In this article we will discuss about the paradox of thrift in an economy.

In the good old days thrift was always regarded as desirable from society’s point of view. And the classical economists assuming that thrift was always a good thing preached the doctrine of saving. In less developed countries like India it is a common argument that in order to achieve a modest level of living the growth rate must be raised.

This, in turn, implies that more should be saved and invested. But more savings may lead to fall in consumption. And under-consumption may lead to a fall in income and savings. So a basic dilemma is encountered. This is known as the ‘paradox of thrift’.

There are two ways of resolving the paradox. First, what is good for an individual may not be good for the economy as a whole? Saving is good from an individual’s point of view. It gives him future security and enables him to consume more in future.

ADVERTISEMENTS:

But if simultaneously each and everybody starts saving more and consuming less, the results may be disastrous. There will occur a fall in aggregate consumption and production. Income will fall due to slackening of investment activity.

The unemployment problem will be aggravated. Poverty will be widespread. And savings will ultimately fall.

As Samuelson argues:

“The attempt of each and every person to increase his savings may result in reduction in actual saving by all the people.”

ADVERTISEMENTS:

Secondly, the level of national income is also important. The question is whether it is at a depressed level. Suppose, there is virtual full employment in the economy and this is maintained for long. Under the circumstances, if more is consumed of the national product, the less will be left for capital formation.

If the economy has reached a point where its output is maximum, thrift would be good from both social and individual points of view. It follows then that at full employment when output cannot be increased with existing facilities and available resources of capital goods and machinery, more thriftiness on the part of the people would mean less consumption, more investment and more income.

This process will not work if there is depression and unemployment. During depression the problem is one of the stimulating effective demand to aggregate employment and income. Now if an individual man’s income, the income of others fall.

So total savings of the community will fall. In times of depression it could make the depression worse and reduce the amount of actual net capital formation in the community. High consumption and high investment are then hand in hand rather than opposed to each other.

ADVERTISEMENTS:

In other words, under conditions of unemployment, any attempt to save more may result in less, not more, saving for the community. Thus consumption and savings (investment) are complimentary under such conditions.

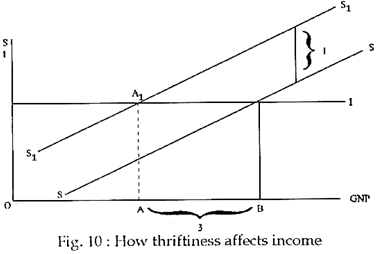

An increase in thriftiness usually raises savings and reduce consumption. It thus causes an upward shift of the saving schedule and a downward shift of the consumption schedule (function)). Consider Fig. 10. Here, the savings schedule shifts from SS to S1S2 and intersects the old investment schedule II at A1 (instead of B1). Consequently national income (measured on the horizontal axis) falls from OB to OA. Why? Because income has to fall — and fall in a multiplier way — until people feel poor enough to again want to save.

Fig. 10 shows that an upward shift in the saving schedule — and, an upward shift in the saving schedule — and, an equivalent downward shift in the consumption schedule — will tend in the absence of any change in the investment schedule to lower the equilibrium level of GNP.

So, in essence, if investment schedule remains unchanged, an upward shift in saving schedule will reduce income. Thus, any attempt to save may not lead to more savings but instead may then simply reduce national income.