Let us make an in-depth study of Interest. Read this article to learn about-:

1. Meaning of Interest 2. Definition of Interest 3. Why Interest is Paid or Charged 4. Types of Interest 5. Elements of Gross Interest 6. Factors Influencing the Rate of Interest 7. Grounds in which Payment of Interest is Justified 8. Additional Information.

Meaning of Interest:

In simple meaning interest is a payment made by a borrower to the lender for the money borrowed and is expressed as a rate percent per year.

It is usually expressed as an annual rate in terms of money and is calculated on the principal of the loan. It is the price paid for the use of other’s capital fund for a certain period of time.

ADVERTISEMENTS:

In the real economic sense, however, interest implies the return to capital as a factor of production. But for all practical purposes, “interest is the price of capital.” Capital as a factor of production, in real terms, refers to the stock of capital goods (machinery, raw-materials, factory plant etc.).

In the money economy, however for all practical purposes capital refers to finance or money capital i.e., the monetary fund’s lent or borrowed for any purpose of expenditure from any source. In strict narrow sense, again, capital may refer to only funds borrowed for real investment in business by the business community from financial institutions.

Definition of Interest:

In economics, Interest has been defined in a variety of ways. Commonly, Interest is regarded as the payment of the use of service of capital.

1. As Prof. Marshall has said – “The payment made by borrower for the use of a loan is called Interest.”

ADVERTISEMENTS:

2. According to Prof. J. S. Mill – “Interest is the remuneration for mere abstinences.”

3. As Prof. Keynes has said – “Interest is the reward of parting with liquidity for a specified period.”

4. According to Seligman – “Interest is the return from the fund of capital.”

5. According to Carver – “Interest is the income which goes to the owner of capital.”

ADVERTISEMENTS:

6. According to Richard – “Interest is primarily a reward for waiting.”

7. As per the opinion of Prof. Wicksell – “Interest may be defined as a payment made by the borrower of capital by virtue of its productivity as a reward for his capitalist’s abstinence.”

But the modern economist in order to avoid the divergent and controversial views about Interest, have explained it in terms of productivity, saving, liquidity and money. In other words, Interest is the reward for the yield of capital, of saving, for the foregoing of liquidity and the supply of money. Thus, they have explained it in terms of the demand and supply of money

Why Interest is Paid or Charged:

There are two views regarding Interest paid or is charged:

(i) From Debtor’s point of view,

(ii) From Creditor’s point of view.

From Debtor’s Point of View:

Debtor’s pay interest on capital because he is aware that capital has productivity and if it can be used in production there can be increase in income. Therefore, out of the earned income, a part of the income is paid to the creditor or a lender from whom money has been taken as loan is known as Interest.

Following are the important reasons for giving Interest:

Use of Capital:

ADVERTISEMENTS:

Whatever amount is paid to the owner of the capital for the use of the capital is known as Interest. Here, the capital is used in further production and whatever he earns, he pays a part of his earnings to the owner of the capital or the lender of the money.

Reward for Risk:

Loan giving is a risk which lender takes at the time of giving loan or advancing money. Lender exposes himself to risk when he lends money and sometimes the loan become bad-debts. Therefore, it has been said that Interest is the reward for risk taking.

Interest is Reward for Inconvenience:

ADVERTISEMENTS:

When a lender gives loan of money he forgets its use for the duration of the loan, if he needs this amount for his personal use, he will have to undergo the inconvenience of arranging it from some other source. Thus, he feels inconvenience.

Expenses in Relation to Management of Business:

For organising and running the business, businessman needs money. Money taken as loan for running and managing business, keeping accounts, maintaining standard of business etc. one has to arrange money and for that has to pay interest over the money.

From Creditor’s Point of View:

Creditors or lender of money demands Interest because he has taken pains in saving money, has suffered inconveniences in postponing his needs and has taken risk of bad debts. If he will not get Interest or some advantage of Interest he may loose interest in saving money or he may not be ready to bear inconveniences. Then, the formation of capital in the market will stop. Therefore, it can be said that the debtor’s give Interest to creditors as capital has productivity and creditors demand interest as the lender of money has taken risk and has faced inconveniences, so he must get some reward for the pains of inconvenience and risk.

Types of Interest:

ADVERTISEMENTS:

There are two types or kinds of Interest:

(a) Net Interest,

(b) Gross Interest.

(a) Net Interest:

The payment made exclusively for the use of capital is regarded as net Interest or pure Interest. According to Prof. Chapman—“Net Interest is the payment for the loan of capital when no risk, no inconveniences apart from that involved in saving and no work is entailed on the lender.”

According to Prof. Marshall, “Net Interest is the earnings of capital simply or the reward of waiting simply.”

Thus, Net Interest = Gross Interest – (payment for risk + payment for inconvenience + cost of administering credit)

ADVERTISEMENTS:

i.e., Net Interest = Net Payment for the use of capital.

