In this article we will discuss about:- 1. Establishment and Organisation of State Bank of India 2. Objectives and Functions of State Bank of India 3. Achievements.

Establishment and Organisation of State Bank of India:

Establishment of State Bank of India:

The State Bank of India is the biggest commercial bank and holds a special position in the modern commercial banking system in India. It came into existence on July 1, 1955 after the nationalisation of Imperial Bank of India. The Imperial Bank of India was established in 1921 by amalgamating the three Presidency Banks of Madras, Bombay and Bengal.

Until the establishment of the Reserve Bank of India in 1935, the Imperial Bank of India, in addition to its normal commercial banking functions had been performing certain central banking functions. It used to act as the banker to the government, as banker’s bank and as the clearing house.

ADVERTISEMENTS:

After the establishment of the Reserve Bank of India, the Imperial Bank of India left its central banking functions, but continued to serve as the agent of the Reserve Bank in the areas where the latter did not have its branches. In 1955, on the recommendations of the Rural Credit Survey Committee, the Imperial Bank of India was nationalised and renamed as the State Bank of India through the State Bank of India Act 1955.

Organisation of State Bank of India:

The organisation of the State Bank of India can be discussed under the following heads:

i. Capital:

ADVERTISEMENTS:

The state Bank of India has an authorised capital of Rs. 20 crore which has been divided into 20 lakh shares of Rs. 100 each. The issued capital of the State Bank is Rs. 5.6 crore. The shares of the State Bank are held by the Reserve Bank, insurance companies and the general public. At the end of March 2001, the paid-up capital and the reserves of the State Bank were Rs. 13461 crore.

ii. Management:

The management of the State Bank of India is under the control of a Central Board of Directors consisting of 20 members.

The break-up of the Central Board is as given below:

ADVERTISEMENTS:

(a) A Chairman and a Vice-Chairman are to be appointed by the Central Government in consultation with Reserve Bank.

(b) Two Managing Directors are to be appointed by the Central Board with the approval of the Central Government,

(c) Six directors are to be elected by the private shareholders.

(d) Eight directors are to be nominated by the Central Government in consultation with the Reserve Bank to represent territorial and economic interests. Not less than two of them should have special knowledge in the working of cooperative institutions and of the rural economy,

(e) One director is to be nominated by the Central Government,

(f) One director is to be nominated by the Reserve Bank.

iii. Subsidiary Banks:

Through the State Bank of India (Subsidiary Banks) Act, 1959, major state- associated banks were converted into subsidiary banks of State Bank of India.

At present, there are seven subsidiary banks of the State Bank of India:

ADVERTISEMENTS:

(a) The State Bank of Bikaner and Jaipur;

(b) The State Bank of Hyderabad;

(c) The State Bank of Mysore;

(d) The State Bank of Patiala;

ADVERTISEMENTS:

(e) The State Bank of Saurashtra;

(f) The State Bank of Travancore; and

(g) The State Bank of Indore.

The State Bank of India holds not less than 55 per cent of the issued capital of each subsidiary bank.

Objectives and Functions of State Bank of India:

ADVERTISEMENTS:

The main objectives and functions of the State Bank of India are given below:

1. Objectives:

The State Bank of India has been established to operate on the normal commercial principles, with the only difference that, unlike other commercial banks in the country, it takes into consideration and responds in a progressively liberal manner the financial requirements of cooperative institutions and small scale industries, particularly in the rural areas of the country.

The main objectives of the State Bank are:

(i) To act in accordance with the broad economic policies of the government;

(ii) To encourage and mobilise savings by opening branches in rural and semi-urban areas and to promote rural credit;

ADVERTISEMENTS:

(iii) To establish government partnership in the provision of cooperative credit;

(iv) To extend financial help for the establishment of licensed warehouses and cooperative marketing societies;

(v) To provide financial help to the small scale and cottage industries;

(vi) To provide remittance facilities to the banking institutions.

