Everything you need to know about compensation. Compensation is the reward that the employees receive in return for the work performed and services rendered by them to the organization.

Compensation includes monetary payments like bonuses, profit sharing, overtime pay, recognition rewards and sales commission, etc., as well as nonmonetary perks like a company-paid car, company-paid housing and stock opportunities and so on.

Compensation is a systematic approach to providing monetary value to employees in exchange for work performed. It is a tool used by management for a variety of purposes to further the existence of the company. It may be adjusted according to the business needs, goals and available resources.

Compensation is relevant to most other fields of human resource management such as recruitment and selection, training and development, performance appraisal, incentives, industrial and employee relations, promotion and separation and outside intervention in human resource matters.

ADVERTISEMENTS:

Learn about:-

1. Introduction to Compensation 2. Meaning and Concept of Compensation 3. Objectives 4. Purposes 5. Structure 6. Contingent Factors

7. Types 8. Relevance in Human Resource Management 9. Theories 10. Advantages and Disadvantages 13. Recent Developments.

Compensation: Meaning, Concept, Objectives, Structure, Types, Importance and Theories

Contents:

- Introduction to Compensation

- Meaning and Concept of Compensation

- Objectives of Compensation

- Purpose of Compensation

- Structure of Compensation

- Contingent Factors in Compensation Plan

- Types of Compensation

- Importance of Compensation to Other Fields of Human Resource Management

- Theories Related to Compensation

- Main Advantages and Disadvantages of Compensation

- Recent Developments in Compensation

Compensation – Introduction

Generally the term compensation refers to compensating any damage, loss or mental harassments, wages or salaries as reward for physical and/or mental efforts to perform any agreed task or job. But the concept of equity in remunerating any work or task has forced us to perceive wages and salaries as compensation, because people work efficiently only when they are paid according to their worth or feel satisfied with the remunerations.

ADVERTISEMENTS:

Besides basic salaries or wages, companies are forced to view the benefits and services to justify the positional and esteem needs of employees and to provide adequate cushion for inflations. Though the cost of human resources is estimated at between 2% to 20% of the operating cost (depending upon the type of industry), to retain the employees or to avoid job-hopping, some of the industries are even forced to adopt varying scales and benefits.

The most common questions that arise in the minds of employees are:

i. Is this compensation justifying my worth?

ADVERTISEMENTS:

ii. How does my package compare with others who are working in a similar industry?

iii. Can I have a better growth plan in this industry?

iv. How important is my pay scale compared to other factors being offered by the industry?

v. Why are others offering better compensation for the same post and job?

These questions arise in the minds of every employee whether he/she is at the executive or the manager levels. At the top and middle level positions, though they recognize the limitations of the organizations, they still feel that some equitable and reasonable relationships should exist. Similarly, the pay increments are also debated as unfair compensation at various levels.

There could be several other questions regarding the perception about compensation as today the industries are designing more and more attractive packages to attract the talents in this competitive era.

But their package designs vary according to the performance desired and the employee’s attitude to keep on improving their personality and offering continuous improvement in organizational growth. What is most important to know is whether the employer and the employee think alike or have divergent views?

Today, the pay being competitive, it is logical for employers to look for employees with attributes other than knowledge and skill, attributes which can enrich their experience at work. They can find out the potential in the employee and provide opportunities for learning and career growth. Thus compensation designs and compensation programmes are being so designed so as to attract the winning horses.

Therefore, the study of compensation is of outmost importance from both an academic as well as practical point of view as wages and salaries are the major factors in socio-economic analysis. From an economic point of view, compensation refers to the payments to the efforts made by an individual.

ADVERTISEMENTS:

In a society it is an occupational category and reflects the individual’s status, while psychologically, compensation relates to the satisfaction of an individual’s needs and aspirations.

It is compensation which directly affects one’s standard of life, meets the needs of his/ her family, enables him/her to save for future liabilities and justifying his/her worth for a job. Wages/salaries, on the other hand, add to the cost of production and are a vulnerable part of a company’s overhead, which affects the profit to the employers.

Both employers and the employees are concerned about the adequacy of the compensation. Employers are interested to hire competent employees by offering attractive and bearable cost to the company, while employees try to get maximum return on their skills, knowledge, expertise or payment to justify their worth.

Compensation – Meaning and Concept

Compensation is the reward that the employees receive in return for the work performed and services rendered by them to the organization. Compensation includes monetary payments like bonuses, profit sharing, overtime pay, recognition rewards and sales commission, etc., as well as nonmonetary perks like a company-paid car, company-paid housing and stock opportunities and so on.

ADVERTISEMENTS:

Apart from the basic financial pay the employees receive paid vacations, sick leave, holidays and medical insurance, maternity leave, free travel facility, retirement benefits, etc., and these are called benefits.

Compensation is a vital part of human resource management decision making as it helps in encouraging the employees and improves the organizational effectiveness.

Compensation packages with good pay and benefits help to attract and retain the best employees. Employees consider pay package to be fair when the amount of wage covers basic living expenses, keep up with inflation, leave some money for savings (perhaps for retirement) and leisure and there is increment over time.

HRM is concerned with the determination of adequate and equitable remuneration of the employees in the organization. HRM use techniques like job evaluation and performance appraisal for determining remuneration.

ADVERTISEMENTS:

Factors that are considered for determining the remuneration of personnel are their basic needs, requirements of jobs, legal provisions regarding minimum wages, capacity of the organization to pay, wage level afforded by competitors, nature of job, skills required, risk involved nature of working conditioning, bargaining power of the trade union, etc.

Wages and salaries form a substantial part of total costs in most of the organization. Hence a systematic approach must be followed for determining wage and salary structure so as to ensure logical, equitable and fair pay to the employees.

The term equity in pay means – pay corresponding to difficulty level of the job assigned to an employee meaning more difficult the job more should be the pay (called internal equity); compensating an employee equally in comparison to similar jobs in the labour market(called external equity ) and equal pay for equal jobs(called individual equity)

Compensation may be defined as money received in performance of work and many kinds of services and benefits that an organization provides to their employees.

Compensation is a systematic approach of providing monetary value to employees in exchange for work performed. It may help to achieve several purposes, such as recruitment, job performance and job satisfaction. It is also defined as the package of quantifiable rewards an employee receives for her or his labour.

It represents both, the intrinsic (psychological mind-sets resulting from job performance) and extrinsic (including both monetary and non-monetary) rewards. The term, compensation refers to all forms of financial returns and tangible benefits that an employee receives as a part of employment relationship. In the globalization era, where the business environment has become increasingly complex and challenging, designing an effective compensation program to attract and retain talent is an important function of organizational effectiveness.

