Let us make in-depth study of the role of discretionary and non-discretionary fiscal policy for economic stabilisation and its effectiveness.

Discretionary Fiscal Policy for Stabilisation:

Fiscal policy is an important instrument to stabilise the economy, that is, to overcome recession and control inflation in the economy.

Fiscal policy is of two kinds: Discretionary fiscal policy and Non-discretionary fiscal policy of automatic stabilisers. By discretionary policy we mean deliberate change in the Government expenditure and taxes to influence the level of national output and prices.

Fiscal policy generally aims at managing aggregate demand for goods and services. On the other hand, non-discretionary fiscal policy of automatic stabilisers is a built-in tax or expenditure mechanism that automatically increases aggregate demand when recession occurs and reduces aggregate demand when there is inflation in the economy without any special deliberate actions on the part of the Government. In this section we shall confine ourselves to the discussion of discretionary fiscal policy.

ADVERTISEMENTS:

At the time of recession the Government increases its expenditure or cuts down taxes or adopts a combination of both. On the other hand, to control inflation the Government cuts down its expenditure or raises taxes. In other words, to cure recession expansionary fiscal policy and to control inflation contractionary fiscal policy is adopted. It is worth mentioning that fiscal policy aims at changing aggregate demand by suitable changes in Government spending and taxes.

Thus, fiscal policy is mainly a policy of demand management. It should be further noted that when the Government adopts expansionary fiscal policy to cure recession, it raises its expenditure without raising taxes or cuts down taxes without changing expenditure or increases expenditure and cuts down taxes as well. With the adoption of any of these types of expansionary fiscal policy Government’s budget will have a deficit.

Thus expansionary fiscal policy to cure recession and unemployment is a deficit budget policy. If, on the other hand, to control inflation, Government reduces its expenditure or increases taxes or adopts a combination of the two, it will be planning for a budget surplus. Thus policy of budget surplus, or at least reducing budget deficit is adopted to remedy inflation. In what follows we will discuss fiscal policy first to cure recession and then to control inflation.

Fiscal Policy to Cure Recession:

As we know, the recession in an economy occurs when aggregate demand decreases due to a fall in private investment. Private investment may fall when businessmen become highly pessimistic about making profits in future, resulting in decline in marginal efficiency of investment. As a result of fall in private investment expenditure, aggregate demand curve shifts down creating a deflationary or recessionary gap. It is the task of fiscal policy to close this gap by increasing Government expenditure, or reducing taxes.

ADVERTISEMENTS:

Thus there are two fiscal methods to get the economy out of recession:

(a) Increase in Government expenditure

(b) Reduction of taxes.

We discuss below both these methods:

ADVERTISEMENTS:

(a) Increase in Government Expenditure to Cure Recession:

For a discretionary fiscal policy to cure depression, the increase in Government expenditure is an important tool. Government may increase expenditure by starting public works, such as building roads, dams, ports, telecommunication links, irrigation works, electrification of new areas etc. For undertaking all these public works, Government buys various types of goods and materials and employs workers.

The effect of this increase in expenditure is both direct and indirect. The direct effect is the increase in incomes of those who sell materials and supply labour for these projects. The output of these public works also goes up together with the increase in incomes. Not only that, Keynes showed that increase in Government expenditure also has an indirect effect in the form of the working of a multiplier.

Those who get more incomes spend them further on consumer goods depending on their marginal propensity to consume. As during the period of recession there exists excess capacity in the consumer goods industries, the increase in demand for them brings about expansion in their output which further generates employment and incomes for the unemployed workers and so the new incomes are spent and res-pent further and the process of multiplier goes on working till it exhausts itself.

How large should be the increase in expenditure so that equilibrium is established at full employment or potential level of output? This depends on the magnitude of GNP gap caused by deflationary gap on the one hand and the size of multiplier on the other. It may be recalled that the size of the multiplier depends on the marginal propensity to consume.

