In this article we will discuss about:- 1. Meaning of Industrial Concentration 2. Methods of Measurement of Seller Concentration 3. Absolute Measures of Concentration 4. Growth of Monopolies and Concentration of Economic Power in India 5. Concentration of Economic Power 6. Extent of the Concentration of Economic Power in India and Other Details.

Contents:

- Meaning of Industrial Concentration

- Methods of Measurement of Seller Concentration

- Absolute Measures of Concentration

- Growth of Monopolies and Concentration of Economic Power in India

- Concentration of Economic Power

- Extent of the Concentration of Economic Power in India

- Forms of Concentration of Economic Power

- Causes of Concentration of Economic Power in India

- Evils of Concentration of Economic Power

- Findings of the Monopolies Inquiry Commission.

1. Meaning of Industrial Concentration:

Industrial concentration means sellers concentration. In other words, in a market some big firms have dominance over production and sales. The limit of this industrial concentration depends upon two main factors, firstly number of active firms in the given market, secondly, quantity of demand fulfilled by a firm out of the total market demand. If in a market number of firms is limited, the size of firms will be relatively big and a big firm will have the control over a large portion of total supply.

This situation is known as high quantity of seller (or industrial) concentration. High class industrial concentration depends upon the market power of every firm. Market power means the capacity of a firm or seller to influence the price of a product or commodity. In the perfect competitive market situation this market power is zero, which means the industrial concentration is zero. But more we move towards the monopoly market more the industrial concentration.

ADVERTISEMENTS:

ADVERTISEMENTS:

2. Methods of Measurement of Seller Concentration:

It is important to measure industrial concentration for many reasons. Firstly, one of the characteristics of the perfect competition is that there is large number of firms in the industry. Lesser the number of firms more is the concentration. For example in 1975, there were 50 firms in the Plastic and Synthetic Resin industry in U.K. Out of these 422 firms had a net production of 10% while the biggest firms had that of 40%.

Hence the market power of such firms which are less in number but big in size is more than those which are more in number but less in size. Secondly, it is necessary to measure industrial concentration because it indicates the ratio of concentration. For example Concentration Ratio (CR) 53.6% indicates that the biggest five firms produce more than 50% in this industry.

The methods of measurement of industrial concentration can be divided into two categories i.e. absolute and relative.

ADVERTISEMENTS:

ADVERTISEMENTS:

3. Absolute Measures of Concentration:

The central point of the absolute measurement is the absolute number of firms and their share in the production, employment or wealth of the industry.

Two absolute measurements are explained here as follows:

1. The Concentration Ratio (CR):

ADVERTISEMENTS:

In the concentration ratio, the share of production, sales, employment etc. of three, four or five biggest firms in the industry is measured. We take here only the analysis of production. For example production share of the biggest 10 firms is considered. Now we take an imaginary example of an industry where total number of firms is 40.

Out of these, the biggest 5 firms have a shape of total production as follows:

Firm A -10,000 Units.

Firm B -12,000 Units.

Firm C -9,000 Units.

Firm D -15,000 Units.

Firm E -13,000 Units.

Total Production of the five biggest firms – 59,000 Units.

Total Production in Industry—1,10,000

ADVERTISEMENTS:

Concentration Ratio of the Five firms – (59,000/1,10, 000) × 100= 53.64%

Hence the industrial concentration of 5 firms is 53.64%

Concentration Ratio can also be shown in the geometrical form. In this situation a cumulative concentration curve is formed.

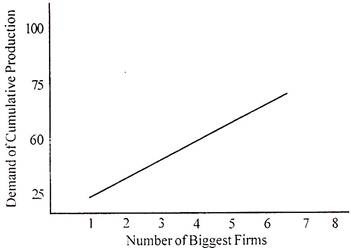

In the following graph this work is shown on the basis of the above figures:

ADVERTISEMENTS:

In this graph five biggest are shown on the X axis. Their share in the total production of the industry is shown on the Y axis. Out of these the first biggest firm has the production of 15,000 units, second firm have 28,000 units. Third big firm has 40,000 units, fourth big firm has 50,000 units and fifth big firm has 59,000 units production. When these concerned points are combined in the graph we get the cumulative concentration curve. Here D is notable that the height of concentration curve measures the degree of concentration.

