In this article we will discuss about the demand-supply gap in power in India. After reading this article you will learn about: 1. Subject-Matter of Demand Supply Gap 2. Future Strategy to Reduce the Demand-Supply Gap.

Subject-Matter of Demand Supply Gap:

India is currently facing a peculiar problem of demand-supply gap in power. The power scenario in India continues to be grim even as the country gears up to expand its power supply to bridge the large demand- supply gap.

A nationwide survey has revealed that at the end of 2006-07, the country’s total installed capacity (utilities) was 132.3 GW, which included hydro 34.7 GW, thermal 93.7 GW and nuclear 3.9 GW. The demand-supply gap in power in India has been increasing steadily in recent years.

ADVERTISEMENTS:

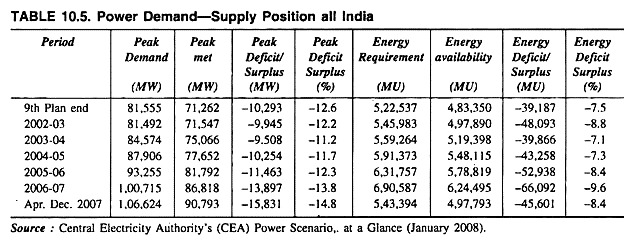

Table 10.5 below clarifies the situation.

Table 10.5 reveals that at the end of Ninth Plan, the peak deficit of power was 10,293 MW and the energy deficit was 39,187 MU. But at the end of 2006-07 the peak deficit increased to 13,897 MW and the energy deficit also increased considerably to 66,092 MU.

In 2007-08 (April to December), the peak demand of power was 1,06,624 MW against peak availability of 90,793 MW resulting a peak deficit of 15,831 MW of power. Similarly, with the energy requirement of 5,43,394 MU against the energy availability of 4,97,793 MU. there is an energy deficit of 45,601 MU of power.

ADVERTISEMENTS:

Thus the deficit in power supply in terms of peak availability and of total energy availability during 2007-08 was 14.8 per cent and 8.4 per cent respectively.

While shortages are being experienced by each region, they are found more acute in North-Eastern and Western region. Thus the country’s power situation is grim despite growth in generation, because demand for power has far outstripped its supply.

The Power Ministry’s annual report for 2006-07 observed that the power supply in the country falls short of the total demand by 13.8 per cent. The peak demand calculated was 1,00,715 MW, whereas 86,818 MW of power has been supplied registering a deficit of 13,897 MW.

To minimise the losses and maximise utilisation of existing capacity and to check theft of power, the Chamber called for devising a proper strategy for strengthening State Electricity Boards (SEBs). The SEBs have not been able to strengthen and modernize their transmission and distribution systems because of inadequate financial allocations during various plan periods.

ADVERTISEMENTS:

This has not only resulted in high transmission and delivery losses of around 22 to 23 per cent but also led to frequent break-downs of transmission and delivery systems and load shedding’s.

Considering this huge shortage of power, arising out of demand-supply gap, the Government has already taken some measures to improve the supply position by undertaking some power projects. At present, as many as 245 new power projects, with a massive installed capacity of 93,661 MW are in the pipeline, from the stage of proposal to execution.

These involve a staggering total investment of Rs 3,39,708 crore. However, there is uncertainty over the gestation period of these projects.

Eight fast track projects are either completed or expected to be completed soon. These are: Jegurupadu (216 MW), Godavari (208 MW) and Vishakhapatnam (1040 MW) in Andhra Pradesh, IB Valley TPS (2 x 210 MW) in Orissa, Mangalore (1000 MW) in Karnataka and Bhadrawati (1072 MW) in Maharashtra and Dabhol (CGT) (740 MW) in Maharashtra.

Thus as against a capacity addition programme of 30,858 MW during the Eighth Plan, the achievement was only around 17,668 MW at the end of the plan.

In 1996-97 as against a requirement of 413,490 million units (MU) the availability of power was around 365,900 MU, leading a shortage of 47,590 MU, which shows a shortage of 11.5 per cent of the total power requirement of the country.

The Working Group on Power for Ninth Plan had recommended a capacity addition of 57,735 MW during the Ninth Plan period to meet the power requirements projected by the 15th Electric Power Survey Committee. But the Planning Commission had proposed a power generation capacity addition of only 40,000 MW during the Ninth Plan (1997-2002).

The Planning Commission decided that the nuclear energy programme and the hydro-electric power programme, which was discontinued in the past few years, was revived during the Ninth Plan. The country has immense hydro potential, particularly in the North-eastern States, which would receive an impetus in the new plan period.