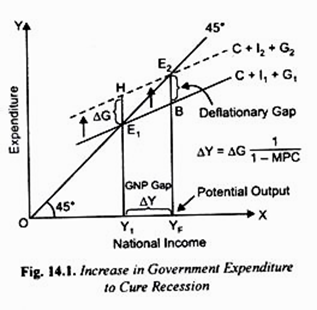

The impact of increase in Government expenditure in a recessionary condition is illustrated in Fig. 14.1. Suppose to begin with the economy is operating at full-employment or potential level of output YF with aggregate demand curve C + I2 + G2 intersecting 45° line at point E2. Now, due to some adverse happening (say, due to the crash in the stock market), investor’s expectations of making profits from investment projects become dim causing a decline in investment.

With the decline in investment, say, equal to E2B, aggregate demand curve will shift down to the new position C + I1 + G1 which will bring the economy to the new equilibrium position at point E1 and thereby determine Y1 level of output or income. The fall in output will create involuntary unemployment of labour and also excess capacity (i.e., idle capital stock) will come to exist in the economy.

Thus emergence of deflationary gap equal to E2B and the reverse working of the multiplier has brought about conditions of recession in the economy. It will be observed from Fig. 14.1 that, to overcome recession if the Government increases its expenditure by E1H, the aggregate demand curve will shift upward to original position C + I2 + G2 and as a result the equilibrium level of income will increase to the full-employment or potential level of output YF and in this way the economy would be lifted out of depression.

Note that the increase (∆Y) in national income or output by Y1 YF is not only equal to the increase in Government expenditure by ∆G or E1H but a multiple of it depending on the marginal propensity to consume. Thus, increase in national income is equal to ∆G x 1/1-MPC where 1/1-MPC is the value of multiplier.

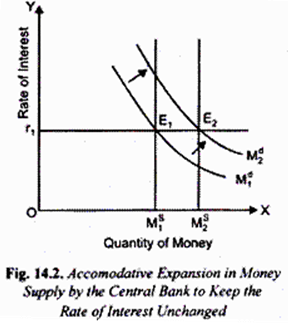

It may also be further noted that increase in Government expenditure without raising taxes (and therefore the policy of deficit budgeting) will fully succeed in curing recession if rate of interest remains unchanged. With the increase in Government expenditure and resultant increase in output and employment demand for money for transaction purposes is likely to increase as is shown in Fig. 14.2 where demand for money curve shifts to right from M1d to M2d as a result of increase in transaction demand for money.

Money supply remaining constant, with increase in demand for money rate of interest is likely to rise which will adversely affect the private investment. The decline in private investment will tend to offset the expansionary effect of rise in Government expenditure.

Therefore, if fiscal policy of increase in Government expenditure (or of deficit budgeting) is to succeed in overcoming recession, the Central Bank of the country should also pursue accommodative expansionary monetary policy and take steps to increase the money supply so that increase in Government expenditure does not lead to the rise in rate of interest.

It will be noticed from Fig. 14.2 that if money supply is increased from M1s to M2s the rate of interest does not rise despite the increase in demand for money. With rate of interest remaining unchanged, private investment will not be adversely affected and increase in Government expenditure will have full effect on raising national income and employment.

ADVERTISEMENTS:

Financing Increase in Government Expenditures and Budget Deficit:

An important question is how to finance the increase in Government expenditure which is undertaken to cure recession. This increase in Government expenditure must not be financed by raising taxes because rise in taxes would reduce disposable incomes and consumers’ demand for goods.

As a matter of fact, rise in taxes would offset the expansionary effect of rise in Government spending. Therefore, proper discretionary fiscal policy at times of recession is to have the budget deficit if expansionary effect is to be realised.

Borrowing:

ADVERTISEMENTS:

One way to finance budget deficit is to borrow from the public by selling interest- bearing bonds to them. However, there is a problem in adopting borrowing as a method of financing budget deficit. When the Government borrows from the public in the money market, it will be competing with businessmen who also borrow for private investment.

The Government borrowing will raise the demand for loanable funds which in a free market economy, if rate of interest is not administered by the Central Bank, will drive up the rate of interest. We know the rise in rate of interest will reduce or crowd out some private investment expenditure and interest-sensitive consumer spending for durable goods.

