Let us make in-depth study of the role of fiscal policy for mobilisation of resources for economic growth.

Introduction:

In the Indian economy, the Government has to play a very active role in promoting economic growth and fiscal policy is an important instrument that the state must use.

In a democratic society, there is an inherent dislike for direct (physical) controls and regulation by the state. The entrepreneurs would not like to be ordered about to produce this or that, how much to produce or where to produce. Fiscal incentives in the form of tax concessions, rebates or subsidies are, therefore, preferable.

Similarly, the consumers would not like to be told directly to curtail their consumption or to consume this and not to consume that. Taxation of commodities and services whose consumption is to be discouraged is therefore preferable. Hence, a democratic state must rely on indirect methods of control and regulation and this is done through fiscal and monetary policies. Thus, in democratic countries, fiscal policy is a powerful and least undesirable weapon on which government can rely for promoting economic growth.

ADVERTISEMENTS:

Capital formation is of strategic importance for bringing about rapid economic growth. It is, therefore, necessary to achieve a higher ratio of savings to national income. In early days of capitalism, payment of low wages and the existence of inequalities of income helped capital formation is the present-day developed countries. But no democratic country can adopt this method in modern times; the effort rather is to raise wages and reduce inequalities of income and wealth.

Under a regime of socialist dictatorship such as that prevailed in erstwhile Soviet Russia capital formation was brought about by ruthlessly curtailing consumption and keeping down the standards of living. But in modern democracies with every adult person having a right to cast vote very low levels of living for a long time is not feasible. Hence the state must rely on instruments official policy to mobilize resources for economic development.

Taxation can be used to raise collective savings for public investment and also at the same time to promote private investment. A well-conceived scheme of taxation is an important way of raising ratio of savings to national income which is one of the crucial determinants of the rate of economic growth.

However, is a liberal mixed economy such as ours the task of fiscal policy is not only to raise saving ratio for acceleration of growth but also to improve investment eliminate for private sector so that higher rate of investment be achieved. As Nurkse says, “public finance assumes a new significance in the face of the problem of capital formation in underdeveloped countries.”

ADVERTISEMENTS:

On the expenditure side, there is positive need for public investment, especially in those spheres of economic activity where the private investments are not easily attracted, for example, the development of power resources, roads and highway, ports and airports, means of transport and communications, basic heavy industries, social infrastructure such as education and research, public health etc. Such investments are very often the very foundations of rapid economic advance. Thus, fiscal policy is of crucial importance in accelerating the pace of economic growth in developing countries.

Capital formation is an important determinant of economic growth. For accelerating the rate of capital formation, savings and investment rate in the economy has to be stepped up. For this purpose savings have to be mobilized and channeled into productive investment. The alternative means other than fiscal policy available to promote savings and investment in the developing countries are not very effective in mobilizing enough resources for investment and capital formation.

Fiscal policy has also to promote voluntary savings. There exist large inequalities of income in these countries and this should ensure a large voluntary savings by the richer sections of the society. But the richer sections in them indulge in conspicuous consumption such as building of luxury houses, indulging in five star culture, buying air-conditioners and such other things and, therefore, the volume of their voluntary savings is inadequate.

This propensity to indulge in conspicuous consumption is reinforced by demonstration effect which is operating strongly these days due to the development of better communication system and superior means of advertisement. Further, rich people tend to invest their rising incomes on unproductive investment such as gold and jewellery, real estate etc., which yield high profits due to their appreciation. In view of these, without proper fiscal policy savings cannot be made available for raising significantly the rate of capital formation.

ADVERTISEMENTS:

Fiscal policy, if properly designed, is an efficient and equitable way of mobilizing resources for augmenting public investment. Through it not only collective public savings can be raised for financing public investment but also at the same time private savings and investment can be encouraged.

In fact taxation may be the most effective means of increasing the total volume of savings and investments in an economy where the propensity to consume is normally high. Further, the fiscal policy can be so devised that not only the objective of rapid capital accumulation or growth, but also other objectives of economic policy such as equitable distribution of income and wealth, price stability and promotion of employment opportunities can be achieved. In what follows we shall explain how the various instruments of fiscal policy such as taxation and Government borrowing can be used to mobilize resources for economic development.