(b) Gross Interest:

Gross Interest according to Briggs and Jordan has said—“Gross Interest is the payment made by the borrowers to the lenders is called Gross Interest or Composite Interest.”

It includes payments for the loan of capital payment to cover risks for loss which may be:

(i) A personal risks or

(ii) Business risks, payment for inconveniences of the investment and payment for the work and worry involved in watching—investments, calling them in and investing.

According to Prof. Marshall:

ADVERTISEMENTS:

Gross Interest is that “Interest of which we speak when we say that interest is the earning of capital simply or the reward of waiting simply, is net Interest but what commonly passes by the name of interest, includes other elements besides this and may be called gross interest.”

By seeing the above definitions when we add elements of payment for risk, payment for inconvenience and the cost of administering credit to the net Interest, it becomes gross interest.

Thus, Gross Interest = Net Interest + payment of risk + payment for inconvenience + cost of administrating credit

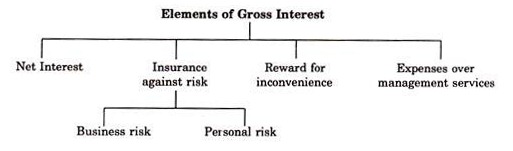

Elements of Gross Interest:

As we have seen earlier that the actual amount paid by the borrower to the capitalist as the price of capital fund borrowed is called gross interest.

Gross interest includes, besides net interest, the following elements:

1. Payment or Compensation for Risk:

The lender has always to bear the risk—the risk that the loan may not be repaid. Besides this, borrower, takes the loan at the time when his requirement is urgent but when he returns it, it is quite possible that the time may not be suitable from lender’s point of view. To cover this risk, the lender charges more, in addition to the net interest. Thus, when loans are made without adequate security, they involve a high elements of risk, so a high rate of Interest is charged.

2. Compensation for Inconvenience:

ADVERTISEMENTS:

When somebody lends the money, he has to bear inconveniences till the period when he gets back the sum, i.e., a lender lends only by saving that is by restricting consumption out of his income which obviously involved some inconveniences which is to be compensated.

A similar inconvenience is that the lender may be able to get his money back as and when he may need it for his own use. Hence, a payment to compensate this sort of inconvenience may be charged by the lender. Thus, the greater the degree of inconvenience caused to the lender, higher will be the rate of Interest charged.

3. Cost of Administering the Credit or Payment for Management Services:

A lender of capital funds has to spend money and energy in the management of credit.

For example:

In the lending business, certain legal formalities have to be fulfilled, say fees for obtaining money-lender’s licence, stamp duties etc. Proper accounts must be maintained. He has to maintain a staff as well. For all these sorts of management services, reward has to be paid by the borrower to the lender. Therefore, gross interest also includes payment for management expenses.

4. Compensation for the Changing Value of Money:

Under this when prices are rising, the purchasing power of money declines over a period of time and the creditor loses. To avoid such loss and high rate of Interest may be demanded by the lender.

ADVERTISEMENTS:

Therefore,

Gross Interest = Net Interest + Payment for risk + Payment for management services + Compensation for the changing value of money.

In economic equilibrium, the demand and supply for capital determines the net rate of interest. But in practice, gross interest rate is charged. Gross interest rates are different in different cases at different places and different times and for different individuals.

Factors Influencing the Rate of Interest:

Interest rates vary from person to person and from place to place.

There are many factors which causes variations in Interest rates which Eire as such:

1. Different Types of Borrowers:

There are different types of borrowers in the market. They offer different types of securities. Their borrowing motives and urgency are different. Thus, the risk elements differ in different cases, which have to be compensated for.

2. Due to Differences in Gross Interest:

Variations in the rate of Interest are due to differences in gross interest such as risk and inconveniences involved, cost of keeping records and accounts and collection of loans etc. The greater the risk and inconvenience and the cost of management of loans, the higher will be the rate of Interest and vice-versa.

3. The Money Market is not Homogeneous:

There are different types of lenders and institutions, specialising in different types of loans and the loan-able funds are not freely mobile between them. The ideals of these institutions are also different. Again, there are moneylenders and indigenous bankers in the unorganised sector of the money market who follow their distinct lending policies and charge different interest rates.

4. Duration of Loan or Period of Loan:

Rate of Interest also depends upon the duration or period of loan. Larger term loans carry higher rate of Interest than short-term loans. In a long-term loan, the money gets locked up for a longer duration. Naturally, the lender wants to be compensated by a higher rate of Interest.

5. Nature of Security:

Interest rate varies with the type of security. Loans against the security of gold carry less interest rates than loans against the security of gold carry less interest rate than loans against the security of immovable property like land or house. The more liquid are the assets the lower is the interest rate and vice-versa.