Creation of New Money:

The more effective way of financing budget deficit is the creation of new money. By creating new money to finance the deficit, the crowding out of private investment can be avoided and full expansionary effect of rise in Government expenditure can be realised. Thus, creation of new money for financing budget deficit or what is called monetization of budget deficit has a greater expansionary effect than that of borrowing by the Government.

(b) Reduction in Taxes to Overcome Recession:

Alternative fiscal policy measure to overcome recession and to achieve expansion in output and employment is reduction of taxes. The reduction in taxes increases the disposable income of the society and causes the increase in consumption spending by the people. If tax reduction of Rs. 200 crores is made by the Finance Minister, it will lead to Rs. 150 crores in consumption, assuming marginal propensity to consume is 0.75 or 3/4.

ADVERTISEMENTS:

Thus reduction in taxes will cause an upward shift in the consumption function. If along with the reduction in taxes, the Government expenditure is kept unchanged, aggregate demand curve C + I + G will shift upward due to rise in consumption function curve. This will have an expansionary effect and the economy will be lifted out of recession, and national income and employment will increase and as a result unemployment will be reduced.

Note that reduction in taxes, with Government expenditure remaining constant, will also result in budget deficit which will have to be financed either by borrowing or creation of new money. It is worth noting that reduction in taxes has only an indirect effect on expansion and output through causing a rise in consumption function. But, like the increase in government expenditure, the increase in consumption achieved through reduction in taxes will have a multiplier effect on increasing income, output and employment. The increase in income due to tax multiplier, as it is called, is given by

Tax multiplier = ∆T x MPC/1-MPC

The effect of reduction in taxes in curing recession and in causing expansion in income and output can be graphically shown by a figure such as Fig. 14.1. In case of reduction in taxes, instead of increase in Government expenditure G, it is increase in consumption C which will cause upward shift in the aggregate demand curve (C + I + G) and will result in, through the working of multiplier, a higher level of equilibrium national income.

There are some instances in the history of the capitalist world, especially U.S. A, when taxes were reduced to stimulate the economy. In 1964, President Kennedy reduced personal and business taxes by about $12 billion to give a boost to the American economy when there was high unemployment and lower capacity utilisation in the American economy.

This tax cut was quite successful in reducing unemployment substantially and expanding national income through full utilisation of excess capacity. Again, over the period 1981-84, President Reagan made a very large tax reduction to get out of recession and to achieve expansion in national income to reduce unemployment.

ADVERTISEMENTS:

There is some debate whether President Reagan’s tax cut alone had positive effect on national income as some economists attribute the recovery in that period to the monetary expansion that took place. However, tax reduction by President Reagan did play a significant role for bringing about the recovery.

Fiscal Policy Option: Increase in Government Expenditure or Reduction in Taxes:

Is it better to use Government expenditure or changes in taxes to stabilise the economy at full employment and potential level of output. The answer depends to a great extent upon one’s view regarding the role of public sector. Those who think that public sector should play a significant role in the economy to meet various failures of a free market system will recommend the increase in Government expenditure during recession on public works to achieve expansion in output and employment.

On the other hand, those economists who think that public sector is inefficient and involves waste of scarce resources would advocate for reduction in taxes to stimulate the economy. The choice between tax reduction and increase in Government expenditure depends on the basis of another factor, namely, the magnitude of the effect of expenditure multiplier and tax multiplier. The value of tax multiplier is less than the Government expenditure multiplier. Ignoring the signs of the multipliers, it should be noted that whereas expenditure multiplier is equal to 1/1-MPC, the tax multiplier equals or MPC/1-MPC or MPC x 1/1-MPC which is less than 1/1-MPC.

Suppose marginal propensity to consume is 0.75 or 3/4 so that value of expenditure multiplier is 4. Increase in Government expenditure by Rs. 100 crores will raise national output by Rs. 400 crores. On the other hand, reduction in taxes by Rs. 100 crores will increase income and output by 100 x MPC/1 – MPC = 100 x ¾ /1 – 3/4 = Rs. 300 crores.