Government Budget Constraint: Role of Taxation in Financing Economic Development:

Government Budget Constraint:

The government normally finances its expenditure through receipts from taxes, both direct and indirect. When government expenditure increases and it finds it difficult to raise more resources from taxation, it resorts to borrowing from the public or printing money to finance its budget deficit.

Increase in rates of income and other taxes not only adversely affects incentives to work more, save and invest more but also promotes tax evasion. Further, as Laffer curve concept shows increase in rate of a tax beyond a point causes revenue from taxes to decline. Thus there are limits to increasing revenue from taxes to finance the increased expenditure of the government.

As result, when government finds it difficult to raise adequate resources to finance its increased expenditure fully through normal taxes, it faces a resource constraint resulting in budget deficit which in recent years is also called fiscal deficit.

Thus government budget constraint refers to the limit to which the Government can finance its budget deficit by taxation, borrowing from the market (i. e., through sale of its bonds) or using printed money. The Government has to make a choice between the magnitude of borrowing from the market and the magnitude of using printed money to finance its budget deficit written as:

The general form of government budget equation is:

G = T + ∆B + ∆M … (1)

ADVERTISEMENTS:

Where G stands for government expenditure (including subsidies and interest payments on past debt), Tis tax revenue, ∆B is the new borrowing from the market (through sale of bonds or securities) and ∆M is the new printed money issued to finance Government expenditure. According to the budget constraint equation (1), government expenditure in a year can be financed by tax revenue (2), new borrowing (∆B) by the government from the market (both within and outside the country) through sale of its bonds, and by creating new high powered money (∆M) which is also called money financing.

The Government budget constraint can be rewritten as:

G – T = ∆B + ∆M … (2)

G – T represents budget deficit (also called fiscal deficit) that must be financed by new borrowing (∆B) by the government through sale of bonds and by creation of new high powered money (∆M) which is called money financing. Thus

ADVERTISEMENTS:

Budget Deficit = New Borrowing (i. e., Sale of Bonds by the Government) + Printed Money The budget deficit (fiscal deficit) can be financed either by printing money (also called seiniorage) by the government or by selling bonds to the public (which includes banks, insurance companies, mutual funds and other financial institutions).

It is through sale of bonds that the government borrows from the market which adds to the government debt. The government has to pay interest annually on its debt and have also to pay back the principal sum borrowed at the maturity of bonds or securities. Besides, borrowing by the Government leads to the rise in interest rate which crowds out private investment.

On the other hand it Government finances its budget deficit by using printed money, it can lead to inflation. Thus due to budget constraint, the Government has to make a difficult choice between borrowing from the market and using printed money to finance its budget deficit. Financing through the use of printed money is also called money financing.

In times of recessionary conditions which arise due to the deficiency of aggregate demand J.M. Keynes argued for the adoption of deliberate policy of framing a budget deficit to get rid of recession and restore full-employment equilibrium. In recent years there has been a considerable debate among economists about the appropriate methods of financing the budget deficits and their consequences.

ADVERTISEMENTS:

It is important to discuss the consequences of budget deficit and the mode of its financing as there has been persistent large budget deficits year after year not only in developed countries such as the United States but also in the developing countries such as India resulting in mounting burden of public debt on the one hand and inflation on the other.

Direct Taxes and Mobilisation of Resources:

Now the question arises what should be the taxation structure of a developing economy which will mobilize the potential economic surplus to the maximum, that is, what kinds of taxes be levied, how much progressive should be their rates and what should be the exemptions and concessions in various taxes.

This is, however, a highly controversial issue. It has been suggested that an appropriate tax which would mobilize resources or mop up economic surplus is the progressive income tax. Income tax is imposed not only on the incomes of individuals but also on the profits of the corporate companies.

Thus there is personal income tax and corporate income tax (that is, tax on net profits earned by corporate companies). In India and the other developing countries income has been regarded as a good base for direct taxation. And the imposition of highly progressive income tax not only mops up relatively greater amount of resources but also tend to reduce inequalities of income.

However, a progressive income tax with a high marginal rates of taxes adversely affects private saving and investment and also raises the propensity to evade the tax. In view of this, two proposals have been put forward to make the income tax both as an effective instrument of resource mobilisation for the public sector and of providing incentives to save and invest.

First, Prof. Kaldor of Cambridge University, who in 1956 was invited by Government of India to suggest reforms in the Indian tax system for mobilizing resources for development, suggested that whereas the marginal rate of income tax be reduced to, say, 45 to 50 per cent, expenditure tax be levied to discourage the people belonging to upper income brackets from dissipating their income in conspicuous consumption.

