. 40,00,000. It is expected the plant will yield an EBIT of Rs. 8,00,000 per annum.

ADVERTISEMENTS:

The company has following financial proposals to meet the cost of the plant:

(i) To finance the project by issuing 4,00,000 equity shares of Rs. 10 each,

(ii) To finance the project by issuing 3,00,000 equity shares of Rs. 10 each and 1,00,000 10% preferential shares of Rs. 10 each,

(iii) To finance the project by issuing 3,00,000 equity shares of Rs. 10 each and raising Rs. 10,00,000 by way of debt at 10%, or

(iv) To finance the project by issuing 2,00,000 equity shares of Rs. 10 each, 1,00,000 10% preferential shares of Rs. 10 each and raising Rs. 10,00,000 by way of debt at 10%.

If the company is in the 40% tax bracket, which financial proposal is best?

ADVERTISEMENTS:

Solution:

Computation of EPS under different financial proposals:

8. Financial Break Even Level

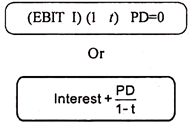

It is that level of EBIT at which EPS is zero and the firm is just able to meet all fixed financial payments like interest on debt and preference dividend.

It can be found out by solving the following equation:

9. Limitations of Leverage

Leverage as a tool of financial management, suffers from the following limitations:

(a) Implicit Cost of Debt Ignored:

The leverage analysis relies on the explicit cost of debt. It suggests that the use of additional debt capital as long as explicit cost of debt exceeds the rate of return on capital employed. However, the increased use of debt capital tends to make the firm financially risky that is reflected by reduction in price of shares in the market.

The intending investor in equity capital expects a higher rate of return as a compensation for increase in risk. This additional risk premium is the implicit cost of debt that is completely ignored.

(b) Increase in Cost of Debt:

With increase in use of debt, the debt equity ratio tends to increase. As a result, the prospective providers of debt funds hesitate to provide additional debt, except at a higher rate of interest. But a basic assumption of leverage analysis is that the cost of debt capital remains unchanged irrespective of amount of borrowings.

(c) Debt with Captive Market:The biggest limitation of the leverage analysis is that they look at the total amount of borrowing, not the firm’s ability to actually service its debt. Some firms, with captive markets, may carry a significant amount of debt, but they generate enough cash to easily handle interest payments. Such firms are labeled as being risky though they may not be because of the captive market they enjoy.