Everything you need to know about the money market instruments in India. Money market instruments are liquid with varying degree and can be traded in money market at low cost.

Money market is a market for short-term loan or financial assets. It as a market for the lending and borrowing of short term funds. It does not actually deals with near substitutes for money or near money like trade bills, promissory notes and government papers drawn for a short period not exceeding one year.

These short term instruments can be converted into cash readily without any loss and at low transaction cost. Money market is the centre for dealing mainly in short-term money assets.

It meets the short-term requirements of borrowers and provides liquidity or cash to lenders. It is the place where short-term surplus funds at the disposal of financial institutions and individuals are borrowed by individuals, institutions and also by the Government.

ADVERTISEMENTS:

Some of the money market instruments are:-

1. Commercial Paper 2. Treasury Bills 3. Certificate of Deposit 4. Primary Dealers in Government Securities 5. Repurchase Agreements

6. Banker’s Acceptance 7. Money Market Mutual Funds 8. Participation Certificates 9. Collateralized Borrowing and Lending Obligation (CBLO) 10. Call/Notice/Term Money.

Money Market Instruments in India

Money Market Instruments in India – Commercial Paper, Treasury Bills, Certificate of Deposit and Primary Dealers in Government Securities

Money Market Instrument # 1. Commercial Paper:

CP is a short-term unsecured promissory note issued by well-established corporates with the requisite credit rating. It is issued by well-established joint stock companies to raise working capital. Though CP has been in existence in the US for more than 100 years, it made its appearance in other countries only after 1980.

ADVERTISEMENTS:

In India, CP made its appearance from January 1990, when the RBI issued detailed guidelines for the issue of CPs. The guidelines undergo a lot of changes now and then. Though there is no secondary market for CP, its importance is growing in the Indian money market.

In the developed economies, a substantial portion of working capital requirements especially those that are short- term, is promptly met through floatation of CP. Directly accessing markets by issuing short-term promissory notes, backed by standby or underwriting facilities, enables the corporate to leverage its rating to save on interest costs.

Typically CP is sold at a discount to its face value and is redeemed at face value. Hence, the implicit interest rate is function of the size of discount and the period of maturity.

Features of Commercial Paper:

ADVERTISEMENTS:

The important features of commercial paper (CP) are as follows:

i. Borrower:

Well established companies are the borrowers through issue of CPs. Very often, they are joint stock companies whose shares are listed on a recognized stock exchange.

ii. Lenders:

The buyers of CPs are other joint stock companies, public sector companies and corporations, banks etc. Insurance companies and term-lending institutions invest in long-term securities. Therefore, they seldom invest in CPs. However, non-corporate bodies, non-resident Indians (NRIs) and foreign institutional investors do invest in CPs.

iii. Networth of Issuing Company:

The networth of the company (capital + reserves) should not be less than Rs.4 crore. The working capital limit of the company should also be not less than Rs.4 crore.

iv. Denomination of CPs:

The minimum denomination for a single investor is Rs.25 lakh. Thereafter, it should be in multiples of Rs.5 lakh.

ADVERTISEMENTS:

v. Issue Price:

It is issued at a discount to its face value. The face value is the maturity value. The issue price is less than the face value. The discount rate can be freely decided by the issuing company. The subsequent discount is decided by the secondary market.

vi. Tenure:

CPs are issued for periods ranging between 15 days to 1 year. CPs of 3 months maturity are popular. CPs of 30 days are also gaining popularity.

ADVERTISEMENTS:

vii. Negotiability:

CP is a negotiable instrument. It is freely transferable and payable to bearer. This feature is the added advantage of CP to the investor.

viii. Credit Rating:

Credit rating should be obtained from any of the credit rating agencies like CRISIL, ICRA, CARE or Fitch. The rating should not be less than P2 from CRISIL and A2 from ICRA.

ADVERTISEMENTS:

ix. Format:

CPs can be issued in the form of a promissory note. It can also be issued in the dematerialized form. The demat form is convenient, when a large number of CPs are issued to many investors.

Advantages and Disadvantages of CP:

Advantages:

The CP is becoming popular due to the following advantages:

a. The advantage of commercial paper lies in its simplicity. It involves hardly any documentation between the issuer and investor.