ADVERTISEMENTS:

Compensation is a systematic approach to providing monetary value to employees in exchange for work performed. It is a tool used by management for a variety of purposes to further the existence of the company. It may be adjusted according to the business needs, goals and available resources.

i. Individual worth – The value of a job is related to similar jobs of the company or the competitors but the value of an individual to perform that job may vary according to his/her skill/knowledge, expertise and more so his behaviour on the job and with associating persons. The combinations of these attributes decide the worth of individual. This definition is a perception of the employees.

ii. Cost to Company – Human resource is considered as an asset to the organisation. The investment on this asset by the company with respect to skill, competence or expertise is a cost to the company and the employer’s intention is to make aware the employees that he/she has to ensure return on this investment through his/her consistent and continuous performance.

iii. Flexible Compensation Package – Employees are being offered compensation structure with numbers of benefits to choose to plan tax plan and provide freedom to choose to get maximum benefit.

Compensation – 2 Main Objectives: Primary and Secondary Objectives

Objective # 1. Primary Compensation:

The primary objectives of compensation or wages are classified under four broad categories:

ADVERTISEMENTS:

i. Equity,

ii. Efficiency,

iii. Macro-economic stability, and

iv. Optimum allocation of labour.

The first category is equity, and may take several forms. Equity includes income distribution through narrowing down of inequalities, increasing the wages of the lowest paid employees, protecting real wages, and the concept of equal pay for work of equal value. Compensation management strives for internal and external equity. Internal equity requires that pay should be related to the relative worth of a job such that similar pay is assured for similar jobs.

ADVERTISEMENTS:

External equity refers to making comparable payments, that is, paying workers what other firms in the labour market pay comparable workers. Compensation differentials, based on differences in skills or contribution, are all related to the concept of equity. Internal equity actually means employees and their contribution are treated fairly with a pay programme in relation to other jobs in the organization.

Efficiency is often closely related to equity. These two concepts are not adverse. The objectives of efficiency are evidenced in attempts to link a part of wages to productivity or profit, group or individual performance, acquisition and application of skills, and so on. Preparations to achieve efficiency are also seen as being equitable, provided they fairly reward performance. The preparations are treated as inequitable if the reward is viewed as unfair.

iii. Macro-Economic Stability:

Companies try to achieve macro-economic stability through high employment levels. Low inflation helps to achieve macro-economic stability. For instance, an inordinately minimum wage would have an adverse impact on the levels of employment, though at what level this consequence would occur is a matter of debate. Although compensation and compensation policies are two of the many factors which influence macro-economic stability, they do contribute to or hinder balanced and sustainable economic development.

iv. Efficient Allocation of Labour:

ADVERTISEMENTS:

Employees consider the net gain. Efficient allocation of labour refers to the concept of labour/employee moving out of a situation to another for a net gain. Such movement may be from one geographical location to another, from one job to another, and within or outside an enterprise. The provision or availability of financial incentives causes such movement.

For example, workers are likely to move from a labour surplus or low-wage area to a high-wage area. On acquiring new skills, they may be tempted to derive benefit from moving to jobs with higher wages. Employee attrition is more when an employer’s wages are below market rates. Again, an employer attracts job applicants when his wages are above market rates. When employees move from declining to growth industries, an efficient allocation of labour due to structural changes takes place.

Objective # 2. Secondary Compensation:

From the standpoint of human resource management, a well-designed compensation package helps an organization to achieve additional objectives which are the secondary objectives of compensation. The secondary objectives include acquiring competent personnel, complying with regulations, controlling costs, enhancing administrative efficiency, facilitating understanding, retaining employees, and rewarding desired behaviour.

i. Acquiring competent personnel – Good compensation helps an organization attract competent applicants. As everyone has become aware of their value in the market, it is only wise for the management to provide suitable compensation packages to the employees for their retention.

ii. Complying with regulations – A sound wage and salary system considers the legal challenges imposed by the government and ensures the employers compliance.

iii. Controlling costs – A rational compensation system helps the organization obtain and retain workers at a reasonable cost. Without effective compensation management, workers might be over-paid (when product costs go up) or under-paid (which reduces employee motivation).

iv. Enhancing administrative efficiency – Any organization desires and attempts to optimally use the human resource information systems (HRIS). A well-designed sound wage and salary programme helps to manage HRIS efficiently.

v. Facilitating understanding – The compensation management system should have a high level of clarity. In addition to the human resource specialists and operating managers, the employees also should understand the compensation management system easily.

vi. Retaining employees – Attrition may increase when compensation levels do not fulfil employees’ expectations. They quit due to the feeling that compensation is not competitive.

vii. Rewarding desired behaviour – Companies expect certain types of behaviour from the employees. Pay is likely to reinforce desired behaviours and acts as an incentive for the behavioural modification, and for the behaviour to occur in the future. Effective compensation plans reward performance, loyalty, experience, responsibility, and other behaviours.

Compensation – Purpose: Attracting the Talent, Retaining the Talent and Motivating the Employees

An organisation has to design its compensation system to attain the following purpose:

(1) Attracting the Talent:

It is widely accepted that human resources of an organisation give it an edge over its competitors. By offering a well-designed pay package, an organisation can get best talent available in the job market.

(2) Retaining the Talent:

Because of liberalisation, globalisation and privatisation, the workforce has become highly mobile. The practice of lifelong employment and commitment between the employer and the employee which was practised in some economies of the world (William Ouchi’s Theory Z) is fast disappearing.

Now, employees don’t hesitate leaving an organisation and joining the other if they are offered better pay package. Therefore, each organisation should design such compensation system that talent not only gets attracted but also stays with the organisation.

(3) Motivating the Employees:

The talented employees may not be motivated to use their talent unless they feel that they will be rewarded duly for their contribution towards the organisational objectives. Therefore, compensation system must be designed to motivate the existing employees to contribute their maximum towards the organisational objectives.

Compensation – Structure and Its Components

There are some unique groups of jobs in each company and these jobs have to be identified, evaluated and plotted on a table. These are known as key jobs. Once this is done, the non-key jobs have to be compared against the key jobs and plotted on the chart. The key jobs are treated as benchmark jobs. This method appears to be a bit complex and involves a series of decisions. In this section, we will look at the methods of collecting information through surveys and utilizing such data and information for setting up wage levels and grades.

Conducting wage and salary surveys is a common practice in many countries and industries across the world. In order to provide a competitive wage scales and salary levels, a company must know what other companies in a community or area pay for their employees.

If a company simply ignores this type of information, the company may lose out their talented employees to other companies. Such surveys will give us a good idea as to what fair wages and salaries are in a community. These surveys are conducted by some consulting groups, professional associations, and government agencies. At times, the companies themselves carry out these surveys and share the output with other companies in the community.

The Singapore National Employers’ Federation (SNEF) conducts a detailed survey annually and distributes as a directory to its members. Such directories give a fairly good idea as to what the current practices are in the community when it comes to wages, salaries, and benefits. If companies are not going to line up their wages and salaries in line with other companies in the community, they will not be able to draw good and talented candidates.

The information obtained through surveys will be useful for benchmarking and against which other companies in the community compare their levels of wages and salaries. Generally only key jobs are used for survey purposes. Since every company in the community requires such information to set their standards, they show their interest participating in such surveys. Similar jobs will be considered for surveys and not necessarily similar job titles.