As against the 84,044 MW economically exploitable hydro-electric potential of the country, only 12,655 MW (15.07 per cent) had been developed so far, while another 6,077 MW (7.23 per cent) was under development.

ADVERTISEMENTS:

In the Ninth Plan, achievement in respect of capacity addition to power generation was less than 50 per cent of the target. The capacity addition was only 19,015 MW against the target of 40,245 MW. During the Tenth Plan, the likely achievement is expected to be around 23,250 MW which is 57 per cent of the original target of 41,110 MW.

With this level of capacity addition, there is still considerable demand-supply gap by the Tenth Plan end.

With a view to give a boost to small capacity generation plants with shorter gestation period, the centre has permitted the setting up of Liquid fuel based power Plants which go on stream in three to five year’s time. So far states have proposed to set up 16,000 MW of such capacity.

An action plan has been drawn up to improve the performance of the power sector in a phased manner, involving -short-term, medium term and long-term measures, covering both physical and financial aspects of generation, transmission and distribution of power.

ADVERTISEMENTS:

Short-term measures include Overhaul and Maintenance (O&M) of boilers and optimal operation of regional rids, which will result in substantial improvement in the availability of stations and consequent increases in Plant Load Factor (PLF).

Significant improvements in the PLF of the thermal power stations can be effected through medium term measures like proper maintenance planning. In the long term, the availability factor in older thermal power plants can be improved by appropriate Renovation and Modernisation (R&M) programmes.

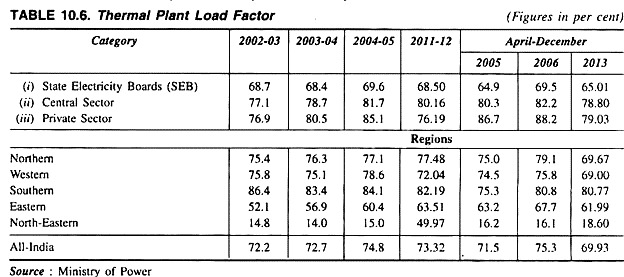

Table 10.6 shows the position in respect of thermal plant load factor (PLF) in India.

ADVERTISEMENTS:

Table 10.6 reveals that in case of thermal power sector, the state, central and private sector plants reported a plant load factor (PLF), a measure of efficiency, of 65.0, 78.8 and 79.03 per cent respectively during 2012- 13 (April-December). The PLF in each of these sector as well as in every region has improved over time.

However, there is a marked variation across the regions. In 2012-13, the PLF of thermal plants was highest 80.77 per cent in Southern region followed by 69.6 per cent in Northern region, 69.0 per cent in Western region, 61.9 in Eastern region and a mere 18.6 per cent in North-Eastern region.

However the all India PLF has recorded an increase from 72.2 per cent in 2002-03 to 73.6 per cent in 2005-06 to 73.3 per cent in 2011-12 and then to 69.93 in 2012-13.

The Power Ministry had taken some steps to improve generation, with emphasis on drawing more out of existing investment. The plant load factor was improved and efforts were made to improve the liquidity of the SEBs, ensure better co-ordination of fuel supply and introduce better managerial practices.

The ministry was also working for better load management by setting up inter regional grids through HVDC and other lines to allow optimal exchange of power and optimisation through the regional electricity boards and load despatch centres. The most crucial issue for the power sector is making the state electricity boards financially viable and improving their operational performance.

One of major reasons for growing shortage of power is the growing volume of transmission and distribution (T&D) losses. The SEBs have continued to suffer from high T & D losses. T & D losses, which stood at 25.0 per cent in 1997-98 have marginally increased to 26.0 per cent in 1998-99.

ADVERTISEMENTS:

These T&D losses are due to a variety of reasons, viz. substantial energy sold at low voltage, the sparsely distributed loads over large rural areas, inadequate investment in distribution systems, improper billing and high pilferage.

During 2006-07 all India energy and peaking shortage were 9.6 per cent and 13.8 per cent respectively, while in 1999-2000 these were 6.2 per cent and 12.4 per cent respectively. Conservation and efficient use of energy has been treated as one of the major thrust areas.

Keeping in view the need to bridge the gap between the demand and availability of various forms of energy. Measures to promote conservation of energy have been taken both on the supply side and the demand side.

Since about 70 per cent of installed generating capacity is in the form of thermal power, number of steps have been taken to increase generation, improve reliability, efficiency and safety as also reduce pollution in these plants.

Special schemes have been devised to renovate/modernize, refurbish old plants to improve their performance. The on-going second phase of this programme covers 44 old power plants. This scheme envisages additional generation of 7864 MU per annum from renovated units.

Plants which are on the verge of retirement are being taken up for extension of their lives by induction of latest technology. A scheme to carry out energy audits is presently, being implemented to save the consumption of fuel oil in power plant.

