Let us make an in-depth study of the changes that took place in the Indian economy with the launch of five year plans.

I. Quantitative Changes:

(i) Rising Rate of National Income and per Capita Income:

Economic growth of any country is measured by the increase in national and per capita real incomes. During the plan period, national income of the country has certainly gone up. In 1950-51, GDP at 1993-94 prices stood at Rs. 140,466 crores. It rose to Rs. 1,151,991 crores in 1999-00.

This means that between 1950-51 and 1999-00 national income grew at the rate of 4.4% per annum. Compared to the income growth in pre-independence period, this is really remarkable. This, of course, is the sign of an expanding economy. Despite fluctuations of national income during the plan period, national income growth exceeded the annual growth rate of population of 2.2%, resulting in a higher rate of capital formation.

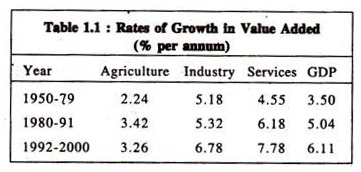

Table 1.1 shows the growth rate of GDP and of different sectors. There was a significant acceleration in GDP from 3.5% during 1951-79 to 5% during 1980-91 and a further acceleration to 6.1% during 1992-2000. No doubt this acceleration in the 1980s was commendable. But it was not sustainable as reflected by the crisis of 1991.

ADVERTISEMENTS:

The reform measures undertaken since 1991 have placed the economy on a higher growth path of above 6% during 1992-2000. No doubt India could not match the long-term performance of some of the newly industrialised countries of East Asia, the so-called tiger economies. But the GDP growth rate during the 1990s translates to a respectable growth rate of above 4% in per capita terms.

Per capita income (at. 1993-94 prices) increased from Rs. 3,687 to 10,204 during the same period. Yet, the growth rate of PCI is inadequate compared to the needs of the country.

(ii) Increase in Agricultural and Industrial Output:

Over the entire plan period, India achieved a positive growth rate of in both agricultural and industrial production. The index of agricultural production showed a rise of 2.8% per annum return 1950-51 and 1999-00. The performance of the industrial sector is certainly a better one. During the same period, the compered annual growth rate in this sector was 4.5% per annum (at 1993 – 94 = 100).

B. Qualitative Changes or Structural Changes:

During the plan period, the Indian economy witnessed structural changes as well. By economic structure we mean inter-relationship among the different productive sectors, i.e., agriculture and allied activities (known as the primary sector), manufacturing and industries (called the secondary sector) and trade and services (or, the tertiary sector). At a low level of economic development, one finds predominance of the primary sector.

ADVERTISEMENTS:

The predominance of any sector can be viewed from the sectoral composition of national income and occupational structure. When, in an economy, the primary sector is predominant, the contribution of this sector to national income is the largest. Moreover, the bulk of the population derives its livelihood from this sector.

On the other hand, in the sectoral composition of national income as well as in the occupational pattern, the importance of the secondary and tertiary sector is low. As economic development proceeds, the inter-relationships among these sectors undergo a change. With economic development the primary sector (from the standpoint of sectoral composition of national income and occupational pattern) loses its importance. By contrast the secondary and the tertiary sectors become more and more important.

Such, structural changes indicate economic development.

ADVERTISEMENTS:

The following structural changes have occurred in India during the plan period:

(i) Sectoral Composition of National Income:

In 1950-51, the contribution of the primary sector in India’s gross domestic product (GDP) was nearly 55.6%, while it was 15.2% for the secondary sector. There has been a steady decline in the share of the primary sector in GDP. It fell to 29.3% in 1999-00. On the other hand, over the plan period, as the secondary (industrial) sector expanded, its contribution to GDP rose to 23.9% in 1999- 00.

Furthermore, the services sector also registered a higher growth rate. In 1999-00 its contribution was about 46.8% (compared to 29% in 1950-51). Thus, it is clear that as economic development occurred during the last five decades of planning the primary sector lost its pre-eminence. This, of course, is a sign of structural change of the Indian economy.