ADVERTISEMENTS:

b. The issuer can issue commercial paper with the maturities tailored to match the cash flow of the company.

c. A well-rated company can diversify its sources of finance from banks to short-term money markets at somewhat cheaper cost.

d. The companies which are able to raise funds through commercial paper become better known in the financial world and are thereby placed in a more favourable positions for raising such long-term capital as they may, from time, require. Thus there is an in-built incentive for companies to remain financially strong.

e. The commercial paper provides investors with returns than they could get from the banking system.

f. Commercial paper facilitates securitization of loans resulting in creation of secondary market for the paper and efficient movement of funds providing cash surplus to cash deficit entities.

Disadvantages:

ADVERTISEMENTS:

The disadvantages of CP are summarized below:

i. Its usage is limited to only blue-chip companies.

ii. Issuance of CP bring down the bank credit limits.

iii. A high degree of control is exercised on issue of CP.

iv. Standby credit may become necessary.

Money Market Instrument # 2. Treasury Bills (TBs):

TB is a money market instrument issued by the central bank on behalf of the government to borrow for the government’s short-term financial needs. By its content, it looks like a short-term promissory note. But, it is regarded as a bill of exchange as it is issued at a discount to its face value. In a promissory note, face value represents the amount borrowed and the repayment will be face value plus the applicable interest.

ADVERTISEMENTS:

In a bill of exchange, the face value represents the value payable in the future. It includes the interest component. As the TB has a face value that is equal to the redemption value, it is similar to a bill of exchange. In other words, the face value represents its maturity value and it is sold at the point of issue at a lesser price.

Features of TB:

The TB has the following features.

i. Borrower:

The borrower is the Central Government. RBI issues the TBs on behalf of the government and honors them on the date of maturity.

ii. Investors:

ADVERTISEMENTS:

Eligible participants to invest are the banks, insurance companies like LIC, GIC etc., NABARD and UTI, corporates and Foreign Institutional Investors (FII).

iii. Tenure:

The tenure is 14 days, 91 days, 182 days or 364 days. The RBI introduced different tenures at different points of time. However, the 91 day TB’s discount rate is the benchmark interest rate for the money market.

iv. Mode of Sale:

The RBI sells the TBs by auction to banks and others. It invites bids for the purchase of TBs. The banks which quote the lowest discount to the face value are sold the TBs.

v. Importance:

The TBs are eligible securities for maintenance of statutory liquidity ratio of banks. In addition, it is also used for the repo operation of the central bank. Corporates also park their funds in TBs because there is no risk of default (issued by the Govt., through RBI).

There is also a high level of liquidity in terms of refinance from Discount and Finance House of India Ltd. (DFHI), and a ready market in National Stock Exchange. The discount rate on 91-day TB is the benchmark interest rate for money market, risk-free interest rate for investment analysis and pricing of futures contract in the derivatives of stock markets.

vi. Mode of Operation:

Banks maintain two types of accounts with the RBI: Current A/c for cash operations and Subsidiary General Ledger A/c (SGL) for securities. While selling securities to banks, RBI debits the Current A/c of the concerned bank and credits its SGL A/c. While buying the securities, the RBI credits the Current A/c of the bank and debits the SGL A/c. Those investors who do not have SGL A/c with the RBI can hold the TBs through Discount and Finance House of India.

vii. Liquidity of Money Market:

The RBI uses the TBs to create additional liquidity in the market or evacuates the unnecessary liquidity. Thus, TBs are very important for the operation and development of money market.

Money Market Instrument # 3. Certificate of Deposit (CD):

CD is a negotiable certificate issued by a bank on the receipt of a large deposit. It is like a fixed deposit receipt issued by the bank on the receipt of a deposit. The ordinary FD receipt is neither negotiable nor transferable. It is only assignable. FD is not subject to restrictions like minimum amount, tenure etc. CD is a negotiable certificate payable to bearer.

CDs appeared in the USA in 1961. In India, the RBI permitted banks to issue CDs from June, 1989. CDs’ are meant for large deposits so that administrative expenses of the bank and the depositor are reduced. CD is a short- term security while the ordinary FD can be of either short-term or long-term security.

