Read this article to learn about the three theories of inflation, i.e., (1) Demand Pull Inflation, (2) Cash Push Inflation, and (3) Mixed Demand Inflation.

1. The Demand-Pull Inflation:

The theory of demand-pull inflation relates to what may be called the traditional theory of inflation.

The essence of this theory is that inflation is caused by an excess of demand (spending) relative to the available supply of goods and services at existing prices.

According to classicals, the key factor is the money supply because in accordance with the quantity theory of money only an increase in the money supply is capable of raising the general price level.

ADVERTISEMENTS:

In modern income theory, however, demand-pull is interpreted to mean an excess of aggregate money demand relative to the economy’s full employment output level. The theory assumes that prices for goods and services as well as for economic resources are responsive to supply and demand forces, and will, thus, moves readily upward under the pressure of a high level of aggregate demand.

Economists like Friedman, Hawtrey, Golden Weiser, who regard inflation as a purely monetary phenomenon, strongly support this theory of inflation caused by excess money supply. The excess demand in the economy develops owing to large-scale investment expenditure either in the public or in the private sector, thereby exceeding the total output.

As a result of this excess demand, prices will rise and excess demand inflation or demand-pull inflation comes to exist. Thus, we find that according to this theory of demand-pull inflation, prices rise in response to an excess of aggregate demand over existing supply of goods and services caused by an increase in the quantity of money—resulting in a fall of interest rates—increasing investment expenditures and prices. But demand-pull inflation may also be caused without an increase in money supply—when MEC or MPC goes up causing an increase in expenditures and hence prices. Since inflation is due to excess demand, it is considered controllable by the demand reducing monetary and fiscal policies.

Excess demand approach is further developed by Bent Hansen, Keynes, Wicksell and Sweedish economists. Their view is that the general price is determined by the total demand for and total supply of goods just as the price of any good is determined by the forces of demand and supply for it.

ADVERTISEMENTS:

According to them inflation is a situation caused by excess demand, in which the total demand for goods as measured by the volume of money offered is in excess of supply of goods at prevailing prices. But a deeper analysis will show that there is very little difference between the two approaches, that is, the approach of quantity theory supported by Milton Friedman that excess demand is caused by excess money supply and Bent Hansen-Keynes approach that excess demand is caused by increased expenditures on C and I, especially when it is realized that excess demand can become effective only by means of an increased supply of money.

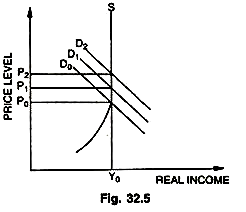

The Figure 32.5 shows that pure-demand-inflation theorists tend to assume that at some income level Y0 in the Figure corresponding to full-employment, the aggregate supply function becomes completely inelastic, as drawn. No income level lower than Y0 is a full-employment one, and increases in demand beyond D0, to D1 and D2 raise the price level from P0 to P1 and P2.

Inflation is a dynamic disequilibrium process. It implies a steady increase in the price level over time. Thus excess demand inflation implies that the IS and/or the LM schedules continue to shift upward over time so that excess demand for goods and services is perpetuated and general equilibrium is never established. Although an increase in the price level would normally tend to clear markets, this does not take place if demand continues to increase as fast as prices rise. Ultimately an excess demand inflation which is not fed by an expanding money supply must come to an end.

ADVERTISEMENTS:

When interest rates rise to a high enough level, the demand for money will become totally inelastic with respect to the rate of interest. At this point there are no more speculative balances to be had, attempts to borrow funds either will be frustrated or, because of the resultant increase in interest rates, will cause the abandonment of other ventures. When the demand for money becomes inelastic, all funds are used for transaction purposes, and further increases in the aggregate demand can then be financed only by a reduction in expenditures elsewhere in the economy or by an increase in the transactions velocity of money. Thus, ultimately money supply is the causal factor.