Thus, the effect of reduction in taxes by an equal amount as the increase in Government expenditure has a smaller impact on national income than that of increase in Government expenditure. This difference in the effects of the two methods of expanding output has implications for the size of the Government deficit.

If we want to achieve expansion in income by the same amount, we need to cut taxes by more than we would need to increase Government expenditure because the size of the tax multiplier is less than that of expenditure multiplier. In other words, in case we adopt the policy of tax reduction, to achieve expansion by a given amount the budget deficit planned will have to be much greater.

ADVERTISEMENTS:

However, the size of expenditure multiplier relative to the size of the tax multiplier is not the sole deciding factor for the choice of a policy option. For example, reduction in taxes is greatly welcomed by the people as it directly increases their disposable incomes.

Further, it is individual or households who themselves decide how to spend their extra disposable income made possible by a tax cut, while in case of increase in expenditure the Government decides how to spend it.

Fiscal Policy to Control Inflation:

When due to large increases in consumption demand by the households or investment expenditure by the entrepreneurs, or bigger budget deficit caused by too large an increase in Government expenditure, aggregate demand increases beyond what the economy can potentially produce by fully employing its given resources, it gives rise to the situation of excess demand which results in inflationary pressures in the economy.

This inflationary situation can also arise if too large an increase in money supply in the economy occurs. In these circumstances inflationary gap occurs which tends to bring about rise in prices. If successful steps to check the emergence of exceeds demand or close the inflationary gap are not taken, the economy will experience a period of inflation or rising prices. For the last some decades, problem of demand-pull inflation has been faced by both the developed and developing countries of the world.

An alternative way of looking at inflation is to view it from the angle of business cycles. After recovery from recession, when during upswing an economy finds itself in conditions of boom and becomes overheated prices start rising rapidly. Under such circumstances anti-cyclical fiscal policy calls for reduction in aggregate demand.

Thus, fiscal policy measures to control inflation are:

ADVERTISEMENTS:

(1) Reducing Government expenditure and

(2) Increasing taxes.

If in the beginning the Government is having balanced budget, then increasing taxes while keeping Government expenditure constant will yield budget surplus. The creation of budget surplus will cause downward shift in the aggregate demand curve and will therefore help in easing pressure on prices.

If there is a balanced budget to begin with and the Government reduces its expenditure, say on defence, subsidies, transfer payments, while keeping taxes constant, this will also create budget surplus and result in removing excess demand in the economy.

It is important to mention that in the developing countries like India, the main factor responsible for inflationary pressures is heavy budget deficit of the Government for the last several years resulting in excess demand conditions.

Rate of inflation can be reduced not necessarily by planning for budget surplus which is in fact impracticable but by trying to take steps to reduce budget deficits. It has been estimated that the aim should be to reduce fiscal deficit to 3 per cent of GNP to achieve price stability in the Indian economy.

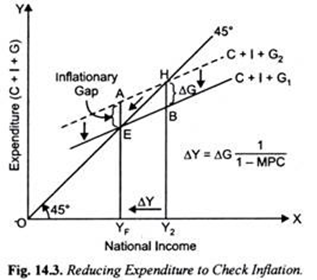

How the reduction in Government expenditure will help in checking inflation is shown in Fig. 14.3. It will be seen from this figure that an aggregate demand curve C + I + G1 intersects 45° line at point E and determines equilibrium national income at full-employment level of income YF. However, if due to excessive Government expenditure and a large budget deficit, the aggregate demand curve shifts upward to C + I + G2, this will determine Y2 level of income which is greater than full employment or potential output level YF.

Since output cannot increase beyond YF, income will rise only in money terms through rise in prices, real income or output remaining unchanged. To put it in other words, while the economy does not have labour, capital and other resources sufficient to produce Y2 level of income or output, the households, businessmen and Government are demanding Y2 level of output.

This excess demand pushes up the price level so that level of only nominal income increases, real income or output remaining constant. It is thus clear that with the increase in aggregate demand beyond the full-employment level of output to C+I+G2 causes excess demand equal to EA to emerge in the economy.