Wage Curve or the Trend Line:

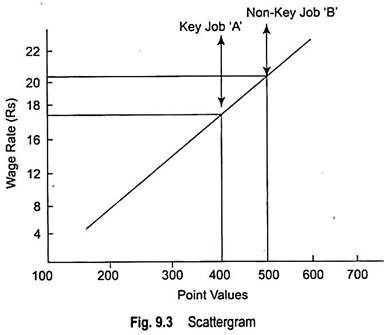

After conducting surveys, the next step is to price the key jobs. Let us see how to go about doing this. By taking the worth of the job obtained through job evaluation and matching it with the value or worth obtained from the labor market. Wage levels for each job must be established and grouping pay levels into a pay structure. Scatter gram is a graph which shows pay levels (on vertical axis) and the point values (on horizontal axis), in case, the point system is used.

Let us look at the scatter diagram:

If point system of job evaluation is used, the points are plotted on the horizontal axis of the figure and the wage level on the vertical axis, using this scatter-gram, the total points and the corresponding wage levels are plotted on the graph for all key jobs. The dots (x) indicate the intersection of point values (in case of point system) and the pay or wage rate (market) for a key job. Say for instance, the point value of a job is 200 and the pay or wage level is Rupees 20.

For non-key jobs, point value is located on the horizontal line. A vertical line is drawn from until it meets the trend line, from that point, horizontal line is drawn until it meets the vertical line, (the wage or pay line). The amount shown on the vertical line is the appropriate wage for that non-key job.

A curve may be drawn by preparing a scatter-gram consisting of a series of dots representing the current wage rates. In other words, the line drawn through the first intersection of wage level and points for key job sets the trend. The dots are plotted for all key jobs trend line is drawn as close to as many dots plotted, using Least Square Method (a statistical method).

Using this trend line, wage levels for non-key jobs are determined. Generally half of the dots will be above the curve and half will be below the curve. This curve known as wage curve can be straight or curved. This curve determines the relationship between the point value of a job and its wage rate at any one given point on the line. Now-a-days these things are prepared by consulting companies and ready-made answers are provided by the reports.

In some companies and especially in the civil service, pay grades are set and used for clubbing jobs into groups. The same rates are paid to all those who fall in the same group or grade. There may be some variation in the grading process when point system is used. A single rate or a range of successive rates are provided for each pay or salary grade. A proportionately greater pay for each successive level within the grade is also possible. In some grading structures, provision for overlap is also provided and this enables an employee with experience to earn more than less experienced employee in the next higher job classification.

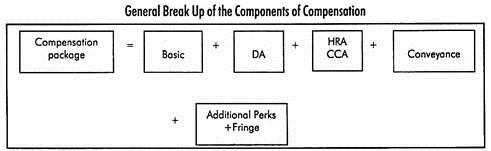

Accordingly, the compensation structure can be broken up into popularly accepted components as:

1. Basic:

This is the main part of the pay package, which refers to the component of compensation that justifies the worth of a job, as compared to a similar job in another industry/organization.

It matches job worth with the human skill, knowledge and experience to perform the job and is a stable wage/salary part of the compensation paid over a period of time, which could be weekly or monthly, and must be paid by the employer to meet the basic needs of the employees.

As per the Fair Wage Committee, it is a fair wage or the minimum wage to be paid by the employer to all categories of employees in a grade. It is a normal rate for a given output by an average employee of the particular grade.

It is fixed as per the job evaluation points for a particular group of jobs and by comparing its worth with other job prices for similar jobs in other organizations to cover equity concept. This basic component, once fixed, remains stable for a reasonable period of time unless some substantial change intervenes.

It is built upon the statutory minimum wage criteria, the tribunal awards as well as the directives of the Pay Commission at the national or state level and collective bargain.

It is the second important part of the compensation structure, which compensates the employee fully or partly for the loss of real earning. It takes care of the price inflation that affects the purchasing power of the employees. It is a regular and continuing part of the compensation package that gets changed according to the price increase, i.e., to establish a real wage concept.

It is linked with the price index (an approved calculation of the Government formulated from time to time depending upon the changes in the price index). However, the W/S policy defines the system of the DA changes and the management is committed to use this protection device.

Since the Wage/Salary grades once fixed cannot be changed quite frequently (till the next Wage Board or Pay Commissions recommendations), DA increase is not termed as the increase in wage or salary, but it is a relief to the employees to meet the additional burden due to price escalation.

In India, the practice of paying this allowance to compensate for the price increase began during the First World War when Mahatma Gandhi sat on a fast in 1918 in support of the Ahmedabad Textile workers’ protest against the increased cost of living.

DA as a continuing component of wage or salary came into existence during the conditions created by the Second World War as the cost of living shot up abnormally towards the end of the Second World War. That time, the AICI (All India Consumption Index) moved up from 269 in 1945 to 285 in 1946 and to 329 in 1947.

The practice of the payment of dearness allowance relates to all the sectors of organizations, as has also been referred to in the Minimum Wage Act, 1948. However, the multinational and private sectors do not separately define this component in their compensation structure, especially those of executives, and put more emphasis on perks and benefits to project more attractive packages.

The Wage and Salary policy defines the system of DA changes and the management is committed to use this protection device. However, the multinationals and private sectors do not separately define this component in their pay packages, especially those of executives, and put more emphasis on perks and benefits to cover this aspect to link the pay to performance and not to inflation.

In the context of the changing pattern of prices of commodities and consumption rate, the real wage or salary is likely to fluctuate greatly, which may upset the employees to meet the basic needs and to support their families. DA is that component of the pay structure which takes care of this fluctuation.

Therefore, an accurate and scientific approach is necessary to review and calculate this component so as to avoid conflicts or dissatisfactions in the minds of employees. For the employees of PSUs, Governments through the Wage Board and/or the Pay Commissions fix this component periodically based on the CPI (Consumer Price Index) to satisfy the real values of wage or salary.

General Principle of Fixing DA:

Whether it is pay fixation or DA fixation, some principles are to be followed to balance the loss of real earning to the employees and the extra financial burden on the employers.

The system of payment of DA was designed based on the following principles:

a. The extent of neutralization of the rising cost

b. The frequency of altering the rate of DA

c. The decision of various tribunals in this regard.

However, the employers felt that the lower paid employees are generally affected by price fluctuations and that class only needs to be protected.

The Gregory Committee appointed by the Government of India thus suggested the following principles for the payment of clearness allowances in India (in 1944):

a. The payment of DA should be limited to an income level of Rs. 200 pm.

b. The amount of DA should be fixed in terms of rupees and not in percentage of basic pay.

c. The payment of additional DA should be considered on the basis of the CPI.

d. There should be a single DA in the same region.

e. The system of payment should be designed based on the extent of neutralization of the rising cost of living.

Generally the employees demands that the DA increase or be revised whenever they feel severely affected and approach the management/Wage Board/Pay Commissions for the settlement of the issue.

The Wage Board or Pay Commission accordingly appoints a committee to examine the issue and fix/revise the DA based on the impact of the raised Consumer Price Index. They also do the neutralization of the old percentage.