ADVERTISEMENTS:

According to him, this will also reduce the tendency to evade income tax on the one hand and promote private savings on the other. The second proposal to reform the income tax put forward by others is that whereas marginal rates of income tax be kept high but some exemptions for approved forms of saving and investment be allowed to the individuals. This will channel individual savings along desired lines and at the same time mobilize resources for development.

Apart from the income tax on individuals and companies, the imposition of other direct taxes such as capital gains tax, wealth tax, gift tax, and estate duty are also needed to mobilize sufficient resources for capital formation. Unlike income tax, these capital taxes do not have any adverse effects on incentives to save and invest.

They are also important instruments of reducing inequalities of income and wealth. Because of these advantages, Professor Kaldor in his report of taxation reforms in India recommended the imposition of these capital taxes and this recommendation was accepted and the annual wealth tax and gift tax were levied in 1957 with estate duty having been already introduced in 1954.

Agricultural Taxation and Resource Mobilisation:

A major part of national income in India and other developing countries originates in the agricultural sector which has substantial economic surplus which can be tapped for capital formation. This economic surplus mainly goes to rich farmers, landlords, merchants and other intermediaries and, in the absence of suitable taxation on agriculture, this is used for conspicuous consumption and for investing in unproductive activities such as buying gold, jewellery, real estate.

Thus, according to Professor Kaldor, “the taxation of agriculture by one means or another has a critical role to play in the acceleration of economic development.” Further, owing to economic growth in general and agricultural development in particular income of the agricultural class and therefore economic surplus enormously increases and therefore need to be mopped up for further development.

ADVERTISEMENTS:

Besides, the agricultural sector has to be taxed not only because it has a potential surplus but also to achieve maximum utilisation of land through devising a system of land taxation which would penalize poor use of good land. In this regard, a progressive land tax “the effective rates of taxation of which vary with the total value of landholdings of the family unit” may be suitable one. Besides this, progressive agricultural income tax with appropriate exemption may be levied to tap resources from affluent sections of the agricultural sector.

It may be noted that as compared to the non-agricultural sector, agricultural sector in India and other developing countries is quite under-taxed. Land revenue which was at one time the greatest source of revenue for government has now become an insignificant yielder of revenue. In the context of India, Agricultural Taxation Committee under the Chairmanship of Dr. K.N. Raj recommended Agricultural Holdings Tax (AHT) which was to be imposed at a progressive rate on the rate able value of agricultural holdings of Rs.5000 and above. It was expected to yield annually Rs. 200 crores.

However, Agricultural Holdings Tax was found to be difficult to assess and administer. In our view, a graded surcharge on the existing land revenue will be far easier to assess and administer and make land revenue a more elastic source of revenue. In 2002, Kelkar Committee on tax reforms also recommended imposition of tax on agricultural income, proceeds from which were to be distributed among the states.

But this was vehemently opposed by the members of the ruling party. However, it may be noted that in India agricultural taxation is a state subject and there is lack of political will on the part of the State Governments to raise the level of land taxation in a country. But if sufficient resources are to be mobilized for development, the level of agricultural taxation has to be raised.

Merits of Direct Taxes for Resource Mobilisation:

As seen above, as an instrument of resource mobilisation for development direct taxes enjoy several advantages:

(1) They raise resources in a non-inflationary way. Indeed, by reducing disposable incomes of the people direct taxes tend to check inflation by curtailing consumption demand.

ADVERTISEMENTS:

(2) If they are made progressive, they help to reduce inequalities of income and wealth, and thus help in achieving the equity objective, and

(3) Progressive direct taxes discourage conspicuous and non-necessary consumption and thereby enlarge economic surplus.

But the direct taxation of income and wealth has its own limits. The coverage of direct taxes is quite narrow and difficult to expand. For instance, in India out of 125 crore of population only about 3 crore individuals of the population come within the purview of income tax as incomes of the majority of the people fall below the exemption limit which in 2012-13 budget was raised to the annual income of Rs. 200,000. Moreover, there is a considerable evasion of income tax. Yield from other direct taxes such as wealth tax, gift tax is quite meagre due to very small coverage, low rates and considerable evasion of them.

