In this article we will discuss about the alternative objectives of firm, explained with the help of suitable diagrams.

Profit maximisation is the traditional objective of the business firm, but not the only objective. Firms pursue alternative objectives as well as sales maximisation or satisficing. W.J. Baumol has put forward the sales-maximisation hypothesis.

In the language of R.G. Lipsey has commented:

“In the giant corporation, the managers need to make some minimum level of profits to keep the shareholders satisfied; after that… they seek growth unhampered by profit considerations. Salary, power and prestige of management are all more closely related to the size of the firm than to its profits; the management of a large, normally profitable corporation may well earn a salary higher than that earned by the manager of a small but highly profitable corporation.”

ADVERTISEMENTS:

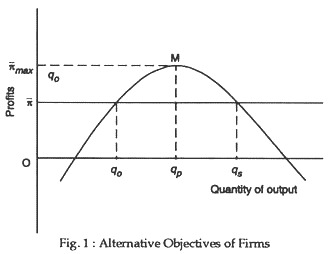

The sales-maximisation hypothesis is illustrated in Fig. 1. It shows that sales maximisation, subject to a profit constraint, causes firms to sacrifice some profits by setting price below, and output above, the profit maximising levels. A profit-maximising firm produces output qp and earns profit of πmax. According to sales maximisation hypothesis, a firm, with a minimum profit constraint π, produces the output qs. Thus, sales maximisation hypothesis predicts a higher level of output than the profit maximisation hypothesis.

The Nobel Laureate economist, H. A. Simon, puts forward the view that business firm want to ‘satisfice’, i.e., achieve certain targets for sales, profits and market share which may not coincide with profit maximisation.

Under the satisficing hypothesis a firm is happy with the profits π and is not following a maximising strategy. It will be content with any output between q0 and qs.

ADVERTISEMENTS:

Managerial Discretion:

Modern economists referred to managerial theories. One such theory focuses on managerial discretion. This is illustrated in Fig.1, where profits are shown on the vertical axis and other things managers like such as leisure, power, prestige (status), utility, etc. on the horizontal axis.

Profit maximisation is at point A, but left to themselves, managers might go for position C where the things they like are maximised. So, point C indicates equilibrium of the firm under managerial discretion. Managers may choose an optimal combination of the two, as indicated by point B.

Other objectives may include the following:

ADVERTISEMENTS:

Market Domination:

This may be pursued for the purpose of profit maximisation, but this need not always be so — domination of a market may also give stability and security to the firm, which may appear to professional managers as more attractive than profit maximisation.

Moreover, pursuit of market domination may lead a business to pursue a policy of sales maximisation. For example, a firm may cut prices of its product for driving its rivals out of business. After having achieved this it could then exploit the market.

Growth Maximisation:

Managers may also seek to maximise corporate growth if they enjoy more power and responsibilities. Growth will mean higher salaries. For achieving growth now less profitable goods may be produced. If growth is achieved at the expense of profit maximisation, it may not be in the interests of the owners of the firm.

Growth may be achieved in three ways:

(1) Market expansion;

(2) Diversification of product range or activity of the firm into new areas;

(3) Takeover of other businesses.