Features of CD:

The basic features of CDs are given below:

i. Borrower:

Borrower is any scheduled bank other than RRBs for raising large funds. On receiving the deposit, the banks issue the negotiable receipt which can be transferred or sold in the secondary market.

ii. Investors:

The investors are generally joint stock companies, institutions, high net-worth individuals or any other funds. The purpose is to park the funds generally for a period of three months.

iii. Tenure:

The tenure is usually between three months to one year. The common tenure is three months.

iv. Denomination of CD:

Originally, the minimum denomination was Rs.1 crore and in multiples of Rs.5 lakh thereafter. Later on, it was modified as a minimum denomination of Rs.10 lakh and multiples of Rs.5 lakh thereafter.

v. Negotiable Instrument:

It is a negotiable so that it can be transferred by delivery and endorsement. In many cases, it is payable to the order of the depositor or to the bearer of the instrument. However, there is an initial lock in period of 30 days during which it cannot be transferred.

vi. Issue Price:

The face value of the CD is its maturity value. It is issued at a discount to the face value. The discount is decided by market forces of demand and supply.

Most of the CDs are held by the depositor until maturity. As a result, a secondary market has not developed yet. DFHI has started buying the CDs. To create a secondary market, it should also sell them. However, it is not able to accumulate enough CDs due to the tendency of the depositor to hold it until maturity. As a result, the secondary market has not developed due to lack of adequate supply.

Rate of Interest on CDs:

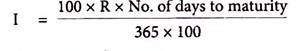

As this instrument is issued at discount, the rate of interest is calculated as rear-end rate on the basis of calculations as follows:

Where,

I = Rate of interest

R = Discounted value

... Issue price of CD = Face value x Discounted value

CDs are time deposits of specific maturity similar in nature to the commonly available fixed deposits (FDs) of the banks with the major difference between the two being that CDs are easily transferable from one party to another, whereas FDs are nontransferable. CDs are unsecured negotiable promissory notes issued by commercial banks and development financial institutions (DFIs) while the commercial bank CDs are issued on discount to face value basis.

The CDs issued by DFIs can be coupon bearing. The discount rates of CDs are market determined. The maturity period ranges from 91 days for the CDs issued by banks, 1 to 3 years for those issued by DFIs. CDs can be issued in multiples of Rs.5 lakhs subject to a minimum investment of Rs.25 lakhs. The primary investors are retail customers and corporate with surplus funds.

Money Market Instrument # 4. Primary Dealers in Government Securities:

The operations in the government securities market have macro-economic implications like rise in inflation resulting from the growth of money supply in the system. This growth is mainly due to monetization of ad hoc borrowing of the government to meet the non-plan expenditure and the budget deficit by the RBI.

This happens because of the development of the issue on the RBI – the reason being the liquidity of the paper. To ease this burden and reduce the growing resistance from the banks to subscribe to the issue, the RBI has introduced the concept of primary dealers. Primarily, the primary dealers have two major roles to play that of an underwriter in the primary market and that of a market maker in the secondary market for the government instruments.

At present, Discount and Finance House of India, Securities Trading Corporation of India, ICICI Securities (I-SEC), SBI Gilts, PNB Gilts and Gilt Securities Trading Corporation are acting as primary dealers for the government instruments. The market for the government securities which was limited to corporate, the RBI and a few other banks will now see the above players in the form of primary dealers.

The intention is basically to phase out the RBI as a player in the primary market. Primary dealers are important intermediaries in the Government securities markets. They act as underwriters in the primary debt markets and as market makers in the secondary debt markets.

Initially, the RBI had also appointed satellite dealers to form the second tier in trading and distribution of government securities. It later cancelled all the licenses issued to satellite dealers.

Objectives for Setting-Up of Primary Dealer System:

Guidelines for primary dealers (PDs) in Government Securities were announced by RBI in March, 1995.

The objectives of setting up the system of primary dealers are:

a. To strengthen the infrastructure in the Government securities market in order to make it vibrant, liquid and broad based.

b. To ensure development of underwriting and market making capabilities for Government securities outside the RBI so that the latter will gradually shed these functions.

c. To improve secondary market trading system, which would contribute to price discovery, enhance liquidity and turnover and encourage voluntary holding of Government securities amongst a wider investor base.

d. To make PDs an effective conduit for conducting open market operations.

Three basic parameters would have to be necessarily fulfilled by an applicant for PD-ship, i.e., the company should have:

(a) Net owned funds of Rs.50 crores,

(b) Sizeable business in government securities, and

(c) Should not be a loss making company.

