Read this article to learn about Monetary Policy of a Country – explained with Diagram) !

Several economists have defined monetary policies differently.

According to Harry Johnson, monetary policy can be defined as,

“a policy employing central bank’s control of the supply of money as an instrument of achieving the objectives of general economic policy,”

According to Shaw, monetary policy can be referred as,

“any conscious action undertaken by the monetary authorities to change the quantity, availability or cost… of money.”

ADVERTISEMENTS:

Monetary policy can be defined as a policy in which the monetary authority of a country, generally the central bank, controls the demand and supply of money.

The main objective of the monetary policy is to achieve economic growth, maximize employment, maintain price stability, and attain balance of payment equilibrium. The monetary policy can be maintained by changing the rates of interests, such as Cash Reserve Ratio (CRR) and bank rate.

The effectiveness of monetary policy can be influenced by two factors, namely, level of monetized economy and level of capital market development. In monetized economy, the monetary policy covers all economic activities. Moreover, in this type of economy, money serves as the medium of exchange for all economic transactions.

Therefore, in such an economy, monetary policy can be implemented by changing the price level. Monetary measures can directly or indirectly affect the economic activities, such as production, consumption, saving, investment, and employment.

ADVERTISEMENTS:

The other important factor that influences the effectiveness of monetary policy is the development of capital market. A capital market can be defined as a market in which both, public and private sectors, sell financial securities to raise funds. Some of the instruments of monetary’ policy, such as CRR and bank rate, work through the capital market.

Monetary policy influences the economic activities by making certain changes in the capital market. Therefore, for effective monetary policy, it is necessary that the capital market should be well developed.

A developed capital market involves the following features:

a. Large number of financial institutions, commercial banks, and credit organizations

ADVERTISEMENTS:

b. Large number of financial transactions

c. Inter-linkage and inter-dependence of capital submarkets

Tools of Monetary Policy:

The tools of monetary policy are the monetary variables, which are used by the central bank to control and regulate the money supply and monitor the availability of credit in an economy. The tools of monetary policy are also termed as weapons of monetary control. Samuelson and Nordhaus have termed these tools as the nuts and bolts of monetary policy.

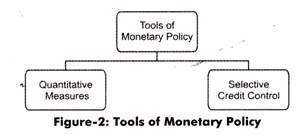

The different tools of monetary policy are shown in Figure-2:

The tools of monetary policy (as shown in Figure-2) are explained in detail.

Quantitative Measures:

Quantitative measures are the measures that can be used for controlling and regulating the demand and supply of money. In addition to the quantitative measures of monetary policy, the nations can also adopt some direct measures for regulating the demand and supply of money. For example, in India, all the major banks are nationalized; therefore, the central bank (Reserve Bank of India) uses direct measures to cope with various economic problems, such as inflation.

ADVERTISEMENTS:

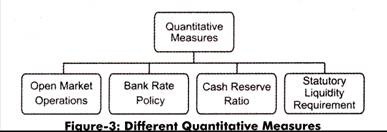

Some of the important quantitative measures are shown in Figure-3:

The different quantitative measures (as shown in Figure-3) are explained in detail.

Open Market Operations:

ADVERTISEMENTS:

Open Market Operations (OMO) of a government involve the sales and purchase of government securities and treasury bills by the central bank. If the central bank wants to increase the supply of money with the public, it purchases government securities and treasury bills. On the other hand, if the central bank wants to decrease the supply of money, it sells the government securities and treasury bills. OMO is the most important and frequently adopted measure of the monetary policy.

These operations are performed by the central bank with the help of commercial banks. The central bank is not involved in the direct dealing with the public. Government securities are purchased by commercial banks, financial institutions, large businesses, and individuals having high income. All these customers of government bonds have their accounts in commercial banks.

When the customers purchase these bonds, the money is transferred from their bank accounts to the central bank account. In this way, when the central bank conducts operations in the open market, the bank deposits and reserves of commercial banks and their potential to generate credit get affected.

For example, to reduce the chances of inflation, the central bank decrease the supply of money in the market. In such a case, commercial banks sell government securities in the market. This operation can be made easier when the commercial banks are under the direct control of government.

ADVERTISEMENTS:

However the supply of money can be adversely affected in certain situations. For example,, when customers purchase government securities they draw checks from their commercial bank accounts in favor of the central bank. In this way the money is transferred from commercial banks to the central bank account.

