In this article we will discuss about the role of the government in a market economy.

The classical economists like Adam Smith, J.S. Say and other advocated the doctrine of laissez faire which means non- intervention of the government in economic matters. Adam Smith introduced the concept of the invisible hand, which refers to the free functioning of the price (market) system in the absence of government intervention.

And, in the 19th century, the western capitalist economics achieved spectacular growth by following the policy of laissez faire. As Paul Samuel- son has put it, “An ideal market economy is one where all goods and services are voluntarily exchanged for money at market prices. Such a system squeezes the maximum benefits out a society’s available resources without government intervention”.

The doctrine of laissez faire, which means ‘leave us alone’ held that government should interfere as little as possible in economic affairs and leave economic decisions to the interplay of supply and demand in the market place. However, the great depression of 1929 (which lasted for 4 years) shattered the economies of U.S.A. and other western industrialised countries and forced them to partially abandon the doctrine of laissez faire.

ADVERTISEMENTS:

And, in 1936, J.M. Keynes suggested in his revolutionary book: The General Theory that the visible hand of the government should replace, at least partly, the invisible hand of the market. Following Keynesian prescriptions governments in most countries took on a steadily expanding economic role, regulating monopolies, collecting income taxes and providing social security in the form of unemployment compensation or pension for the old people.

To quote Samuelson again, “in the real world, no economy actually conforms totally to the idealised world of the smoothly functioning invisible hand. Rather, every market economy suffers from imperfections which lead to such ills as excessive pollution, unemployment and extremes of wealth and poverty”.

For all these reasons, any government anywhere in the world, whether conservative or liberal, intervenes in economic affairs. In a modern economy like our own, the government has to perform various roles mainly to correct the flaws (defects) of the market mechanism. The military, policy, most schools and colleges, health centres and hospitals and highway and bridge construction are all government activities, research and space exploration require government funding.

Governments may regulate some businesses (such as banking and insurance), while subsidising others (such as agriculture and small-scale and cottage industries). And last, but not the least governments tax their citizens and redistribute the revenues to the poor as also the elderly (retired) people.

Four Main Functions of Government in a Market Economy:

However, according to Samuelson and other modern economists, governments have four main functions in a market economy — to increase efficiency, to provide infrastructure, to promote equity, and to foster macroeconomic stability and growth.

1. Efficiency:

ADVERTISEMENTS:

First, the government should attempt to correct market failures like monopoly and excessive pollution to ensure efficient functioning of the economic system. Externalities (or social costs) occur when firms or people impose costs or benefits on others outside the marketplace.

2. Infrastructure:

Secondly, the government should provide an integrated infrastructure. Infrastructure (or social overhead capital) refers to those activities that enhance, directly or indirectly, output levels or efficiency in production.

Essential elements are systems of transportation, power generation, communication and banking, educational and health facilities, and a well-ordered government and political structure. Since the cost of providing these essential services are very high and benefits accrue to numerous diverse groups, such activities are to be financed by the government.

3. Equity:

ADVERTISEMENTS:

Markets do not necessarily produce a distribution of income that is regarded as socially fair or equitable. As market economy may produce unacceptably high levels of inequality of income and weather. Government programmes to promote equity use taxes and spending to redistribute income toward particular groups.

4. Economic Growth or Stability:

Fourthly, governments rely upon taxes, expenditures and monetary regulation to foster macroeconomic growth and stability to reduce unemployment and inflation while encouraging economic growth.

Macroeconomic policies for stabilisation and economic growth includes fiscal policies (of taxing and spending) along with monetary policies (which affect interest rates and credit conditions). Since the development of macroeconomics in the 1930s governments have succeeded in bringing inflation and unemployment under control.

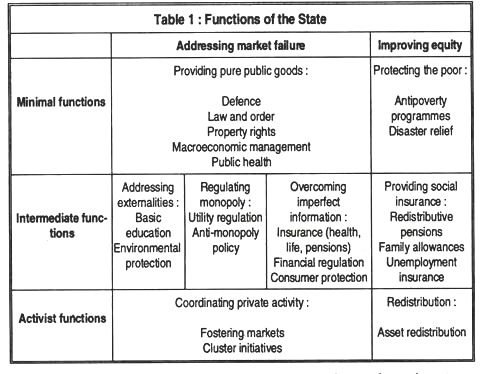

Table 1 presents a framework for classifying the functions of government along a continuum, from activities that will not be undertaken at all without state intervention to activities in which the state plays an activist role in coordinating markets or redistribution assets.

Countries with low state capability need to focus first on basic functions: the provision of pure public goods such as property rights, macroeconomic stability, control of infectious diseases, safe water, roads and protection of the destitute. Recent reforms have emphasised economic fundamentals. But social and institutional (including legal) fundamentals are equally important to avoid social disruption and ensure sustained development.

Going beyond these basic services are the intermediate functions, such as management of externalities (pollution, for example), regulation of monopolies, and the provision of social insurance (pensions, unemployment benefits).

States with strong capability can take on more-activities functions, dealing with the problem of missing markets by helping coordination.

Matching role to capability involves not only what the state does but also how it does it. Rethinking the state also means exploring alternative instruments, existing or new, that can enhance state effectiveness.

ADVERTISEMENTS:

For example:

In most modern economies the state’s regulatory role is now broader and more complex than ever before, covering such areas as the environment and the financial sector, as well as more traditional areas such as monopolies.

Although the state still has a central role in ensuring the provision of basic services — education, health, infrastructure — it is not obvious that the state must be the only provider, or a provider at all.

In protecting the vulnerable, countries need to distinguish more clearly between insurance and assistance. Insurance, against cyclical unemployment for example, aims to help smooth households’ income and consumption through a market economy’s inevitable ups and downs. Assistance, such as food-for-work programs or bread subsidies, seeks to provide some minimum level of support to the poorest in society.