The Wage Board or Pay Commission fixes the DA increase by considering the comparative price index and by neutralizing the old percentage of DA in wage or salary. In this process, the last price index is taken as 100% and the increase in price is worked out in points. For every change of 4 points after every six months one DA is considered worth to meet the cost of living.

For example, if the increase in the price index is 12 the DA increase will be 3 points as calculated below:

DA at the time of 100% datum = Pi x 3/100

Neutralization of DA means merging some part of this component in the basic wage/salary and adding the new DA in the pay scale. The method and extent to which neutralization in the cost of living is to be considered have been under constant examination by the industrial tribunals and other wage/salary fixing authorities.

Most of the Wage Boards provide for a flexible component of DA to neutralize the rising cost of living. However, the principles and practices in different Wage Boards, in establishing a link between the price index and the DA, vary widely.

System of Payment of DA:

The practice of payment of Dearness Allowance relates to all the sectors of organizations as has been referred to in the “Minimum Wage Act, 1948”. However, the system of payment of DA varies from industry to industry and even within the same centre of industry. Some link it with an increase in the price and some may follow the flat rate system or graduated rate system for the ease of calculations.

As such, two systems of the payment of DA are mostly used, as below:

i. Linked with Price Index

ii. Not Linked with Price Index.

It is the most commonly used system of payment of DA. In this system, DA automatically increases or decreases with a rise or fall of price index, i.e., the real value of money. The Consumer Price Index is intended to show, over a period of time, the average percentage change of prices of essential commodities or services being consumed by a particular population group.

The average percentage change of the price index is calculated month after month with reference to a datum or a fixed period known as the “Base Period”. The change in the DA is calculated in the points by which the CPI has risen above the base period index.

The Gregory Committee (1944) advocated this system, wherein it was advocated that a fixed amount of DA in terms of rupees should be an absolute amount. Under this system, the management analyzes the impact of the price increase on the real value calculations and after discussing with the union, decides a flat rate or a fixed amount, say, Rs. 20/30/50, etc., to be paid to the workers and staff, irrespective of their pay scales.

The main advantage of this system is that it is very simple and gives greater relief to the workers and staff with an assurance of an additional amount they will get if there is a price increase. However, this has a disadvantage that the employees at different grades and scales have to be satisfied with the same rate to everyone.

This system provides a graduated scale of DA for different grades of employees grouped in a mutually agreed slab. However, in this system also a fixed DA rate is decided for different slabs and a maximum limit is also fixed. This method is the most popular as it satisfies the employees at different slabs and is convenient.

This system also has both a fixed percentage system as well as a variable rate with different percentages for different slabs.

ii. Not Linked with Price Index:

Some of the industries/organizations fix the DA proportion of wage or salary for automatic escalation without following any specific formula related to the CPI. The management, in consultation with the employees’ representatives, takes a decision to increase some percentage for providing relief to the employees and reducing the financial burden on the organization.

DA, as an essential component of compensation, is linked with the CPI and is highly injurious to the financial stability of any organization, as its increase has no correlation with the increase in productivity. The DA increase is to ensure the real value of money to the employees but the employees at the supervisory and executive levels draw much less increase as compared to the employees whom the supervise or manage.

Such disparity does influence the effectiveness or the productivity and is highly dangerous to the organization. Therefore, there is a need of proper schemes for supplementing the payment of DA with a close network of fair price shops.

3. HRA – House Rent Allowance:

It is another component of pay, which takes care of the cost of living and provides extra money to meet the housing accommodation expenses so that the employee can maintain his/her status. This allowance is generally provided to outside employees to manage their stay so that they do not feel a reduction in their compensation or worth or loss of real earning.

However, there is no provision for HRA to the workers under the existing labour laws as the employers generally consider the workers’ quarters in their project cost to ensure the quick availability of the workers at work. But the problem of getting house accommodation is becoming acute. In order to give some relief to the industrial workers, some of the states have made laws to provide for HRA paid by the employers.

In the case of executives, this component plays a vital role to let them maintain their status and get tax relief. This allowance is generally based on the class of city, the standard of life in the region and the capacity of the company to pay to maintain their own image as well as that of their executives.

The fixation of HRA depends on the category of city, the collector’s rate for rents in different areas, proximity to railway station/bus stand, hospitals and schools, etc. Generally the position or level of employee, the ability of the company to pay rental value in a city and income tax criteria help in deciding the percentage for HRA.

The Wage Board or Pay Commission fixes HRA in the government sector, and in the private sector it is fixed by the employers depending upon the wage/salary policy and the capacity to pay.

4. CCA (City Compensatory Allowance):

In the same region, the rental rates may vary according to the ranking of the city such as urban, metro, or class A, B, C etc. To meet the expenses of cost of living, in different grades of the city, the employer includes CCA in the compensation package, which depends upon the grade of city like Class A, Class B, Class C, etc.

Bonus is the most expected component of compensation, especially when an employee stays with the organization for more than a year and expects recognition of his/her continuous efforts throughout the year to let the organization earn and grow. It is also perceived as a reward for continuing services to an organization and the expectations of the employees to share the fruits of their efforts for developing the organization.

Bonus is also regarded as an incentive for regular attendance, an encouragement for good work, an award for excellence, and as an ex-gratia payment, depending upon the goodwill of the employer.

(a) Customary Bonus

(b) Profit based Bonus.

(a) Customary Bonus – This is a commitment of the organization defined in their policy, such as ex-gratia payment, attendance bonus, productivity bonus, etc., which cannot be claimed as a right but depends on the company’s policy and plans. Customary bonus does not require calculation of profit or availability of surplus. It is a payment based on long usage.

(b) Profit based Bonus – This award refers to the payment of the share of profit or extra earning achieved through the efforts of the employees, and the employee has a right to share in the increased profits that are made in a particular period.

The Bonus Act, 1965, however, assumed the payment of bonus as statutory with the enactment of this Act. This Act is intended to enable the employees to share in the prosperity of the establishment to which they contribute.

The bonus under this Act varies from industry to industry and also varies in payment from year to year.

Bonus related to performance are generally termed as:

i. Productivity bonus: extra payment for increasing the productivity

ii. Performance bonus: award for increasing the efficiency or proving oneself different from others

iii. Excellence bonus etc.: a reward for doing something special or innovative.

Some of the industries also offer allowances such as project allowance, shift allowance, washing allowance:

i. Project allowance is offered to the employees sent to implement any project outside the works and to motivate him/her to be away from the family.

ii. Shift allowance is to encourage an employee to work in shifts such as employees of call centres or outsourcing agencies.

iii. Washing allowance helps the employees to maintain neatness and cleanliness without losing their real earnings.

Compensation – Contingent Factors in Compensation Plan

Contingent factors are of two types. These are internal factors and external factors.

Internal Factors:

1. Organizational strategy and attitude

2. Organizational culture

3. Nature and worth of job

4. Capacity to pay

5. Nature of human resource

External Factors:

1. Nature of HR market

2. Cost of living

3. Employee union

4. Legal framework

5. Socio-economic factors

Both factors influence the compensation system in an organization. In fact because of such reasons the compensation system is very strategic in nature. Global competition in human resource market influence the retention of employees within the organisation. From the employer’s perspective, compensation is an issue of both affordability and employee motivation.