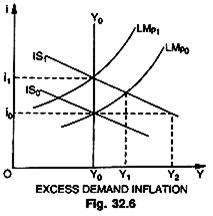

Consider the diagram 32.6, which analyses the working of excess demand inflation irrespective of the fact whether excess demand is caused by increased money supply or by expenditures on C and I. Fig. 32.6

Let us suppose that the full-employment level of output remains fixed at Y0. General equilibrium is established at Y0 and i0 with price level p0. An increase in the price level may now come about as a result of an increase in aggregate demand, which shifts the IS0 schedule to IS1; the resulting excess demand of Y1 – Y0 leads to a bidding up prices so that the real value of the money supply shrinks and the LMp0 schedule shifts to LMp1, where general equilibrium is again established at the higher interest rate i1 and higher price level p1.

2. Cost-Push Inflation:

The theory of cost-push inflation became popular during and after the Second World War. This theory maintains that prices instead of being pulled-up by excess demand are also pushed-up as a result of a rise in the cost of production. Under cost-push inflation prices rise on account of a rise in the cost of raw materials, especially wages. The theory holds that the basic explanation for inflation is the fact that some producers, group of workers or both, succeed in raising the prices for either their product or services above the levels that would prevail under more competitive conditions.

In other words, inflationary pressures originate with supply rather than demand and spread throughout the economy. Inflation of the cost-push type originate in industries which are relatively concentrated and in which sellers can exercise considerable discretion in the formulation of both prices and wages. Cost-push inflation may not be possible in an economy characterized by pure competition.

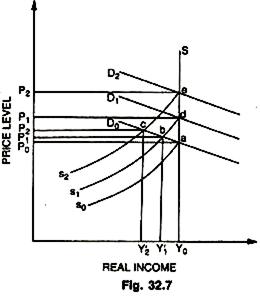

Since this inflation is due to the forces of cost and supply, it is not subject to easy treatment because fiscal and monetary measures may cure a cost inflation only at the expense of increasing unemployment and slower growth. That is why many cost-push inflation experts advocate mitigation rather than elimination of inflation. The Figure 32.7 illustrates the pure cost-push inflation phenomenon:

Figure 32.7 shows that according to pure supply (cost-push) inflation theorists—in societies of oligopolies, unions and other pressure groups the aggregate supply curve moves upwards from S0 to .S1to S2 whatever may happen to aggregate demand. A usual characteristic of such markets is that the money wage rate is inflexible downward, the result of which is an aggregate supply curve of the kind shown by S0S. With the initial SoS and D0 curves in the Figure 32.7, we can turn to the process by which increases in the money wage rate push up the price level. We assume that there is an increase in the money wage rate that results entirely from the exploitation of the market strength of labour unions and in no part from increased productivity of labour or increased demand for labour. Increase in wage rate has pushed S0S curve to S1S.

The price level at which each possible level of output will be supplied increases proportionally with the increase in the money wage rate. With aggregate demand of D0, the result of the higher money wage rate and the resultant upward shift in SS function from S0S to S1S is a rise in the price level from P0 to P1 and a fall in the output level from Y0 to Y1 (which results in unemployment).

ADVERTISEMENTS:

Thus, the rise in price level is accompanied by the appearance of unemployment. Further increase in money wage will bring further upward shifts in the SS curves (e.g., S2S). Each increase in money wage rate leads to a higher price level, lower output and higher unemployment. If left to increases, such increases in the money wage rate cannot continue indefinitely as the worsening unemployment that follows each such increase may be expected to restrain the Unions’ demands for ever higher money wage rates.

Thus, this group of economists says that the process of inflation is caused not by an excess of demand but by increase in cost, particularly when factors of production try to increase their share of the total product by raising their awards or factor costs called cost-push inflation.

It is caused by the monopoly elements either in the labour market when there is wage-push or in the commodities market when there is profit-push but mostly it is due to wage-push which increases the cost of production and hence prices. It has been observed recently that in many countries labour unions have become very powerful so that they are able to get wage increases almost every year greatly in excess of the overall average increase in output per man-hour.

ADVERTISEMENTS:

According to an important variant of the cost-push theory, sectoral shifts in demand are the main causes of the inflationary process. For example, when the prices of tractors go up due to high prices of steel, the costs of agricultural products like food may go up necessitating a further rise in wages and so on. Thus, cost-push inflation once set in motion in one industry or sector, spreads like wildfire in the whole economy.