Facilities Available to Primary Dealers:

The following facilities are extended to primary dealers:

i. Liquidity Support:

Liquidity support is available to primary dealers through the Liquidity Adjustment Facility (LAF). The RBI provides liquidity support to primary dealers against collateral of government securities.

ii. Current and SGL Accounts:

One Current Account and two Subsidiary General Ledger (SGL) Account for government securities are available to the primary dealer. A primary dealer utilizes one SGL Account for its own operations and the second for operations on behalf of its constituents.

iii. Access to Call Market:

Primary dealers are permitted to borrow and lend in the money market including in the call money market and to trade in money market instruments.

iv. Repos and Refinance:

Liquidity support to primary dealers is given through repo operations/refinance with the RBI. Repos are conducted in Central Government securities and in T-Bills up to a limit fixed by the RBI.

v. Fund through Commercial Papers (CPs):

Primary dealers can raise funds through CPs.

Money Market Instruments in India – Treasury Bills, Commercial Bills, Repurchase Agreements, Commercial Papers, Certificate of Deposit, Banker’s Acceptance & MMMFs

Money market instruments are liquid with varying degree and can be traded in money market at low cost. In recent years various instruments such as 182 days treasury bills, certificate of deposits and commercial paper have been introduced. Inter-Bank call money transactions still form the major part of money market. Treasury bill and Certificate of Deposit (CD) are now widely used and use of Commercial Paper (CP) is also picking up.

The other instruments used are money market mutual funds and call money, term money and notice money. Money market instruments take care of the borrowers’ short-term needs and render the required liquidity to the lenders. The varied types of India money market instruments are treasury bills, repurchase agreements, commercial papers, certificate of deposit, and banker’s acceptance.

(i) Treasury Bills (T-Bills):

Treasury bills were first issued by the Indian government in 1917. Treasury bills are short-term financial instruments that are issued by the Central Bank of the country. It is one of the safest money market instruments as it is void of market risks, though the return on investments is not that huge.

Treasury bills are circulated by the primary as well as the secondary markets. The maturity periods for treasury bills are respectively 3-month, 6-month and 1-year. The price with which treasury bills are issued comes separate from that of the face value, and the face value is achieved upon maturity. On maturity, one gets the interest on the buy value as well. To be specific, the buy value is determined by a bidding process, that too in auctions.

The treasury bills have not developed as an active monetary instruments in the market as these bills of 91 days do not provide any yield which is positive. Due to their high liquidity and safety, 182 days treasury bills despite low rates represent the most important instrument of money market and a versatile one in the hands of the effective funds managers of firms, companies and banks.

(ii) Commercial Bills:

Commercial bills are basically negotiable instruments accepted by buyers for goods or services obtained by them on credit. Such bills being bills of exchange can be kept upto the due date and encashed by the seller or may be endorsed to a third party in payment of dues owing to the latter.

(iii) Repurchase Agreements:

Repurchase agreements are also called repos. Repos are short- term loans that buyers and sellers agree upon for selling and repurchasing. Repo transactions are allowed only among RBI-approved securities like state and central government securities, T-bills, PSU bonds, FI bonds and corporate bonds.

Repurchase agreements, on the other hand, are sold off by sellers, held back with a promise to purchase them back at a certain price and that too would happen on a specific date. The same is the procedure with that of the buyer, who purchases the securities and other instruments and promises to sell them back to the seller at the same time.

(iv) Commercial Papers:

The commercial papers refers to unsecured promissory notes issued by creditworthy companies to borrow funds on a short term basis. Commercial papers are usually known as promissory notes which are unsecured and are generally issued by companies and financial institutions, at a discounted rate from their face value. The fixed maturity for commercial papers is 1 to 270 days.

The purposes with which they are issued are – for financing of inventories, accounts receivables, and settling short-term liabilities or loans. The return on commercial papers is always higher than that of T-bills. Companies which have a strong credit rating, usually issue CPs as they are not backed by collateral securities. Corporations issue CPs for raising working capital and they participate in active trade in the secondary market. It was in 1990 that Commercial papers were first issued in the Indian money market.

(v) Certificate of Deposit:

A certificate of deposit is a discount of title to a time deposit. Being a bearer document, certificate of deposit is readily negotiable and attractive both to the banker and to the investor in as much as the banker is not required to encash the deposits prematurely while the investor can sell the same in the secondary market.

A certificate of deposit is a borrowing note for the short-term just similar to that of a promissory note. The bearer of a certificate of deposit receives interest. The maturity date, fixed rate of interest and a fixed value – are the three components of a certificate of deposit. The term is generally between 3 months to 5 years.