Companies must consider what they can reasonably afford to pay their employees and the ramifications of their decisions: will they affect employee turnover and productivity? In addition, some employers and managers believe that pay can influence employee work ethic and behaviour and hence link compensation to performance.

Moreover social, economic, legal, and political forces also exert influence on compensation management, making it a complicated yet important part of managing a business.

More specifically, six primary but interrelated factors can shape a company’s pay structure:

i. Social Customs:

Beginning in the thirteenth century, employees began demanding a “just” wage. This idea evolved into the current notion of a federally mandated minimum wage. Hence, economic forces do not determine wages alone.

ii. Economic Conditions:

Demand for labour influences employee wages. Employers pay wages based on the relative contributions employees make to production goals. In addition, supply and demand for knowledge and skills helps the organization to determine the wages.

iii. Company Factors:

Pay structures depend on the kind of technology a company has and on whether a company uses pay as an incentive to motivate employees to improve job performance and to accept more responsibilities.

iv. Job Requirements:

Some jobs may require greater skills, knowledge, or experience than others and hence fetch a higher pay rate.

v. Employee Knowledge and Skills:

Likewise, employees bring different levels of skills and knowledge to companies and hence they are qualified to work at different levels of a company hierarchy and receive different rates of pay accordingly.

vi. Employee Acceptance:

Employees expect fair pay rates and determine if they receive fair wages by comparing their wages with their co-workers’ and supervisors’ rates of pay. If employees consider their pay rates unfair, they may seek employment elsewhere, put forth little effort in their jobs, or file lawsuits.

Compensation – 2 Important Types: Financial Compensation and Non-Financial Compensation

Type # I. Financial Compensation:

1. Direct Financial Compensation:

Financial compensation means monetary payment made to an employee in exchange for his work. This includes basic pay, bonus, incentives, overtime payment, commission and variable pay.

a. Basic Pay – It is the direct financial compensation an employee gets for the time worked. It takes the form of wage or salary.

b. Incentives – It is a plan that links pay to productivity or profitability. It may be linked to the performance of an individual or a team or the entire organizational level performance. Bonus, profit-sharing plan, variable pay and stock options are examples of incentive plans.

2. Indirect Financial Compensation:

It includes benefits like pensions, insurance, paid holidays. These benefit are available to all employees.

They are employer-provided other than wages, salaries, or incentives. They make up indirect component of a financial compensation plan. These benefits are not performance-based and are awarded to all employees by virtue of their membership in a given organization.

They are of two types:

1. Mandatory and

2. Voluntary

1. Mandatory Benefits:

These benefits are legally binding on an employer to provide to the employees., viz., Provident fund, gratuity scheme, health plan, maternity leave, medical leave, etc., are examples of these benefits.

2. Voluntary Benefits:

These are discretionary and provided by the employer voluntarily. These include compensation for’ time not worked, for example, paid holidays, family-friendly benefits, retirement benefits, etc. Organizations today offer their employees benefits like sabbaticals, Childcare centers, work from home option, job search facility for spouse, health/life/accident insurance, company-sponsored education facility, Free transport, subsidized meals, free concierge services by which employees have their telephone, electricity bills, etc., paid.

Type # II. Non-Financial Compensation:

These are psychological rewards given to employees who entertain a feeling that their skills are recognized. Employees at senior and middle levels who prefer to work on high end technology, desire empowerment. Besides recognition awards and service awards there are also other important non-financial compensations given to employees by contemporary employers.

They are:

1. Awards – Awards include cash, gift certificates, movie tickets, parties and dinner coupons for family members, travel concessions to famous destinations, etc.

2. Recognition awards – Felicitation award for employee of the month and employee of the year given at a colourful event have the potential to motivate the employees for better performance. Individuals who make contribution to society, work beyond the call of duty or whose ideas have impact on business are given suitable awards.

3. Service awards – Employees who have completed a certain number of years become eligible for loyalty award.

4. Appreciation – When an employee performs the job to the full satisfaction of superiors, appreciation of superior in the presence of colleagues is a sure-fire reward for the employees.

5. Challenging task – Assignment of a challenging task to the promising employees has the potential to unlock latent talent in the employees concerned.

6. Deputation for foreign assignment – Selection of best performing employees for training and for important overseas assignment would certainly trigger their motivation and it adds to their value and prestige among their colleagues.

7. Seeking consultation – Consulting key employees on strategic issues and seeking their honest opinion has a tremendous bearing on their morale and positive energy.

8. Participatory opportunity – Employees participation in decision-making, in the form of joint decision-making autonomous workgroup, consultative committees, kaisen management, collective bargaining, quality circles, suggestion committees and so on would indubitably kindle their enthusiasm and impel them to contribute positively towards the goal of the organization.

9. Power delegation and decentralization – Decentralization of power to employees, fixation of accountability, delegation of authority have the power to enable the employees to unleash their otherwise dormant potentials.

10. Conducting of refresher training – Conducting frequent training to freshen up the knowledge skill, competency of employees has the potential to empower the employers and recharge their energies.

11. Provision of congenial work environment – Provision of congenial work environment like separate cubicles, latest electronic communication gadgets, air conditioned rooms, secretarial facilities, comfortable desk & chair, pleasant interior decoration, clean drinking water, relaxation facility, etc., can help the employees in sustaining pleasant mood and creates a mind-set for churning out quality works.

12. Alternate work schedule – Alternate work schedule like past time work, job sharing, flexi time, annulated work hours, work from home, option to work in day shift, etc., go a long way towards sustaining the loyalty of employees.

13. Provision of leadership development career development opportunities – These opportunities are sure to attract and retain challenge-loving employees.

14. Liberal holidays – Providing various type of holidays and sabbatical is one of the powerful motivations for employees.

15. Career counselling and mentoring Facilities – Provision of career counselling and guidance mentoring have power to inspire the contemporary employees to unearth their potential.

16. Conducting events – Conducting various events like founders day independence day, festivals, new year’s day, sports events, literary events, carnival day, etc., ensure a feeling of oneness among the employees.

17. Transparency dealing – Transparent performance appraisal reward system, award system, transfer system, promotion on career advancement practice, etc., help in positive inclination towards the employer.

18. Well-developed communication system – Conduct frequent town hall meetings, barrier free flow of communication, fixation of deadlines, clear-cut rules, well defined policies, processes and strategies, in-house news enlightening the dynamics in the company and in the industry stop spread of rumours, breed a conducible and healthy work environment and help employees stay positive in the facility.

Compensation – Importance of Compensation to Other Fields of Human Resource Management

Compensation is relevant to most other fields of human resource management such as recruitment and selection, training and development, performance appraisal, incentives, industrial and employee relations, promotion and separation and outside intervention in human resource matters.

The importance of compensation in some of these areas is briefly explained below:

1. Recruitment and Selection:

In order to attract potential and competent employees, it is necessary to offer lucrative remuneration to the aspirants. In the era of competition, where companies compete for getting best candidates, this aspect has become all the more relevant. Managements have to take decisions about the appropriateness of the quantum and form of compensation—direct or indirect, short-term or long- term remuneration and also the packages being offered.

