Fiscal system is concerned with management of government finances, assessment of the financial requirements of the government, modalities of raising revenue and, finally, with the scale and pattern of government expenditure. Fiscal Policy refers to the deliberate use of government budgets in the form of changes in revenue and expenditure to achieve desired macroeconomic goals.

The government budget is an estimate of receipts and expenditure of the government for a financial year. The government budget is presented in the form of current and capital account. The current account records all receipts and payments related to current flow of income and expenditure of the government. The receipts in the current account consists of flow of tax revenue (like income and excise taxes) and non-tax revenue (like income from government departments, dividends from public enterprises).

The current account government expenditure refers to recurring expenditure and related to economic activities that does not lead to the creation of productive or income generating assets. The capital account records all asset-related transactions. Any transaction in the capital account gives rise to either assets or liabilities.

The capital account receipts essentially represent government loans and any transaction in capital account increases the government’s liabilities for loan repayment. The capital account expenditure records all productive or income generating transactions.

ADVERTISEMENTS:

The goals of fiscal policy are often linked to the stage of development of a country. A developing country like India is far behind the industrially advanced economies in terms of productivity, output, employment, investment and efficiency of resource use. The market failure associated with the provision of public goods, externalities, asymmetry of information, monopolistic control over resources and lack of infrastructural facilities prevent resources from being productively employed.

Inequality in the distribution of income and resources generates unhealthy concentration of economic power in a few hands who are capable of diverting resources into rent-seeking activities. Uneven supply of resources and products reinforces the incentives for rent-seeking activities.

In such a milieu, fiscal policy plays a multi-dimensional role with a focus on macroeconomic stability and economic growth. Fiscal policy aims at creating and sustaining the public economy with the provision of public goods and services. At the same time, it is a tool for efficient reallocation of resources, redistribution of income and wealth, promotion of savings, investment and output growth and the maintenance of macroeconomic stability. The key areas of fiscal policy are resource mobilisation and resource utilisation.

Resource mobilisation is concerned with transferring resources from private to government sector. Taxation is the most important means of resource mobilisation. There are also non-tax revenues like dividends from public enterprises, incomes from departmental undertakings. Taxes should be used to mop-up economic surplus and not to curtail socially necessary consumption.

ADVERTISEMENTS:

In a developing economy, taxes are also necessary to finance public investment for social overhead capital. Tax financing of government activities often involves reduction in private savings and investment. In other words, public taxation has an opportunity cost in the form of loss in private savings and investment. Tax policy must be designed to minimise the opportunity cost of raising public revenue. Taxes may distort production and consumption decisions by forcing the economic agents to move away from their optimum decisions.

Raising resources through taxation should aim at minimising tax-induced inefficiency. Resource mobilisation through taxation may also affect income distribution. In a developing economy, promoting distributional equity—or, at least, not worsening the distribution of income—should also be considered while raising taxes.

In developing economies, tax and non-tax revenue are often inadequate to finance the proposed budgetary expenditure of the government. The resultant government deficit or fiscal deficit is to be financed by raising loans. The financing of budgetary expenditure by borrowing is known as deficit financing. The government may take resort to borrowing from the private sector to finance the deficit.

The extent to which government borrowing contributes to economic growth depends on the type of resources transferred and the way the government use the borrowed resources. Under conditions of full utilisation of private savings in the form of private investment, the government borrowing will subtract resources from private investment. If the borrowed resources are fully used to finance public investments, the decline in private investments will be offset by a rise in public investments.

ADVERTISEMENTS:

In a developing country, public investments in Infrastructure and capital goods may help to remove supply bottlenecks and thereby provide incentives to private investments. In this sense, public investments and private investments are complementary. It is often found that the government uses borrowed resources to finance its current expenditure such as salary bill, defence, subsidies. Then, loan financing of government expenditure retards economic growth by curtailing private investments and often generates inflationary price rise by over-heating the demand side of the economy.

Deficit financing was made popular by Keynes during the Great Depression of the 1930s. The deficit financing was advocated to stimulate the aggregate demand for output at a time when output and employment were constrained by demand deficiency. The government spending through borrowing came to be recognised as an important means of transferring idle cash component of private wealth into aggregate demand for output. Thus, fiscal policy became an important tool for stabilisation of output and employment.

