The below mentioned article provides information on financing of fiscal deficit in Indian economy.

Introduction:

Government expenditure on goods and services and resources mobilized by it through taxes, etc., are important factors that determine aggregate demand in the economy.

When there is a deficit in the budget of the government, it spends more than it collects resources through taxes and non-tax revenue. In recent years there have been huge fiscal deficits in India which have created large excess demand in the economy. This has resulted in inflation or sharp rise in the general level in prices. The deficit may occur either in the revenue budget or capital budget or in both taken together.

When there is an overall budget deficit of the Government, it has to be financed by either borrowing from the market or from the Reserve Bank of India which is the nationalized central bank of the country. RBI has the power to create new money, that is, to issue new notes. Thus, to finance its fiscal deficit, the government may borrow from Reserve Bank of India against its own securities.

ADVERTISEMENTS:

This is only a technical way of creating new money because the government has to pay neither the rate of interest nor the original amount when it borrows from the Reserve Bank of India against its own securities. It is thus clear that fiscal deficit implies that government incurs more expenditure on goods and services than its normal receipts from taxes and non-tax revenue.

This excess expenditure by the government is financed by either borrowing from the market or by newly created money which leads to the rise in incomes of the people. This causes the aggregate demand of the community to rise to a greater extent than the actual amount of deficit financing undertaken through the operation of what Keynes called income multiplier.

In the opinion of many economists, the expansion in money supply caused by monetisation of fiscal deficit leads to the excess aggregate demand in the economy, especially when aggregate supply of output is inelastic. The excess aggregate demand causes rise in the price level or brings about inflation in the economy.

Revenue Deficit:

The budget has two parts: Revenue Budget and Capital Budget. Receipts in the revenue account come from such sources as various types of direct and indirect taxes and also from non-tax sources such as interest received on loans given, dividend and profits of public enterprises. The items of expenditure in the revenue account are of the type that represents collective consumption of the society and therefore, creates no earning assets.

ADVERTISEMENTS:

The various types of expenditure on the revenue account are incurred on:

(1) Interest payments on public debit,

(2) Civil administration,

(3) Defense,

ADVERTISEMENTS:

(4) Subsidies on food, fertilizers, exports and

(5) Social services such as education, health, etc.

Revenue deficit refers to the excess of revenue expenditure over revenue receipts:

Prudent management of public finance requires that receipts on revenue account should not exceed expenditure on revenue account. In other words, there should be surplus on revenue account so that this surplus should be used for investment in development projects or building assets which yield returns. In fact, surplus on revenue account of the budget represents public or government savings which can be used for financing developmental activities. However, in India, for the past several years, there has been deficit on the revenue account. That is, there has been government dissaving for the last some years in India.

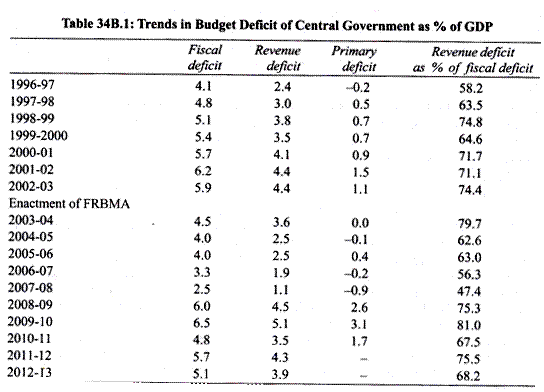

Therefore, borrowed funds from the capital account have been used to meet a part of consumption expenditure of the government. This has bad consequences for the economy. Revenue deficit as percentage of gross domestic product (GDP) has been quite high in recent years. Revenue deficit of the central government of India for the last some years is given in Table 34B. 1.

As per cent of GDP, revenue deficit rose from 2.4 per cent in 1996-97 to 4.4 per cent in 2002-03 but fell to 1.1 per cent in 2007-08. Fiscal Responsibility Budget Management (FRBM) Act passed in 2003 required to eliminate it by 2008-09. However, due to global financial crisis in 2008, it could not be achieved.

As a part of fiscal stimulus package the government increased its expenditure and cut customs and excise duties in 2008 and 2009 to prevent large slowdown of economic growth following the global financial crisis.

