Here we detail about the four factors that affect the foreign exchange rate in India.

Factor 1# Purchasing Power Parity: The Relative Price Levels:

If there are no restrictions imposed on trade by the countries the exchange rate between two national currencies is allowed to adjust freely.

And with the further assumption that costs of transport of goods between the countries is nil, then the exchange rate between the two currencies will reflect the differences in the price levels in the two countries.

This is because with the above-mentioned assumptions if the price of the same good BPL TV set is lower in Britain than in India, then it will pay traders to buy the BPL TV sets in Britain and sell them in India. This will reduce the supply of TV set in Britain pushing up its price there and increase the supply of TV sets in India and thus causing a decline in its price in India.

ADVERTISEMENTS:

This process would continue till the price differential of the same quality of T.V. sets is eliminated and the same price of TV set prevails in the two countries. Thus, if law of same price holds and each country consumes the same market basket of goods, the exchange rate between the two currencies would be determined by the relative price levels in the two countries.

For example, if prices in Britain and India are such that a pair of same quality of shoes costs 5 pound in England and 350 rupees in India, then the exchange rate between rupees and pound would be 1 pound for 70 rupees. If the exchange rate between the two is different from this, it will be possible for the businessmen to make profits in sending pairs of shoes from a country to the other depending on the price levels in the two countries.

We therefore conclude that price levels of commodities in the different countries influence the exchange rate between their currencies. It may however be noted that it is only in the long run and with no restrictions on the trade between the two countries that relative price level in the two countries will be reflected in the exchanges rate.

Factor 2# Rate of Inflation and Exchange Rate:

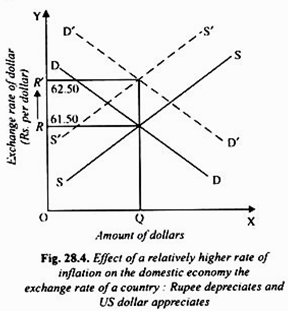

Having shown the effect of relative price levels in the countries on the exchange rate between their currencies, we can now explain how a relatively higher rate of inflation in a country can affect the exchange rate of its currency. Suppose in India a relatively higher rate of inflation prevails than in the USA, how will it affect the exchange rate between the rupee and dollar?

ADVERTISEMENTS:

A relatively higher rate of inflation causing rise in prices of the goods in India as compared to those in the USA will make US goods relatively cheaper and the Indian goods expensive. This will serve as incentive for the Indian individuals and firms to increase their imports of goods from USA.

This will raise the demand for US dollars shifting the demand curve for dollars in the foreign exchange market to the right, as shown in Fig. 28.4 where the demand curve of US dollars is shown to have shifted from DD to D’D’ under the influence of higher rate of inflation in India leading to greater imports by India.

However, at the same time due to higher price level American people will find Indian goods more expensive and as a result will reduce their imports of Indian goods. This will cause a decline in exports of goods from India to the USA, shifting the supply curve of dollars to the left to S’S’.

ADVERTISEMENTS:

Both these effects of a higher price level due to higher rate of inflation in a country, namely, rise in imports of US goods into India and the reduction in Indian exports to the USA will cause the foreign exchange rate of dollar in terms of rupees to rise and the price of Indian rupee in terms of dollar will fall. Thus, as a result of higher rate of inflation in India, the US dollar -will appreciate and the Indian rupee will depreciate (See Figure 28.4).

Factor 3# Interest Rates and Exchange Rate:

Another important factor influencing the exchange rate is the interest rate in a country relative to interest rate of other countries with which it trades its goods. Suppose there are no restrictions imposed by the Governments on the flow of capital funds between the countries. Assume that interest on securities or bonds in USA is 5 per cent whereas it is 8 per cent in India.

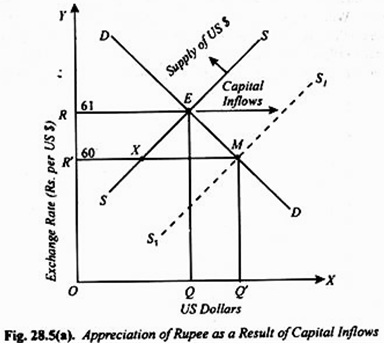

Thus businessmen, firms, banks etc., with funds to invest would obviously have incentive to buy securities and bonds of India companies. That is, there will be flight of capital from the USA or capital inflows into India as the American business corporations, firms, banks etc. will use their funds to purchase high-yielding Indian securities. In order to buy the Indian securities, they will have to convert dollars into rupees, and thus increasing the supply of dollars. Consequently, the supply curve of dollar will shift to the right.

This will pull down the foreign exchange rate of dollar in terms of rupees (Conversely, the exchange rate of rupee in terms of dollar will appreciate). Thus, a relatively higher interest rate in India as compared to the USA would lead to the depreciation of dollar and appreciation of rupee. This is what actually happened in India in the fiscal years 2003-04, 2004-05 and 2005-06.

Figure 28.5 illustrates the effect of higher interest rates in India on the dollar-rupee exchange rate. Initially, the demand for and the supply of US dollar are given by the curves DD and SS respectively. The balance between the two determines OR (or Rs. 61.50 to a dollar) as the exchange rate between the two. With the flow of United States funds into India to buy the Indian securities and stocks, the supply curve of dollars shifts to the right to the new position S’S” (dotted) and lowers the equilibrium exchange rate to OR'(Rs. 61 to a dollar).

It may be noted that during the early eighties, the Federal Reserve Bank of USA adopted a tight monetary policy to fight inflation which caused very high interest rates in USA. These high interest rates attracted a lot of foreign capital, particularly from Japanese firms which due to high saving rate in Japan had a large amount of funds to make investment in American bonds.