The government might also finance the deficit through money creation. The deficit financing through money creation became popular during the Second World War (1939-45) as a method of financing war expenditure. Many Western governments used the newly created money to transfer resources from private to public use by deliberately creating inflation. Then, deficit financing acted as an ‘inflation tax’ to compete away resources from civilian to defence use.

In the post-Second World War period, development economists turned their attention to the use of deficit financing for financing development expenditure in developing countries. In those days, private sector had little capacity to lend funds to the government sector. The deficit financing through money creation became one of the important instruments for financing development expenditure.

Such deficit spending was supposed to aid the process of economic growth in two ways. Firstly, it was believed that deficit spending in sectors characterised by unemployed resources would help to mobilise additional resources for development. Secondly, deficit spending could curtail private consumption and generate ‘forced savings’ by imposing ‘inflation tax’ on the consumers.

But deficit financing through money creation is a risky way of financing development. The price stability in a less developed country depends to a large extent on the stability of agricultural production. The successive years of good harvest may keep the price front stable despite cumulative expansion of money supply through years of deficit financing.

In the event of a harvest failure, food prices not only rise due to shortfall of supply but also due to speculative activities spreading out in an economy flush with money. Moreover, ‘forced savings’ generated through ‘inflation tax’ is bad for incentives and hurts the poor.

Fiscal policy is concerned with resource mobilisation in form of taxes and loans and resource utilisation in the form of government expenditure. The role of fiscal policy in economic development depends on the scale and pattern of government expenditure. A large share of development expenditure in total expenditure is desirable from the perspective of promoting economic development. But more important is the sectoral pattern of development expenditure.

The developing economies are sometimes characterised by simultaneous existence of supply and demand constraints. If the share of development expenditure directed towards the areas of demand constraints can be expanded, the additional demand will generate new production. Inflationary price rise is likely to occur if the expenditure tends to be concentrated in areas of supply shortages.

ADVERTISEMENTS:

Indian fiscal policy in the post-independence period was conducted within the framework of a high level of public investment. But the public sector’s own savings performance had been extremely poor. The public sector investment during the entire planning period failed to generate invisible surplus. In the 1980s, the government had to depend increasingly on borrowed funds also to finance its current expenditure. This led to the excessive growth of public debt. There were several consequences of this growing public debt.

If the government borrows to finance expenditure that yields no return, debt repayment adds to future expenditure without giving revenue to the government. This had been precisely the case with India’s public finances in the 1980s. The debt expansion and the interest payment obligation of the debt further accelerated the growth of current government expenditure. This led to a vicious cycle of growing deficits, rising debt, rising interest payment and further expansion of the deficit.

If interest payment constitute a growing share of government expenditure, the government’s ability to spend for society desirable purposes will be severely constrained. Financing current government expenditure and uneconomical public investment through borrowing crowd out private investment.

This limits the growth of productive capacity on the supply side and the excessive growth of government expenditure overheats the demand side of the economy. The widening gap between domestic demand and domestic supply not only leads to inflationary price rise but also to a growing current account deficit in the balance of payment.

ADVERTISEMENTS:

Moreover, a government which depends too much on loans to finance its activities will have less flexibility of policy to respond to exogenous shocks such as droughts or war. Finally, we have to consider the issue of sustainability of government deficit. If deficits are financed by excessive borrowing, a debt crisis is likely to occur—and this will lead to a high tax regime in future.

If deficits are financed by printing new money and the growth in money supply exceeds the growth in money demand arising out of the growth in real national output, deficit financing will lead to inflation. In the last two decades, a small but influential group of economists advocated the use of fiscal policy to generate supply-side effects on the economy. This approach came to be known as “supply-side economics”.

Two important propositions of the Supply-side Economics are:

(i) A policy of tax-cut will produce large supply-side effects in the form of increase in work- effort and enterprise so that loss of tax revenue on existing income will be more than compensated by the gain in tax revenue arising from the increase in income.

ADVERTISEMENTS:

(ii) A reduction in public expenditure can help the economy in more then one way. It can encourage the unemployed to work and the underemployed to work because of the withdrawal of relief measures for the unemployed. It can encourage private investments by reducing the borrowing requirement of the government from the private sector. It can improve the efficiency of resource use by releasing resources from government managed activities to private sector.

Some of the recent reforms in Indian fiscal policy have been in line with the policy prescriptions of the supply-side economists. The foregoing discussion gives us the perspective and the working structure for understanding fiscal system in India.