The State Bank of India acts as an agent of the Reserve Bank in all those places where the latter does not have its branches.

As an agent of the Reserve Bank, the State Bank performs the following functions:

ADVERTISEMENTS:

(i) It acts as the government’s bank, i.e., it collects money and makes payments on behalf of the government and manages public debt.

(ii) It acts as the bankers’ bank. It receives deposits from and gives loans to commercial banks. It also acts as the clearing house for the commercial banks, rediscounts the bills of exchange of the commercial banks and provides remittance facilities to the commercial banks.

3. Ordinary Banking Functions:

The State Bank of India performs all kinds of commercial banking functions:

(i) It receives deposits from the public.

(ii) It gives loans and advances against eligible securities including goods, bills of exchange, promissory notes, fully paid shares of companies, immovable property or documents of title, debentures, etc.

ADVERTISEMENTS:

(iii) It invests its surplus funds in government securities, railway securities and securities of corporations and treasury bills.

4. Other Functions:

The State Bank of India also performs the following other functions:

(i) It buys and sells gold and silver.

(ii) It acts as agent of cooperative banks.

(iii) It underwrites issues of stocks, shares, debentures, and other securities in which it is authorised to invest funds.

ADVERTISEMENTS:

(iv) It administers, singly or jointly, estates for any purpose as executor, trustee or otherwise.

(v) It draws bills of exchange and grants letters of credit payable out of India.

(vi) It buys bills of exchange payable out of India with the approval of the Reserve Bank; it subscribes buys, acquires, holds and sells shares in the capital of banking companies.

5. Prohibited Functions:

The State Bank of India has been prohibited from doing certain businesses by the State Bank of India Act:

(i) The State Bank cannot grant loans against stocks and shares for a period more than six months.

(ii) It can purchase no immovable property other than its own offices.

(iii) It can neither rediscount nor offer loans against the security of exchange bills whose maturity period exceeds six months.

(iv) It cannot rediscount bills which do not carry at least two good signatures.

(v) It can neither discount bills nor grant credit to individuals or firms above the sanctioned limit.

Achievements of State Bank of India:

The following are the major achievements of the State Bank of India in different fields:

(A) General Progress:

The State Bank of India has made a tremendous progress since its inception in 1955.

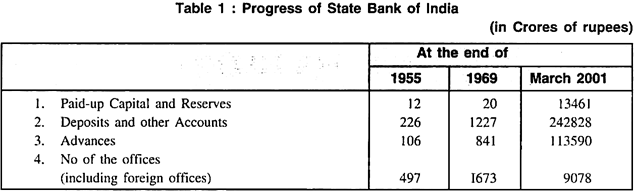

Table 1 shows the progress of the bank in the fields of deposit mobilisation, credit expansion and branch expansion:

i. Deposit Mobilisation:

There has been an increasing trend with regard to mobilisation of deposits by the State Bank of India. Total deposits and other accounts which were Rs. 226 crore at the end of 1955, increased to Rs.1227 crore at the end of 1969 and further to Rs. 242828 crore at the end of March 2001. Thus, there has been about 1075 times increase in Banks’s deposits during 1955 to 2001.

ii. Credit Expansion:

The progress in the field of credit expansion has also been considerable over the years. At the end of 1955, total advances made by the State Bank were Rs. 106 crore. These advances increased to Rs. 841 crore in 1969 and Rs. 113590 crore in March 2001. This indicates that there has been 1072 times increase in advances during 1955 to 2001.

iii. Branch Expansion:

The number of branches of the State Bank of India has also grown remarkably since its establishment. In 1955, the Bank had 497 offices, in 1969 and 2001, the number increased to 1673 and 9078 respectively.

iv. Present Position of State Bank Group:

By the end of March 2001, total deposits of the State Bank Group (i.e., State Bank of India and its seven associates) had reached Rs. 312117 crore, total advances granted by the group were Rs. 150390 crore, and total number of branches of the Group was 13509.