The revival of cost-push inflation theory was staged by Willard Thorp and Richard Quandt in their work ‘The New Inflation’ published in 1959. They emphasised the fact that cost-push inflation is caused by wage increases due to strong trade union activities on the part of labour. The wage increase and the rising cost of various inputs provide the initial impulse to inflation. It is due to rising cost on account of wages that workers and employers try to include escalator clauses in labour contracts, agreeing to raise wage rates as soon as there is a rise in the cost of living index.

Escalator clauses provide for monetary correction on account of the facts of inflation, a measure also known as indexing. Under it as the inflation increases, the real income of labour is protected by equivalent wage increases. This, in turn, gives rise to cost-push inflation. Another variant of cost-push inflation is administrative inflation, which can occur during recession, recovery or shortages or simultaneously with demand-pull inflation.

In some industries or in case of certain goods, prices are determined less by demand and supply and more by administrative action, for example, when management in some industries raise prices in an attempt to increase profits, it results in administrative inflation. This has happened in steel, cement, coal, oil industries in the world and in India where there has been 30 to 50 per cent increase in prices despite high unemployment of both men and machines. However, both monetarists and Keynesians reject the idea of administrative type cost-push inflation—in fact monetarists reject all versions of cost-push inflation. Are there no limits to the extent to which this merry cost-push chase of wages after prices and prices after wages can be carried? Consider the adjacent Figure 32.8.

ADVERTISEMENTS:

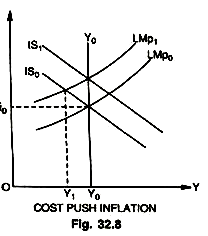

In this Figure general equilibrium prevails at Y0, i0 and p0. A price increase instigated autonomously by monopolistic business groups or as a result of wage pressure raises the price level to p1 and thus shifts the LMp0 schedule to LMp1. But at the new equilibrium between the IS and LM functions the level of output is below the full-employment level and, thus, there will be un-cleared markets and pressure on wages and price to return to their former level.

It looks, then, as if a general wage-price increase will create a situation in which all the higher priced output will not be bought, and this means that cost-push inflation is not likely to be self-sustaining as is sometimes believed. The rise in wages and costs leading to rise in prices (wage-price spiral) will come to an end. Though the theory of cost-push inflation does tell us that in order to reduce unemployment a slowly rising price level is better than slowly sagging price level.

3. Mixed Demand Inflation:

The problem of identifying the basic nature-and fundamental source of inflation continues. Does inflation arise from the demand side of the goods, factor and asset markets or from the supply side or from some combination of the two—the so-called mixed inflation. Many economists have come to believe that the actual process of inflation is neither due to demand-pull alone, nor due to cost-push alone, but due to a combination of both the elements of demand-pull and cost-push—called mixed inflation.

The process may be initiated either by demand-pull or by cost-push but it cannot be maintained unless other forces also operate activity. The major difference between the two theories of the inflationary process centres on the responsiveness of both the money wages and prices to change in demand. Those who believe that there is wage and price flexibility in the economy argue in favour of demand- pull inflation; because such flexibility renders it impossible for any cost induced inflationary trend to sustain itself.

On the other hand, those who believe that wages and prices are not flexible emphasize the cost-push theory or inflation. Neither approach taken by itself should be considered a completely satisfactory explanation of the cause and nature of inflation—both the approaches are supplementary rather than competitive (or alternative) as explanations of the cause of inflation. The adjacent Figures show cases of mixed inflation.

ADVERTISEMENTS:

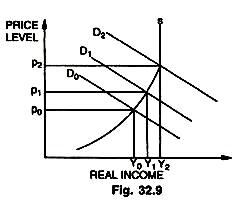

One variety of mixed-inflation theory (in Fig. 32.9) denies for several reasons (one of them money illusion), that aggregate supply is price-inelastic at full employment. In the Fig. 32.9 (Y0, P0), (Y1, Y1,) and (Y2, P2) are all full- employment positions in that no involuntary unemployment exists. The first corresponds to A.P. Lerner’s “low full employment” with substantial voluntary unemployment, and the last to his “high full employment” with little or none.

The region between low and high full employment was called by Keynes “semi-inflation” in contrast to the true or full inflation. Mixed inflation theorists usually think society prefers the couple (Y2, P2) to other alternatives, even when all three are full-employment positions. In this type mixed inflation does not continue after (Y2, P2) is reached. In this respect, the solutions related more closely to demand than to cost inflation.