For example more the height of curve of the four firms more the concentration ratio of these four firms. The degree of concentration in two or more industries can be shown or measured with the help of the related concentration curve. We require the related figures

from two or more industries. Different curves can be drawn from these figures, and conclusions can be drawn by comparing their heights.

The greatest difficulty in measuring the concentration ration, is the choice of n number of seller concentration. This choice is important but there is not any theoretical basis for this. Some traditions are followed in this context. For example in Britain concentration ratio of 3 to 5 firms is estimated, while in America concentration ratio of 4 firms is known.

ADVERTISEMENTS:

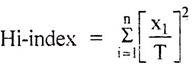

The Herfindahl Index:

This is an absolute measure of industrial concentration. Sometimes it is also known as Herfindahl Herschman index.

Under this method instead of some big firms all the firms in the industry are considered. H-index can be defined as follows:

where,

n = Number of firms in industry.

ADVERTISEMENTS:

x = Absolute degree of firm production.

T = Total production of the industry.

It is clear that in H index all the firms in the industry are included in calculation. The value of this index is between zero and one. When the number of firms of equal size is much more in any industry the value of this index is considered zero. On the contrary when there is only one firm in the industry, its value is 1.

H-index can be understood by a simple example. Suppose there are only 4 firms in an industry and production of every firm in the industry is 500, 350, 300 and 200 units. Hence the value of T is 1350, share of every firm in the total production of industry is[x1/T]2 means 0.372, 0.262, 0.222 and 0.152 so, the value of H index is 0.275. As this value is much near zero, it shows that the level of concentration is not more in the industry. This index is used to know the degree of concentration in different periods in the industry.

2. The Relative Measures of Concentration:

In this measure the main stress is given on the inequality of firms. That means that in a market, firms of unequal sizes also have unequal degree of production. The relative measure of seller concentration can be measured by the help of Lorenze Curve. Its algebra synonym is Gini-coefficient of Gini concentration.

ADVERTISEMENTS:

Gini Concentration Ratio:

This is a statistical measure which is based on Lorenze Curve:

Gini co-efficient of inequality the value of Gini co-efficient is between 0 and 1. If all firms are of equal size, the equality line and Lorenze Curve will be same. In this position the value of Gini co-efficient will be zero. More he inequality grows, more the value of Gini co-efficient will grow.

4. Growth of Monopolies and Concentration of Economic Power in India:

Monopoly Situation:

ADVERTISEMENTS:

Monopoly situation is s situation in which a group of producers acts and behaves in such a way that it begins to effectively control the supply of a particular commodity. Monopoly can be of different forms. Monopolies have their own advantages as well as disadvantages.

These days there is an increasing demand that Monopolies should be checked and controlled, for which different steps and already of Monopolies and developing nations are taking particular steps for their control, so that the masses are not exploited and welfare of the people is not ignored.

Monopoly situations and conditions are prevailing in all economics, either in one form or the other. Though some of the nations are trying to check monopolies, yet the fact remains that these are rapidly increasing and not being checked; because the system has its own advantages.

Monopoly Defined:

Monopoly is a situation in which a group of persons is in a position to end competition in a particular commodity and control sale and supply of that commodity. That group is also in a position to influence its prince. An extreme Monopoly situation arises when a firm o group of closely connected and interested persons only begins to produce a particular commodity.

In the words of Stonier and Hague, “The pure monopoly, as we may call it, will occur when a producer is so powerful that he is always able to take the whole of all the consumer’s income whatever, be the level of his output.” Similarly Liftwich has said that, “Pure Monopoly is a Market situation in which a single form sells a product for which there are no good substitutes.” From both these definitions it becomes clear that under monopolies there is sole right to supply the product or service thus collected.

ADVERTISEMENTS:

In Perfect Monopoly Possible?:

Perfect monopoly situation is not possible in the world. For production, distribution and pricing there must be some sort of competition, though in some cases it may be very though, while in others only normal. It will be only an ideal situation in which competition can be completely eliminated.

Form of Monopoly:

A monopoly situation provides the monopoliser with an advantage of fixing the price, and produce quality of goods or distribute them in the way he lakes and as such every person or business house is in a position to have monopoly.

This monopoly is created either by an individual with his vast resources, or by combining together and thus pooling their resource or groups of industries coming together so that mutual competition is avoided and monopoly is created.