Thus, the State Bank of India Group accounted for about 41 per cent of deposits, 35 per cent of advances and about 21 per cent of the offices of all scheduled commercial banks in India. The paid-up capital and reserves of the Group were Rs. 4751 crore at the end of March 1994. Net profits of the group were Rs. 2222 crore (Rs. 1604 crore of the SBI and Rs. 618 crore of the associate branches) during 2000-01.

v. Profits, Efficiency and Capital Adequacy:

Over the years, the SBI continued to show better performance in terms of profits, efficiency and capital adequacy. It recorded a net profit of Rs. 1604 crore for the year 2000-01 against Rs. 832 crore for 1995-96, indicating an increase of 48%.

The major contributing factors for improved net profits were higher interest income from advances as well as investment operations, lower operating cost and better performance of foreign offices. The Bank’s capital to risk-weighted assets ratio was 12.79% during 2000-01. This is well above the internationally accepted ratio of 8%. Net NPA of the Bank was 6.03% in March 2001 against 6.41% in March 2000.

vi. International Banking:

At present (March 2001), the SBI has a network of 52 overseas offices with their operations spread over 31 countries. These foreign offices mainly cater to the needs of the country’s foreign trade and provide foreign currency resources to the Indian corporates.

During 2000-01, the foreign offices of the SBI earned a net profit or Rs. 248 crore. The deposits and advances of the Bank’s foreign offices were Rs. 7932 crore and Rs. 14797 crore respectively at the end of March 2001.

vii. Technology Upgradation and Consumer Services:

The State Bank of India (SBI) has taken significant initiatives in the fields of technology upgradation and better consumer services.

At present (March 2001), the following major facilities in these areas are available:

(a) 2555 computerised branches operating in 620 centres and covering 76% of the Bank’s domestic business;

(b) Network of 100 ATMs in 8 cities;

(c) Internet banking covering 35 branches by March 2002;

(d) 360 VSATs linking 130 centres ;

(e) Tele-banking;

(f) Remote banking for corporates;

(g) State Bank electronic payment system (STEPS) to facilitate instantaneous electronic transfer of funds;

(h) Electronic Data Interchange projects for handling customer transactions at airports and seaports;

(i) Introduction of computerised printing of drafts;

(j) Electronic Nostra Account Reconciliation (ELENOR) enabling online reporting of forex transactions from 444 forex intensive branches;

(k) Extended business hours (7 to 12 hours) and 7 days banking.

Progress since 2001:

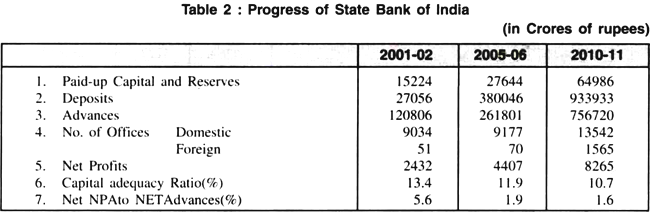

Table -2 shows the progress and performance of the State Bank of India since 2001:

(i) Paid up capital & reserves of the bank increased from Rs.15224 crore on 2001-2 to Rs.64986 crore in 2010-11.

(ii) Deposits of the bank increased from Rs. 270560 crore in 2001-2 to Rs. 933933 crore in 2010-2011.

(iii) Advances of the bank increased from Rs. 120806 crore in 2001-2 to Rs. 756720 crore In 2010-11.

(iv) Number of domestic offices of the bank increased from 9034 in 2001-02 to 13542 in 2010-11 and of foreign offices increased from 51 in 2001-02 to 1565 in 2010-11.

(v) Net profits of the bank increases from Rs. 2432 crore in 2001-02 to Rs. 8265 crore in 2010-11.

(vi) Capital-adequacy ratio moved from 13.4% in 2001-2 to 10.7% in 2010-11.