As a result, revenue deficit rose to 4.5 per cent of GDP in 2008-09 and 5.2% of GDP in 2009-10. Waving of loans of farmers in 2008-09 and rise in salaries of central government employees following the implementation of Sixth Central Payment Commission in 2008 and 2009 also caused the revenue deficit, to go up in 2008-09 and 2009-10. Since revenue deficit represents negative savings of the government it leads to lower investment by the government and slows down economic growth of the country in the long run. Central government has been trying to achieve fiscal consolidation by raising more tax revenue by roll-back of tax concession withdrawing tax exemptions.

ADVERTISEMENTS:

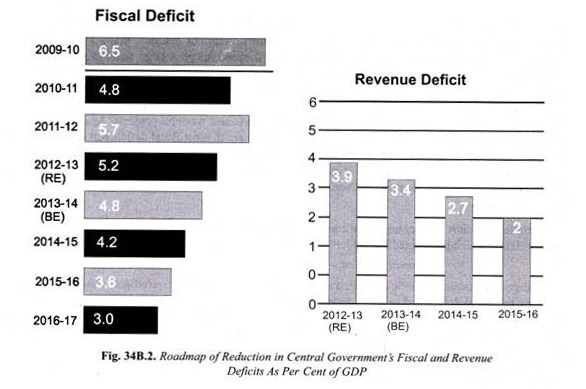

As a result, the Central Government revenue deficit in 2010-11 fell to 3.5% of GDP, revenue deficit again rose to 3.9% of GDP. The Finance Minister plans to reduce it to 3.4% GDP in 2013-14, to 2.7% 2014-15 and further to 2% of GDP in 2014-15 (see Fig. 34B.2). Government expenditure to meet revenue deficit does not lead to increase in durable assets and therefore does not cause expansion in productive capacity to ensure sustained economic growth in future.

Fiscal Deficit:

Fiscal deficit in the budget is an important measure of deficit. IMF and the World Bank generally prescribe targets for budget deficit in terms of fiscal deficit. Fiscal deficit is the excess of total expenditure (both on revenue and capital accounts) over revenue receipts and non-debt type of capital receipts such as recoveries of loans.

Thus,

ADVERTISEMENTS:

Fiscal Deficit = (Total Expenditure both on Revenue Account and Capital Account) – (Revenue Receipts + Non-debt Capital Receipts)

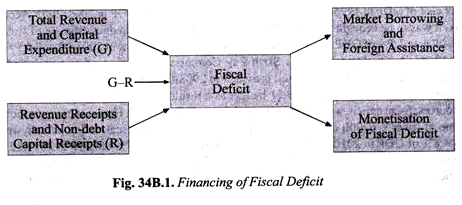

Fiscal deficit is a more comprehensive measure of budgetary imbalances. Thus, we see that when the government’s total expenditure, both revenue and capital expenditure, exceeds its receipts from taxes and other normal non-revenue and non-debt capital resources, a fiscal deficit is created. Now, this fiscal deficit can be financed in two ways.

First, through borrowing by the government from the market, both inside and outside the country. On this borrowing, the government has to pay rate of interest annually. Apart from that it has to pay back the internal and external debt taken.

Secondly, the government can finance the fiscal deficit by borrowing from the Reserve Bank of India which issues new notes against government securities. Thus, borrowing from the Reserve Bank results in expansion of high powered money in the economy and is popularly called deficit financing. It is in fact monetisation of fiscal deficit which, if undertaken to an excessive extent, leads to inflation in the economy. On the other hand, Government borrowing from the market to finance fiscal deficit adds to the public debt and increases burden on future generations on whom heavy taxes have to be imposed for repaying the loans.

ADVERTISEMENTS:

In the Table 34B.1, fiscal deficit of the Central Government of India has been calculated for the last fifteen years. Fiscal deficit had been quite large prior to 2003-04 which led to inflation or rise in prices in the economy on the one hand and increase in public debt on the other. Therefore, to ensure economic growth with stability in 2003 it was decided to follow a prudent fiscal policy and accordingly to reduce fiscal deficit to 3 per cent of GDP by the fiscal 2008-09.

In the budget for 2007-08, the Finance Minister planned to reduce it to 3.1 per cent and actually succeeded to reduce it to 2.5% of GDP. In 1990-91, fiscal deficit of the Central Government which was around 8% of GDP came down to 4.1 per cent of GDP in 1996-97 but again rose to 6.2 per cent of GDP in 2001 -2002. According to FRBMA, it was to be brought down to 3% of GDP in 2008-09.