However, in India due to buoyancy of personal income tax and corporate tax percentage share of direct taxes in gross tax revenue of the central Government greatly went up to 58.9 per cent in 2009-10 from 41 per cent in 2003-04. This reflects sharp improvement in equity of our tax system. In 2011-12, the share of direct taxes (personal income tax and corporation tax) was 54.9 per cent.

Role of Indirect Taxes in Resource Mobilisation:

As a result of limitations of direct taxes, developing countries have resorted to extensive use of indirect taxes. In India, almost all commodities have been brought within the net of indirect taxes such as excise duties and sales tax. Besides, there are custom duties (i.e., taxes on imports and exports). Indirect taxation is an important source of development funds in a developing Country such as India. In the last five decades of planned development, revenue from several indirect taxes has been rising.

It has been pointed out by some economists that indirect taxes are better suited to the conditions obtaining in developing countries for reducing current consumption and mobilizing resources for development. This is because in such countries quite a large proportion of national income tends to be diverted to current consumption instead of being productively invested.

ADVERTISEMENTS:

The average propensity to consume in such countries is much higher than is the case in advanced countries. Indirect taxes which reduce consumption must thus play a more important part. They will raise the rate of savings which are so essential for economic growth. It may be noted that indirect tax system can also be made progressive by levying higher indirect taxes on income-elastic luxuries such as cars, air conditioners, air travel.

This will serve the equity objective, apart from making larger contribution to resource mobilisation for economic growth. Similarly, imposing higher indirect tax on harmful commodities such as cigarette-less and alcohol will serve a useful social purpose of discouraging their consumption.

“High rates of taxes on commodities with a high income elasticity of demand are quite effective in siphoning a substantial proportion of increase in output into the resources of the public sector needed for development financing and a higher rate of commodity taxes on luxury articles tends to introduce an element of progressiveness in an otherwise predominantly regressive tax structure in developing countries.”

But in order to make sure that the resources raised through commodity taxes are adequate, it will be necessary to extend their coverage to include some goods of mass consumption. In the poor countries, it is not possible to exempt entirely goods of general and necessary consumption, because they are the only goods that provide a base broad enough to assure an adequate amount of resources.

It may be noted that revenue from indirect taxes has substantially increased during the six decades of development (1951-2010). From a small sum of Rs. 227 crore in 1950-51, the revenue raised from indirect taxes rose to about Rs. 5, 04,423 crore in 2012-13 (BE). Moreover, the share of indirect takes to gross tax revenue (direct plus indirect taxes) was about 44 per cent in 2012-13.

It is thus clear that for mobilisation of resources for growth and capital formation indirect taxes have made an important contribution. But due to reduction in customs duties and union excise duty on the one hand and a large increase in revenue from direct taxes such as personal income tax and corporation tax on the other, share of indirect taxes in gross tax revenue of Central Government has declined from 78.4 per cent in 1990-91 to 44 percent in 2011-12. Now, about 55 per cent of GDP in India comes through ‘services’.

Therefore, to increase the tax base for indirect taxation, more than 120 services have been brought in the net of the service tax. In 2011-12, revenue from service tax was estimated at Rs. 97, 579 crores and for 2013-14 service tax is estimated to yield 1.80 lakh crore. It is expected that in future service tax will make a substantial contribution to the mobilisation of resources for economic growth.

To improve the indirect tax structure, broaden its base and rationalize the rates a single indirect tax called ‘Goods and Services Tax (GST)’ is proposed to be introduced in near future. This new indirect tax GST will replace CENVAT (which is a central excise duty levied by the central government on the basis of value added) and service tax levied by the Centre and VAT levied by the States.

Limitations:

But there are some limitations of raising resources through indirect taxes. First, they lead to cost-push inflation. The burden of indirect taxes are passed on to the consumers in the form of higher prices charged from them. In India excise duties on sugar, cloth, kerosene oil, petrol etc., has raised the prices and have contributed a good deal to cost-push inflation witnessed in past some years. Secondly, levying of custom duties on imports of capital goods, raw materials used for industrial production have accelerated cost-push inflation in the Indian economy.

Thirdly, imposition of custom duties on imports of goods also protect inefficiency in domestic industries. This also contributes to high-cost production and promotes inefficiency. Fourthly, indirect taxes are regressive in nature; both the rich and poor have to pay the same rate on the taxed commodities.