2. Training and Development:

Employees will be more willing and responsive to training and development programmes if they are aware that, after the successful completion of training and improvement of their skills, they will receive suitable monetary rewards. When the compensation policy and practices of the organisation assure such enhancement of reward is in somewhat definite terms, they are very likely to be attracted towards such programmes.

It is, however, desirable that the training and development programmes are well designed and are open to all employees without any element of discrimination.

3. Performance Appraisal and Incentives:

Where an objectively designed and clearly understood performance appraisal system is in operation, the employees become aware that they will get pay rises and other rewards based on the extent of their contributions towards improvement of the quantity and quality of products and accomplishing other targets. Similarly, the success of specific incentive schemes depends, in large part, on their clarity and adoption of an acceptable system of sharing the fruits of increased production.

4. Disputes and Grievances:

In many organisations, grievances and disputes often arise on the question of compensation. A study of causes of industrial disputes in India as in many other countries of the world clearly shows that the highest number of industrial disputes leading to work stoppages have taken place on the question of wages and allied matters.

In order to prevent such disputes from arising, it is essential for the management to adopt effective compensation policies and plans which could be acceptable to the union and which are in conformity with governmental policy and prevailing norms. Similarly, grievances often arise on the question of wage relativities worked out on the basis of job evaluation.

As such, management should be careful in designing such a system of job evaluation, which is acceptable to majority of employees in the organisation. In order to ensure transparency in the system, it is often beneficial to associate employees’ representatives in the formulation and implementation of the system.

5. Promotions and Transfers:

Employees expect suitable rise in compensation when they are promoted to higher jobs. In many cases there is rise in jobs, but with meagre or no corresponding enhancement of remuneration. Such a phenomenon generates dissatisfaction amongst the promoted employees. Management should, therefore, try to ensure that payments made to promoted employees are commensurate with the value of the jobs to which they are promoted.

Similarly, when employees are transferred to a more disagreeable environment, they should also be suitably compensated for the inconvenience to which they are put.

6. Industrial Relations:

In many organised establishments, compensation issues are vital in negotiations. In order to ensure the establishment of harmonious industrial relations on a durable basis, it is desirable for the management to take a realistic approach towards compensation issues.

7. Termination of Service:

Employees are interested not only in the compensation packages during the tenure of their service but also in financial gains in the event of superannuation and retirement, or otherwise termination of service resulting from lay-off, retrenchment, closure, disability, dismissal and so on.

Availability of attractive post-retirement benefits in the forms of pension, provident fund and gratuity is conducive to generating greater satisfaction among the employees and strengthening of their commitment towards the organisation. Managements should also give due attention to the payments to be made to the employees affected as a result of lay-off, retrenchment, disability and similar other circumstances. This will enhance the prestige of the organisation and will attract competent workforce for it.

8. Governmental Intervention:

Many areas of compensation have come to be regulated by labour laws, adjudication awards and court decisions. In most cases, these lay down the minimum standards in the field of compensation. Managements are generally free to make payments over and above the minimum either on their own or in agreement with the union.

The importance of compensation to other fields of human resource management has also been emphasized by many scholars. As a matter of fact, compensation matters pervade through a wide range of fields of human resource management in a variety of ways. The nature of its relevance to a particular human resources field, however, varies from organisation to organisation.

Compensation – Theories

Generally theories provide a solid background and a framework for putting the concepts and ideas into practice. A number of sound ideas have been generated by these theories to provide a framework for implementing compensation (wage and salary) system in organizations. These theories will occur from time to time where they find relevance. These theories may be related to Economics, Management, Behavioral Sciences, and other fields. We will not get too deep into Economics since you will come across those theories in Economics courses.

Gerhart and Rynes suggest reasons why some companies pay more than the others and provide a theory, evidence, and strategic implications of these theories. Adam Smith who is identified with Classical Theory argues that market forces would force employers to offer jobs roughly equal overall attractiveness and that any differences in the short-range in attractiveness would disappear in the long-run.

Adam Smith’s Wealth of Nations (the tide was altered at a later stage to this title) published in 1776 is considered to mark the beginning of Classical Economics. This school was active into the middle nineteenth century and was followed by neo-classical economists, who claimed that free markets regulate themselves when free of any interventions. Adam Smith referred to the so-called ‘invisible hand’ which will move market towards their natural equilibrium without any outside interventions.

Several people are associated with Neo Classical Theory and they are inclined to contend that pay levels are always tending towards equality while those who take alternative views tend to say that there are substantial and durable differences in pay for the same type of work carried out across employees, even in the same regions.

Some tend to believe that employers are by and large “wage takers”. They have considerable discretion to act strategically in setting up pay practices. The Neo-Classical theorists contend that there is little room for employers to manage compensation. Goodin states that the employee compensation system plays an important role in efforts to manage human resources better.

Equity theory focuses on the fairness of compensation system. This theory suggests that employee perceptions of their contribution to the organization, and in return what they receive, and how their contribution-return ratio compares to others inside the company and outside the company ‘determine how fair they think their employment relationships to be’. To put it simply, inequity causes employees to take action to get back equity.

There is behavioral element in the theory when Adams says that when employee perceives unfairness or inequities in the employment situation, changes his or her behavior.

If they feel that they have been treated unfairly in comparison with other employees, they will react in one of the following ways:

1. Some will change their output to be equal to their rewards

2. Some will ask for a raiser through request or legal action

3. Some will try to change their own perception of inequality by rationalizing

4. Some decide to quit rather than to try to change the situation.

Representatives of transport Workers Union presented a petition hearing to the Chief Executive online about compensation practices at American Airlines. Due to economic crisis, the employees took a pay cut and made other concessions to the management amounting to more than billion dollars in 2008. While all these things were happening, the top executive received a bonus payment of 2.1 million dollars. There were more than 500,000 e-mail messages sent in protest. It looks that the employees had chosen one of those options.

As per Porter-Lawler Theory states the perceived value of reward is determined by both intrinsic and extrinsic rewards that result in need satisfaction. When a job is completed, the individual receives intrinsic rewards because of performing the task well, and the extrinsic rewards are outside the task, mostly from the environment in which the task is performed.

The Vroom Expectancy Theory emphasizes some complexities of motivation. This theory is based on the premise that felt needs cause human behavior. As per this theory, motivation strength is determined by the value of the result of performing a behavior and the perceived probability that the behavior performed will cause the result to materialize. People tend to perform the behavior that enhances the value of reward in the long-run.

According to Vroom, individuals assign values to the outcomes of each alternative course of action. The assignments of values reflect the individual’s expectations and order of preferences among the alternative courses of action and their outcomes. The expected outcomes, however in some cases are not truly valid. The outcome may give the person greater satisfactions than he or she anticipated, or it may cause him or her harm which he or she failed to anticipate.