It is this excess demand EA relative to full-employment output YF which causes the price level to rise and thus creates inflationary situation in the economy. This excess demand EA at full-employment level has therefore been called inflationary gap. The task of fiscal policy is to close this inflationary gap by reducing Government expenditure or raising taxes.

With equilibrium at point H and nominal income equal to Y2, if Government expenditure equal to HB (which is equal to inflationary gap AE) is reduced, aggregate demand curve will shift downward to C + I + G1 which will restore the equilibrium at the full-employment level YF. The reduction in Government expenditure equal to HB through the operation of multiplier will result in a multiple decline in the level of national income or output.

It will be seen from Fig. 14.3 that the decrease in Government expenditure by HB has led to a much bigger decline in output by Y2YF. Ideally Government expenditure should cut down its expenditure on non-development or unproductive heads such as defence, unnecessary subsidies. It may however be noted that in India to control inflation the Government has been reducing capital expenditure which is mainly of development nature and has therefore been validly criticised.

Raising Taxes to Control Inflation:

As an alternative to reduction in Government expenditure, the taxes can be increased to reduce aggregate demand. For this purpose especially personal direct taxes such as income tax, wealth tax, corporate tax can be raised. The hike in taxes reduces the disposable incomes of the people and thereby forces them to reduce their consumption demand.

Note that in Fig. 14.3 as a result of hike in personal taxes it is the decrease in consumption-demand (C) component which will cause the aggregate demand curve C + I + G2 to shift downward. Since, as shown above, the magnitude of tax multiplier is smaller than the expenditure multiplier, the tax revenue will be raised by a greater amount to achieve contraction in national income by Y2YF.

Disposing of Budget Surplus:

To control demand-pull inflation, the Government either reduces its expenditure or raises taxes to lower aggregate demand for goods and services. Reduction in expenditure or hike in taxes results in decrease in budget deficits (if occurring before such steps) or in the emergence of budget surplus if the Government was having balanced budget prior to the adoption of anti-inflationary fiscal policy measures.

Let us assume that anti-inflationary fiscal policy results in budget surplus. Anti-inflationary impact of budget surplus depends to a good extent on how the Government disposes of this budget surplus.

There are two ways in which budget surplus can be disposed of:

(1) Reducing or retiring public debt and

(2) Impounding public debt.

We examine below the anti-inflationary effects of these two ways of disposing of the budget surplus:

1. Retiring Public Debt:

The budget surplus created by anti-inflationary policy can be used by the Government to pay back the outstanding debt. However, using budget surplus for retiring public debt will weaken its anti-inflationary effect. In paying off the debt held by the public, the Government will be returning the money to the public which it has collected through taxes.

Further, this will also add to the money supply with the public. The general public will spend a part of the money so received which will raise consumption demand. Besides, retiring of public debt will result in the expansion of money supply in the money market which will tend to lower the rate of interest. The lower rate of interest will stimulate consumption and investment demand while anti-inflationary policy requires that they should be reduced.

2. Impounding of Public Debt:

To realize a large anti-inflationary effect of budget surplus it is desirable to impound the surplus fund. The impounding surplus funds means that they should be kept idle. Thus by impounding the budget surplus, the Government shall be withdrawing some income or purchasing power from the income-expenditure stream and thus will not create any inflationary pressures to offset the deflationary impact of the budget surplus. To conclude, the impounding of budget surplus is a better method of disposing of budget surplus than of paying off public debt.

Non-Discretionary Fiscal Policy: Automatic Stabilizers:

There is an alternative to the use of discretionary fiscal policy which generally involves problems of lags in recognizing the problem of recession or inflation and lag of taking appropriate action to tackle the problem. In this non-discretionary fiscal policy, the tax structure and expenditure pattern are so designed that taxes and Government spending vary automatically in appropriate direction with the changes in national income.

That is, these taxes and expenditure pattern without any special deliberate action by the Government and Parliament automatically raise aggregate demand in times of recession and reduce aggregate demand in times of boom and inflation and thereby help in ensuring economic stability. These fiscal measures are therefore called automatic stabilizers or built-in stabilizers.