The regressive character of indirect taxes have been attempted to be reduced by imposing higher rates of excise and custom duties on luxury items and smaller rates of duties on goods of mass consumption. However, the need for mobilizing greater resources have forced the finance ministers to levy higher indirect taxes even on articles of mass consumption. Lastly, the higher excise duties, customs duties and service tax lead to higher prices of Indian goods and thus adversely affect competitiveness of Indian goods in the foreign markets.

Due to these shortcomings of indirect tax the reforms undertaken in India since 1991 seek to bring about a compositional shift from excessive dependence on indirect taxes to direct taxes and provide for increased competitiveness of the Indian Industry.

Role of Taxation in Promoting Private Saving and Investment:

It is worth mentioning that in a mixed economy such as ours, there is need to raise not only the public savings and investment but also to promote private saving and investment so that the overall rate of saving and investment in the economy is stepped up. This implies that taxation measures should not impair incentives to save and invest of the people.

Therefore, a developing economy encounters a crucial dilemma in augmenting larger resources for public investment on the one hand and to promote private savings and investment on the other. Thus, according to Prof. Heller, “Tax Policy faces a basic dilemma in its role as a an instrument of capital formation for economic development. On the one hand, high levels of taxes are necessary to finance that part of the development which falls in the government share and to mobilize for investment the private resources that might otherwise be dissipated. On the other hand, the lower the taxes the greater will be the inducement to private investment. The dilemma is worsened by the fact that those taxes which are most effective in capturing a large share of the gains from economic development for further capital formation are the ones most likely to affect the returns from private investment. Only way of the dilemma may be to combine high rates of taxation in general, with preferential treatment for categories of desired development activity.”

However, the empirical evidence of the last 20 years of tax reforms in India confirms the Laffer curve concept that increase in tax rate beyond a point causes Government revenue to fall. Therefore in our view, moderate rates of tax on income with preferential treatment of some desired development activities such as building of infrastructure can ensure higher private saving and investment. Private savings can be promoted in several other ways. First, interest on several types of private savings such as bank deposits, investment in units of Unit Trust of India and National Savings Certificates, and other approved forms of saving be exempted from taxation to a reasonable extent.

This will encourage private savings through raising the rate of return on savings as the savers would earn some interest income free of income tax. Secondly, voluntary savings in certain selective lines such as voluntary contributions to provident fund, life insurance premium, certain specific units (of UTI) and National Savings Certificates be substantially exempted from income tax. This will also stimulate private savings by raising the rate of return on these savings. For, people will not only earn rate of interest or dividend but will save a good amount of income tax on these approved forms of savings.

Thirdly, as noted above, if very high progressivity in tax rates is avoided (that is, if rates of income taxes do not increase much with the increase in income) private saving and investment will be boosted up. The Laffer curve concept shows that the policy of moderate progressivity in tax rates will not only help to maintain incentives to save and investment but will also yield more revenue to the Government:

In view of the present author, the lower marginal rates of taxes will place more disposable income in the hands of higher income brackets which will tend to raise their conspicuous consumption, especially when goods catering to their frivolous wants are available in abundance these days through both domestic production and imports.

As mentioned above, this is reinforced by the international demonstration effect which exercises a strong influence on the consumption behaviour of the richer sections of the Indian society. The increase in consumption can be discouraged by living expenditure tax as proposed by Nicholas Kaldor. Besides private savings, private investment can be directly encouraged through taxation.

Firstly, in order to stimulate private investment, the retained profits which are reinvested by the business firms instead of distributing them among the shareholders can be exempted from taxation or taxed at preferential rates.

Secondly, to boost private investment liberal depreciation and investment allowances can also to be allowed to the business firms which will be used for purposes of investment in new plant, equipment and machinery. Further, subsidies on investment, that is, tax break or tax rebate can also be provided by the Government which generally prove to be a very effective way of promoting private investment.

Another important fiscal method of stimulating private investment in developing countries is granting of tax holidays or relief from tax on the profits of new enterprises for some specified period of time. Further, indirect taxes can also be manipulated in a variety of ways to promote private investment in certain selected fields of industrial activity.

Thus exemption or lowering of sales tax or excise duties on some domestically produced important raw materials or lowering of import duties on raw materials and capital goods from abroad can provide a boost to private investment. Likewise, reduction of export duties may also bring about a healthy effect on investment outlook.