Understanding Government Budget:

Fiscal policy is pursued through the annual government budget. Fiscal year begins on April 1. It is not only the Central budget but also the budgets of the State Governments, Union Territories and local bodies which are important to understand the fiscal system in India. The consolidated accounts can be found in the RBI’s Report on Currency and Finance. But to understand the macroeconomic policy framework and its impact on the economy, we shall mainly focus on the Central budget.

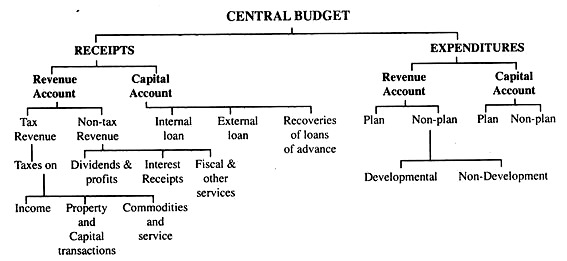

The budget of the Central government summarizes the economic activities of the government in the course of a year. The budgetary activities may be summarised by two set of accounts : Revenue Account and Capital Account. Revenue account records all transactions related to current flow of income and expenditure of the government and not related to the creation of assets and liabilities.

Revenue receipts consist of those items which have no repayment liabilities, such as tax revenue and non-tax revenue. Revenue expenditure is concerned with recurring and non-recurring current expenditure and not related to the creation of productive assets. Capital account records all transactions related to the creation of assets or liabilities. Receipts in the capital account consist largely of internal and external borrowings and, therefore, capital account receipts generate liabilities. Capital account expenditure is geared towards the creation of productive assets.

In a developing country like India, the purpose of capital account budget is not to judge the financial viability of the government by balancing assets against liabilities but to measure the government’s contribution to nation’s capital stock.

ADVERTISEMENTS:

Ideal fiscal management requires financing of revenue expenditure by revenue receipts because the benefits of revenue expenditure mainly accrue to the present generation. Capital expenditure can be loan-financed because returns from capital expenditure in the form of income or social utility can be balanced against loan repayment liabilities. A surplus in the revenue account is treated as public savings and can be used to finance capital expenditure.

Sources of Receipts:

Revenue account receipts consist of taxes on income, property and capital transactions, commodities and services. Non-tax revenue comprise interest receipts including interests paid, by the Railways and Communications, dividends and profits from public sector enterprises, incomes from fiscal and other services.

Capital account receipts are composed of market borrowings, small savings, other capital receipts like provident fund, special deposits of non-government provident funds, external loans and net recoveries of loans and advances from state governments, Union Territories and public sector enterprises.

Components of Expenditure:

The government expenditure in both revenue and capital account can be divided into plan expenditure and non-plan expenditure. Plan expenditure consists of budgetary provisions for the schemes included in the current Five Year Plan. The central plan expenditure and central assistance for plans of the States and Union Territories constitute plan expenditure in the central budget.

The revenue account plan expenditure refers to recurring expenditure associated with development projects initiated in the current plan. The capital account plan expenditure is related to the creation of capital assets for the ongoing development projects. Non-plan expenditure consists of interest payments, defence, subsidies on food, fertilizer, police, pension, social services such as education and health, economic services such as agriculture, industry, power, transport, communications, science and technology.

Apart of the non-plan expenditure is required for the maintenance of the assets and services created in earlier plants. At the beginning of every plan, the maintenance of schemes completed in the previous plan is shifted to the non-plan head. Non-plan expenditure is bound to rise with the execution of more and more Five Year Plans. While plan expenditure is geared towards the creation of new development facilities, a part of the non-plan expenditure is geared towards the maintenance of existing facilities.

ADVERTISEMENTS:

To understand the importance and impact of government expenditure, it is often useful to classify government expenditure into developmental and non-developmental. As Five Year Plans are geared towards economic development, the entire plan expenditure is developmental. Capital expenditure is also developmental as it creates productive assets. Non-developmental expenditures arise in the non-plan component of the revenue account expenditure. The major heads of non-developmental expenditure are administration, defence, subsidies and interest payments.

The various components of the central budget are illustrated in the following diagram:

Different Concepts of Deficit:

Tax revenue is the major source of financing government expenditures. Non-tax revenue also finances a part of the government expenditure. But tax and non-tax revenue are inadequate to finance the entire government expenditures. The government must borrow to finance the amount by which its expenditure exceed its revenue receipts. International institutions regard the entire loan-financed expenditure of the government as the deficit.

