Value Maximisation Model of the Firm (With Limitations and Diagram)!

In modern managerial economics business decision making by managers are guided by the objective of maximising value of the firm.

Since in a corporate form of business it is the shareholders who are the owners of the firm, value of a firm represents shareholders wealth.

Thus, value maximisation of a firm implies maximisation of shareholder’s wealth. Therefore, this model is also known as “shareholders wealth maximisation model”.

ADVERTISEMENTS:

Thus modern managerial economics departs from the traditional economic theory in which it is assumed that managers of corporate firms or owner-managers of self-owned business enterprises seek to maximise short-run profits. It has often been observed that firms sacrifice some short-run profits for the sake of higher profits in the future years.

That is, they aim at maximising long-run profits. It is because of this objective that business enterprises incur huge expenditure on research and development, new capital equipment and expensive promotional schemes for their products. Therefore, incorporation of time in the analysis of decision making by managers of business enterprises is essential. Modern theory of the firm assumes that primary objective of the firm or their managers are to maximise value of wealth or shareholder’s wealth.

1. Value Maximisation Model:

Value of the firm is measured by calculating present value of cost flows of profits of the firm over a number of years in the future. To do so profits of future years must be discounted because money value a rupee of profit in a future year is worth less than a rupee of profit in the present. Therefore, the value of the firm or shareholder’s wealth is given by the present value of all expected future profits of the firm.

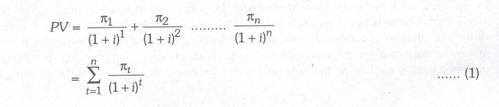

Thus, the value of a firm may be expressed as follows:

ADVERTISEMENTS:

Value of the firm = Present value of expected future profits

Since profits are the difference between revenue (R) and cost (Q, the above equation (1) may be written as

Where PV is the present value of the future expected profits and therefore represents the value of the firm, ,

2 etc. are the expected profits in each of the future years t1, t2, t3 and so forth up to any future year n which are considered by the firm for maximisation of expected future profits, i is the appropriate interest rate at which expected future profits are discounted to obtain the present value of the firm. ∑ denotes the sum of the present values of expected future profits.

It may be noted that in the above equations (1) and (2) time dimension has been included in the maximisation model by considering the expected future profits rather than only the profits of the current year. Secondly, this model also allows for the consideration of risk and uncertainty. For instance, if a series of future profits is highly uncertain (that is, it is likely to differ, substantially from the expected values of future profits) it will involve a great deal of risk. To compensate the shareholders for bearing this risk, the discount rate of interest can be raised. Thus, the greater the risk involved in obtaining a future amount of profit, the lower will be the value placed by shareholders on future profits. We thus see that value maximisation model of the firm enables us to overcome the two major shortcomings of the static short run profit maximisation model.

Further insights regarding maximisation of value of the firm can be gained by decomposing TR and TC which determine profits made by the firm. TR is obtained from multiplying price with the quantity of output sold. Thus

TR = Pt. Qt

Where Pt stands for the price of the product of the firm in a period and Qt is the quantity sold in that period.

Cost can be obtained by taking a sum of variable cost and fixed costs. Thus

TC=Vt.Qt + F

Where Vt is the average variable cost and Vt . Qt measures the total variable cost in a period. Ft represents the total fixed cost.

The present value of the firm measured in equation (2) can be written as:

The term Pt. Qt measures the total revenue generated by the sale of the product, while (Vt . Qt + F) represent the total cost of the firm in period.

ADVERTISEMENTS:

It is evident firm equation (3) that the value of the firm depends on the sales of the product (Qt) and pricing decision (Pt) by managers on the one hand and firm’s cost, both variable and fixed, on the other. Sales and pricing decision of a firm depends on demand function for the firm and its marketing strategy.

The choice of capital investment made by a firm or, in other words, capital budgeting decision determines the proportions of fixed and variable costs in the total cost function of the firm. The division of total cost into fixed cost and variable cost is determined by the choice of a production method to be used for the production of a commodity. Thus, choice of a capital-intensive method by the firm will mean a greater proportion of fixed cost and vice versa.

ADVERTISEMENTS:

Cost of production also depends on physical production conditions including the technology used and prices of inputs. The discount rate of interest that is used to find out the present value of the present value of the stream of expected future profits depends on the perceived risk of the firm, rate of expected inflation and conditions in the financial markets.

Conditions in the financial markets determine interest rate and, therefore, the borrowing costs of the firm. It is thus clear that equation (3) provides us a unifying theme for the analysis of business decision by a firm.