Another important aspect of sectoral composition or national income is the share on contribution of public sector to GDP. As time progresses, the contribution of this sector rises. In 1960-61, the public sector contributed 10% to GDP. Its share rose to 25.6% in 1996-97, and has declined marginally in 1999-00.

Finally, one can notice a structural change by studying the contribution of the commodity sector and non-commodity or service sector in NNP. Between 1950-51 and 1999-00, rate of growth of the services sector was satisfactory as compared to the growth of the commodity sector.

During the period, the compound annual rate of growth of the primary sector was 2.8%, that of the secondary sector was 4.5% and of tertiary sector was 5.2%. The growth of the economy is no longer as vulnerable to agricultural performance as in the past. The share of agriculture in GDP has been diminishing more than half since independence reflecting the diversification of economy.

The slow growth of the commodity producing sectors was mainly due to the inadequate expansion of certain manufacturing industries, construction, gas, electricity, etc. On the other hand, the service sector witnessed a much faster growth. The expansion of the tertiary sector no doubt implies modernisation of the economy. Yet, in the Indian context the growth of the services sector at the expense of the commodity producing sector implies some sort of ‘structural retrogression’.

(ii) Occupational Pattern:

In the light of structural change, one finds India’s occupational structure a static one. But we know that as economic development takes place, the occupational structure also changes. The Clark-Fisher thesis says that in an expanding economy more and more people move from primary sector to secondary and tertiary sectors. With economic growth per capita income rises. In LDCs, a large portion of income is spent on buying goods mainly produced in the primary sector.

Obviously, most of the people remain engaged in this sector. The expenditure on food items- does not rise proportionately with the rise in per capita income. On the other hand, increased per capita income raises the demand for goods and services produced in the secondary and tertiary sectors.

ADVERTISEMENTS:

This causes a shift in the occupational pattern. This mean that the number of people engaged in the primary sector tends to decline while it tends to rise in the other two sectors. This type of change in the occupational structure of the population is another indicator of economic development.

But considering the development of the Indian economy in the last five decades, one finds an almost unchanged occupational structure. Throughout the last century, the percentage of people engaged in agriculture has not fallen appreciably. Even in 2001, 63% of the total population were engaged in the primary sector, compared to 72% in 1951. On the other hand, between 1951 and 2001 the percentage of population engaged in the secondary and tertiary sectors increased marginally from 11 to 13 and from 17 to 24, respectively.

Thus, the occupational pattern is not only a static one but also an unbalanced one. This is a symptom of economic underdevelopment.

The reasons behind such static occupational structure are the following:

ADVERTISEMENTS:

(i) Rapid growth of population;

(ii) Limited success in the agricultural sector and

(iii) Inadequate growth of both industrial and services sector.

(iii) Development of Basic and Heavy Industries:

Immediately after independence, India’s industrial structure was devoid of any heavy and basic industries. In other words, India’s industrial structure at that time tilted heavily in favour of consumer goods industries. But under the impact of planning, especially the Second Five Year Plan (1956-1961), industrial structure became biased toward heavy industries. Moreover, the industrial structure has been diversified and newer and newer types of industries have been setup. This symbolises economic development.

(iv) Social Capital Formation:

ADVERTISEMENTS:

By social capital we mean transport, irrigation, power, education, health, etc. Building-up of social capital is one of the prerequisites of economic development. So, social capital formation is equivalent to economic development. During the plan period, we have made rapid strides in respect of construction of railway lines, irrigation, power, etc.

Conclusion:

If all these are considered as criteria for development then we must say that the Indian economy has witnessed enormous changes which are not only synonymous with development but also help the process of development.

At the same time, it is true that we have been able to come out of the ‘low level equilibrium trap’ engineered by the British Raj (1757- 1947). Signs of development are positive in nature. Thus, we find both the pictures of development and underdevelopment. So, the Indian economy can be called an underdeveloped or a developing economy.