Indian budgetary account uses different concept of deficit. The right measure of deficit depends on the purpose for which the measurement is sought. We proceed step by step to explain the concepts of deficit used in Indian budget. Following the practice of dividing the budgetary transaction into revenue and capital accounts, we define revenue balance and capital balance separately. In the next step, concepts of fiscal, primary and budget deficits are introduced.

Revenue Balance = Revenue Receipts – Revenue Expenditure

ADVERTISEMENTS:

(1) A positive revenue balance indicates revenue surplus and a negative revenue balance is a measure of revenue deficit. Stated differently, revenue surplus is a measure of public savings and revenue deficit is a measure of public dis-savings. While public savings can contribute to capital formation, public dis-savings mean a draft on private savings and a corresponding decline in private investments under condition of full utilisation of resources in the absence of external borrowing.

Capital Balance = Capital Receipts – Capital Expenditure

(2) A surplus in the capital account arises when capital receipts exceeds capital expenditure. Because capital receipts—consists mainly of loans—involves future repayment liabilities and capital expenditure generates asset, the capital account surplus can be interpreted as net addition to the government’s liabilities.

(3) When capital expenditure is added to revenue deficit, we get a bigger deficit which has to be met out of capital receipts.

Capital receipts consists of:

(a) Recovery of loans,

ADVERTISEMENTS:

(b) Other receipts (mainly proceeds from public sector disinvestments), and

(c) Borrowings and other liabilities.

While (a) and (b) are non-debt related capital receipts, (c) is a true measure of debt- related capital inflow. Subtracting non-debt related capital inflows from the preceding measure of deficit, we have a measure of the total borrowing requirements of the government from all sources—and this is what we call fiscal deficit. Thus,

Fiscal Deficit = Revenue Deficit + Capital Expenditure – Non-Debt Capital Receipts.

Fiscal deficit is a measure of all loan-financed expenditure of the government. Analytically, government expenditure can be divided into reducible expenditure and non-reducible expenditure. Technically, all items of government expenditure except interest payment is reducible. Interest payment is contractual in nature and, therefore, non-reducible. Subtracting interest payment from fiscal deficit, we have a measure of the avoidable part of fiscal deficit—and this is called primary deficit. Then,

Primary Deficit = Fiscal Deficit – Interest payment

(4) The term ‘budget deficit’ has been widely used in Indian budgetary exercise during roughly the first fifty years after independence.

Budget Deficit = (Revenue Expenditure + Capital Expenditure) – (Revenue Receipts + Capital Receipts)

= (Revenue Expenditure – Revenue Receipts) + Capital Expenditure – Borrowings and other Liabilities – Non-debt Capital Receipts

= [Revenue Deficit + Capital Expenditure – Non-debt Capital Receipts] – Borrowings and other Liabilities

= Fiscal Deficit – Borrowings and other Liabilities

Therefore,

Fiscal Deficit = Budget Deficit + Borrowings and other Liabilities

This shows that the budget deficit understates the true deficit of the government. In other words, the budget deficit is a part of the fiscal or government sector deficit.

The term ‘monetized deficit’ was closely related to the concept of budget deficit. Till the mid-1990s, the budget deficit was financed by short-term borrowings from the RBI. The short- term treasury bills were issued by the Central Government to the RBI. The RBI, in turn, purchased the treasury bills by creating new money.

At the end of the year, the Treasury Bill liabilities were converted into long-term securities held by the RBI. This is how budget deficit was monetised by the net RBI credit to the government. But budget deficit in India was an under-statement of the extent of monetisation caused by budgetary operations because RBI also contributed to the market-borrowings of the government. Thus,

Monetized Deficit = Net increase in the holdings of Treasury Bills of the RBI + RBI’s contribution to the market borrowing of the Central Government.

The net RBI credit to the Central Government in the form of monetisation of a part of the government expenditure increases the stock of high-powered money and, in the process, increases the money supply through the banking system.

The concept of budget deficit has become irrelevant following the abolition of ad hoc Treasury Bills with effect from April 1, 1997. There is still provision for the RBI’s purchase of government securities. This borrowing from the RBI is similar to monetisation of government expenditure. But actual extent of monetisation may be less than the amount of the RBI’s purchases of government securities because the RBI can sell-off the government securities in the open market to mop up the excess liquidity.