2. Constrained Optimisation:

The primary goal or objective of the firm is to maximise value of the firm, that is, shareholders wealth. But to achieve its objective it faces many constraints. Thus, in making efficient or optimum decisions regarding pricing level of output, production method, costs, managers of the firms work under several constraints.

Subject to the various constraints a firm seeks to maximes its profits or the present value of the stream of expected future profits. Therefore, decision-making by a firm to maximise profits or value of the firm is called constrained optimisation. The constraints faced by a firm restrict the range of possible opportunities or alternative courses of action from which a firm has to choose for maximsing its profits or value.

ADVERTISEMENTS:

These constraints are of the following types:

(i) Legal Constraints:

The legal constraints relate to such laws as minimum wage acts, company act to regulate corporate governance, Anti-Trust Act or Competition Promotion Act to prevent the emergence of monopolies and unfair trade practices, rules fixed by SEBI (Security and Exchange Board of India) regarding issue of shares and transactions in stock markets. Besides, there are laws which require the business firms to ensure pollution emission standard for protection of environment, required health and safety standards of the employees.

A society imposes these constraints on the firms in order to modify behaviour so as to make them consistent with the overall social objectives.

(ii) Input Constraints:

Another important type of constraints relates to the limited availability of essential physical inputs. A firm may not be able to obtain as many skilled workers as it needs for the production of a good. Further, a firm may also find difficulties in procuring specific raw materials it requires for its production. The limited factory space and storage facilities may also be other constraints which a firm may be facing.

(iii) Financial Constraints:

Another type of constraints under which a firm works relates to the financial resources it is able to raise.

Two important sources of raising resources for corporate firms are:

ADVERTISEMENTS:

(1) Issuing shares or debentures to raise resources from stock market,

(2) Obtaining loans from the commercial banks and other financial institutions. The firms may find difficulties in raising the required financial resources from these two sources.

3. Limitations of the Value-Maximization Model of the Firm:

The basic model of the firm outlined above which considers that the primary objective of the manager is to maximise value of the firm or shareholders wealth has been criticized on the ground that it is quite unrealistic. More specifically it has been alleged that maximising short-run profits or present value of the firm considers higher profits alone as the sale objective of the firm or the basis of firm’s behaviour.

It is pointed out that in the present-day corporate form of business firms, in their decision making managers strive to promote their own interest by enhancing their power, prestige, leisure. In fact, managers may maximise their utility rather than profits or value of the firm. Thus, William Baumol has argued that managers seek to maximise sales rather than profits or value of the firm. He has put forward a sales maximisation model as an alternative to profit or value maximisation model.

Olivar Williamson has argued that managers of modern corporate firms seek to maximise their utility rather than maximising short-run profits or value of the firm. According to him, utility of a manager depends on their salaries, fringe benefits, stock options, the number of subordinate staff under him, and the extent of his control on the company.

Finally, following the work of Herbert Simon a Nobel Prize winner in economics, Richard Cyert and James March ‘ have suggested that in view of great uncertainty and a lot of constraints faced by a firm, the management of a modern corporation is a very difficult and complex task.

ADVERTISEMENTS:

According to them, managers are not able to maximise profits even if they so desire. Therefore, in their opinion, managers only satisfied, that is, they attempt to have a satisfactory performance in terms of profits, sales, market share or growth of the firm. Thus, according to Simon, Cyert and March, managers of business corporations try to satisfy rather than to maximise.

Comments:

While the alternative theories of firms lay stress on some relevant aspects of managerial behaviour, none of them provide a satisfactory substitute for the profit or value maximisation model of the firm.

Managers who strive for maximisation of their own interests or utility rather than the firm’s profits or value are likely to be replaced by the shareholders of the firm. Alternatively, if managers do not fully exploit profit opportunities, they will be taken over by other firm which sees its profit potential.

Research has shown that in free market economies intense competition that prevails in the product and capital markets forces the managers to strive for maximising firm’s profits or its value (i.e. shareholder’s wealth) rather than promoting their own interest or maximising their utility.

If they do not do so, they will be either replaced by the shareholders or the firms being managed by them will be taken over by others. Recent studies also show that there is a high correlation between profits and managerial compensation (i.e. their salaries and perks).

Thus, in the free market economies today managers have strong incentives to pursue profit motive or value maximisation of the firm. Recent studies also show that there is a high correlation between profits and managerial compensation (i.e. their salaries and perks). Stock holders are interested in profit maximisation or value maximisation of the firm because it affects rate of return on capital investment.

ADVERTISEMENTS:

Therefore, in managerial economics, the theory of the firm based on profit maximisation or value maximisation is generally used in explaining managerial decision making. However, discussion of alternative theories of sales maximisation, managerial utility maximisation and satisficing behaviour provide us further significant insights into working of modern business corporations.