Read this article to learn about the differences between the limitations of monetary policy and fiscal policy.

Tools of fiscal policy like budget, taxation, public spending and debt have great practical limitations and give rise to certain fundamental problems.

These difficulties are mainly three. The effectiveness of fiscal policy depends on the size of the measures adopted and their timing.

For example, what is the exact amount of expenditure that should be incurred or the revenue that should be raised at a given time is more than any fiscal authority can foresee.

ADVERTISEMENTS:

Then, there are political and administrative delays in taking measures especially when legislative sanction is needed for changing the rates and structure of taxes or expenditure on programmes. The success of fiscal measures depends also upon the redistribution of income and a chain of economic and psychological reactions on the part of the people as a result of these measures.

Again, the effects of an increase in government expenditure are counteracted, to some extent, by an increase in the value of imports and a decline in the value of exports, thereby reducing the multiplier effects. Moreover, the funds for increased expenditure should be raised in such a way as would not depress investment in industries of the private sector. If a government demand for labour and raw materials come in competition with private industries, the latter would suffer indefinitely.

Hence, government spending should be such as to supplement and not supplant private investment. Further, government spending may not be in the direction of correcting maladjustments caused by depression and may even be neutralized by factors working in the opposite direction such as structural unemployment.

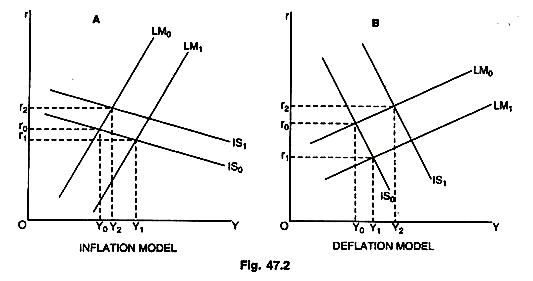

The entire fiscal armory has to be made use of with great care. Thus, the effectiveness of fiscal policy is impaired to a considerable extent by the choice of policy lags and there timing combined with recognition, action, administrative, operational lags. Besides, there is the problem of forecasting, selectivity and adequacy of fiscal measures. Sometimes, the various compensatory fiscal policies become mutually offsetting. Safeguards have got to be adopted against these limitations. The effectiveness or otherwise of the fiscal measures can be accurately determined by-the elasticities of IS and LM functions, as shown in the Fig. 47.2.

ADVERTISEMENTS:

In these models, monetary policy operates by shifting the LM function whereas fiscal operates by shifting the IS function. In Fig. 47.2(A), the IS function is more elastic while the LM function is less elastic, as such the monetary policy is relatively more effective while the fiscal policy is less effective. A shift in the LM function to the right LM1 in Fig. 47.2(A), causes an expansion in income more than the possible decline in interest rate (from Y0 to Y1 as compared to a fall in interest from r0 to r1).

On the other hand, a shift of the IS function to the right will cause a small expansion in income and a greater rise in the rate of interest (from Y0 to Y2 and the rise from r0 to r1). This clearly shows that the monetary policy is quite effective during inflation. But when tax reduction or increase in public spending shifts the IS function from IS0 to IS1— income expands from Y0 to only Y2; while the rate of interest increases considerably from r0 to r2.

On the other hand, in Fig. 47.2(B), the LM function is more elastic and the IS function is less elastic. The shift in the LM function will have little effect on income while significant effect on the rate of interest (income will change from Y0 to Y1 and the rate of interest will change from r0 to r1). It shows the relative ineffectiveness of monetary policy.

Again, a shift in the IS function to the right will cause more changes in income while the rate of interest changes slightly (income changes from Y0 to Yi and the rate of interest varies from r0 to r1). This shows a greater effectiveness of fiscal policy. The monetary expansion brings an increase in income from Y0 to Y1 which lowers the rate of interest considerably from r0 to r1. The fiscal changes cause a shift in the IS function from IS0 to IS1 and a shift in income from Y0 to Y1 and the rate of interest from r0 to r2.

ADVERTISEMENTS:

The fiscal policy is relatively more effective in expanding income and employment than monetary policy in a period of depression. There is, however, no certainty about the elasticities of IS-LM functions and, therefore, the two policies (monetary and fiscal) cannot be used to the exclusion of each other to counteract cyclical changes. It is, therefore proper to operate these two policies together.

Before the depression of the 1930s, monetary policy was viewed with respect. The deliberate use of fiscal policy had not come to the forefront at that time. Severe depression exposed the weaknesses of monetary policy as an important stabilizer of income, output and employment: monetary policy became obsolete and the swing turned in favour of fiscal policy.

The great advantage of monetary policy was is flexibility; it could be altered quickly if the maintenance of stability so desired. Moreover, it has been impersonal and non-discriminatory in nature (save for selective credit controls) and involved a minimum amount of direct government interference in economic matters.

The weaknesses of monetary policy made fiscal policy a powerful weapon for checking unemployment and depression. In case of worst depressions, fiscal policy can be resorted to through public works expenditures.

The weakness of fiscal policy lies in the difficulty of applying sufficient restraint in times of inflation. Limitations of monetary policy and fiscal policy clearly warn us against assuming that we have the matters of stable economic growth and full employment firmly in hand. Yet, to end on a negative note would be unfortunate.

It is true that virtues of monetary policy are still doubted. If monetary policy has its defects, fiscal policy has no loss. However, a proper combination of both provides a powerful tool against economic instability and unemployment.

Neither monetary nor fiscal policy, taken alone, can provide the means for an adequate stabilization programme. In fact, each is essential and must be used to supplement the other and the one should not (need not) come in conflict with the other. There is no inherent contradiction between monetary and fiscal policies. Both of them aim at objectives such as full employment and the complementary to each other.

While monetary policy affects income and expenditures—particularly in the private sector by influencing the cost and availability of money; the fiscal policy affects income and spending through its effects on the amount, character and timing of government revenues and expenditures.

ADVERTISEMENTS:

Again, in order to control inflation, monetary policy aims at high interest rates and tight money conditions to reduce expenditures in general; with the same end in view, fiscal policy aims at higher taxes and lower public expenditures by attaining a budget surplus. Moreover, both policies are formulated and implemented by government through different departments—monetary policy through the central bank and fiscal policy through the Ministry of Finance. Thus, in the interest of economic stability and full employment, it is necessary to co-ordinate the working of various monetary and fiscal tools.

If unemployment and payments deficit co-exist, an expansionary fiscal and restrictive monetary policy may prove useful; if payments deficit is associated with inflation, it is proper to adopt restrictive monetary and fiscal policies; if unemployment and external surplus co-exist, expansionary monetary and fiscal policies may be adopted and if internal inflation is accompanied by external surplus, a restrictive fiscal and an expansionary monetary policy will remedy the situation. These generalizations, however, are not universal.

It all depends upon a particular situation. While fiscal policy may be more effective during depression, monetary policy is more effective in inflation. Monetary fiscal policy mix is adopted not only for internal and external balances but also for high rate of economic growth.

In developing economies, where a major portion of the low level of income is spent on consumption, the resources for economic development can be mobilized only by restricting consumption through additional taxation and direct controls.

ADVERTISEMENTS:

The monetary policy like low interest rates and easy availability of credit for stimulating investment will also have to be followed. It is, therefore, clear that an appropriate mix of monetary and fiscal measures is a must for success.