The import quotas can have various effects such as price effect, protective or production effect, consumption effect, revenue effect, redistributive effect, terms of trade effect and balance of payments effect. Some of them can be studied under the partial equilibrium analysis while some others under general equilibrium system. However, these effects have been almost exclusively analysed under the partial equilibrium conditions.

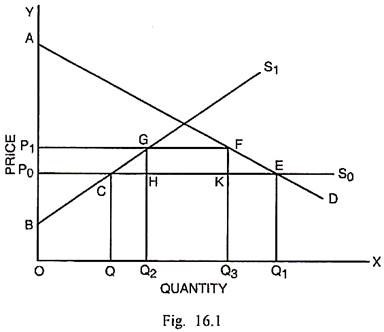

The effects of import quotas can be discussed with the help of Fig. 16.1. In this figure, S0 is the foreign supply curve under free trade and it is perfectly elastic. S1 is the domestic supply curve which slopes positively. D is the demand curve for the given commodity and it slopes negatively. The quantity demanded and supplied of the given commodity is measured along the horizontal scale and price is measured along vertical scale.

In the conditions of free trade, the quantity supplied is OQ and the quantity demanded is OQ1. The excess of demand over supply is met through the import from abroad.

1. Price Effect:

Import quota is the direct physical limitation of the quantity of the given commodity imported from the foreign country. The enforcement of import quota restricts its availability in the home market and creates shortage and consequent rise in its price. Originally, the price of the commodity was Po and the quantity imported amounted to QQ1. The government of the home country fixes the import quota to the extent of Q2Q3.

ADVERTISEMENTS:

The initial total supply in the home market, made up of OQ as the domestic output and QQ1 as the import, amounted to OQ + QQ1 = OQ1. After the enforcement of import quota, the total supply is OQ3 out of which domestic production is OQ2 and import quota is Q2Q3 (OQ3 = OQ2 + Q2Q3). It signifies a shortage of the commodity compared with the original situation. As a consequence, given the supply OQ3 and demand curve D, the price rises from P0 to P1. This rise in the price of the commodity is the price effect of import quota.

2. Protective or Production Effect:

An import quota has a protective effect. As it reduces the imports, the domestic producers are induced to increase the production of import substitutes. The increased domestic production due to import quota is called as the protective or production effect. According to Fig. 16.1, originally the domestic production was OQ. After the import quota is fixed at Q2Q3, the domestic production expands from OQ to OQ2. Thus there is an increase in domestic production by QQ2. This is the protective or production effect.

3. Consumption Effect:

After the import quota is prescribed, there is a rise in the domestic price of the given commodity. As a consequence, the consumption of the commodity gets reduced. This is known as the consumption effect. In Fig. 16.1, the consumption under free trade situation is OQ1. After the fixation of import quota up to Q2Q3, the total consumption at the higher price P1 is reduced to OQ3. Thus there is a reduction in consumption by OQ1 – OQ3 = Q1Q3, subsequent to the fixation of import quota. This is the consumption effect.

4. Revenue Effect:

ADVERTISEMENTS:

Unlike tariff, the revenue effect of import quota is complex and difficult to determine. If the government follows the policy of auctioning the import licenses, the revenue accruing to the government will amount to P0P1 × Q2Q3=GHKF. Such a revenue effect is equivalent to the revenue effect in the event of equivalent tariff. But in fact the governments do not auction the import licenses in recent times.

In such an event, the revenue effect is either captured by the domestic importers or foreign exporters, or shared between the domestic importers and foreign exporters in some proportion. It is, therefore, not easy to quantify exactly what the revenue effect of import quota will be and to which group or groups will it accrue and in which proportion.

5. Redistributive Effect:

The fixation of import quota leads to a rise in the price of the given commodity. It may result in a loss in consumer’s surplus for the importing country. At the same time, higher price and increased production ensures a gain in producer’s surplus. Thus import quota causes redistributive effect in the quota enforcing country. According to Fig. 16.1 after the fixation of import quota, the price rises from P0 to P1 and the loss in consumer’s surplus amounts to P0EFP1.

The gain is producer’s surplus amounts to P0CGP1. If importers are organised, an amount equal to the revenue effect GHKF will accrue to them. Consequently, the net loss to the community will be P0EFP1 – (P0CGP1 + GHKF) = ΔGCH + ΔFKE. If the revenue effect neither accrues to the government nor to the importers, the redistribution effect will involve a large net loss in welfare. In this case, the net loss in welfare will amount to P0EFP1 – P0CGP1 = GCEF.

6. Balance of Payments Effect:

ADVERTISEMENTS:

One of the objectives of enforcing import quota is to reduce the balance of payments deficit by restricting imports. That portion of national income going into imports can be utilised for investment in the import- substitution or export industries. The expansion in exports, coupled with restriction of imports is likely to bring about improvement in the balance of payments position of the country.

According to Fig. 16.1 the quantity imported under free trade conditions at the price P0 is QQ1 and the total value of imports is QCEQ1. In case, the government prescribes the imports quota as Q2Q3, the physical quantity imported has been slashed.

Since price of imported commodity rises to P1, the value of imports is Q2GFQ3. If the government auctions the import licenses, its revenue receipt is GFKH. Alternatively, if the importers are organised, the gain due to higher price in the form of additional profit can be obtained by them. In either of the case, there can be saving of foreign exchange of the size of GFKH and actual payment to foreign country is Q2HKQ3 which is less than the payment QCEQ1 for imports under the free trade. Thus import quota brings about a reduction in the balance of payments deficit.

7. Terms of Trade Effect:

The imposition of import quota can influence the terms of trade of a country in a favourable or unfavourable way depending upon the elasticity of the offer curve or monopolistic and monopoly power of the importing and exporting countries respectively. If the offer curve of importing country is elastic or it has a monopsony power, the terms of trade will become favourable to it.

On the contrary, if the offer curve of exporting country is elastic or it has some monopolistic control on the given commodity, the terms of trade are likely to become favourable for it and unfavourable for the importing country.

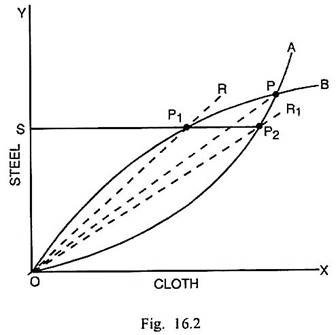

It is possible that the terms of trade effect of import quota may be uncertain and indeterminate. In the words of Kindelberger, “As in the case of bilateral monopoly—with a monopoly buyer and a monopoly seller, the outcome is theoretically indeterminate.” The terms of trade effect of import quota can be explained through Fig. 16.2. Cloth is the exportable commodity and steel is the importable commodity of the quota-imposing home country A. OA is the offer curve of country A and OB is the offer curve of foreign country B.

Originally P is the point of exchange and the terms of trade are measured by the slope of the line OP. If the county A imposes an import quota OS upon the importable commodity steel, the exchange can take place either at P1 or P2. If P1 is the point of exchange, the terms of trade are measured by the slope of the line OR. Since OR is more steep than OP, the terms of trade become favourable to the home country A.

On the opposite, if exchange takes place at P2, the terms of trade are measured by the line OR1 which is less steep than OP. In this case, the terms of trade become unfavourable to the quota-imposing country A. It shows that the terms of trade may be uncertain or indeterminate consequent upon the enforcement of a specified quota upon imports.