Read this article to learn about the seven types of inflation on the basis of rate of increase of prices, i.e., (1) Currency Inflation, (2) Credit Inflation, (3) Deficit-Induced Inflation, (4) Profit-Induced Inflation, (5) Open Inflation, (6) Suppressed or Repressed Inflation, and (7) Latent Inflation.

1. Currency Inflation:

It is caused when the rise in the price level is the consequence of expansion in currency or printed money in the economy.

2. Credit Inflation:

When the prices rise on account of an expansion in the bank credit, it is called inflation.

3. Deficit-Induced Inflation:

ADVERTISEMENTS:

When the prices rise on account of the deficit in the government expenditure (i.e., when the public expenditure exceeds public income), there is expansion of money and credit resulting in inflation. Since it is induced by deficits in the public expenditure, it is called deficit-induced inflation.

4. Profit (Wage)-Induced Inflation:

When the prices rise on account of rise in profits and Wages, it is called price-induced or wage-induced inflation.

5. Open Inflation:

Open inflation is another name of ordinary price inflation under which the price level keeps on rising and there is no check against it. In other words, the gap between the increase in quantity of money and the increase in the volume of goods and services becomes so glaring that everybody talks of open inflation.

According to Milton Friedman—open inflation refers to “the inflationary process in which prices are allowed to rise without being suppressed by government price control or similar techniques”. The inflationary conditions in Germany and Russia in 1920s and in China and Hungary during 1940s were clear instances of open inflation. It assumes different forms, for example ‘creeping inflation’ when prices rise but slowly.

ADVERTISEMENTS:

As the time passes, creeping inflation gives way to walking inflation, when the price rise is more marked and this in turn changes into running or galloping inflation, when price changes are very fast; in fact, they rise at a terrific speed. It is also called hyper-inflation. The nature of creeping inflation has been aptly compared with a newly born child who ceases to creep after some time, learns to walk, runs and finally starts galloping. The walking and galloping inflation differ from creeping inflation in the degree or rapidity with which prices rise. In creeping inflation prices rise by fits and starts.

Hyper-inflation is a phenomenon that usually accompanies war and its aftermath. It impairs production besides creating terrific social consequences. It replaces investment and thrift by hoarding and speculation. Under circumstances of hyper-inflation government bonds, saving deposits, insurance policies and other types of fixed interest yielding assets that generally appeal to small savers become traps through which the value of savings is eroded by a rising price level.

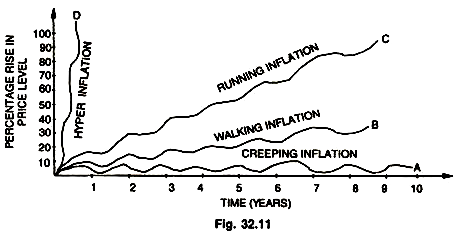

The Fig. 32.11 shows the different types of inflations as mentioned above:

This figure show the creeping, walking, running and hyper- inflation, with the help of curves OA, OB, OC and OD respectively. The curve OA shows the creeping inflation which the price level is about 10 per cent decade (in ten years). In case or running of galloping inflation, the price rice is much more violent and over a decade the price rice is almost by 100 per cent. This is shown by the curve OC.

The extreme case of hyper- inflation is shown by the curve OD where the price level rises even by more than100 per cent in less than a year. In other words, in case of hyper-inflation, there is practically no limit to the rise in prices Prof. K. Kurihara believes that hyper-inflation may be caused on account of the abnormal behaviour of the consumers and investors. It may be caused on account of two factors: (a) Either MP may be unity or greater than unity (b) or the marginal propensity to invest C may be greater than the marginal propensity to save

6. Suppressed or Repressed Inflation:

Suppressed inflation refers to a situation in which the government intervenes directly to control the price system through various measures because no government can allow the prices to rise beyond limits; especially during war periods we find that “to avoid the harmful effects of rising prices, controls and rationing may be imposed which prevent households and firms from buying as many goods and services as they would like to buy at existing prices and income levels”, resulting in huge savings because they could not spend it during war.

Thus, if by means of rigid controls, the public are prevented from spending their money income “the inflation may show itself not in rising prices but in the accumulation of cash, bank balances and other forms of en-cashable private wealth in the hands of the people.” Such a development is described as suppressed inflation because the volcanic forces which keep pushing prices up are very much there and might burst any time, if they get the opportunity, resulting in open inflation.

7. Latent Inflation:

Economists also speak of latent inflation. This situation arises when large amount of savings or funds (especially during war) come into existence and a wait spending because goods are not available or entrepreneurs are unable to book orders. As soon as the situation changes, these savings are let out and may generate inflation.