It needs to be stressed that various incentives to promote private savings and investment will prove effectively only if they are kept as simple, transparent, certain and stable as far as possible. A complicated schemes of incentives with frequent and arbitrary changes are likely to defeat the very purpose of these incentive schemes. Prof. Prest rightly points out, “If the main purpose of investment incentives is to raise the long-term level of investment rather than offset cyclical downturns and this clearly is the case in underdeveloped countries… the emphasis should be on the stability of these tax arrangements rather than their variability.”

It is important to note that private investment depends upon several factors such as size of the market (i.e., aggregate demand), cost of inputs, availability of infrastructure facilities such as power, coal, oil, transport, availability of technical know-how. Tax incentives will prove effective only if conditions regarding these other factors are not unfavorable. Further, unless there is an efficient and competent system of tax administration it is very likely that incentives become tax loopholes.

The businessmen in the developing countries tend to take advantages of these tax exemptions on bogus basis without fulfilling and carrying out the underlying intent of such concessions. An honest and efficient administrative machinery, therefore, remains the basic precondition for the purposeful use of incentives.’

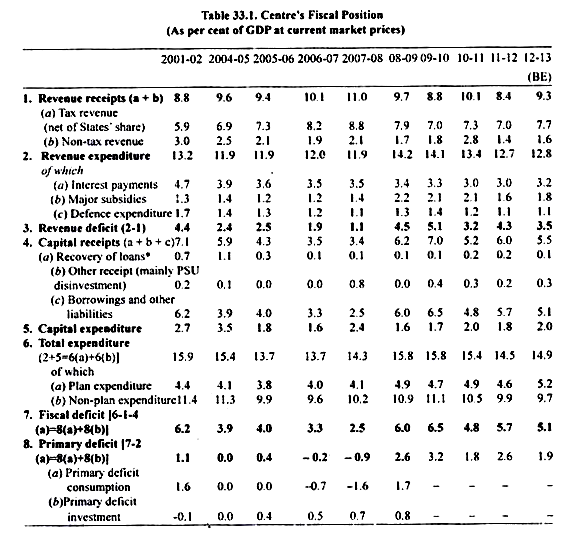

It will be seen from Table 33.1 that there has been revenue deficit throughout since 1980-81 which as per cent of GDP increased from 3.4 % of GDP in 1990-91 to 4.4% in 2001-02 and to 5.2 per cent in 2009-10 but declined to 3.2 per cent in 2010-11 but again rose to 4.3% of GDP in 2011- 12. It is important to note that revenue deficit of the government indicates public dissaving’s.

This shows that far from contributing to resources for investment and capital formation receipts from tax and non-tax revenue have not been sufficient to meet Central government current (i. e. consumption) expenditure. As a result, borrowed funds (i’. e. capital receipts) have been used to finance the current government expenditure. Thus revenue deficit has been a great impediment to economic growth.

This is because resources which could have been used to step up investment expenditure have been used to meet revenue expenditure. Recognizing this lacuna in India’s fiscal system, ‘Fiscal responsibility Budget Management Act (FRBMA)’ was passed in 2003 which prescribed reduction of revenue deficit to zero by 2008-09. Accordingly, effort was made to raise more resources through taxation so as to achieve the target of zero revenue deficit by 2008-09.

As percentage of GDP revenue deficit declined to 2.5% in 2005-06, to 1.9 per cent in 2006-07 and to 1.1 per cent in 2007-08. But after 2007-08, revenue deficit as per cent of GDP again went up (see Table 33 .1). During 2008-09 to prevent the slowdown in the Indian economy and keep the growth momentum following global financial crisis, the government had to raise its expenditure and cut customs duties and excise duties to give fiscal stimulus.

Consequently, revenue deficit rose to 4.5 per cent of GDP in 2008-09. 5.2 per cent of GDP in 2009-10 but fell to 3.2 per cent in 2010-11 again rose and to 4.3% in 2011-12. Accordingly, due to increase in Government expenditure and cut in taxes to fight global meltdown following global financial crisis, gross fiscal deficit which had been reduced to 2.5 per cent of GDP in 2007-08 rose to 6.0 per cent in 2008-09 and 6.5 per cent of GDP in 2009-10 and was estimated at 5.7% in 2011-12 and 5.1% in 2012-13.