This results in the reduction of deposits and reserves held by commercial banks which further decreases their credit creation capacity. As a consequence to this, the flow of credit from commercial banks to general public decreases.

Apart from this, in case commercial banks themselves purchase government securities, their cash reserves decrease. As a result, the credit creation capacity of commercial banks decreases. This eventually results in reduction in the credit flow from commercial banks to the public.

However, in case the central bank wants to increase the supply of money in economy, it purchases government securities from commercial banks and other purchasers of government securities. In such a case, money moves from the central bank account to individuals’ accounts.

This leads to an increase in deposits and reserves of commercial banks. Consequently, the credit creation capacity of commercial banks increases, which raises the flow of credit to the public.

The effectiveness of OMO is influenced by various factors.

ADVERTISEMENTS:

Some of the factors are explained as follows:

(a) Excess Liquidity:

Acts as a major factor that affects the effectiveness of OMO. The OMO does not work properly in case the liquidity of commercial banks is in excess.

(b) Business Cycles:

Play a crucial role in the efficient working of OMO. When an economy enters into the recovery stage, the demand for credit is dubious. On the other hand, in the depression stage of an economy, there is lack of demand for credit. In such a case, OMO does not work efficiently.

(c) Capital Market:

ADVERTISEMENTS:

Implies that if the capital market of a nation is not developed, OMO cannot be effective. This is because of the reason that important tools of OMO, such as bank deposits and reserves, depend on the capital market.

(d) Rate of Returns:

Refers to one of the most important factors that influence the efficiency of OMO. Generally, customers to do not prefer to purchase government securities due to low rate of return. In such a case, the central bank needs to perform certain coercive procedures and compel commercial banks to purchase government securities.

Bank Rate Policy:

Bank rate refers to the rate at which the central bank further discounts the bills of exchange presented by commercial bank. According to RBI Act, 1935, Lank rate can be defined as, “standard rate at which (the bank) is prepared to buy or rediscount bills of exchange or other commercial papers eligible for purchase under this act.”

The central bank can rediscount the approved bills and bills of exchange only. If commercial banks are not left with adequate cash reserves, they are required to consult the central bank for rediscounting their bills of exchange. In this way, commercial banks borrow from the central bank. The central bank rediscounts the bills of exchange of commercial banks as it is one of the functions of the central bank.

ADVERTISEMENTS:

For the rediscounting of bills of exchange, the central bank charges a particular amount from commercial banks that is termed as bank rate. It is also referred as discount rate. For all other practical purposes, bank rate is defined as the rate at which the central bank provides credit to the commercial banks.

The central bank changes the bank rate depending on its purpose of increasing or decreasing the flow of money banks. In case, the central bank wants to increase the credit creation capability of commercial banks, then it decreases the bank rate and vice-versa. This is termed as the bank rate policy or discount rate policy.

This policy was first implemented in 1839 in Bank of England. In 1839, it was considered as one of the most important tools for controlling and regulating money in the economy. However, the place of bank rate policy was overtaken by OMO in 1922.

Let us understand how the bank rate comes into operation. In case, the discount rate of central bank increases then the commercial banks also increases their discount rate and vice-versa. The discount rate of central bank is usually kept 1% more than the discount rate of commercial banks.

The discount rate affects the flow of money in an economy. For example, in case, the central bank needs to reduce the flow of money in banks, then it increases the discount rate. Increase in the discount rate affects the flow of money in many ways.

Firstly, an increase in discount rate results in the decrease of net worth of government securities on the basis of which commercial banks get loans and credit from the central bank. This further leads to reduction in the money borrowing capability of commercial banks from the central bank.

ADVERTISEMENTS:

Consequently, the reserves of commercial banks also reduce; therefore, the flow of money decreases in the economy. Secondly, when the discount rate of the central bank increases, then the discount rate bank also increases. This leads to an increase in the cost incurred on credit, which, in turn, demotivates business to get their exchange discounted.

The increase in the discount rate results in the increase of rate of interest and affects the demand of money adversely. This policy is termed as the dear money policy. In case of cheap money policy, the process of dear money policy is reversed. Thirdly, the rate of lending by bankers gets drastically affected by the credit rate.

An increase in the discount rate increases the credit rate. In such a case, businesses prefer to deposit money in banks instead of borrowing money. This lead to an increase in the bank’s savings in terms of credit. This effect is termed as deposit mobilization effect.