To purchase American bonds Japanese had to convert Yens into dollars. This caused increase in demand for dollars and caused a sharp rise in the price of dollar. It is thus clear that like the relative price levels, relative interest rates can also have a significant effect on the exchange rate.

Factor 4# Capital Flows and Exchange rate:

Relative interest rate affects exchange rate through changes in capital flows. But capital flows are not determined by relative interest rate alone. For example, in India and China capital inflows in the form of foreign direct investment (FDI) are occurring due to higher rate of return that foreign investors (i.e., multinational corporations) expect to earn in these countries than in their domestic economies.

ADVERTISEMENTS:

Besides, capital inflows in India occur when foreign institutional investors (FII) and Non-resident Indians buy in the equity (i.e., share capital) of Indian Companies in Indian stock market. On the other band, when Indian business class invests abroad, capital outflows from India occur. It may be noted that these capital inflows and capital outflows are recorded in the capital account of the balance of payments. On the other hand, trade of goods and services are recorded in the current account of the balance of payments.

We are interested here to show how capital flows affect exchange rate of the currency of a country. This is shown in Figure 28.5 (a) and 28.5 (b) where determination of exchange rate between rupee and US dollar is shown. To begin within Fig. 28.5 (a), we have drawn demand curve DD and supply curves 55 of US dollar as determined by flows of trade of goods (that is, imports and exports) between the two countries, without any capital flows of taking place between the two countries.

These demand and supply curves, DD and SS, determine equilibrium exchange rate OR (or Rs. 61 to a US dollar). Note that at this equilibrium exchange rate, there is equilibrium in the current account balance of payments since we are so far assuming that no capital flows occur.

Now suppose foreign institutional investors (FII) and Non-Resident Indians buy shares of the Indian companies. They will therefore bring dollars and convent them into rupees for buying shares of the Indian companies. These capital inflows will increase the supply of US dollars causing a shift in the supply curve to the right, say to the new position S1S1. The new supply curve of dollars S1S1 intersects the demand curve DD of dollars at point M and determine the new exchange rate OR (or Rs. 60 to a dollar).

ADVERTISEMENTS:

Thus, as a result of capital inflows, the Indian rupee has appreciated (and dollar depreciated). It may be noted that at the new equilibrium exchange rate OR (or X 60 to a dollar), the overall balance of payments (that is, total inflows and outflows of US dollars on account of both trade and capital flows) will be in equilibrium.

However, in this situation due to capital inflows as depicted in Fig. 28.5 (a), current account must be in deficit while the overall balance of payments is in equilibrium. Since as a result of capital inflows the exchange rate of rupee has appreciated, this will cause the total Indian exports of goods and services to decline.

Total exports of goods and services at the new exchange rate OR (or Rs. 60 to a dollar) is given by the point X on the original supply curve of dollars SS corresponding to this new exchange rate OR. From Figure 28.5(a), it is clear that total exports of goods and services RX are less than the imports of goods and resources R’M. Thus there is deficit of AM on current account.

ADVERTISEMENTS:

This deficit on current account is met by surplus in capital inflows of capital account since overall balance of payments balances at the new equilibrium exchange rate. We thus reach an important conclusion that the deficit in current account implies capital inflows (i.e., foreign investment) of that order occur in the economy in that year, if there are no withdrawal from foreign exchange reserves.

Capital Outflows:

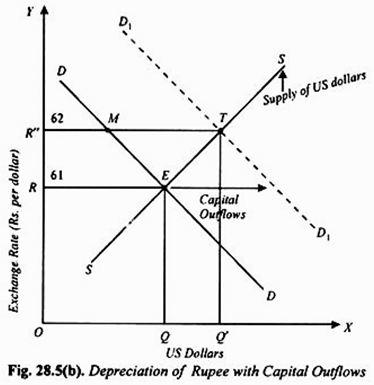

Let us take the opposite case when instead of net capital inflows, there are net Capital outflows. For example, the rate of return on investment rises in the USA or interest rate falls in India as compared to that in USA. This will cause capital outflows from India and result in shifting the demand curve of US dollars in foreign exchange market.

This is illustrated in Figure 28.5 (b). Where demand curve of US dollars DD and supply curve SS of US dollars determine equilibrium exchange rate OR (or Rs.61 to a dollar) when there are no capital flows. Now suppose that net capital outflows occur due to the factors mentioned above. Capital outflows require that those who want to invest abroad will convert Indian rupees into US dollars to invest in the USA.

This will cause an increase in demand for US dollars resulting in a shift of the demand curve for US dollars to the right, say to D1D1. The new demand curve for US dollars intersects the given supply curve SS of dollars at the new point T and determines the exchange rate OR” (or Rs. 62 to a dollar), that is, US dollar appreciates and the Indian rupee depreciates. Since the Indian rupee depreciates, the Indian exports of goods and services will increase because depreciation of Indian rupee will make the India goods and services cheaper.

In Figure 28.5 (6), at the new exchange rate OR” (Rs.62 to a dollar) exports of Indian goods and services increase to R”T. On the other hand, depreciation of Indian rupee will make the Indian imports costlier than before and will therefore lead to the decrease in imports to R”M at the new exchange rate OR”. With this Indian exports of goods and services exceed its imports by the amount MT.

ADVERTISEMENTS:

Thus, there will be surplus in balance of payments on current account of India which will be equal to the capital outflows. We thus reach an important conclusion that surplus on current account of the balance of payments implies that there will be capital outflows of that order.