The monopolies may be classified as:

(a) Natural Monopoly;

(b) Legal Monopoly;

(c) Social Monopoly and

(d) Voluntary Monopoly.

(a) Natural Monopoly:

This is monopoly in which individual has less and nature has more roles to play. In its nature blesses the nation with bounties in a particular commodity and that is available in that country, which can control that in the way that likes. Arab nations oil monopolies and they can control the world economy is so far oil and oil products are concerned. In it the people have contributed less, whereas nation has contributed far more.

(b) Legal Monopoly:

In some cases, a product does not exist or if that exists that is comparatively less or unknown. An organisation an individual works hard, carries out research, spends his life and is in a position to produce and market that. He feels that his product is being well received and does not wish that any individual or organisation should take advantage of his labour.

He gets his trade mark and formula registered with the Government by paving fixed fees. After that has been accepted no one else can either use formula or trade mark; that then becomes his absolute monopoly. It is called legal monopoly. We find that in every country patent marks are registered with the state.

(c) Social Monopoly:

In every society there are certain civic amenities and facilities to be provided to the citizens. Therefore, an organisation may be allowed to provide those facilities e.g., in Delhi, electricity is supplied by Delhi Electric supply undertakings or water is supplied Delhi Water and Sewerage Department and so on. This type of organisation which is solely responsible for the supply of a particular civic amenity is staled to be enjoying a social monopoly in that commodity.

(d) Voluntary Monopoly:

It is also known as combination. In it some of the producers dealing in the same commodity come nearer and closer to each and combine in one form or the other so as to avoid competition. There is no external force or compulsions to join or to combine, that is why it is called voluntary monopoly. Such a monopoly can be in the form of Trusts or cartels.

This voluntary monopoly can be both vertical and horizontal. A vertical combination is also known as integration. A horizontal combination can be in the form of pools, holding company and complete merger.

Monopolies are not very much appreciated these days because it is felt that socially these are harmful than useful to the society.

Monopoly and Concentration of Economic Power:

Monopoly refers to the control on production or distribution of any commodity by any institution or firm. So, market power is essential for monopoly. State of monopoly can be found even in small scale industries. On the contrary concentration of economic power means centralisation of effective control over important economic activities (Industry, Agriculture, Transport etc.) to decide, to make jobs available and on the stream of income and wealth in the hands of some persons or groups.

In India concentration of economic power has been occurred through monopoly. Thus monopoly is the means through which concentration of economic power flourishes and its flourishing enhances the power of monopolistic institutions.

5. Concentration of Economic Power:

To check concentration of economic power and diffuse and decentralise economic power has become the accepted goal of a modern economy. Concentration of power in a few hands is a negation of social justice since it leads to larger inequalities of income and wealth.

In free enterprise economies and in mixed economies with an important role for the private sector there exists a tendency for the economic power to be concentrated in a few hands. In India a few big business houses each being controlled by members of a family or house wield large economic power.

The economic power is manifested in the control by few big businessmen over the price of industrial products, the attempt and pattern of investment and the choices of technology and therefore over the creation of employment opportunities in the economy.

6. Extent of the Concentration of Economic Power in India:

In a developing economy such concentration of economic power widens the gap of disparity in income and wealth, which is harmful to the development of the country. This malady is growing fast in India. Many committees were formed to study it and to suggest remedies.

1. Mahalanobis Committee (1960):

According to this committee, the working system of the planned economy has encouraged the growth of big companies in Indian industries. These received financial assistance from Indian Industrial Finance Corporation, National Industrial Development Corporation etc., which are public institutions. These have derived more profit of tax reliefs and other facilities.

2. Monopoly Enquiry Commission (1964):

Monopoly Enquiry Commission (1964) has studied the extent, effect and causes of this concentration and concludes that, “Concentration has been promoted more by way of planned economy which was adopted for rapid industrialisation in the country.” The main causes, according to the commission, are defective licensing system and discrimination in availability of institutional loans.

3. Other Committees:

Hazari Committee Report (1966) and Batta Committee (1967) have also underlined that big houses had adopted corrupt means for getting licences. 8% big houses received 38% licences.

Extent of Concentration:

According to the Mahalanobis Committee, in 1960-61 86% companies (which have paid up capital less than Rs. 5 lakh) had only 14.6% of the total paid up capital in the country while Big Companies having paid up capital above 50 lakh, and which are only 1.6% in number had 58.1% of the total paid up capital of the corporate world in the country.

