Disinvestment and Privatisation of Public Sector Enterprises in India!

Meaning of Disinvestment:

An important aspect of present industrial policy of the Government is that it should not operate commercial enterprises.

With that end in view the Government has decided to disinvest the public enterprises. The Government can sell its enterprises completely to the private sector or disinvest a part of its equity capital held by it to the private sector companies or in the open market.

Distinction may be drawn between disinvestment and privatisation. Strictly speaking, disinvestment means the dilution of stake of the Government in a public enterprise. This can be done in two ways. When the Government sells a part of its equity of a public enterprise less than 50 per cent of its total stock, it is called merely disinvestment and in this case control and management of the business enterprise remains in the hands of Government.

ADVERTISEMENTS:

On the other hand, when disinvestment or sale of its equity capital by the Government exceeds 50 per cent so that the majority ownership and therefore control and management of the enterprise is transferred to private enterprise, it results in privatisation. Therefore, in many disinvestment programmes government retains 51 per cent or more of the total equity capital of the public enterprises so that control and management remains in its hands.

Through disinvestment or privatisation, the Government can mop up a good amount of resources which can be used for various purposes. The released resources can be used to restructure and strengthen the public sector enterprises which are potentially viable. These resources can also be used to pay back a part of public debt. These resources can also be used to finance budget deficits.

Case for Public Sector Disinvestment:

What are the reasons for the policy of public sector disinvestment or privatisation? First, resources available with the Government are scarce. The Government needs resources to reduce its budget deficit. Second, the Government urgently requires resources to make investment in infrastructure, social sectors such as education, public health and for poverty alleviation programmes. Resources released through disinvestment can be used for investment in these crucial sectors.

Thirdly, a good number of existing public enterprises are working inefficiently and incurring huge losses. Disinvestment can lead to the improvement of efficiency of these enterprises. When government divests a good part of its stake to a private enterprise or public at large, it increase accountability of management of an enterprise which have a beneficial effect on the efficient working of the enterprise. “The shareholders would require to be compensated and this will, in turn, compelling the enterprise to run more efficiently and earn more profits”.

ADVERTISEMENTS:

Thus, Dr. C. Rangarajan is of the view that, “There is a compelling need to expand the activities of the state in areas such as education, health and medicine. It is therefore legitimate that a part of the additional resources needed for supporting these activities come out of the sale of shares of public enterprises built up earlier by the Government out of its resources.”

Another important use of disinvestment of public enterprises is the resources raised from them can be used to pay off past debts of the Government and thereby reducing the interest burden of the Government. The proposal of the use of proceeds from disinvestment for retiring a part public debt has been put forward by several economists.

However, in our opinion, it does not make much difference if the resources raised from disinvestment of public enterprises are used as receipts to be spent on education, health and employment generation schemes or used for retiring a part of the past public debt. In the former case of disinvestment receipts being used for making worthwhile expenditure will result in a lower borrowing by the Government, that is, less increment in public debt.

Disinvestment, especially privatisation of public sector enterprises, will ensure that the working of these enterprises will be governed by professional managers guided by market mechanism instead of being administered by bureaucrats.

ADVERTISEMENTS:

Functioning of these enterprises in the competitive environment of free markets will lead to higher efficiency and productivity. Privatisation will also lead to the closing down of unviable and sick public sector enterprises. A private company which buys such sick public sector units will benefit only from the real estate and assets of the sick public sector units.

Privatisation of public enterprises through public sector disinvestment is also beneficial because this will enable these enterprises to attract private foreign investment in setting up joint ventures. It may be noted that capital inflow through private direct foreign investment is better than that procured through foreign aid or commercial borrowing from abroad.

In support of privatisation of public enterprises it is also argued that it will end state monopolies in certain industries. State monopoly is said to be as bad and undesirable as private monopolies. The privatisation of some monopolistic public enterprises would infuse competition which will lead to increase in efficiency and productivity. As a result of privatisation underutilized capacity will be fully utilised.

Arguments against Disinvestment and Privatisation:

Privatisation has also been opposed by some who say that dismantling of public sector which has been built at a very heavy cost to the society would do no good.

The following arguments are given against privatisation, that is, disinvestment of public sector enterprises:

1. Disinvestment of public enterprises is criticised by left-oriented economists on the ground that it amounts to selling ‘family silver’. This in our view is not a valid criticism. This is because original investment on these public enterprises was made by the Government out of its revenue and capital receipts in the past. If some part of these public enterprises are sold and the resources so released are spent on certain beneficial schemes of promotions of education and health or reduction of poverty and unemployment, it cannot be called an undesirable act.

2. Second, it is pointed out that privatisation of some public enterprises would, in the absence of anti-trust law, lead to the emergence of private monopolies under which resources are misallocated. As a result, consumer welfare will be reduced. Besides, adoption of monopolistic practices will lead to higher prices and lower levels of output and employment.