Since these automatic stabilizers do not require any fresh deliberate policy action or legislation by the government, they represent non-discretionary fiscal policy. Built-in stability of tax revenue and Government expenditure of transfer payments and subsidies is created because they vary with national income.

These taxes and expenditure automatically bring about appropriate changes in aggregate demand and reduce the impact of recession and inflation that might occur in an economy at some time. This means that because of the existence of these automatic or built-in stabilizers recession and inflation will be shorter and less intense than otherwise would be the case. Important automatic fiscal stabilizers are personal income taxes, corporate income taxes, transfer payments such as unemployment compensation, welfare benefits, corporate dividends.

We discuss below these taxes, revenue from which varies directly with the change in national income:

Personal Income Taxes:

The tax rate structure is so designed that revenue from these taxes directly varies with income. Moreover, personal income taxes have progressive rates; the higher rates are charged from the upper income brackets. As a result, when national income increases during expansion and inflation, increasing percentage of the people’s income are paid to the Government.

Thus, through causing a decline in their disposable income these taxes automatically reduce people’s consumption and therefore aggregate demand. This decline in aggregate demand because of imposition of progressive personal income taxes tends to check inflation from becoming more severe.

On the other hand, when national income declines at times of recession, the tax revenue declines as well which prevents aggregate demand from falling by the same proportion as the decline in income.

Corporate income Taxes:

Companies, or corporations as they are called now, also pay a percentage of their profits as tax to the Government. Like personal income taxes, corporate income tax rate is also generally higher at higher levels of corporate profits.

As recession and inflation affect corporate taxes greatly, they have a powerful stabilizing effect on aggregate demand; the revenue from them rises greatly during inflation and boom which tends to reduce aggregate demand, and revenue from them falls greatly during recession which tends to offset the decline in aggregate demand.

Transfer Payments: Unemployment Compensation and Welfare Benefits:

When there is recession and as a result unemployment increases, the Government has to spend more on compensation for unemployment and other welfare programmes such as food stamps, rent subsidies, subsidies to farmers. This hike in Government expenditure tends to make recession short-lived and less intense.

On the other hand, when at times of boom and inflation national income increases and therefore unemployment falls, the Government curtails its programme of social benefits which results in lowering Government expenditure. The smaller spending by the Government helps to control inflation.

Corporate Dividend Policy:

With economic fluctuations, corporate profits also rise and fall. However, corporations do not so quickly increase or reduce dividends in tune with fluctuations in profits and follow a fairly stable dividend policy.

This permits the individuals to spend more during recession and spend less than would have been the case if dividends were lowered in time of recession and raised in conditions of boom and inflation. Thus, fairly stable dividends tend to cushion a recession and curb inflation by stabilizing consumption expenditure.

Conclusion:

It follows from above that automatic stabilizers reduce the intensity of business fluctuations, that is, both recession and inflation. However, the automatic or built-in stabilizers cannot alone correct the recession and inflation significantly. According to an estimate made for the U.S.A., automatic stabilizers have been able to reduce fluctuations in national income only by one-third. Therefore, the role of discretionary fiscal policy, namely, deliberate and explicit changes in tax rates and amount of Government expenditure, are required to cure recession and curb inflation.

Crowding-Out Effect and Effectiveness of Fiscal Policy:

The critics of Keynesian theory have pointed out that expansionary effect of fiscal policy is not as much as Keynesian economists suggest. In the Keynesian theory it is asserted that when Government increases its expenditure without raising taxes or when it reduces taxes without changing expenditure, it will have a large expansionary effect on national income.

In other words, deficit budget would lead to the large increase in aggregate demand and thereby help to expand national output and income. However, it has been pointed that the above analysis of effect of expansionary fiscal policy of budget deficit ignores the effect of increase in Government expenditure or budget deficit on private investment.

It has been argued that increase in Government expenditure or creation of budget deficit adversely affects private investment which offsets to a good extent the expansionary effect of budget deficit. This adverse effect comes about as increase in Government expenditure or reduction in taxes causes rate of interest to go up.

