The following points highlight the four important types of tax levied on income. The types are: 1. Progressive Tax 2. Proportional Tax 3. Regressive Tax 4. Digressive Tax.

Tax Type # 1. Progressive Tax:

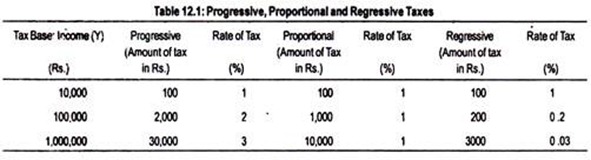

A progressive tax is one which taxes an increasing proportion of income as income rises. Thus, as income increases, tax rate increases and as income decreases tax rate decreases.

This means that the rise in tax liability (say, ∆T) is more than the rise in income (say, ∆Y). In symbolic terms, progressive taxation means ∆T > ∆Y. For progressive tax, ATR increases with the size of the base and MTR exceeds ATR at all levels of income.

Tax Type # 2. Proportional Tax:

A proportional tax is one if tax rate remains constant, even if incomes rise. Whatever the level of income, the rate of tax remains unchanged. Taxes that vary in direct proportion to the increase or decrease in income is called proportional tax.

ADVERTISEMENTS:

A proportional tax thus takes a constant proportion of income:

Symbolically ∆T = ∆Y, in the case of proportional tax. This is called flat rate tax. Under proportional tax, both ATR and MTR are the same because rate of taxation does not vary with the taxable base. This kind of tax is also called ‘flat rate tax’.

Tax Type # 3. Regressive Tax:

A regressive tax is one which extracts a declining proportion of income as income rises. In the case of regressive taxation, tax rate declines as income rises. Regressive tax is just the opposite of progressive tax. In the case of regressive tax, ∆T < ∆Y. For regressive tax, ATR declines as the tax base increases and MTR falls short of ATR.

Tax Type # 4. Digressive Tax:

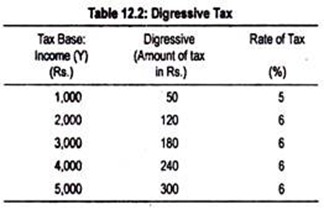

A digressive tax is partly progressive since tax rate increases as income increases; and partly proportional because tax rate remains unchanged even if income increases. Thus, digressive tax is an admixture of progressive and proportional tax. Under digressive tax, tax payable increases only at a diminishing rate but up to a certain limit beyond which a flat rate of tax is charged.

ADVERTISEMENTS:

Tables 12.1 and 12.2 will help our understanding of the different rates of tax.

All these four types of rate of taxes can be diagrammatically explained:

ADVERTISEMENTS:

In Fig. 12.2, income as the basis of taxation is measured on the horizontal axis while taxation receipts or tax rate is measured on the vertical axis. Note that the proportional tax rate has a constant slope, progressive tax rate has a positive slope, while regressive tax rate has a negative slope.

The steeper the slope of the line the more progressive the taxation and the steeper the negative slope the more regressive the taxation. The digressive tax rate line has a positive slope up to a certain bend after which it has a constant slope.