3. It is argued that mere change of ownership, from public to private, does not ensure higher efficiency and productivity of industrial enterprises. In the modern corporate form of business organisation, management has been separated from ownership. In case of both public and private enterprises professional managers can be employed to manage the industrial enterprises to ensure efficiency in working. Thus, it is argued that for professionalization of management, privatisation of public enterprises is not needed.

4. The disinvestment of public enterprises is also opposed on the ground that it will lead to the concentration of economic power in a few private hands. This economic power can be used to exploit the consumers on the one hand and workers on the other. Further, greater concentration of economic power in private hands will also lead to increase in inequalities of income and wealth. Thus, disinvestment and privatisation is a negation of the objective of promoting equality.

ADVERTISEMENTS:

5. An important argument against privatisation is that it will lead to retrenchment of workers who will be deprived of the means of their livelihood. Further, private sector, governed as they are by profit motive, has a tendency to use capital-intensive techniques in production. This will not lead to generation of many employment opportunities. As a result, unemployment problem in India will worsen.

6. Disinvestment is also opposed on the ground that it is no solution for loss-making sick public sector undertakings. In fact, it is pointed out that about 50 per cent of loss-making public enterprises, especially in the field of textiles, are those sick units which were taken over by the Government from the private sector to protect the jobs and interests of the workers.

7. Last but not the least, it is argued that public enterprises should not be privatized because, though they may not be yielding enough profits, they are socially profitable and have made important contribution to build up a strong base for industrial development of the country. But for the growth of public enterprises in the industries such as machine making, heavy chemicals, fertilizers, steel and power, and communication, these industries would not have been developed as has been actually the case.

In the absence of this strong base, rapid industrial development would not have been possible. If they are privatized, the private sector would encase the benefits from the basic heavy industries for whose development heavy social costs have been incurred. Further, many public enterprises come under public utilities which must be run in public interest and not on the basis of maximising private profits.

Conclusion:

ADVERTISEMENTS:

Now, whatever the reasons for and against privatisation of public enterprises, the need for resources by the Government are very large and therefore it has been decided by the Government to go in for disinvestment of the public sector enterprises. The Government claims that Monopolistic and Restrictive Trade Practices Commission (MRTPC) will check the monopolistic practices, if any, adopted by private enterprises.

Further, the Government claims that while making strategic sale to a buyer, interests of the workers will be protected. If a private enterprise after buying the equity capital controls and manages the enterprise, it will be permitted to reduce manpower employed only if VRS (Voluntary Retirement Scheme) is introduced and golden hand-shake is provided to the workers whose services are not required.

Disinvestment Process and Valuation:

Disinvestment of public enterprises can be made in a number of ways:

1. The entire public enterprise can be sold to a private sector firm which is the highest bidder or otherwise. In this case both the ownership and control or management is transferred to the private firm. This happened when ‘Modem Food’, a public company, was sold to Hindustan Lever and Centaur Hotel in Bombay was sold to a private company.

ADVERTISEMENTS:

2. The second way in which disinvestment in a public enterprise can be made is selling a part of the Government stake to a strategic private company. A strategic company is one which has a strategic interest in the public enterprise and has a capability to run it efficiently. The strategic buyer can be chosen by inviting tenders from the private companies.

3. Thirdly, the Government can offer for sale its shares of a public enterprise to the general public through the stock-market intermediaries.

4. Finally, sale of a certain number of Government shares in a public enterprise can be made through auction of shares among a selected number of private firms. The reserve price of shares of a company for auction can be determined with the help of merchant bankers.

Accordingly, as a part of the economic reforms policy, the Government has started reforms in public sector enterprises.

The main elements of Government policy towards Public Sector Enterprises (PSU) are:

ADVERTISEMENTS:

1. Disinvestment of Government equity in all non-strategic Public Sector Undertakings (PSU) to 26 per cent or lower if necessary.

2. Those public sector enterprises which are potentially viable have to be restructured and revived.

3. Those Public Sector Undertakings (PSU) which cannot be revived would be closed down.

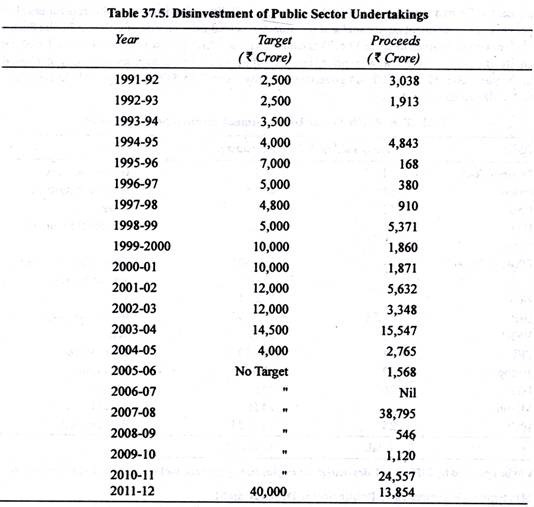

There is a need for evolving a fair, transparent and equitable procedure for disinvestment in selected public sector enterprises. The achievement made with regard to disinvestment of Public Sector Undertakings which started in 1991-92, are given in Table 37.5.