The funds cannot be withdrawn instantaneously on demand, but has the facility of being liquidated, if a certain amount of penalty is paid. The risk associated with certificate of deposit is higher and so is the return (compared to T-bills). It was in 1989 that the certificate of deposit was first brought into the Indian money market.

(vi) Banker’s Acceptance:

A banker’s acceptance is also a short-term investment plan that comes from a company or a firm backed by a guarantee from the bank. This guarantee states that the buyer will pay the seller at a future date. One who draws the bill should have a sound credit rating. 90 days is the usual term for these instruments. The term for these instruments can also vary between 30 and 180 days. It is used as time draft to finance imports, exports.

(vii) Money Market Mutual Funds:

In India, the decision to promote MMMFs was announced by RBI while unveiling its credit policy in 1991. These funds invest in short term debt securities in the money market like certificate of deposits, commercial paper, Government trading bills etc. Owing to their large size the fund normally get a higher yield on short term investments than an individual investor.

MMMFs used to be regulated by the RBI and money market schemes of other mutual funds were regulated by SEBI. However, on 7th March, 2000 the RBI withdrew these guidelines and it was notified by SEBI later on that the MMMF schemes like any other mutual funds schemes would exclusively be governed by SEBI (Mutual Funds) Regulations, 1996.

It depends on the economic trends and market situation that RBI takes a step forward to ease out the disparities in the market. Whenever there is a liquidity crunch, the RBI opts either to reduce the Cash Reserve Ratio (CRR) or infuse more money in the economic system. In a recent initiative, for overcoming the liquidity crunch in the Indian money market, the RBI infused more than Rs. 75,000 crore along with reductions in the CRR.

Money Market Instruments in India – Commercial Paper, Certificate of Deposits, Participation Certificates

1. Commercial Paper (C.P):

CP is a short-term instrument of raising funds by a company. Originally C.P. is carved out of the bank Cash Credit limits and there was surety that on maturity, it would be repaid out of bank credit limit. This link was cut off in Oct. 1994, with the result that the C.P. stands on credit worthiness of the company.

The Commercial Paper is a new money market instrument introduced by the RBI. A company with a net worth of more than Rs.10 crores (later reduced to Rs.4 crores) can issue a commercial paper. Its maximum permissible bank finance (MPBF) for working capital requirements should not be less than Rs.25 crores (later reduced to Rs.4 crores). It should have a current ratio of 1.33:1 and a credit rating of excellent (PI) (plus) should be secured from the CRISIL (later relaxed to P2 only).

A company should be listed on one or more of the stock exchanges and can be a FERA company or Indian company. The maturity period should be 3-6 months and the issue should be for a minimum of Rs.1 crore (later reduced to Rs.25 lakhs) and in multiples of Rs.25 lakhs (later reduced to Rs.5 lakhs).

The secondary market transactions may be for an amount of Rs.5 lakhs and multiples. The RBI’s prior permission is required for each issue and the general permission is required for each company to enter this market which was later delegated to the banks. The CP should be raised only for working capital purposes and should be less than 75% of the cash credit limit of bank’s finance to the company. This was made 100% in cases the bank finance limits are more than Rs.20 crores.

In 1996, it was completely delinked from cash credit limits of banks. The banks are authorised to decide on the terms and amount of the C.P. issued by the company. The company will have to bear the expenses of issue, commitment charges, stamp duty, etc. These are not permitted to be underwritten. The NRIs are permitted to invest on a non-repatriation basis.

A company may enter into stand by facilities with the bankers to ensure the meeting of the CP liabilities of the company. The brokers can enter only in the secondary market trading as the issue is not permitted to be underwritten.

2. Certificate of Deposits (C.D.):

Only banks can issue the CDs. It is a document of title to a time deposit. It is a bearer certificate and is negotiable in the market. The minimum CD should be for Rs.1 crore, later lowered to Rs.50 lakhs and in multiples of Rs.25 lakhs, later lowered to Rs.10 lakhs.

It is issued by banks against deposits kept by individuals, companies and institutions and is marketable after 45 days. It can have tenure of 91 days to 1 year. Banks are to observe CRR and SLR rules. These are permitted up to 1% of average aggregate deposits, later raised to 10% of average aggregate deposits. They are issued on discounting basis. No loans and no buy-backs are permitted and no duplicates are to be issued by banks. Banks cannot discount them or negotiate them.

