Let us make in-depth study of the problem of widening current account deficit of India.

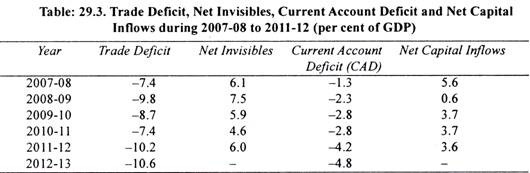

In the last three years India is faced with a serious problem of current account deficit. The deficit in current account has been mainly due to the large merchandise trade deficit.

Our imports of goods rose in relation to our exports due to lagging competitiveness of our exports and failure of our government to diversify market for exports. Crude oil and gold in recent years constitute almost half of our imports. Demand for gold in India is quite large as it is demanded both for making jewellery and as hedge against inflation.

India’s current account deficit plumbed new depths as gold and oil imports soared, putting pressure on the government to come up with new measures to attract foreign investments and increase exports to cut the deficit. Current account deficit, or CAD, the excess of spending overseas than earning, rose to 6.7% of the GDP in the third quarter of the year 2012-13 (from Oct. to Dec. 2013) from 5.4% in the previous quarter, smashing optimistic estimates. This is more than double of what was prevalent during the 1991 currency crisis. The country got a relief when at the end of June 2013 the RBI said that for the whole year 2012013 current account deficit was 4.8 per cent of GDP.

ADVERTISEMENTS:

Due to pick up of exports in the 4th quarter of 2012-13 though in this quarter CAD was quite high (3.6% of GDP) it was lower than 6.7% of the third quarter of 2012-13 and 5.4 per cent of its second quarter. The deterioration was all-round, with software exports – India’s mainstay when it comes to US dollar earnings – remaining flat at $18.9 billion in the quarter from a year ago. Remittances from workers and Indians overseas fell as a weakening currency and lower interest rates deterred fresh inflows.

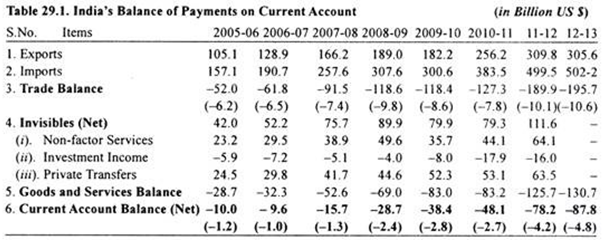

Current account deficit for the financial year (2012-13) still works out to be record of high 4.8 per cent of GDP indicating that the economy is still not out of the woods on the external front. The high CAD essentially reflects the fact that export earnings fall short of the huge import bill. It will be observed from the Table 29.1 that net invisible (which represent net exports of services is positive throughout). It is therefore on account of trading in goods that shows a large deficit and is responsible for overall current account deficit.

This resulted in sharp depreciation of rupee from June 2013 when value of the Indian rupee to a US dollar fell from about Rs. 56 to a dollar in the first week of June to over Rs. 60.73 to a dollar on June 26, 2013, further to Rs. 61.21 to a US dollar on July 8, 2013, a 10 per cent decline in the value – rupee is a single month. As a result of capital outflows and uncertainty in Government policy, depreciation of rupee continued and it fell to Rs. 66 to a dollar on Aug. 16, 2013 and hit the record level of RS. 68.8 On August 28, 2013.

ADVERTISEMENTS:

The outflow of capital is taking place partly because of large current account deficit hurting the foreign investor confidence for investment in the Indian economy and also the announcement of the governor of the US Federal Reserve about reducing the ‘quantitative easing’ (QE) following the signs of the recovery of the American economy prompted the foreign portfolio investors to withdraw from the debt and equity markets in the month of May and June 2013 of India for safe investment in the US. Around $7 billion were pulled out from the Indian debt and equity markets in the months of May end June 2013 and this not only resulted in crash in India’s stock market but also further raised the demand for dollars.

As a result, the rupee fell below Rs. 68 to a US dollar on Aug. 28, 2013 despite the intervention by the RBI to stall the process of more depreciation by selling US dollars from its reserves. However, with the postponement of unwinding of quantitative easing by the US Federal Reserve, rupee rose to around Rs. 62 to a US dollar at end September 2013.

The Indian government also tried to reduce current account deficit by raising import duty on gold from first 6 per cent to 8 per cent and then to 10 per cent. Further, the government is also wooing foreign investment by raising the caps (i.e., upper limits) on foreign direct investment (FDI) in various sectors of the economy such as telecom, oil refineries, defense production, insurance.

ADVERTISEMENTS:

Recall that FDI is a stable source of foreign capital that can help to finance the current account deficit. Further, the government is hoping that since rate of return in India is higher than that in the US and European countries, even portfolio capital by FII which is now flowing out will ultimately return to India.

The basic solution to our widening current account deficit is to frame economic policies that improve productivity of our manufacturing sector substantially so that their exports may be increased. Over the years manufacturing exports have struggled while service exports have surged.