(vii) Net NPA to net advances ratio has fallen from 5.6% in 2001-2 to 1.6% in 2010-11.

(B) State Bank and Rural Credit:

The State Bank had made remarkable progress in the field of rural credit. Since its establishment, it has been making tremendous efforts to develop rural credit by extending credit facilities to cooperative institutions and agriculturists.

Important measures undertaken by the State Bank to promote rural credit are as follows:

I. Expansion of Rural Branches:

The branch expansion of the State Bank has been largely rural – oriented. Out of the total 12486 branches of the State Bank Group at the end of March 1990, 5811 (i.e., 44.8%) were located in the rural areas with population less than 10,000; 3483 (i.e., 27.9%) were in semi-urban areas with population 10,000 to less than 1 lakh; and 3192 (i.e., 25.6%) in the urban areas and metropolitan cities.

II. Agricultural Finance:

The State Bank has been extending financial help to agriculture. In 1969, the total agricultural advances by the State Bank were Rs. 92 crore, which increased to Rs. 14982 crore in March 2001.

The State Bank of India has identified and is expanding its involvement in the following critical areas in agricultural lending:

(i) The Bank has contributed to the spread of minor irrigation schemes;

(ii) To increase productivity at the farm level, the Bank provides production finance directly to the farmers.

(iii) To develop dryland farming, the Bank- (a) grants loans for agricultural development in dryland areas, and (b) prepares and finances dryland farming projects in compact areas on the watershed basis.

(iv) The bank finances the farmers to install drip irrigation schemes in Karnataka, Tamil Nadu and Maharashtra.

(v) The Bank provides assistance to farmers to take up cultivation on waste lands under social forestry schemes for raising nurseries and planting of trees for fuel, fodder, etc.

(vi) The Bank provides financial help for modernising agricultural practices and raising farm productivity through the use of tractors and other agricultural implements.

III. Village Adoption Scheme:

The State Bank has undertaken a village adoption scheme. Under this scheme, a village is selected for development by meeting its complete financial requirements, including the requirements of the farmers, artisans and others.

The total number of villages adopted by the State Bank (other than those covered by the agricultural development banks) in 1987 was 54207. The total amount of credit and the number of farmers financed under this scheme stood at Rs. 1559 crore and 26.4 lakh respectively in March 1989.

IV. Integrated Rural Development Programme:

Integrated rural development scheme aims at all round and integrated development (i.e., economic, social, cultural, etc.) of the rural areas. The total loans disbursed by the State Bank upto the end of March 1999 under this programme amounted to Rs. 3212 crore spread over 69 lakh beneficiaries.

V. Regional Rural Banks:

Regional rural banks have been started with a view to provide credit to the small and marginal farmers and other weaker sections of the society. The State Bank is providing financial assistance to these banks. Upto the end of March 2001 the State Bank had sponsored 30 regional rural banks, covering 85 districts in the country.

VI. Agricultural Development Branches:

An important feature in the field of agricultural financing by the State Bank is the expansion of special agricultural development branches. These branches aim at financing all – round development of agriculture and function in close cooperation with Agricultural Refinance Development Corporation (ARDC), now called National Bank for Agriculture and Rural Development (NABARD). Upto March 1999, the Bank has contributed Rs. 1681 crore to NABARD.

VII. Remittance Facilities:

The State Bank provides liberalised remittance facilities to the institutions operating in the rural areas like state and central cooperative banks, land development banks, etc. With the implementation of the branch expansion programmes, the State Bank is now in a position to extend these liberalised remittance facilities more effectively to the rural and semi-urban areas.

VIII. Short-Term Credit to Cooperative Banks:

The State Bank has been providing short-term credit facilities to the state and central cooperative banks against government securities at a rate half per cent below the usual rate charged by it.

IX. Assistance to Land Development Banks:

The State Bank also gives financial assistance to the land development banks which provide long-term credit to agriculture:

(a) The State Bank subscribes to the debentures issued by the land development banks.