The budget estimate of fiscal deficit for 2008-09 was 4.5% of GDP. However, actually it rose to 6.0 per cent in 2008-09 and 6.5% of GDP in 2009-10 due to implementation of Sixth Pay Commission revision of pay scales of Central Government employees and fiscal stimuli provided in 2008-09 to keep the growth momentum in the light of global financial crisis. In 2010-11 budget as a result of fiscal consolidation through raising more resources, fiscal deficit, was estimated to go down to 5.5% of GDP.

However, revenue mobilisation of revenue of (over Rs. 67000 crore) from auction of 3G spectrum, fiscal deficit actually went down to 4.8% of GDP in 2010-11. However, fiscal deficit rose to 5.7% of GDP in 2011-12 and was 5.1 per cent of GDP for 2012-13 (RE).

In the budget for 2013-14 the Finance Minister provides for fiscal deficit of 4.8% and has promised to stick to it. Further, in his budget speech for 2013-14, he has presented the whole roadmap of reducing fiscal deficit to 4.2 per cent in 2014-15, to 3.6% in 2015-16 and 3.0 percent of GDP in 2016-17 (see Fig. 34B.2).

ADVERTISEMENTS:

Implications of Large Fiscal Deficit:

There are four implications of fiscal deficit. First, a good part of it is financed through borrowing from within and outside the country. This leads to the increase in public debt and its burden. Secondly, if a part of fiscal deficit is financed through monetisation of fiscal deficits, it leads to the creation of new money and rise in prices or inflation.

To check inflation and achieve price stability, IMF and World Bank had recommended that fiscal deficit in India should be reduced to 3 per cent of GDP in a phased manner. Thirdly, a large fiscal deficit adversely affects economic growth. Due to large revenue deficit, a very large part of borrowed funds by the Government is used to finance current consumption expenditure of the Government.

As a result, a smaller amount of resources are left for productive investment in infrastructure and social capital (i.e. education and health) by the Government. This lowers the rate of economic growth. Lastly, more borrowing by the Government leaves less resources for private sector investment.

To reduce fiscal deficit to 3 per cent requires a drastic cut in non-productive revenue expenditure which is a difficult task. In India, in the past attempts have been made to reduce fiscal deficit by curtailing capital expenditure which is incurred on projects of capital formation and other developmental activities.

This is not a desirable way of reducing fiscal deficit because this adversely affects economic growth. For sound management of Government finances there is need to cut revenue expenditure and raise revenue receipts by mobilizing resources through taxation. Attempts to reduce fiscal deficit by curtailing capital expenditure, as has been the practice in India so far, adversely affects economic growth and should therefore be avoided.

ADVERTISEMENTS:

However, fiscal deficit, even a large one, is not always bad. In times of recessionary situation or slowdown in economic growth such as the one that prevailed in 2008-09 large fiscal deficit is needed to fight recession and prevent slowdown of economic growth.

All over the world (including the US and European countries), the governments resorted to a large dozes of fiscal deficit to stimulate the economy and prevent further deepening of recession and losses of more jobs. It was for such a situation when private investment declines that J.M. Keynes recommended that Government should undertake deficit spending on a large scale to overcome recession and increase employment. In our view, undertaking reasonable fiscal deficit in a recessionary situation is desirable to fight recession or prevent slowdown in growth.

However, in developing country such as ours borrowed money should be spent for productive purposes (especially for building infrastructure) and not frittered away in spending on useless and wasteful projects. Against fiscal deficit it is generally argued that borrowing by the government to meet fiscal deficit will crowd out private investment.

In our view if borrowed funds are spent by the Government to step up investment in infrastructure, private investment will indeed rise rather than fall as lack of infrastructure is an important factor that impedes private investment.

Primary Deficit:

Primary deficit is another important concept of budgetary deficit. Primary deficit is a measure of budget deficit which is obtained by deducting interest payments from fiscal deficit. Thus,

Primary Deficit = Fiscal Deficit – Interest Payments.

ADVERTISEMENTS:

Interest payments on public debt are transfer payments made by the government. The difference between the fiscal deficit and primary deficit shows the importance of interest payments on public debt incurred in the past. Huge interest payments are very largely responsible for causing a large fiscal deficit. In India, in recent years, interest payments on public debt has increased very much.