Certificates of Deposits are permitted to be issued during 1991-92 by the All India Financial Institutions like IDBI, ICICI, IFC, etc. The maturity period for them may range from 1 year to 3 years and the RBI may fix an aggregate limit for them. There is no ceiling interest rate on them.

3. Participation Certificates:

As in the case of certificates of deposit, participation certificates are also issued by banks for periods ranging from 3 months to 6 months or upto a maximum period of one year. All these instruments are as per the recommendations of Vaghul Committee Report on Money Market for the development of Money Market Instruments for participating in the advances by a bank in need of funds by other lender banks and FIs.

Two types of such certificates are being developed:

1. 91 day p.cs involving no transfer of the underlying asset risk to the borrower but subject to a ceiling rate of 12.5%.

2. 91 to 180 days p.cs bearing full risk on the underlying asset but not requiring statutory reserves unlike in the above case and subject to a floor rate of 14% (ceiling rates on all were removed in 1994).

The first one is unsecured debt, but securitised for the purpose of negotiation and development of Secondary Market. The second one which may extend upto one year is more risky and carry a higher return.

Money Market Instruments in India – Certificates of Deposits, Commercial Paper, Treasury Bills, CBLO, Repurchase Agreements, Call/Notice/Term Money & Commercial Bills

The Money Market Instruments have a maturity period of less than one year.

The main money market instruments are as follows:

Instrument # 1. Certificates of Deposits:

Certificate of Deposits (CDs) are negotiable money market instruments and are also known as Negotiable Certificate of Deposits. They are issued in dematerialized form by commercial banks and financial institutions at discount to face value for a specified time period. They are like bank term deposits accounts.

CDs are issued in the form of Usance Promissory Note (UPN) by financial institutions and the titles are easily transferable by endorsement and delivery. CDs were introduced in 1989 by Reserve Bank of India with a maturity of not less than 7 days and maximum up to a year. Scheduled banks can issue CDs for a period ranging from 1 year to 3 years.

The issuance of CDs in India is governed by the Indian Negotiable Instruments Act, 1881. The issue of CDs attracts payment of stamp duty under the Indian Stamp Act, 1899. There is no lock in period for CDs. They are generally issued to individuals, corporations, trusts, funds and associations.

They are issued at a discount rate to the face value, determined by the investors. For the repayment of CDs no grace period is provided. However if there is a holiday on the date of maturity, the payment is to be made by the issuing bank on the immediate preceding working day. Buy- Back of CDs is also allowed.

Instrument # 2. Commercial Paper:

Commercial Paper (CP) is a short-term borrowing by corporate, financial institutions, primary dealers from the money market. It is an unsecured instrument issued in the physical form (Usance Promissory Note) or demats form. It was initiated by RBI in 1990. It enables the corporate borrowers to meet the need for short term borrowings at competitive rates through the market. CP issued in physical form is freely transferable by endorsement and delivery.

The credit rating companies in India like Credit Rating Information Services of India Ltd (CRISIL), the Investment Information and Credit Rating Agency of India limited (ICRA), Credit analysis and research Ltd. (CARE) or the FITCH Rating India private limited provide ratings to the participants for issuing commercial paper. CP is issued as per the guidelines of RBI and with minimum denomination of Rs.5 lakhs and its multiples thereof. The rate of interest on CP is related to the yield on the one year government bond.

CP can be issued by the high rated corporate (corporate borrowers, primary dealers, satellite dealers and all-India financial institutions) whose tangible net worth is more than Rs.4 crore. The investment in CP is as per the limits set by Securities and Exchange Board of India and can be bought by individuals, banking companies, other corporate bodies registered or incorporated in India and unincorporated bodies, Non-Resident Indians (NRIs) and Foreign Institutional Investors (FIIs).

There is no security requirement against investments in CP, thus it is a very risky instrument. The maturity period of issue ranges between 7 days to one year from the date of issue.

Instrument # 3. Treasury Bills (T-Bills):

A treasury bill is also called as T-Bills. The Government of India issues T-Bills to meet the requirement for short term borrowing. The treasury bills are issued at a discount-to-face value and their maturity period ranges between 14 to 364 days. The longer the maturity period for T-bills, the higher the interest rate on them the investor can earn.

T-Bills can be purchased by banks, primary dealers, State Governments, provident funds, financial institutions, insurance companies, NBFCs, FIIs (as per prescribed norms), and NRIs as an investor through the secondary market where it has been previously issued.