ADVERTISEMENTS:

On the side of management of demand, there is a tremendous scope for energy conservation in agriculture and industrial sectors. The Government is giving liberal assistance to SEBs, REC and other state agencies to carry out modification in pump sets and motors to improve their efficiency. The industrial sector accounts for about 40 per cent of total energy utilisation.

Efforts are being made to create awareness about energy conservation potential by better house-keeping, proper maintenance and better controls of instruments and adaptation of latest technologies. Efforts are also being made to popularize use of energy efficient lighting devices like Compact Fluorescent Lamps (CFLs), electronic ballasts, etc.

Efforts of National Thermal Power Corporations (NTPC):

The National Thermal Power Corporation Limited (NTPC) was incorporated in November 1975 with the objective of planning, promoting and organising integrated development of thermal power in the country. NTPC is a schedule ‘A’ Navaratna Company with its total approved investment of Rs 59,615.43 crore at the end March 2003. At present, the NTPC has an approved capacity of 31,500 MW.

The authorised capital of the corporation is Rs 10,000 crore. Thus the NTPC, the topmost public sector enterprise of the country has been playing an important role in raising the installed and the generating capacity of power in the country.

NTPC is the third largest power giant in the world and produces 24,000 MW from coal, 5,000 MW from gas, 500 MW of wind power and 2000 MW of hydel power. NTPC will infuse up to Rs 1,000 crore investment for setting up nuclear plants up to at least 2,000 MW.

ADVERTISEMENTS:

Accordingly, two Indian major public sector corporations, Nuclear Power Corporation of India Ltd. (NPCIL) and NTPC signed a Memorandum of Understanding on February 14, 2009 to incorporate a joint venture to set up nuclear power plants.

At present 13 thermal and 7 gas based power projects under NTPC located in various parts of the country, was generating 29,000 MW of power. Thus the NTPC was contributing around 20 per cent of the total power generation in the country and was lighting one-fifth of the nation.

Meanwhile, the company had taken an early lead and initiated steps to utilize the potential of the new policies in seeking growth through setting up of new power projects in joint ventures.

The NTPC had successfully navigated the operating stage with a modest generation of 1,120 million units during 1982-83 and touched a record of 78,383 million units during 1994-95. The NTPC controlled power stations had also been consistently maintaining a very high plant load factor (PLF) which was much higher than the national level.

During 2002-03, the average plant load factor of NTPC’s stations was 75.7 per cent against the national average of 71.1 per cent.

With the vast experience gained in power plant engineering, NTPC’s consultancy division has been spreading its wings as it had started consultancy activities at Dubai, Nepal, Bhutan and Tanzania. The corporation had also emerged as a solid and financially viable institution, displaying enviable track record in financial management since its inception.

ADVERTISEMENTS:

As a result, the World Bank and various other international lending organisation had reposed immense faith in NTPC by extending financial support for its power projects. The company also had so far mobilised Rs 226.35 crore through public depository schemes.

The present generating capacity of all the NTPC power projects shows that as against the total approved capacity of 28,500 MW, the NTPC had already established a generating capacity of 27,404 MW. NTPC Limited is considered as the only PSU to have been ranked amongst top ten companies in India according to a survey conducted by Grow Talent in Partnership with the Great Place to Work, Institute of US and Business World – 2006.

The company has been placed at seventh position among 25 companies listed as Great Places to Work for in the country. Thus, the Third time in succession that NTPC has been ranked amongst the top ten Great Places to Work.

NTPC is India’s largest power generation Company with over 24,000 employees working at various locations spread all over the country. The company has a total installed capacity of 27,404 MW, with its 25 power stations. Presently with 20.18 per cent of the total installed capacity of the country, NTPC contributes around 28.5 per cent of the country’s power generation.

NTPC is now poised to become a 75,000 MW company by 2017.

Future Strategy to Reduce the Demand-Supply Gap:

Thus under such a situation it can be said that better utilisation of existing capacity can greatly reduce the prevailing shortage conditions. The country is facing peak shortage of nearly 20 per cent which is likely to persist in the medium term.

Thus under this regime of shortages, proper grid management becomes vital. Thus there is an urgent need to observe grid discipline by the constituent member of different region in order to facilitate integrated operation of the regional power systems.

To facilitate setting up of large sized thermal and hydel power plant in the country, in order to derive economies of scale, the Ministry of power has suggested consideration of projects having a capacity of 1,000 MW or above and supplying of power to more than one state, as a Mega project.

The Government policy proposes identification of such project sites by the Central Electricity Authority, preparation of Feasibility Reports by NTPC and Power grid to facilitate measures for selection of promoters and finalising of Power Purchase Agreements (PPAs) between promoters and SEBs.