There are two ways in which rise in rate of interest is explained. First, within the framework of Keynesian theory increase in Government expenditure leads to the rise in national output which raises the transactions demand for money. Given the supply of money in the economy, the increase in transactions demand for money will cause the rate of interest to go up. Secondly, in order to finance its budget deficit the Government will borrow funds from the market. This will raise the demand for loanable funds which will bring about rise in the rate of interest.

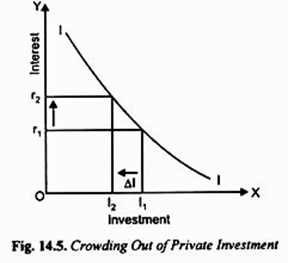

Whatever the mechanism, the budget deficit or increase in Government expenditure to achieve expansion in national income and output will cause the rate of interest to go up. The rise in the rate of interest will discourage private investment. As we know from the theory of investment, at a higher rate of interest, private investment declines.

Thus, increase in Government expenditure or fiscal policy of budget deficit crowds out private investment. This fall in private investment as a result of the rise in rate of interest will offset or cancel out a part of the expansionary effect of increase in Government expenditure. The magnitude of this crowding out effect depends on the elasticity of the investment demand.

If investment demand is more elastic, the decrease in private investment consequent to the rise in rate of interest will be quite substantial and will greatly offset the expansionary effect of the increase in Government expenditure. On the contrary, if investment demand is relatively inelastic, the rise in rate of interest will lead to only a small decline in private investment and therefore crowding out effect will be relatively small.

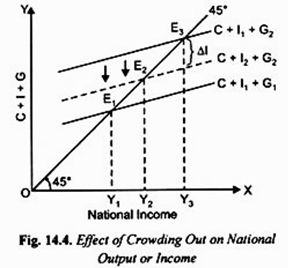

It, therefore, follows that the magnitude of crowding out weakens the effectiveness of fiscal policy. The crowding out effect of expansionary fiscal policy and its effect on national output and employment is graphically shown in Figs. 14.4. and 14.5. To begin with the economy is in equilibrium at Y1 level of income where aggregate demand curve C + I1 + G1 intersects the 45° line and determines Y1 level of income.

Let us assume that this is much below the potential or full-employment level of output. Suppose in order to raise the level of national income and output, the Government raises its expenditure from G1 to G2 so that the aggregate demand curve shifts upward to the new position C + I1 + G2 which intersects the 45° line at point E3. With increase in Government expenditure national income will rise by ∆G x multiplier, that is, by ∆G x (1/1-MPC).

In the absence of crowding out effect, national income will rise to Y3. This change in national income, ∆Y or by Y1 Y3 is equal to the increase in Government expenditure (G) times the value of multiplier 1/1-MPC. However, the increase in Government expenditure or the creation of budget deficit causes the rate of interest to rise, say from r1 to r2 (See Figure 14.5).

It will be seen from Fig. 14.5 that with the rise in interest from r1 to r2, private investment decreases from I1 to I2. Now, with the decline in private investment expenditure, aggregate demand curve in Fig. 14.4 shifts below to the new lower position C + I2 + G2 (dotted) and as a result new equilibrium is reached at Y2 level of income.

Thus, net result of increase in Government expenditure (∆G) and crowding out of private investment equal to I1I2 or ∆I is the expansion in national income equal to only Y1 Y2 which is relatively very small as compared to the rise in income by Y1 Y3 in the absence of crowding out effect. Thus, the crowding out effect has weakened the expansionary effect of fiscal policy.

However, in view of this author crowding out effect has been blown out of all proportions by the critics of Keynes. As a matter of fact, when Government raises its expenditure, it leads to a large increase in aggregate demand for several goods and services through working of the multiplier. This rising aggregate demand improves investment climate by raising expectations of making profits by the private sector.

As a result, the investment demand curve II shown in Fig. 14.5 will shift outward to the right showing that at each rate of interest more private investment will be forthcoming. Thus, while negative crowding out effect takes place as a result of moving upward along the given investment demand curve, there is positive effect of increase in aggregate demand on private investment which occurs as a result of rightward shift in the investment demand curve. Thus, we see that crowding out effect is a highly controversial issue of macroeconomics.