Presently in India the Government has issued the following types of treasury bills through auctions like 91-day, 182-day and 364-day. T-Bills can also be purchased at an auction where price is fixed through a competitive bidding process generally at a discount and redeemed at par. For example: An investor buys T-Bills of Rs.100 face value at a discount for Rs.90. But at the time of maturity of T-Bills, it is redeemed at Rs.100. Thus investor gains t 10 on the T-bills investments as an interest.

The State Government does not have an option to issue any treasury bills. The minimum amount for which treasury bills are available in market is Rs.25,000. The investments can be in the multiple of Rs.25,000 only. The issue price and the discount are to be calculated at each auction. The 91 -day T-bills are auctioned by RBI weekly, whereas the Central Government auctions the 182-day T-bills and 364-days T-bills on a fortnightly basis.

Instrument # 4. CBLO (Collateralized Borrowing and Lending Obligation):

A CBLO is one of the money market instruments available in electronic book entry form. It represents an obligation between borrower and lenders as per the terms of the loans. The maturity period ranges from one day to ninety days. As per RBI guidelines this can also be extended up to one year.

They are approved and developed by RBI and Clearing Corporation of India (CCIL) in 2003. It is an online trading system where major participants in the lender side are mutual funds and insurance companies. In case of borrowers the major participants are nationalized banks, primary dealers and non-financial companies.

In CBLO, the borrower has the obligation to repay the money borrowed at a predetermined future date. The lender has an authority to receive money lent at the predetermined future date. There is a charge on security held by CCIL.

By providing a dealing system, CCIL has an authority to enable participants to borrow and lend funds.

The dealing systems available are:

1. Indian Financial Network (INFINET) – This is a closed group formed by the members of the Negotiated Dealing System (NDS), who generally have an account with RBI.

2. Internet gateway – This enables the dealing system for those entities which do not maintain a Current account with RBI.

Entities like banks, financial institutions, primary dealers, mutual funds and co-operative banks who are members of NDS can participate in CBLO transactions. The Non-NDS members like corporates, co-operative banks, NBFCs, Pension/Provident Funds, Trusts, etc. can, however, participate only by obtaining the Associate Membership to the CBLO Segment.

Instrument # 5. Repos or Repurchase Agreements:

Repos are also known as repurchase agreement. It is a short term borrowing where one party who sells the security agrees to repurchase it in future. The securities for Repo transaction are government approved securities like treasury Bills, and Central/State Government securities.

Repo (repurchase agreement) instruments enable collateralized short- term borrowing through the selling of debt instruments. For the seller the transaction is a repo as he agrees to repurchase it at a specified date and rate. Whereas for the buyer it is a reverse repo as he agrees to buy the security now and sells it in future.

The seller agrees to buyback the securities at a rate which includes the interest charged by the buyer for allowing purchasing securities from the seller. The seller requires funds so he repurchases the securities by paying interest to the buyer.

Instrument # 6. Call/Notice/Term Money:

Call money is an important constituent of Indian Money Market. It is a market where money is borrowed or lent on demand and has a maturity ranging between one day and two weeks. It is also known as Inter-bank call money market. The main purpose of Call/Notice market is to facilitate the commercial banks to bridge the gaps of shortfall of funds, to meet the sudden requirement of funds out of large outflows, and to fulfill the stipulated requirements of RBI such as the Cash Reserve Ratio (CRR) and the Statutory Liquidity Requirements (SLR).

The difference among call money, notice money and term money is in terms of the period of maturity of the borrowed money. Call money is defined as the money borrowed or lent for a single day and repaid on the next working day. There is an exception of holiday or Sunday in this case as the transaction is only for overnight basis. Notice money is defined as the money borrowed or lent for a period ranging between two to fourteen days. There is no collateral security required in these types of requirements as they are of short term nature.

If the funds are transacted for more than 14 days then it is called as “Term Money”. RBI fixes the prudential limits for transaction in Call/Notice Market which keeps on changing from time to time. Scheduled Commercial Banks, Co-operative banks and Primary dealers are the borrowers in call/notice market. The non-banking financial institutions are not permitted to transact in the call/notice market since 2005. Important lenders in the call/notice market are commercial banks, cooperative banks and primary dealers.

