The following points highlight the seven major functions of government in a modern mixed economy. The Functions are: 1. Improving Efficiency of the Economic System 2. Controlling Externalities and Public Goods 3. Supplying Correct Information 4. Improving the Distribution of Income 5. Grants and Subsidies 6. Macroeconomic Stabilisation 7. Representing the Country at the International Level.

Function # 1. Improving Efficiency of the Economic System:

An important function of the government is to assist in the socially desirable allocation of scarce resources. This, in its turn, would require the government to perform certain subsidiary functions. As Samuelson has put it, “Courts and police forces would be needed to ensure fulfilment of contracts, non-fraudulent and non-violent behaviour, freedom from theft and external aggression, and legislated rights of property.”

In today’s complex world government intervention is needed primarily to ensure an optimal correction of market failure.

Market failure is attributable to:

ADVERTISEMENTS:

(i) Breakdown of perfect competition,

(ii) Externalities like air pollution and public goods and

(iii) Imperfect information.

The emergence of monopolies and market imperfections calls for government intervention. Similarly unregulated private factories tend to pollute the environment and create various health problems which can be effectively tackled only by the government. Similarly, there are certain goods which are to be provided for all members of society, if at all, such as roads, medical care, police protection, street lighting, etc.

ADVERTISEMENTS:

These are called public (collective consumption) goods and, of necessity, are to be provided by the government. Otherwise, there will be the free-rider problem, i.e., most people would consume such goods without making any payment.

Similarly in a free market consumers are not adequately informed about the characteristics of the goods they buy and sometimes consumers get wrong information through false advertising.

So the market system is not ideal for maximising social welfare. And the government has to intervene to improve the efficiency of the economic system.

Differently put, the government often deploys its weapons to make an optimal correction of market failure.

ADVERTISEMENTS:

The following three cases are worth considering in this context:

Control of Monopoly:

When large firms, viz., monopolies and oligopolies collude to avoid price war or drive some rivals out of business, government may enforce anti-monopoly policies or regulations. This is the main reason why the Monopolistic and Restrictive Trade Practices Act was passed in India in 1969.

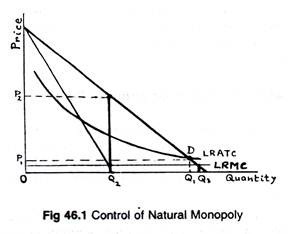

Natural monopoly occurs when the technology of providing a product or service makes it cheaper for only one firm to produce the market output. In this case there are increasing returns to scale at all output levels. See Fig. 46.1 which illustrates the case of natural monopoly.

A natural monopoly has a declining average total-cost curve at all output levels. If the firm were to charge a price equal to its marginal cost, it would produce Q3 units of output and incur economic losses.

If left unregulated, it could charge the monopoly price of P2 and produce only Q2 units of output. Government or anti-monopoly commissions often attempt to make regulated firms produce where average total cost equals price. At the output level Q2 the natural monopolist would cover its costs of production while maximising consumers’ surplus.

Function # 2. Controlling Externalities and Public Goods:

ADVERTISEMENTS:

The unregulated market may and often do produce too much air, water and land pollution as also greenhouse-gas emission, leaving too little resources for investment in public health or knowledge. An externality is a cost or a benefit imposed by a transaction on someone who was not a party to the transaction. Control of externalities is one of the important functions of the government.

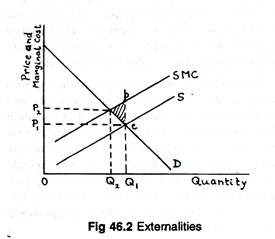

In Fig. 46.2 .S represents the private cost of the firms. SMC includes the cost of the externality. If the firms do not internalize the externality, market output is Q1 and price is P1. If the firms must account for the SMC, they produce only Q2. The shaded area, abc, shows the additional cost to society of producing Q1: the difference between the area under the SMC curve and the market demand curve.

This is why in industrially advanced countries governments seek to control harmful externalities or spend money on science and public health which are not adequately taken care of (and supported by) private industry.

The government alone can tax such activities as cigarette smoking which are harmful to society and which impose external public costs. It can also subsidies other activities such as scientific and industrial research and development which are socially beneficial.

ADVERTISEMENTS:

A solution to the externality problem lies in enforcing property rights. A property right is the exclusive ownership of specific goods or the exclusive privilege to behave in a certain manner. When individual property rights are not clearly established, governments have to intervene.

Function # 3. Supplying Correct Information:

This is an age of information and knowledge and information is now treated as a separate factor of production, a new form of capital particularly after the recent information revolution all over the world.

And in a world of uncertainty it is necessary for consumers to collect adequate information to be able to take the correct decision. However, unregulated markets provide very little, if any, information for consumers to make rational decisions.

ADVERTISEMENTS:

That is why food-processing firms are required, by law, to provide information on the nutrition of food products and on the energy efficiency of household appliances like water coolers and washing machines.

Similarly, firms manufacturing life- saving drugs and pharmaceuticals are required to provide sufficient information to the government on the safety and usefulness of new drugs before they can be commercially introduced.

Moreover, the government can spend money to collect additional information itself, which, it thinks, is essential not only for the smooth functioning of the economy but also for controlling and managing the economy through the planning system.

This is why the Government of India has set up the Central Statistical Organisation (C.S.O.) of the Planning Commission which collects and supplies information on certain key macro- variables such as national income, national product, the contribution of different industries to social product and so on.

