The following points highlight the four main forms of agricultural taxes. The forms are: 1. Land Revenue 2. Agricultural Income Tax 3. Other Direct Taxes 4. Indirect Taxes.

Agricultural Taxes: Form # 1. Land Revenue:

It is the oldest of all agricultural taxes and at present it is the most important’ tax on agricultural land. This tax is imposed and collected by the State Govts. In levying, this tax, State Govts, have followed different bases. For example, the land revenue may be on net assets or on the value of the net produce. In some States assessment maybe left to the judgement of the assessing authority.

Time was when its assessment was revised periodically but this has been given up in recent years and such land revenue has become a :crude average tax.

From Rs. 52 crores in 1951-52 the amount collected has increased to Rs. 108.7 crores in 1968-69 to 115.5 crores in 1969-70 and to Rs. 112.7 crores in 1970-71 and to Rs. 124 crores in 1974-75, and to Rs. 200 crores in 1976-77. The importance of the land revenue has greatly fallen in recent years as a result of inflation and also due to the introduction of a flood many new taxes.

Agricultural Taxes: Form # 2. Agricultural Income Tax:

ADVERTISEMENTS:

This tax is imposed and collected by the State Government. Bihar was the first to impose this tax in 1938. At present Assam, Bengal, Bihar, UP., M P., Orissa, Tamil Nadu and Kerala are (the States which have- levied agricultural income tax. The rates of tax have generally been lower than those applicable to urban income tax.

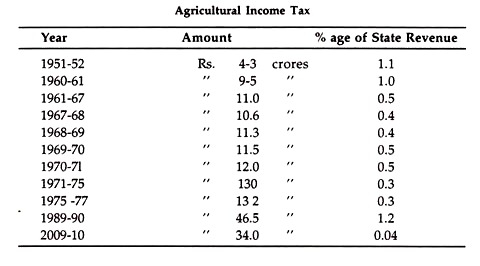

This tax has occupied a minor role in India as can be seen from the following table:

Agricultural Taxes: Form # 3. Other Direct Taxes:

Beside; said taxes, the farmers are also subject to such direct taxes as expenditure tax, gift tax, estate duty and wealth tax. These taxes have not become important in India and may not become so in coming years. Again, as the exemption limit of these taxes are very high, and as the farmers are also given some special exemptions, the amount collected from life farmers cannot be much.

Agricultural Taxes: Form # 4. Indirect Taxes:

ADVERTISEMENTS:

Among the significant indirect taxes which fall on farmers, stamp and registration may be especially mentioned, The receipts from these taxes have been quite handsome. Excise duties are imposed and collected by the Central Govt., but 20% of the net proceeds of the Central excise distributed among States.

The State Govt. also levies certain excise duties on such goods as alcoholic beverages and narcotics. The general sales tax has now become the most important. Import duties, entertainment tax, electricity duties, motor vehicle tax etc. are some of the taxes which fall on farmers to a certain extent. But the problem with the indirect taxes is that they fall on all people and there is no accurate method of dividing their incidence between agricultural and non-agricultural sectors.

Impressed by the “historical role” played by agricultural taxation in Japan, U.S.S.R., China and other countries, Indian Planning Commission and the progressive economists of India have always advocated additional agricultural taxation, from the point of view of equity and raising resources for our 5-year plans.