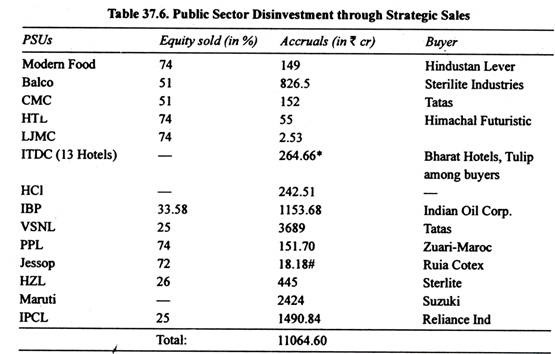

For the year 2001-2002, the Government set the target of Rs. 12, 000 crore regarding public sector disinvestment, but equity worth Rs. 5,632 crores was sold to the private sector. 100 per cent equity of Modem Food (a non-strategic public sector undertaking) has been sold to Hindustan Lever. 51 per cent of Government equity holding of BALCO (Bharat Aluminum Company Ltd.) has been sold to private sector firm Sterlite Industries at 826.5 crore rupees. 51 per cent of Government equity holdings in CMC has been sold to TATA. 25 per cent of Government equity in VSNL has been sold to TATA at 3689 crore rupees, 25 per cent of Government equity in IPCL has been sold to Reliance Industries at 1490 crore rupees.

The per cent of Government equity sold and the money received from its sale of different Public Sector Undertakings are given in Table 37.6. This table also gives which private company has purchased the equity of Government and at what price. The pace of public sector disinvestment greatly quickened in the year 2003-2004. In 2003-04 government equity worth Rs. 15, 547 crores was sold as compared to Rs. 3348 crores in 2002-03.

Strategic Sale Approach to Public Sector Disinvestment:

Another approach adopted for public sector disinvestment is called ‘strategic sale’. Simply put, it means that the Government, instead of offloading a minority percentage of its equity in market either at home or abroad, chooses to sell blocks of shares, usually more than 26 per cent of its stake, to an investor ideally having a strategic interest in the company. This is accompanied by the transfer of management control.

This has worked wonders. Not only have a wide range of companies been disinvested, but they have reaped handsome dividends for the Government as well (see Table 37.5). Importantly, a mere 14 companies were involved in these sell-offs. Compare this with Rs. 18,368 crore obtained through the public offer route between 1992 and 1999, in the recent strategic sales of 45 PSUs, some important companies like Concor, VSNL and Gail (Gas Authority of India, Ltd.) were involved.

The P/E (price- to-equity) ratios of shares of the companies sold in strategic sales have been phenomenal. IBP shares were sold at P/E ratios of 63 and IPCL at 58. Compare them to the P/E ratios of 4 to 6 obtained, when the Government sold minority shares in VSNL, HPCL and BPCL in the early 90s.

The New Approach to PSU Disinvestment: Public Sale of Shares:

The strategic sales approach to public sector disinvestment during 2001-2002, and 2002- 03 was quite successful. But Supreme Court in its judgment in September, 2003 restrained the Central Government from proceeding with disinvestment in Hindustan Petroleum Corporation Ltd (HPCL) and Bharat Petroleum Corporation Ltd (BPCL) through strategic sales without amending the law by the parliament.

Therefore, the Central Government decided that the various public sector companies such as HPCL, BPCL which were making profits will make initial public offers (IPO) of selling their shares to the public in the primary market. In this way they hoped to mop up huge funds. The Government believed that with the public issue of profitable public sector companies, the capital markets which were in depressed mode at that time would also revive.

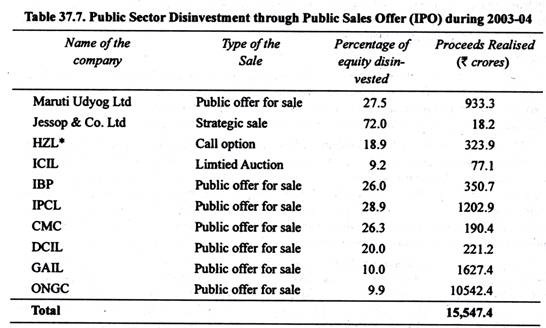

It was argued that by offloading Government stake in profitable Public Sector Undertakings (PSUs) in the market, it will not only revive the capital market but also strengthen the financial position and liquidity of the public sector companies. Various public sector companies made public offer for sale of a part of government equity. As a result of this Rs. 15,547 crores were realised during 2003-04. The names of various public sector companies which made disinvestment through public sale and the proceeds realised by them are given in Table 37.7.