Over a passage of time, bank rate policy has lost its importance in monetary control.

Following are some of the limitations of the bank rate policy:

(a) Self-efficiency of commercial banks:

Implies that the bank rate policy is based on variation in bank rate. This variation only works in situations when commercial banks borrow money from the central bank. However, in present times, commercial banks are self-efficient in terms of financial resources. Therefore, the changes in bank rate by the central bank do not affect the discount rate of commercial banks.

(b) Growth of capital market:

Refers to one of the most important limitation of the bank rate policy. Over the years, the capital market has expanded rapidly with the growth of financial institutions and credit organizations.

This has reduced the scope of bank credit. Therefore, variations made by the central bank in the discount rate, particularly in case of increase in the discount rate, have very less impact on credit market.

(c) Elasticity of interest:

Implies that fluctuation in the discount rate effective only when the demand of money is interest elastic. Generally, in less developed or underdeveloped countries, the interest rates in the credit market are sticky. Therefore, in these countries, the changes in discount rate have not been proved very effective.

Cash Reserve Ratio:

CRR refers to the percentage of credit that needs to be maintained by commercial banks in the form of cash reserve with the central bank. The main aim of CRR is to avoid any kind of shortage of money in meeting the demand of money of depositors.

CRR is usually determined by the previous experience of banks related to the extent of cash demanded by depositors. Commercial banks always retain their reserves beneath the safe limits. This is because of the reason that cash reserves are non-interest bearing in nature.

This situation may result in financial crunch in banking sector. Therefore, CRR has been made obligatory by the central bank for commercial banks. In addition, it has become an important measure for the central bank to control the supply of money. CRR IS also termed as Statutory Reserve Ratio (SRR).

The central bank possesses the power of changing the rate of CRR depending on economic situations. When there is a need of contractionary monetary policy in the economy, CRR is increased by the central bank. In this case, commercial banks need to reserve a-large amount of their total deposits with the central bank.

As a result, the credit creation capability of commercial banks reduces, which further decreases money supply in the market. On the other hand, in case there is a requirement of increasing supply of money in the economy, the rate of CRR is decreased by the central bank. In such a case, the credit creation capability of commercial banks increases.

Consequently, there would be increase in money supply. The effect of changes in CRR on money supply can be understood with the help of an example. Suppose commercial bank A has total money deposits of Rs. 200 million with 20% of CRR.

This implies that the bank can provide loans on the remaining amount, which is Rs. 160 million. On the other hand if the rate of CRR increases to 25%, then the bank would be able to provide loans on the amount Rs. 150 million.

CRR is the most effective tool then the other tools of quantitative measures of monetary policy. It is the most popular instrument in developed countries where banking system is highly developed and had a greater stake in the capital market. However, CRR is restricted by its dependency on the bank credit system in the credit market.

Statutory Liquidity Requirement:

Apart from CRR, another reserve requirement imposed by the central on commercial banks is Statutory Liquidity Requirement (SLR). SLR is the amount of money that commercial banks need to keep with them in the form of liquid assets, besides CRR.

The liquid assets can include cash reserve, gold, and government securities. In India, SLR was proposed by RBI to prevent the selling of government securities by commercial banks in case of increase in CRR. Before SLR was introduced, commercial banks were involved in the practice of selling government securities, in case of increase in CRR, to overcome a fall in their loanable funds.

In India, RBI has continuously increased SLR from 25% in 1970s to 38.5% in 1991. However, SLR has been reduced to 30% on additional deposits in 1992. Now, the rate of SLR is 25% for commercial banks. However, it keeps on changing depending on the economic conditions.

Selective Credit Controls:

The quantitative measures of monetary control have uniform effect on the whole credit market. In simple terms, these measures have an even effect on all the sectors of an economy. However, this situation may not always wanted by policymakers for the formulation of policies.

This is because of the reason that policymakers need to allocate the money in different sectors of the society and move the flow of money from most important sectors to least important sectors of the economy. In addition, the policymaker’s nave to reduce the risk factors associated with the availability of bank credit.

All these objectives of monetary control can be achieved by implementing quantitative measures. Therefore, several selective credit controls are introduced by monetary authorities.