6. Goodwill or Credit of the Borrower:

Interest rate also depends upon the credit or goodwill of the borrower. Persons of better goodwill and known integrity and credibility can get loans on easy terms.

7. Amount of Loan:

The greater the amount of loan, the lower is the rate of Interest and vice-versa.

8. Interest Policy of the Monetary Authorities:

Monetary policy of the authorities may also lead to differences in Interest rates, e.g., the Reserve Bank of India has adopted differential interest rates policy for the deployment of credit to the priority sectors.

9. Difference Due to Distance:

Distance between the lender and the borrower also causes differences between Interest rates. People are willing to lend at a lower rate of Interest nearer home than at a long distance.

10. Market Imperfections:

Differences in Interest rates are also due to market imperfections that may be found in a loan market. Money-lenders indigenous banks, mutual funds, commercial banks etc. follow different lending policies and charges various Interest rates.

11. Differences in Productivity:

Productivity of capital differs from work to work or from venture to venture. People are willing to borrow at a higher rate of Interest for productive purposes or productive ventures and vice-versa.

Grounds in which Payment of Interest is Justified:

The payment of Interest is justified on various grounds.

The following are the reasons for payment of Interest:

1. The Productivity of Capital:

Interest is paid by the borrower to the lender, because borrowed money capital is productively used.

2. Compensation for Parting with Liquidity:

As Keynes has said that interest is the reward for parting with liquidity when a lender lends money he undergoes a sacrifice of present time consumption is parting with its purchasing power to the borrower. This is to be compensated by the borrower to the lender by paying a rate of Interest as agreed upon.

3. To Induce Savings:

Lending of money mostly comes out of savings. Savers are induced to save more by restricting consumption, when high rates of Interest are paid. When investment demand is in excess of savings, Interest rates will go up.

4. To Mobilise Loan-Able Funds:

Banks and other financial institutions offer Interest rates to mobilise loanable funds from the household sector to the money and capital markets. People may opt for financial investment of their savings when attractive returns are offered by the financial institutions. Financial institutions serve as intermediaries and pass on these funds so mobilised to the firm sector for real investment.

Similarly, the demand for Interest on the lender’s side is also justifiable for the reason for abstinence or sacrifice of immediate consumption undergone by them in parting with liquidity. They also claim a share in the income generated by capital in its productive use in terms of Interest rate. They also face the risk of losing money when the loan is not repaid by the borrower. To compensate for all these risk elements, they reasonably demand some Interest.

Additional Information:

Why Does a Kabuliwala or Village Money-Lender or Indigenous Banker Charge a Higher Rate of Interest?

In our country Kabuliwala or village Money lenders or Indigenous Banker give loans at very high rate of Interest.

The important reasons for charging high rate of Interest are as follows:

1. Lack of proper security:

Kabuliwala or village money lenders give loans to small farmers or small handloom weavers. They have not to give anything as security. Kabuliwala mostly give loans without having anything as security but banks or others financial institutions give loans without having adequate securities and that too they press for guarantee.

2. Unproductive loan:

Villagers need money for marriage purposes or they take loan on festivals or to perform Saradh ceremony i.e., villagers need loan for unproductive purposes, which Banks or Government institutions never allows loans for such purposes but Kabuliwala without any hesitation give loans at high rate of Interest.

3. Expenses on management, recovery of loans and keeping of accounts:

Village money-lenders and Kabuliwalas have to spend a lot of money over keeping of accounts and recovery of loans. They do regular charging of loan taker to refund the money. That is why they charge high rate of Interest.

4. They take more risk:

Village money lenders and Kabuliwalas have to take a great risk in giving loans because, there is always the danger of bad debts or the villagers mostly return money in small installments. Sometimes, the loan takers leave the village and silently go to some where else. This type of risk they have often to meet.

5. Money lenders and Kabuliwala have to face inconvenience:

They have to meet villagers regularly for the payment of loan. They have to persuade them, chase them, sometimes when they go they return dis-appointed because the villager is not in the village. He has gone somewhere else. For all these inconveniences they charge higher rate of interest.

6. Lack of Financial Institutions:

In village money-lending financial institutions have not developed much. Villagers have to go these people for money and have to pay high rate of Interest under pressure or compulsion or because of their inability to get money from other sources.

7. Kabuliwalas or Moneylenders give loan to such people even who have less credit or less goodwill in the market:

For such type of people returns of loan becomes difficult and that is why they charge high rate of Interest.

8. Money lenders and Kabuliwala exploit villagers as they are illiterate, ignorant, poor and have not much knowledge of the market or society and because of these reasons they charge high rate of Interest. In the end it can be said that Kabuliwala and village money lenders take high risk, suffer a lot of inconveniences and meet more expenses and suffer bad debts in the recovery of loans given. The above written are the important reasons of charging high rate of Interest from villages.