For analyzing the long-run behaviour of the firm we would require knowledge of its long-run demand and its long-run cost schedules.

However, there is great uncertainty regarding these schedules. Tastes in the market change continuously and the reaction of competitors is impossible to predict.

Thus firms cannot estimate their future demand. Past experience does not help much in reducing uncertainty, because extrapolation of past conditions in the future is hap-hazardous given the dynamic changes in the economic structure.

Given this uncertainty average-cost pricing theorists reject the demand schedule as a tool of analysis, thus abandoning half of the apparatus of the traditional theory of the firm.

ADVERTISEMENTS:

Uncertainty also envelops the long-run costs of the firm. Rapid technological change and changes in factor prices make it impossible to obtain reliable estimates of the long-run cost schedule. Thus in average-cost theories it is assumed that the firm takes its decisions on the basis of its short-run average costs.

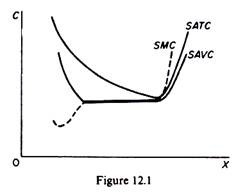

It is explicitly or implicitly assumed that the short-run average variable cost has a flat stretch (figure 12.1) which reflects the fact that firms build into their plant some reserve capacity which allows them flexibility in their operations. Reserve capacity is required for various reasons.

(a) To meet seasonal fluctuations in demand.

(b) To allow a smooth flow of production when break-down of some equipment occurs,

ADVERTISEMENTS:

(c) To meet a growing demand until further expansion of scale is realized.

(d) To allow some flexibility for minor alterations of the style of the product in view of the changing tastes of customers, and for other reason.

The average variable cost has a saucer-type shape (figure 12.1). The falling part shows the decrease in cost due to better utilization of some of the fixed factors up to the capacity of the plant. Over the range of the falling SAVC the SMC is below it. The increasing part of the SA VC reflects the waste of raw materials, the higher repair costs of machinery and overtime payment to the labour force. When the SAVC is rising the SMC lies above it.

ADVERTISEMENTS:

Over the flat stretch of the SAVC the SMC is equal to the average variable cost (the two curves coincide). Pricing is based on the flat stretch of the SA VC. At levels of output lower than the normal capacity level (that is, the range of output for which the plant has been optimally designed) firms have high costs, yet they do not charge a price to cover these costs because they expect to eventually reach the normal range of output.

Similarly, the firms may produce (when there is pressure of demand) on the increasing part of their AC, but they will not charge a higher price to cover such costs because they are afraid of losing their goodwill. (If the pressure of demand is revealed to be permanent, firms will install additional equipment, enlarging their plant capacity).