Let us make an in-depth study of the role of Harrod-Domar models in less developed countries.

It is often argued that the Harrod-Domar model offers little help in solving the growth problems of under-developed countries.

Though this argument has some weight, but it is not wholly justified. No doubt, this model has played a pioneer role in analysing the growth problems of advanced countries.

This model with necessary modification, can also act as guide for less developed countries.

ADVERTISEMENTS:

Harrod-Domar model was very popular with the planners of under-developed countries. This model was used for the calculation of income, saving and investment targets which were vital in the planning of under-developed economy.

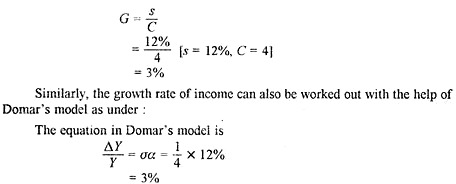

In this connection, Prof. Hirschman writes: “The Domar model, particularly, has proved to be remarkably versatile, it permits us to show not only the rate at which the economy must grow, if it is to make full use of the capacity created by new investment, but inversely the required savings and capital-output ratios, if income is to attain a certain target growth rate.”Use of these models in the planning of underdeveloped economies could be illustrated with the help of an example. Suppose the capital-output ratio is 4:1 and the saving-income ratio is 12% in the economy.

The growth ratio of national income of the economy can be calculated with the help of the Harrod model as follows:

From this numerical example it is clear that the calculation of growth rate of income is a simple mathematical exercise.

ADVERTISEMENTS:

The implications of this model for less developed countries are:

1. The growth rate of income derived from this model would be meaningful only if it exceeds the rate of growth of population.

2. As far as possible, the capital-output ratio must be kept at a low level by preferring labour-intensive techniques. The Planning Commission in India had accordingly given due importance to small-scale industries in the Second and the Third Plans.