Some of the measures under selective credit controls are as follows:

(a) Credit Rationing:

Refers to one of the important measures to control money supply. The allocation of money is different in different sectors of an economy. In case there is reduction in money supply in an economy, then large industries are generally inclined to hold the largest share of the total money supply in the market. In such a case, those industries that are important for economic growth, but are not very strong suffer from the problem of lack of money.

For avoiding such situations, the central bank allocates money in different sectors of the society with the help of different tools, which are as follows:

i. Obligating upper limits on money available for large industries and organizations.

ii. Keeping the interest rate higher on loans from bank beyond a particular limit.This helps in providing bank credit to every section of the society.

iii. Offering bank credit at lower interest rates to the weaker section of the economy.

(b) Lending Margins:

Helps in controlling money supply by a continuous change in the lending rates. Banks provide loans to individuals by keeping their property as security in the form of houses, buildings, shares, and jewelry.

They calculate the value of total property and provide loans equal the percentage of the total property. The difference between the amount of loan and total value of property is termed as lending margin. For example, if the value of a property is Rs. 100 million and amount of loan provided on this property is Rs. 60 million, then the lending margin is 40%.

The central bank has the power to make any type of changes in the lending margin on the basis of increase or decrease in the bank credit. The measure of lending margins was adopted by RBI in 1949 to avoid speculation in the share market. Further, RBI implemented this method – other sectors, such as agriculture, to reduce speculation activities. However, the selective credit controls were abolished in October 1996.

(c) Moral Suasions:

Refers to a measure of assuring and influencing commercial banks to raise credit in alignment with the directives set by the central bank. The moral suasion method is used when other quantitative measures of monetary policy are not effective for monetary control.

In this method, the central bank conducts meetings with commercial banks and writes letters to them. The main purpose of holding meetings is to persuade commercial banks to work as per the rules of the central bank and for the welfare of the economy.

(d) Direct Controls:

Refer to measures when other monetary control measures of the central bank fail to control the situation. In such a condition, commercial banks need to perform their lending activities according to the instructions of the central bank.

One more measure that is adopted by RBI is repo rate and reverse repo rate. Repo rate refers to the rate at which RBI charges commercial banks when they take money from it. On the other hand, reverse repo rate refers to the rate at which RBI is ready to retain the money of commercial banks with it.

Repo rate helps in increasing the supply of money to reverse repo rate reduces the supply of money. The changes are made in repo rate and reverse repo rate by RBI according to the economic conditions.

Limitations of Monetary Policy:

As discussed above, the monetary policy of a government plays a major role in maintaining the supply of money in an economy. However, monetary policy is not free from limitations.

Some of the limitations of the monetary policy are as follows:

(a) Time Gap:

Refers to one of the major limitations of the monetary policy. It involves time taken in formulating and implementing monetary policy in an economy. Time gap can be classified into two categories, namely, inside time lag and outside time lag.

Inside time lag denotes to the time gap in analyzing the type, selection, and implementation of monetary policy as well as its results. On the other hand, outside time lag is the time taken to receive feedback from individuals and organizations on monetary measures that are implemented in the economy.

In case, both the time lag increase, result in new types of economic problems, but make the whole monetary policy ineffective. Fiscal policy has a shorter time lag as compared to monetary policy. The time lag in monetary policy can be 12 to 16 months.

(b) Difficulty in Forecasting:

Implies that monetary policy can be effective if there is a proper analysis of economic problems for which the policy is being used. Moreover, the consequences of monetary policy to be implemented should be assessed properly. However, forecasting economic conditions has always been a controversial issue.

This is because different economists have different viewpoints and they analyze the situation differently. Forecasting based on guesses is unfruitful. Therefore, monetary policy can be effective if it is based on evidences.

(c) Non-banking Financial Intermediaries:

Refers to the fact that the growth of financial market has decreased the scope of monetary policy. With the emergence of non-banking financial intermediaries, such as industrial development banks, insurance companies, and mutual funds, there is only a small room for bank credit.

This new segment of the economy is responsible in grabbing the share of commercial banks. The non-financial intermediaries do not make credit with the help of credit multiplier, but their share in money supply makes the monetary policy ineffective.

(d) Less Development of Money and Credit Market:

Acts as one of the important factors for ineffectiveness of policy. The effectiveness of monetary policy. The effectiveness of monetary policy depends upon the efficiency of money and credit market. Usually, in underdeveloped countries, the structure of money and credit market is not so strong. Therefore, monetary policy in these countries has proved ineffective.