The higher interest payments on the past borrowings by the Government have greatly increased the fiscal deficit. Therefore, primary deficit is much lower than the fiscal deficit. In India, in the year 1990-91 primary deficit was 2 .8 per cent of GDP, whereas fiscal deficit was 6.3 per cent of GDP.

The primary deficit came down to 0.4 per cent of GDP in 1995-96 and negative (-0.2) in 1996-97, went up to 0.7 per cent of GDP in 1999-2000 and to 1.5 per cent in 2001-2002. Primary deficit as per cent of GDP again fell to around zero per cent of GDP in 2003-04, 2004-05, 2005-06. It was negative in 2006-07 and 2007- 08. It may be noted that only when primary deficit is positive, a part of it can be used to meet consumption expenditure and a part to use for investment purpose.

If primary deficit is negative, then borrowing by the Government is not even sufficient to make the entire interest payments on the past debt. Interest payments is an item of liabilities on the revenue account of the budget. Therefore, if fiscal deficit has to be reduced, interest payments on the revenue account should be reduced which can be done if past public debt is quickly retired by mobilizing more resources and by curtailing non-developmental public expenditure.

Monetisation of Fiscal Deficit:

It may be noted that fiscal deficit can be financed by borrowing from the Reserve Bank of India by the central government against its own securities or treasury bills. The fiscal deficit is financed by borrowing from the Reserve Bank which issues new money or currency against government securities, which leads to the expansion in money supply.

In the old terminology, it was known as deficit financing in India. Financing the fiscal deficit by issuing new money through borrowing from the Reserve Bank against securities in the new terminology is called monetisation of fiscal deficit. It may be noted that in the earlier years separate data regarding the budgetary deficit and therefore, the magnitude of deficit financing undertaken in a year were provided by the government.

ADVERTISEMENTS:

However, in recent years the data regarding budgetary deficit is not separately provided by the government and it has become a part of fiscal deficit which is shown to be financed by government borrowing and other new liabilities.

Now the data regarding these deficits, namely:

(1) Revenue deficit,

(2) Fiscal deficit and

(3) Primary deficit are provided in the budget documents.

Measures for Fiscal Consolidation:

By fiscal consolidation we mean raising more resource and reducing non-essential expenditure by the government so as to reduce fiscal deficit to a reasonable level. Reducing fiscal deficit is a for middle challenge for control of inflation and achieving 8% growth in the 12the plan period (2012- 17) large fiscal deficit has two bad consequences. First, it leads to excessive Government borrowing from the market which causes rise in market interest rate. Higher market interest rate tends to reduce private investment.

Further, it reduces the resources available for private sector investment. Second, the extent to which a large fiscal deficit is financed by borrowing from the Reserve Bank of India which issues new currency (which is called reserve money or high-powered money) for the government. This causes greater expansion in money supply through the process of money multiplier and generates inflationary situation in the economy.

Thus, to check the rate of inflation, fiscal deficit has to be reduced through both raising revenue of the government and reducing government expenditure. In the Indian context, the following measures can be adopted to reduce fiscal deficit and thereby to reduce inflationary pressures in the economy. We first spell out the measures which may be adopted to reduce government expenditure and then describe measures for raising Government revenue.

Measures to Reduce Public Expenditure:

In the context of the Indian economy, the following measures can be adopted to reduce public expenditure for reducing fiscal deficit and thereby check inflation.

1. A drastic reduction in expenditure on major subsidies such as food, fertilizers, and petroleum products is required to curtail public expenditure. A huge sum of money is spent on major subsidies on food, fertilizers, petroleum products by the central government. Without a drastic cut in subsidies over time it is difficult to reduce public expenditure to an appreciable degree.

In June 2012, the government rightly decontrolled petrol so that its price is aligned with global price level. Besides, to reduce its expenditure on subsidies diesel prices were increased in September 2012 by Rs. 5 per litre and now it has been decided to increase diesel price by around 50 paisa every month.

As regards checking leakages the policy of direct cash transfers to the beneficiaries has been adopted. To reduce subsidy on LPG, the supply of subsidized LPG cylinder to each consumer was capped at 6 per annum which together with hike in diesel prices was expected to lower government expenditure by Rs. 2300 crore. However, in the budget for 2013-14 expenditure on subsidies as per cent GDP is planned to be reduced marginally to 2 per cent of GDP compared to 2.2% of GDP for the years 2009-10 and 2010-11.