Monopoly Enquiry Commission found out that there is high grade of concentration in 65 commodities, medium in 10, low in 8 and zero in 17, and 2259 goods under study. These are controlled by 82 Industrial houses.

According to the Sachhar Committee, “Top 20 houses had 89.4% growth in their assets during 1972-78.” They had assets of Rs. 648 crores in 1951, which were multiplied nine times up to 1978 (5795 crores).

Current Position:

According to the Economic Times Research Beareau, in 1987-88, There are 251 big companies in private sector in which 101 are considered Jiant’ and 150 as mini Jiant. Rs 29,720 crore were invested in the Jiants’ The Biggest in these is the Reliance Industries (which had 250,00 crore rupees assets in 1988). Next come Tata Steel, Larson & Tubro, Tata Engineering. J. K. Synthetics, and Southern Petro-Chemicals.

In 1987, Tata Group had the biggest assets. Then came Birlas and Reliance. Five Toppers out of 20 have increased their assets from 7312 crores in 1983 to 14311 crores in 1987 that is 95.7% growth during the period of 5 years. Also they controlled 58.4% of the total resources under the top 20.

This means that the utmost concentration has been in these 5 toppers. Among these five, Reliance stood first in the growth rate, i.e., 259.2%. Among 20, Chidambaram Group had the most spectacular growth rate. During 4 years it had 910% growth in its assets; it has leaped up from the 47th position in 1983 to 9th in 1987.

7. Forms of Concentration of Economic Power:

Monopoly Enquiry Commission has mentioned two forms of concentration in 1964:

1. Product-Wise Concentration:

When a production or distribution of any commodity or service is controlled by any person or group, it is called product-wise concentration.

It is divided in three parts:

(a) High Concentration:

On 75% or more by 3 main producers or distributors.

(b) Medium Concentration:

On 60% to 75% by 3 main producers or distributors.

(c) Low Concentration:

On 50% to 60% of production or distribution by 3 main producers, if the concentration is less than 50% it will not be considered as concentration.

2. Country-Wise Concentration:

If ownership or control of most enterprises engaged in production or distribution of different goods is in the hands of one person, family or industrial group it is called country-wise concentration.

8. Causes of Concentration of Economic Power in India:

In a rapidly rising and growing economy like India some degree of inequality and concentration of economic power and wealth in a few hands is to be expected, but the disturbing things is that the degree of inequality and concentration is very much more that can be justified on a ground.

The following are the major causes for concentration of wealth and economic power in few hands:

1. Government Policies:

The Dutta Committee (1969) pointed out nearly that the Government of India never specified clearly to the licensing authority the objective of preventing concentration of economic power or monopoly.

2. Rule of Government Financial Institutions:

The financial institutions contributed to the growth of concentration of wealth and economic power. The financial institutions were set up with the ideal of helping the private sector. But the large industrial houses managed to influence its lending policies of those institutions. The Dutta Committee found that about 56 per cent of the total assistance provided by the IFC, IDBI etc. had gone to the large industrial houses.

3. Guidelines of Large Industrial Houses:

So, after independence the Government of India launched upon a programme of massive economic development. The government provided financial, tax benefits, etc. for the promotion of the private sector. The industrial houses which were already in the field saw the abundant chances for their growth and expansion. They took full advantage of the concessions.

4. Role of Commercial Banks:

Before Bank nationalisation the large industrial houses controlled the banking system. The bank deposits coming from the general public were used exclusively for financing industries owned and managed by large industrial houses. Even after nationalisation in 1969 there was not much of a change in the lending policy of the nationalised banks.

5. Inter-Company Investments:

Inter-company investment means, purchasing shares of a company by other company. Big companies or Industrial groups purchases stock of other companies on large scale and make them as their subsidiaries.

6. Technological Progress:

Big firms can reduce the production cost through modern technology due to their sound financial condition. Thus they get large economies and become more powerful.

7. Managing Agency System:

This system has greatly controlled in the development of big companies by providing financial assistance. These maintained their credit through intercompany investments. Though the system was abolished in 1970, its dominance still remained upon industrial groups.