Features of Call Market:

1. There is no collateral required in call market and loans are made available on clean basis.

2. The call money market facilitates the redistribution of surplus day to day funds among banks by curbing temporary deficit of funds.

3. The call market enables facilitates banks to economize their cash.

4. Call money market is a very competitive and sensitive market.

5. Call money helps to improve the liquidity position of banks and other financial institutions.

Instrument # 7. Commercial Bills:

Commercial bills facilitate short term liquidity to banks in need of funds. This Money market instrument is an important method of providing credit to customers by banks by discounting commercial bills at prescribed discount rates. The bill market scheme was introduced by RBI in 1952 and later a new scheme called bills rediscounting was introduced in 1970.

The bills drawn and accepted between the buyer and seller are called trade bills. When these bills are accepted by the commercial banks, they are called commercial bills. The commercial bill can be rediscounted in the commercial bill rediscount market. It helps the commercial banks to get money before the maturity date. According to RBI, only those commercial bills whose maturity period is not more than 90 days from date of rediscounting and which have been created out of a commercial transaction of sale of goods can be rediscounted.

Money Market Instruments in India – With Features

1. Treasury Bill:

A treasury bill is a promissory note issued by Reserve Bank of India on behalf of the Central Government of India to raise funds to meet the short term financial requirements.

Main features of a treasury bill are:

(i) They are the financial instruments issued by Reserve Bank of India on behalf of the Central Government of India.

(ii) They are the financial instruments with maturity period of less than one year.

(iii) They meet the short term financial requirements.

(iv) They are highly liquid financial instruments with assured yield and negligible risk of default.

(v) They are issued as promissory notes for a period of 14 to 364 days.

(vi) They are also called as Zero Coupon Bonds.

(vii) They are issued at a price less than their par value and are redeemed at par value. The difference between the par value and the issued value is discount on issue and is treated as interest on investment.

(viii) They are issued in multiples of Rs.25,000.

Example:

Rahul wishes to invest in Treasury bill. He is informed that he must invest at least Rs.20,000 to purchase one Treasury bill and will receive Rs.25,000 after 95 days. This means the par value of a treasury bill is Rs.25,000, issue price is Rs.20,000 and maturity period is 95 days. The extra Rs.5,000 received by Rahul at maturity is the interest or discount he has earned on the investment done. If he wishes to buy five bills then he needs to invest Rs.1,00,000 and will receive Rs.1,25,000 at the time of maturity.

2. Commercial Paper:

A Commercial Paper is a short term unsecured promissory note which is negotiable and transferable by endorsement and delivery with a fixed maturity period.

Main features of a commercial paper are:

(i) They are issued by large and creditworthy companies.

(ii) They are issued as a promissory note with maturity period of 15 to 364 days.

(iii) They are issued at interest rates lower than market.

(iv) They are issued to raise finance to meet working capital, seasonal capital or as bridge financing.

(v) They are issued at discount and redeemed at par. The difference is considered as interest earned on money invested.

3. Call Money:

Call Money is the short term finance raised by commercial banks as inter-bank transactions with an aim to maintain the cash reserve ratio.

Main features of call money are:

(i) They are issued with maturity period of 1 to 15 days and are repayable on demand.

(ii) Commercial banks borrow or lend cash to each other to maintain the cash reserve ratio. The banks having excess cash may lend and banks having shortage may borrow.

(iii) Interest rate paid on Call Money is called as call rate. The call rate is highly volatile and fluctuates on daily basis and at times even on hourly basis.

4. Certificate of Deposit:

Certificates of Deposit (CD) are the short term unsecured, negotiable and bearer form instruments issued by commercial banks and development financial institutions to individuals, corporations and companies.

Main features of certificate of deposit are:

(i) They are issued with maturity period of 91 to 364 days.

(ii) They are negotiable instruments payable to the bearer of the instrument.

(iii) They are issued usually when the deposit growth is slow and credit demand is high.

(iv) They mobilize large amount of money to meet short term requirements during tight liquidity.

5. Commercial Bill:

Commercial Bill is a short-term, negotiable, self-liquidating bill of exchange or trade bill accepted by a commercial bank for the purpose of discounting.

Main features of commercial bills are:

(i) They are issued by business firms to its buyers against goods sold on credit.

(ii) These instruments are issued to finance credit sales of firms.

(iii) They are issued to meet the working capital requirements of business firms.

(iv) The trade bills can be discounted with a bank before the maturity of the bill.