In 2011 -12, public sector disinvestment through offer for sale in Oil and Natural Gas Commission (ONCC) amounted to Rs. 1274.9 crore. Disinvestment through the public offer route has been attempted in other countries, such as Britain where the aim was to widely disperse shares. Companies like British Airports Authority were 100 per cent privatised through this route. They were then run by professional managements.

Thus in India the Government can continue with a high stake in the PSUs and make a very large public offer to ensure a widely dispersed holding of equity capital of these companies. However, if the objective is that the management should change, then a strategic sale is a more viable option in Indian conditions. However, some analysts are skeptical of this strategy of public offer route to disinvestment.

According to them, true disinvestment and privatisation would not take place if Government control and management of the public sector companies continue after public offer to retail investors. True disinvestment and privatisation occur when the companies are controlled and managed by the private professional managers.

However, in our view, professional managers can be appointed even in public enterprises controlled by government. In fact, through public sale of equity, profitable public sector companies can raise resources through the capital market.

UPA Government Approach to Public Sector Disinvestment:

An important issue before UPA government was to clarify its policy towards public sector disinvestment. As a part of Common Minimum Programme (CMP), it was decided that public sector companies which were making profits would not be privatised though they could raise resources from the capital market.

In 2009 with no need for support of left parties, the Government announced public sector disinvestment through sale of a part of its equity in some public sector enterprises though the Government would retain their public character and control management by not allowing its equity to drop below 51%.

ADVERTISEMENTS:

Though Finance Minister Pranab Mukherjee was silent in his budget for 2009-10, he made the statement to this effect in the Parliament on July 14, 2009. The PSUs such as NHPC, OIL, Tyre Corporation of India (TCA) and Central Inland Water Transport Corporation (CIWTC) have been identified for disinvestment. Further, these PSUs have been permitted to float IPOs simultaneously to raise the required funds to meet their needs. In defence of such disinvestment through a part sale of government equity and issue of IPO by PSUs would enable the people to have a partial ownership of state-run units.

Navaratna PSUs:

UPA government pledged to devolve full managerial and commercial autonomy to successful, profit-making public sector companies operating in a competitive environment. All privatisation will be considered on a transparent and case by case selective basis. The existing public sector “navaratnas” will remain in the public sector but they can raise resources from the capital market.

The Government has delegated enhanced financial and operational powers to the Navaratnas and Miniratnas and other profit-making central public sector enterprises (CPSE). In addition to professionalising the Board of Directors of CPSE, it has also issued the guidelines to them on corporate governance While every effort will be made to modernize and restructure sick public sector companies and to revive sick industries, chronically loss-making firms will either be sold off or closed after all workers have got their legitimate dues and compensation. The government will induct private industry to turn around companies that have potential for revival.

The Board for Reconstruction of Public Sector Enterprises (BRPSE) has been established to advise Government on revival of sick and loss-making enterprises. The BRPSE has made recommendations in 47 cases including two for closure till Oct. 31, 2007. The proposals for revival of 26 Central Public Sector enterprises and closure of two have been approved by the Government. The total assistance approved by the Government up to Dec. 2007 in this regard is Rs. 8,285 crores including Rs. 1,955 crore cash assistance and Rs. 6,330 crore non-cash assistance.

In 1997 when Mr. Chidambaram was finance minister he announced that nine profit-making public sector companies had the capacity and resources to become ‘global giants’. He called them navaratnas. These navaratanas are: IOC, ONGC, HPCL, IPCL, VSNL, BHEL, SAIL, and NTPC. Due to stiff opposition from the left, the UPA government put the disinvestment process in profit- making enterprises on hold.

However, Maruti Udyog Ltd was permitted to raise resources from the market through sale of some government shares in the market in Feb. 2006. Maruti Udyog succeeded in raising Rs.1600 crores from the open sale of Government shares in Feb. 2006. In 2006- 07, the Government created national investment fund (N1F) to park funds raised through proceeds of disinvestment of the Centre’s stake in public sector enterprises.

It was stipulated that while 75 per cent of NIFs funds would have been invested in social sector projects on education, healthcare and employment, the rest would be ploughed in capital investment in select profitable and revivable PSUs. Since disinvestment process was put on hold because of stiff opposition by the left adequate funds from disinvestment could not be raised. This affected not only the revival of PSUs but also the expenditure on education, healthcare and employment.