8. Monopolistic and Restrictive Trade Practices:

Monopolistic firms adopt such practices as creating artificial shortage of goods, and get high prices, decide high distribution rates of goods, exploit the consumer by distributing market among themselves. Sell goods on different prices to different purchasers, rejecting sales to some buyers or by other producers etc.

9. Strict Import Policy:

After independence the Government had given protection to various industries, and restricted imports. This resulted in imposing monopoly by some Indian producers upon the market.

10. Foreign Collaboration:

After independence India has accepted foreign collaboration on large scale. Foreign industrialists prefer to collaborate with big firms. Thus their dominance got increased.

11. Taxation Policy:

Government offers many concessions on starting new industries, such as relief in income tax and sales tax. Grants are also provided. Big industries derived utmost advantage from this.

9. Evils of Concentration of Economic Power:

1. Concentration of economic power is associated with monopolies and therefore with high prices and exploitation of consumers.

2. The small scale units are not in a position to compete with them without the development of small and cottage industries concentration of economic power cannot be diffused.

3. The large profits made by the rich people are usually spent on luxurious consumption, this creates demonstration effect and as a result propensity to consume of the other people is raised. This reduces the rate of saving.

4. The big businesses block the entry of new young entrepreneurs in the industrial field by the use of their advertising strength and large resources and influence.

5. Big businesses use their resources to corrupt officials and politicians. To quote the words of the commission appointed by the government of India, “We cannot ignore the unfortunate reality that some big business houses do not hesitate to use their deep pockets to try to corrupt public officials in the attempt to continue and increase their industrial domain.”

In view of the serious evils of concentration of economic power steps should be taken to check this concentration and ensure wider diffusion of economic power. Small scale industries, cooperative enterprises should be encouraged.

10. Findings of the Monopolies Inquiry Commission:

i. Causes of Economic Concentration:

According to the Commission, the development of joint-stock companies and the economies of scale arising out of continual technological advancement that was taking place were the main causes of increasing concentration of economic power in the private corporate industrial sector.

The Commission noted. “The evolution of the corporation has made it possible for captains of industry to use these economies of scale to their greatest advantage.” An industrialist holding a small percentage of share capital was in a position to collect through the scale of shares vast amounts of money and acquire control over the industrial establishments and the process went on in a snowballing manner— controlling other companies through the originally promoted company, a third company through the first and second company and so on.

ii. Managing Agency System:

Along with the joint-stock form of business organisation and economies of scale, the managing agency system played a vital role in bringing about industrial concentration in the private corporate industrial sector. Dearth of management skills in the country result in vesting enormous economic power in the’ hands of those who had the capital to function successfully as managing agents.

Acquiring shares of another industrial company by one company and continuation of this process gave enormous economic power to the managing agents, which led to increasing the number of companies in control of each managing agent.

Another device was inter-locking of directorships. The same boards of directors in several industrial establishments producing similar product or producing the needed raw materials and engaged in the production of allied products resulted in increasing economic concentration in a few hands or in a few industrial houses.

Also, large fortunes amassed during the Second World War (1939-45) helped entrepreneurs to promote new industrial companies when the country became independent in 1947 and the Five Year Plans with emphasis on rapid industrialisation began to the implemented since 1951 and especially with the commencement of the Second Five Year Plan (that is, after 1956).

iii. Sale Out of British Firms:

Also, when the country became independent, many industrial houses in India managed to acquire industrial establishments of British and other foreign nationals who sold them and left India for good. This had the effect of accentuating economic concentration.

iv. Licensing Policy:

Further, acceleration of the concentration of economic power in the private corporate industrial sector took place because of the system of industrial licensing, control of capital issues and regulation of imports due to the difficult balance of payments position in the country.

The already well-established industrial companies could take advantage of their position in securing additional licences for expanding the already existing industrial units or starting new ones, and securing permission for additional capital issues, additional imports and so on.

v. Additional Funds:

The big industrial houses were in a more favourable position to raise additional funds because of their well- established connections and past experience; licensing authorities preferred to give additional licences to companies already well- established than to some unknown industrial concerns; well-established companies could get additional licences because of their ability to manage to get foreign collaboration agreements, foreign companies naturally preferring already well-known industrial companies rather than entering into agreements with some unknown companies; new companies found the procedure for obtaining licenses extremely complicated and time-consuming and almost beyond their capacity.