2. The huge sum of money is spent by the government on LTC (Leave Travelling Concessions), bonus, leave encashment etc. A reduction in expenditure on these is necessary if the government is determined to cut public expenditure.

3. Another useful measure to cut public expenditure is to reduce interest payments on past debt. In India, interest payments account for about 40 per cent of expenditure on revenue account of the central government. In our view, funds raised through disinvestment in the public sector should be used to retire a part of old public debt rather than financing current expenditure. Retirement of public debt quickly will reduce burden of interest payments in future.

4. Budgetary support to public sector enterprises other than infrastructure projects should be substantially reduced. Further, public sector enterprises should be asked to raise funds from the market and banks.

5. Austerity measures should be adopted to curtail non-plan expenditure in all government departments.

Increasing Revenue from Taxation:

To reduce fiscal deficit and thereby check rise in inflation rate, apart from reducing government expenditure, government revenue has to be raised. However, in recent years tax-GDP ration has declined. In 2007-08, tax GDP ratio was 12 per cent which came down to 10.4 per cent for the year 2012-13. Continuing on the path of fiscal consolidation with a view to narrowing the gap in Government spending and resources, the tax-GDP ratio has been targeted at 10.9 per cent in the 2013-14 (BE) with a nominal growth rate of 19.1 per cent.

However, this is not enough for fiscal consolidation to reduce fiscal deficit to 3% of GDP. The Finance Minister has not made genuine efforts to raise more resources through taxation. He has in his budget for 2013-14, has only levied a surcharge of 10% on income of those earning Rs. 1 crore or more. This is too low to yield enough tax revenue. With current income tax rate of 30% in this income bracket, it will means a super rich person will pay only Rs. 3 lakh more tax on his or her income of Rs. one crore per annum which is too small.

1. As regards mobilizing resources to increase public revenue, it may be noted that the policy of moderate taxes with simplified taxation structure should be followed. This will help to increase public revenue rather than reduce it. High marginal rates of taxes should be avoided as they serve as disincentives to work more, save more and invest more. Further, high marginal rates of direct taxes cause evasion of taxes.

However, in our view, the present marginal rate of tax in India is 30 per cent for above 10 lakh income per annum. This is too small. Besides, due to various exemptions effective rate has been estimated to be around 20 per cent. Therefore, there is need for introducing a higher income tax slab with 35% rate of income tax.

2. In India, the tax base is narrow for both direct and indirect taxes’, only about 2.7 per cent of population pays income tax. To increase revenue from taxation, tax base should be broadened by taxing agricultural incomes and incomes derived from un-organised industrial and services sectors. The various exemptions and deductions provided in the income and wealth taxes should be withdrawn to broaden the tax base and collect more revenue. It may be noted that the Indian experience of the last 50 years reveals that these exemptions and deductions do not promote the intended objectives.

3. As is well known, there is a huge amount of black money in the Indian economy which has come into existence as a result of tax evasion. A good part of black money is parked in Swiss banks. In the last VDIS (Voluntary Disclosure Income Scheme) in 1997-98, more than, 10,000 crores of rupees were collected. However, there has been huge increase in the amount of black money since then. Not only the current black money has to be mopped up but also tax evasion that occurs every year has to be prevented by strict enforcement of the tax laws.

4. The past experience has shown that various tax concessions which have been given in income taxes and indirect taxes for promoting employment, industrial development of backward regions and for other such social objectives do not actually serve the intended purposes and are largely used for evading taxes.

These concessions should therefore be withdrawn to collect more revenue from taxes and the social objectives should be served by adopting more effective policy instruments. Long-term capital gains on equity shares are exempted from income tax. In the context of boom conditions in the stock market, their exemption should be withdrawn to increase public revenue. They represent unearned incomes and canon of equity in taxation demands that this exemption should be withdrawn

To sum up, with the adoption of above measures of reducing public expenditure and enhancing public revenue, it will be possible to reduce fiscal deficit to a safe limit. The reduction in fiscal deficit will prevent the emergence of excess demand in the economy and thereby help in controlling inflation and achieving price stability.