The SEBs and the State Governments have been advised to introduce a more competitive element in the process of selection of developers and award of projects and consider awarding new projects only on the basis of competitive bidding.

Elaborate guidelines have been framed by the Government to speed up privatization of power sector. These guidelines will enable private promoters to take over power plants from State Electricity Boards on long term lease.

The Power Ministry’s idea behind this is to draw investments for modernizing these plants without parting away with the actual title (ownership) of the plant.

The private firms, thus taking over power plants are expected to run them efficiently so that before the expiry of the lease the work ethics as well as technology are adequately reformed to the benefit of the Board.

The State Electricity Boards will also be able to sell uneconomical plants to private parties. The resources, thus, generated by the boards are supposed to be utilised for upgrading of the State-run power plants.

In order to improve the financial condition of SEBs and to make them financially viable, restructuring of tariffs must be done and plant capacity utilisation must be raised.

To make the policy more attractive, the tariff notification has been amended twice, offering an assortment of additional incentives to investors, such as protection up to 16 per cent on foreign equity from foreign exchange fluctuations, clarity on incentives to be earned for performance beyond 68.5 per cent PLF, liberalised rates of depreciation and allowing flexibility in tariff structure subject to certain conditions.

To boost private investment in hydro-electric projects, the Government is reviewing the hydro tariff guidelines and is expected to issue revised guidelines soon. To attract private investment in the renovation, modernisation and updating of old power plants, the Government is working on a package which is expected to be announced shortly.

Government’s Recent Strategy to Reduce the Demand-Supply Gap:

In the meantime, the Government has adopted a three-pronged strategy to reduce the demand-supply gap of power in the country. Firstly, the Government has been trying to improve the productivity of the existing investment in the power sector.

Secondly, the Government was facilitating the restructuring and reform in the SEBs and lastly, the Government is encouraging private participation in the future development programme for the power sector.

Although the country is suffering from a huge demand-supply gap in power but India’s per capita consumption of electricity was only 315 kWh as compared to that of 602 kWh for China, 1,467 kWh in Malaysia and even as high as 15,000 kWh in some other advanced countries. This only reflects the poor power supply position of the country.

Considering the huge power crisis in the country, the Government of India announced a policy on Hydro-Power development during 1998-99, with a view to exploiting the vast hydropower potential available in the country at a faster rate.

Various steps have been taken during subsequent years on the measures envisaged in the policy to provide incentives to hydro power projects, e.g., tariff for hydro projects has teen rationalised, procedures for transfer of techno-economic clearance have been simplified, the ceiling limits for techno-economic clearance by Central Electricity Authority (CEA) for hydro-power projects on MoU route has been enhanced and notified, a mechanism to cover geological risks has been evolved and small hydro projects up to 25 MW capacity have been transferred to the Ministry of Non-Conventional Energy sources.

As against the existing hydel capacity of 2,664 MW under the Central Sector, Government has sanctioned a hydro-electric projects with a capacity of 1,265 MW for commissioning during the Tenth Five Year Plan.

In view of the paucity of resources with Central/State PSUs as well as the SEBs and the need to bridge the gap between the rapidly growing demand for the supply of electricity, the Government has adopted a policy to encourage greater investments by private enterprises in the power sector.

This policy, which has the objective of mobilising additional resources for capacity addition in power generation and distribution had been formulated in 1991, and is currently under implementation.

The policy to invite private participation in the power sector also covers areas of transmission and distribution besides generation. The response to the policy has been encouraging. At the end of 1996-97, interest has been expressed in putting up more than 124 power projects (requiring clearance of the Central Electricity Authority) for a total capacity of 67,281 MW and involving an investment of about Rs 2,46,472 crore.

In addition, there are several projects (MoU/Lol projects) costing up to Rs 100 crore and Projects awarded through competitive bidding and costing up to Rs 1,000 crore) which are being set up by the private sector with the approval of the concerned State Government itself.

Moreover, in order to make the policy more attractive, the tariff notification has been amended twice to offer an assortment of incentives to investors. The Government has revised the hydro tariff guidelines to boost private investment in hydro-electric projects.

To bring about private investment in the renovation, modernisation and upgradation of old power plants, the Government has finalised the policy and the guidelines have been issued.

The Government has also taken steps to encourage captive/co-generation plants by industries. In order to encourage short gestation period projects, the Government has decided to permit setting up of power projects based on heavy fuel oils such as naphtha, heavy petroleum stock (HPS), low sulphur heavy stock (LSHS), heavy furnace oil (HFO), furnace oil (FO) and natural gas, wherever available, as primary fuel.