To boost manufacturing exports we need better infrastructure such as adequate availability of power, good ports, good highways, relaxation of rigid labour laws, lower transaction costs in terms of lesser paper works, quick environment clearances of projects so that projects are not stalled for a long period. The government should also guide exporters to diversify into new markets, for example, in African nations where growth is strong.

The large current account deficit poses a great challenge for the Indian economy to tackle it. If foreign investment, direct and portfolio is not coming in adequate quantity we will use our own foreign exchange reserves to finance CAD. However, these foreign exchange reserves are available only in a limited quantity.

In August 2013, foreign exchange reserves of only $285 billion were available which was sufficient to cover only 7 months of imports. Thus, to solve the problem of CAD, either we have to attract sufficient foreign capital inflows or we have to cut our imports if we fail to expand our exports.

Two types of measures to solve the problem of current account deficit must be distinguished. First type of measures is to find ways of financing current account deficit which in recent years has become much larger than the comfort level of 2.5% of GDR The second type of measures is to reduce this current account deficit (CAD) by increasing exports and curtailing imports.

We first discuss the second type of measures. In recent years the imports of gold have largely risen adding to the current account deficit. The imports of gold have to be reduced. In 2009-10 we imported about $30 billion of gold and silver. Before that it was $22 – $24 billion of which about $7 billion was re-exported as jewellery. Financing that was not a problem but when imports of gold went up to $62 billion in 2011-12 it became a problem.

In 2011-12 and 2012-13, a large part of imports of gold had gone into gold coins and biscuits. Even banks were selling gold coins to the public. The many households buy these coins and biscuits as hedge against inflation. Therefore, it was necessary to reduce the imports of gold. Finance Minister raised the import duty on gold first from 6% to 8% and then 8% to 10% to discourage the imports of gold.

The RBI also made the imports of gold tougher The RBI announced that 20% of imports of gold by businessmen must be exported in the form of jewellery. If any importer of gold fails to export 20% of its imports of gold, he would he debarred from importing any more gold. This would have a dual effect. On the one hand, 20% export condition will lower imports of gold, on the other hand it would encourage exports of gold jewellery. This will help in reducing current account deficit.

ADVERTISEMENTS:

Further, our exports of iron has been drastically reduced because of restrictions on mining of iron as there was a lot of corruption and violation of law regarding mining. To reduce current account deficit these mining restrictions on iron have to be relaxed so that their exports are increased. Similarly, our imports of coal have significantly increased that have led to the widening of current account deficit.

The government allotted quotas of coal mining to those who had no experience of mining coal and there has been coal scam involving thousands of crores which has worsened domestic coal- supply scenario. We must improve our policy on coal mining so that larger requirements of coal should be met by domestic production. Our Finance Minister rightly says that “the only way to contain CAD is to increase the domestic production of oil and coal and restrain the consumption of gold”.

Further, a lot of foreign exchange is used for importing electronic goods such as laptops, desktops, smart phones, mobiles, their imports must be curbed by imposing heavy import duties and also through some suitable way of quantitative restrictions such as adopted in case of gold (Note that outright quantitative restrictions on imports of goods are not permitted under WTO rules. To promote overall exports, 3% subsidy on interest has been announced on exports. This is a step in right direction.

Now we turn to explain the ways of financing current account deficit (CAD). Our present stock of foreign exchange reserves ($ 281 billion) are insufficient to meet the current account deficit as they only cover 7 months of imports. Besides, we have to use them to payback our short-term loans taken from abroad which mature in a year. It is therefore important to finance CAD than to draw upon foreign exchange reserves.

ADVERTISEMENTS:

We have been relying on capital inflows by FIIs, which are quite volatile and unstable. Therefore, to attract foreign direct investment (FDI), government has recently raised the caps (i.e., limits) on FDI in various industries such as telecom, oil refineries, defence production, insurance and make its entry easier by permitting a large percentage of FDI through automatic route, that is, without the approval of Foreign Investment Promotion Board (FIPB).

The economic growth dipped to a decade low of 5% in 2012-13 and FDI inflows during 2012-13 declined by 38% to $22.42 billion. Despite all odds the government was able to finance CAD and also added $3 billion in 2012-13 to foreign exchange reserves. What is required in 2013- 14 for which CAD is estimated to be 4.3% of GDP is to attract foreign direct investment (FDI) which is quite stable source of funding CAD by raising its limits in various industries and make its entry into the country easier as has been now done by the government.

All European countries at present are in recession and so is the case with Japan, and other developed countries. Only the US economy is showing some signs of revival. India still continues to remain a desired destination for foreign direct and institutional investment. To attract them therefore we need to adopt proper policy and restore confidence among foreign investors.

Finally, policy makers in India have been considering the idea of issuing sovereign bonds to overseas investors to attract dollar inflows to meet the current account deficit (CAD). However, according to former RBI governor D. Subbarao, issuing of sovereign bonds to overseas investors may not be good for the long-term financial stability of the economy as it would further increase external indebtedness of the economy making it more vulnerable to external shocks.

ADVERTISEMENTS:

In our view if by raising interest rate on non-India resident Indian deposits (i. e., NRI deposits) in Indian banks as RBI has now permitted good amount of dollars can be attracted which can be used to finance current account deficit.