The individual is faced with a set of alternative outcomes. These outcomes occur at two levels — the first and the second level. The choice of outcome is based upon how the choice of first level outcome is related to second level outcomes. The preference for a particular outcome is based upon the strength (valence) he or she attaches to that outcome. The performance he or she attaches depends on second level outcome. The perception of this relationship is known as instrumentality.

Expectancy is the probability that a specific action will be followed by a particular first level outcome. A subjective probability ranging from zero to one can be assigned to this. Valence is measured by asking employees to rank important individual goals and instrumentality by using a rating scale that determines the strength of perceived relationship between the first and second level outcomes.

The assignment of values reflects the individual s expectations among the alternative courses of action and their outcomes. The expected outcome, however, may in some cases not be truly valid. The outcome may give the person greater satisfaction than anticipated, or it may cause harm which the individual failed to anticipate. When it comes to needs, this theory recognizes the individual differences and differences in their goals and expectations.

This theory recognizes that preferences and expectations differ among individuals, but it makes no attempt to describe the differences or to categorize individuals in any way. The surer the employees are of their estimates of expectancies and instrumentalities, the more likely it is possible to predict their behavior accurately.

B.F. Skinner’s Theory is known as the Reinforcement theory. According to Skinner, the following are the components of behavior that occurs as a result of rewards for performance enhancement. For example, when performance is high, an employee will get a pay increase.

If employee perceives this relationship, he or she will tend to strive for higher performance because he or she knows that the behavior will be rewarded. The theory assumes that the results or consequences of an individual’s behavior will determine the level of motivation.

There are a number of other theories which will be related to various aspects of human resource management. These theories will be covered in Behavioral science, Economics and other courses. Here, we have just examined the relationship of some of these motivational theories to compensation aspect. McClelland identifies three types of basic needs namely, need for power, need for affiliation and the need for achievement.

The importance of these non-monetary needs should not be over-looked in setting up compensation system in an organization. We have examined the needs and motivation aspect in designing compensation systems in organizations.

Compensation – Main Advantages and Disadvantages to Employer and the Employee

Compensation is beneficial to both the employer and the employee.

A. Advantages:

1. With the Point of View of Employer:

(i) Workers compensation protection narrows an employer’s disability benefit planning for its employees to the areas of accidents or illnesses that are not job related.

(ii) Employees are limited as to the amount of benefits they may recover.

(iii) Workers compensation is the exclusive remedy for on-the-job injuries, therefore employees may not seek further damages through a separate tort suit against the employer.

2. With the Point of View of Employee:

(i) Payments are made to an employee’s spouse or dependent children in the event of death.

(ii) Medical expenses are compensated.

(iii) Prompt payment of claims following an injury.

(iv) Payments are based on the employee’s day-to-day earnings.

(v) Coverage is provided without direct cost to the employee.

B. Disadvantages:

Compensation is disadvantageous to both the employer and the employee.

1. With the Point of View of Employer:

Main disadvantages are as under:

(i) Premiums may be high due to the nature of the employer’s business as the cost of the premiums is based on the accident record of the company;

(ii) An employer is required to file accident reports with the administering state authority, thus increasing its paperwork burden.

(iii) In some cases, time is spent defending against spurious claims.

2. With the Point of View of Employee:

Main disadvantages are given as under:

(i) An employee’s retirement plan benefits may be reduced by the amount of worker’s compensation benefits that he or she receives; and

(ii) The employee is denied the opportunity to seek further damages such as pain and suffering or punitive damages – through a separate tort action against the employer;

(iii) In some states, worker’s compensation benefits may be offset by social security disability benefits.

Compensation – Recent Developments

Integration of compensation criteria into corporate objectives is becoming increasingly important. The organizations are realising the need for a new benchmarking for deciding the reward for the employees with a view to attract, retain, and to motivate the best brains to contribute at the maximum of their capacity.

Therefore, the rewards for an employee must ensure fairness vis-a-vis compensation standards in the industry, a fair deal in comparison to his colleagues and his unique contribution to the company.

To achieve the above purpose the following new methods of compensation are being adopted by various organizations:

1. Increased Emphasis on Merit or Performance Related Pay (PRP):

Under this method the individual’s increase in compensation is solely dependent on his/her performance appraisal or merit rating. This rating not only take into consideration to output on the job but also other indicators such as – quality, flexibility, job behaviour, contribution to team working and ability to achieve the goals.

This method is primarily used for managerial levels, although attempts are being made to introduce it at lower levels also but so far, it has not been very successful.

This method helps –

i. To increase the attractiveness of salaries in order to improve recruitment and retention as it sends the right message in rewarding those whom the organization wants to keep and not those whom organizations would prefer to lose.

ii. To facilitate change in organization culture to encourage desired qualities among employees, like flexibility, dynamism, entrepreneurial spirit, etc.

iii. To weaken trade unions; since the compensation would be performance based rather than through collective bargaining or negotiations with the management. This may also lead to the removal of grievances of the employees as most of the grievances are due to compensation issues and thus a consequential reduction in support for the trade unions.

iv. To increase the role of the line managers, the managers would be required to pay more attention to evaluating the performance of their subordinates and discussing with them the methods to improve their performance.

v. To improve the performance and advancement in their career through development – since the employees will be getting constant feedback on their performance, they would develop desire to improve themselves for better compensation.

2. Flexible Compensation Schemes-Cafeteria Benefits:

The organizations are facing the problem of adjusting the salaries of new comers at all levels in the existing compensation structure as they come from different organizations and enjoying different benefits – both monetary and non-monetary.

Such organizations may use this flexible compensation scheme called Cafeteria Benefits which is recommended, especially for the managerial employees. Under this scheme, the overall price is fixed for each level with a menu of benefits.

Each employee is allowed to pick the benefits within the overall limit. Thus the employees are able to decide which benefits they prefer and how to balance the amount of compensations they are to get.

This scheme also provides enough flexibility to the employees to plan their income tax apart from helping them increase their motivation.

However, this scheme has not been adopted on large scale by companies, as the employees tend to compare the benefits different employees are enjoying and they want all those benefits which any other employee is enjoying without realising that they had exercised their option in favour of other benefits the principle of equity is raised in support of their argument.

3. Harmonisation:

Traditionally, at least two methods of payment of wages and salaries have been in operation -one for blue collared and the other for white collared-or one for workers and the other for supervisory and managerial employees. The workers are paid for their work and the supervisory and managerial employees are paid for not only the work but also for their qualifications, experience and personal characteristics.

This differentiation problems in the organization, in the sense that the employees who are not enjoying the benefits which others are, feel de-motivated and feel divided into two separate classes.

Harmonisation is a process of bringing different conditions of service into some sort of alignment. The purpose is to have a single status for all employees in the organization by having same salary structure.

This could be achieved by –

(i) Gradual elimination of differences between different categories of employees’ conditions of employment, like holidays, working hours, use of punch cards, deductions for late coming, separate canteens,

(ii) Single status, which means all employees are treated equally in all aspects of employment except pay.

(iii) Extending staff status to certain non – staff employees,

(iv) Providing similar fringe benefits including transport, catering, medical care, education facilities for children of all employees, etc.

