The below mentioned article provides a quick note on the Public Debt of Central Government of India.

In the post-independence period, the Central Government has been raising a good amount of public debt regularly in order to mobilise a huge amount of resources for meeting its developmental expenditure. Total public debt of the Central Government includes internal debt and external debt.

The Government raises public debt from the open market by issuing bonds and 15 years annuity certificates. The Government also borrows for a temporary period from RBI (treasury bills issued by RBI) and also from commercial banks.

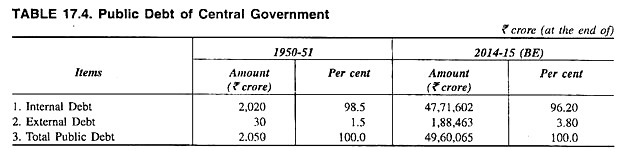

Moreover, the Central Government is also borrowing from international financing agencies for financing various developmental projects. These agencies include World Bank, IMF, IDA etc. Table 17.4 shows the position of public debt since 1950-51.

Thus the Table 17.4 reveals that volume of outstanding public debt rose significantly from Rs 2,050 crore in 1950-51 to Rs 49,60,065 crore in 2014-2015. Moreover the share of internal debt in India’s total debt declined from 98.5 per cent in 1950-51 to 96.20 per cent in 2014-2015 and thus the share of external debt increased from 1.5 per cent to 3.80 per cent during the same period.

Major portion of India’s external debt is contributed by USA. As the volume of public debt has increased considerably thus the expenditure on interest payment reached a serious proportion, i.e., Rs 4,27,011 crore in 2014-15.