In short, since markets do not always provide a socially optimal level of information, the government may have a role in providing this information. Information is an important issue.

Some observers claim that providing information is the only function that government should perform in offsetting externalities and other socio-economic problems. However, the truth is that there are several possible allocational problems for government to handle.

Function # 4. Improving the Distribution of Income:

ADVERTISEMENTS:

Even when the invisible hand works smoothly and efficiently, the free play of market forces creates another problem, viz., the problem of income inequality.

In fact, the market system is a system of rewards and penalties. It rewards the efficient, i.e., those who can read the market signals properly and produce the commodities which most people want to buy at a price. At the same time it penalises the inefficient, i.e., those who read wrong signals and produce commodities which most people do not want to buy.

This inequality in income distribution is a fact of life. To this we have to add inequality in the distribution of property, wealth which arises for various reasons: laws of inheritance (of property), luck, talents and efforts and so on. And it is one of the important economic functions of the modern government to redistribute income (and wealth) from the rich to the poor.

This is done in advanced countries by spending a major portion of government revenues to maintain minimum standard of health, nutrition and income through such schemes as transfer programmes, medical care and social security.

In India and other developing countries where there is no safety net for the poor in the form of a comprehensive social security system, this goal—income redistribution—is sought to be achieved through other measures such as public distribution system of food grains, land reform, progressive income taxes on the rich and subsidy for the poor, and above all, the control of big business and multinationals.

In recent years most modern governments have passed laws and imposed regulations designed to ensure equal employment, housing and educational opportunities for the weaker sections of society.

Function # 5. Grants and Subsidies:

ADVERTISEMENTS:

Governments also award grants that give firms exclusive rights to a national resource or to the production of a good or service. Governments award cable television and radio rights as well as landing rights at airports to firms for no more than the application cost. By doing so the government is releasing control over scarce resources technically owned by the whole community.

Governments also often decide to favour some firms and entire industries relative to others. This support is often provided in the form of a subsidy. A subsidy is a payment to a firm in the form of tax reduction or a fixed amount of money, or a payment based on the output of the firm. The subsidy lowers the firm’s production costs.

A government subsidizes a firm when the firm would not otherwise produce output at the level the government desires. A government can use subsidies to encourage production by firms that create positive externalities.

Governments subsidies cover a wide array of firms and industries: museums, public television and radio stations, bus and passenger train services, public parks, highways and bridges, and universities. In offering subsidies, governments lower the direct costs to those consuming the goods and services and increase the quantity consumed.

Function # 6. Macroeconomic Stabilisation:

The capitalist economies prior to the Great Depression of 1929 were prone to business cycles— periodic bouts of inflation and unemployment. However, today, government has the responsibility of avoiding such economic fluctuations by judicious and appropriate use of monetary and fiscal measures, as well as close regulation of the financial system.

Furthermore, government attempts to stabilise the economy, i.e., it tries to smooth out the ups and downs of the business cycle, in order to avoid either large-scale unemployment at the bottom of the cycle or accelerating price inflation at the top of the cycle. More recently, government has become more concerned about promoting long-term growth of the economy by expanding production capacity.

Function # 7. Representing the Country at the International Level:

ADVERTISEMENTS:

In recent years, international trade and investment have become much more important to a modern mixed economy than they were in the past. This very fact implies that government now plays a critical role representing the interests of the nation at the international level and negotiating beneficial agreements with other countries on a wide range of issues.

The international issues of economic policy can be divided into the following four areas:

(i) Reducing Trade Barriers:

Perhaps the first important aspect of the government’s international economic policy involves harmonising laws and reducing trade barriers so as to encourage fruitful international specialisation and division of labour.

This is why in recent times nations with progressive outlook have negotiated a series of trade agreements to lower tariff and -other trade barriers on farm (primary) products, manufactured articles, and services. For example, in 1993, the USA, Mexico and Canada concluded the North American Free Trade Agreement (NAFTA) to promote growth through trade in that prosperous region by lowering tariff barriers.

(ii) Exchange Rate Stability:

ADVERTISEMENTS:

The foreign exchange reserves of a country are kept with the government or its authorised agent, the Central Bank. And the Central Bank, on behalf of the government, often intervenes in the foreign exchange market to maintain stability of the country’s currency in terms of other currencies.

(iii) Macroeconomic Co-Ordination:

The governments of different countries now meet at periodic intervals to co-ordinate their exchange rate and other macroeconomic policies to combat the problems of global inflation and unemployment.

This is important because exchange rates do not manage themselves; establishing a smoothly functioning exchange rate system is a prerequisite for promoting efficient multilateral trade. Moreover, macroeconomic co-ordination is important because fiscal and monetary policies of other nations can affect domestic economic conditions.

(iv) Environmental Protection:

Finally protection of the global environment is very much on the agenda of government economic policy. So one of the important aspect of international economic policy is to work with other nations to protect the environment in cases where several countries contribute or are affected by spill-overs.

As Paul Samuelson and W.D. Nordhaus have put it, “The most active areas historically have been protecting fisheries and water quality in rivers. More recently, as scientists have raised concerns about ozone depletion, deforestation, global warming, species extinction, nations have began to consider ways of protecting these global resources. Clearly, international environmental problems can be resolved only through the cooperation of many nations.”