The advantages of this system are that it seeks to bring in a measure of equity and fair play and contribute to the improvements in employee attitudes and performance apart from simplification of payroll procedures and fringe benefit administration.

4. Decentralisation of Payment Systems:

With the organizations becoming multi-technology, multi-location, multinational, there seems to be increasing interest in the decentralisation of compensation determination with a view to take the local financial performance and labour market conditions into consideration.

The disadvantage of this method in India is that the employees tend to compare and ask for those benefits which could benefit them, irrespective of their location. Although in the Public Sector and the Government Departments, the quantum of allowances vary but by and large the allowances, head-wise, remain the same.

Although, this system is the need of the hour, but it should be introduced very carefully so that it does not cause any dissatisfaction among employees at various locations or units.

5. Contingency Theory:

After going through the different systems, it may be concluded that there is no best way to design a compensation system which would be suitable for the organizations under all conditions. The management must take into account factors such as – the type of product it manufactures, the technology it uses, the characteristics of the labour force available and the market conditions of the labour.

The organizations must keep on designing and inventing newer and innovative schemes and benefits to remain ahead of the competitors, market demands and practices, to attract, the employees to the fold of the organization. The schemes should also encourage employees to go for training in multiple skills, accept redeployment and relocation.

According to Lupton and Bowey, “Essentially a contingency approach” is one in which it is argued that in some industries and in some environment one kind of managerial practice will contribute to some desired objectives, but in other industries and circumstances entirely different results may occur. Therefore, in order to be sure of the outcome of a scheme the manager needs to consider the particular circumstances of his/her firm.

The compensation systems do not operate within a vacuum-remuneration strategies. Both affect, and are affected by all aspects of the employment relationship. Thus, the design of compensation systems should not only be integrated with other human resource management policies but also reflect and perpetuate the overall objectives of the organization.

Moreover, companies must be aware that the differences in individual motives will determine how they, either as individual or on a collective basis, will respond to certain compensation methods.

No single method of compensation could be considered as suitable for all organizations under all conditions; therefore, this approach suggests use of any method which would meet the requirements of the organization at a point of time.

The current approach towards the adoption of schemes as PRP and Profit sharing, harmonisation, decentralisation of pay determination, and the contingency theory do reflect some change in the emphasis on compensation management as a tool to achieve the objectives.

But this is not the end, nor it should be treated as such, rather continuous efforts should be made to come up with innovative ideas so that the present day as well as the problems which are likely to come up in near future, are taken care.

6. Changing Practices in Compensation Management in India:

The present day trend in compensation management has moved from fixed salary grades and fixed allowances to more flexible grades and allowances/reimbursements. The grades are being used these days to indicate the starting or the minimum salary for a particular level, and the allowances are being worked out in ranges so that the varying demands of new employees in terms of emoluments could be met.

In addition, it is being observed that different companies have large number of components for paying to the employees the compensation package. Some of the companies have even system of giving freedom to the employees to determine and work out the distribution of the compensation under different heads themselves.

This has happened as the companies found that different companies were compensating their employees under various heads, and have different structure. It has been observed specially in the case of new companies – for example, provident fund is not payable for first three years, but the employees who are getting this benefit from their previous employer, demand the same from their new employer and are compensated in some other form or under different head.

However, when the employer has to introduce provident fund for its employees as a statutory requirement, they find it difficult to withdraw the amount which was given to the employees in line of provident fund. In case of Orissa Synthetics, this happened and the employees went on strict when the payment being made in lieu of provident fund was withdrawn.

In case of another company, Pasupati Acrylon, the company did not withdraw this amount and paid provident fund contribution, over and above the adjustment which they had made for provident fund contribution of the previous employers of their employees. However, this meant additional cost to the company which they had to pay to prevent the employees from going on strike.

To avoid this confusion and to work proper compensation, most companies have started negotiating with the new employees in terms of cost to the organization. The new organization would ask the new employee to list out all the benefits in terms of cash along with the allowance and salary which he is drawing from his present employer and then negotiate the amount he would like to have for joining the new organization.

This method, although, has been found to be quite systematic but it has been observed that at times employees find it difficult to work out their net take home salary or at times organizations tend to over compensate new employees. The new benefits which it might have given to the new employee may be forced to introduce for all employees subsequently.

Similar has been the situation in case of annual or half-yearly increments. The rate of increments for employees at different levels has been different in different companies. The employees on their joining new organization have been demanding the same rate or better rate of increment.

At times, this meant higher compensation to be fixed in the structured salary grades which it did by giving percentage increase in emoluments to new joinees and adjust the same in their grade. Even increments to the employees now a days are granted on the basis of percentage increase and not on the basis of fixed increments. This system has provided more flexibility in wage/ salary adjustment.

The percentage of increment these days is worked out simply by taking the inflation figure as the base or the starting point and followed by higher rate of percentage. For example, if the inflation figure for the year is 10 percent, then 10 percent increase in salary would be the lowest rate of increment and higher rates could be linked with the performance.

The annual rate of increment had been as high as 35 to 50 percent during the last four five years which has now come down to 15 to 20 percent due to slump in the economy.

Another important trend in compensation management has been to reward employees on their achievements for the organization immediately and not waiting for the annual increment time.

This helps motivating the employees and at the same time allows organizations to save from recurring expenditure due to granting increment in the grade. This practice is being followed not only in the private sector but also in the public sector.

This system followed for this practice is to pay a percentage of the gain to the organization due to the efforts of the employee or to work out the total cost of one graded increment for one year and pay that amount to the employee. This system is worth following in more and more organizations.

Another trend which can be observed is that the organizations have started compensating their employees with goods for use of the employees or sanction them facilities instead of making cash payments. The best example in this case is the facility to the senior executives to travel abroad with family and treat it as official trip for promoting the interest of the organization.

The present day flexibility in the compensation management coupled with increments in terms of percentage could be used for replacing Dearness Allowance as a component of salary the employees could be compensated to the extent of increase in the consumer price index as well as reward for extra hard work put in by the employees. The employees will be able to see the relation between the two – performance and compensation.

The flexibility in the compensation structure has assumed greater relevance for the Indian industry as the multinational companies have entered the Indian economy in a big way and are offering much higher wages for attracting the right employees.

It is being said that the employees who were being compensated in thousands couple of years ago, are being compensated now in lakhs. Therefore, the increase in compensation package could best be taken care by flexible compensation management.

To sum up, we would say that for determining compensation policy, we must lay down the job objectives, determine its worth through job evaluation or wage boards or by setting standards and linking wages with productivity or by using another method, conduct a labour market survey, decide where the company should be positioned compensation management – wise and then fix the price of the jobs keeping in view the economic forces, labour market.

Government policies and the labour laws influence of trade unions, and the capacity of the organization to pay.

It should be flexible and should not be based on old system of grades necessarily but must find newer and innovative ways of compensating employees – ways which would provide enough incentives for the employees to contribute their best for the growth and prosperity of the organization and at the same time would help the employees to improve their standard of living. The changing trends in the work culture all over the world, like flexi – working hours, group incentives, etc., must be taken into account while finalising the wage and salary structure.