(b) The State Bank grants advances on the security of such debentures. This improves the marketability and popularity of these debentures in the money market.

(c) The State Bank provides loans and advances to cooperative central land development banks.

X. Finance for Marketing and Processing Societies:

The State Bank gives direct financial help to marketing and processing cooperative societies in the areas where the central cooperative banks are not in a position to assist them. The marketing societies can get advance by pledging their produce at favourable prices. Processing cooperative societies such as cooperative sugar mills, cotton ginning and pressing societies, etc. are also provided similar credit facilities by the State Bank of India.

XI. Warehousing Finance:

Warehousing aims at scientific storage of the products and is essential for the development of agricultural marketing. The State Bank has been actively associated with the warehousing development scheme and provides advances against warehousing receipts.

It has also been making efforts to improve its procedures and terms with a view to promote and popularise the warehousing scheme. Moreover, the State Bank has permitted its officers to serve on the advisory committees for warehouses.

(C) State Bank and Industrial Finance:

The State Bank of India has been extending financial help for the promotion of industrial growth in the economy.

Various forms of assistance to the industries by the Bank are given below:

I. Industrial Finance:

In tune with the rapid industrial growth in the country, the loans and advances of the State Bank to the industrial sector has shown substantial growth over the years. As compared to the amount of Rs. 9771 crore at the end of 1987, the advances to the industrial sector (including the small scale sector) increased to Rs.15519 crore at the end of March 1990.

Bank’s Corporate Banking Group:

It consists of three strategic business units, i.e.- (a) Corporate Accounts Group (CAG), (b) Leasing Strategic Business Units (Leasing SBU) and (c) Projects Finance Strategic Business Unit (Project Finance SBU).

(i) The CAG is a single window shop for the entire range of financial services needed for the large corporates. At present it caters to a more than 200 corporates in India. CAGs advances were Rs. 16943 crore at end March 2001.

(ii) The Leasing SBU performs its role as a leading provider of big-ticket leases to corporates.

(iii) The Project Finance SBU, an active infrastructure advisory services group, focuses on core and infrastructure sectors like power, telecommunications, oil and gas, roads, bridges, ports and urban infrastructure.

II. Finance to Small Scale Industries:

The State Bank of India’s finance to small scale industries has also increased substantially over the years. In 1969, the advances to small scale industries were Rs.104 crore, which increased to Rs. 12718 crore in March 2001. Similarly, the Bank’s small business finance increased from Rs. 7 crore in 1969 to Rs. 3711 crore in March 1998.

Other facilities provided by the Bank to small-scale and cottage and village industries are as given below:

(i) The Bank offers technical and financial consultancy to the units on its books to enable them to overcome problems of technological obsolescence, marketing, management, etc.

(ii) Under its Equity Fund Scheme, the Bank makes available the equity assistance in the form of interest – free loans repayable on a long – term basis to the needy entrepreneurs to set up new small- scale units.

(iii) The Bank conducts Entrepreneurial Development Programmes to promote entrepreneurship for the development of ancillaries near large project areas and of high – tech industries, such as electronics, computer peripherals, etc.

(iv) To assist the export efforts of the small – scale industrialists, arrangements have been made to extend the Whole Turnover Packing Credit Guarantee Scheme (WTPCG Scheme) to small – Scale industries from January 1, 1988.

(v) To increase opportunities for self – employment in the tertiary sector, the Bank provides finance to small business enterprises.

(vi) Project Uptech, set up by the Bank in 1988 for bringing about technology upgradation of small and medium enterprises, has taken up 19 projects upto March 2001. Six new projects are in the pipeline.

Conclusion:

The State Bank of India has been progressing well in the right direction. It has made remarkable achievements in the fields of expanding banking facilities in the rural and semi- urban areas, and providing financial help to agriculture, cooperative institutions and small scale industries.