The below mentioned article provides a brief idea on the international trading environment.

Subject-Matter:

Being competitive in international markets is no doubt a growing challenge to private management. And developments in the international economy often impinge on domestic performance and affect national policy-making.

So it is necessary for private managers to understand the international economic context in which decision-makers operate.

They have to analyse the consequences of developments in the global economic environment because international economic forces, national government policies, international economic, financial and trading institutions affect management in complex and subtle ways. Moreover, international developments frequently determine the requisite policies for managing national economies.

ADVERTISEMENTS:

Decision-makers in both the private and public sectors need greater understanding of the major forces of global economic change. These multi-dimensional forces are commonly summarised as constituting ‘globalisation’, ‘interdependence’, or an intensified process of ‘industrialisation’. The post Second World War period has seen the progressive internationalisation of trade and finance, the growing interdependence of nations, and the formulation of national economic policies on the basis of changes in the world economy.

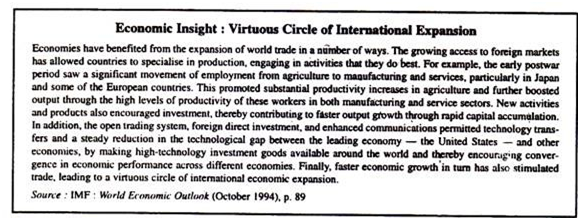

Twenty five years ago only 10% of world production was traded across national borders. Today more than 30% of world production does. This is a clear indicator of the increasing degree of openness throughout the world and greater integration of national economies. The growth in world merchandise trade has been considerably faster than the growth in world output. It is likely that world trade will continue to more than double in the comment a decade.

Surely, the foreign trade sector will become an even more dynamic sector of many national economies. More powerful in this process is the internationalisation of markets, that is, the growing flow of commodities, factors of production, management technology and financial capital across national borders. International trade in commercial services — which include transportation, tourism, telecommunications, banking, insurance and various other professional services — grew twice as fast as merchandise trade since the mid-1980s.

Not only have the movement of these goods, services and factors increased, but they have also become more responsive, or more elastic to differences between domestic and foreign variables. Commodities and services flow more rapidly response to price differentiation among nations and financial capital moves more rapidly in response to interest rate differentials.

ADVERTISEMENTS:

The internationalisation process also results in a greater stock of foreign factors of production within countries — more foreign investment, foreign technology and foreign workers.

The process of globalisation is likely to be even more rapid in the future. If private and public managers are to have the capacity to manage change, they must understand the international context in which they operate.

International Capital Flows:

With the growth of Euro currency markets, international syndication of loans, government loans and foreign direct investment, the international investment of capital has increased sharply.

The international linkage of national money and capital markets has also grown rapidly with the removal of restrictions on financial flows across national borders, deregulation of financial institutions, and international financial innovators. There is 24-hour screen-based trading around the world. Now competition for capital is worldwide. Long-term interest rates are increasingly determined by the integration of world capital markets.

Equity markets in developing countries are also expanding markedly. Increasingly global firms are raising capital in many countries. Foreign direct investment (FDI) has also increased dramatically. International investment is undertaken not only by large companies. Small firms are also gradually becoming global enterprises in large numbers. Many of the small companies now operating abroad are niche manufacturers, making specialised products whose sales often rise more rapidly overseas than at home.

The increased international flow of capital is reflected on the foreign exchange market — the most liquid of markets. Interbank transactions and capital movements account for most of today’s foreign exchange flows or constitute the bulk of such flows.

International Transfers of Technology:

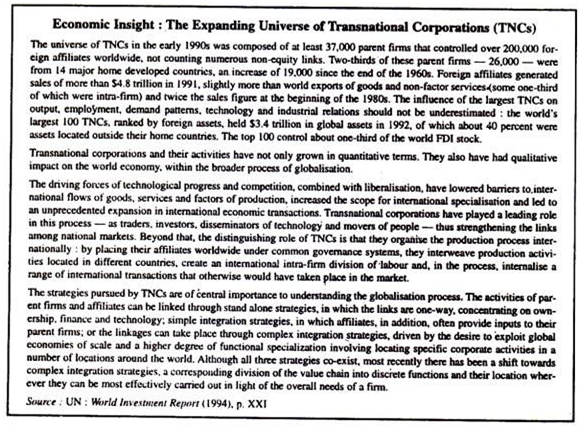

The international diffusion of technology has increased — not only through cross-border licensing agreements, but also among affiliates of multinational corporations (MNC) and by joint ventures and cooperative R&D activities. The international transfer of technology is often linked to foreign direct investment that brings to the host country a package of capital, management, know-how and technology.

Another important factor has been contributing to the international diffusion of existing technologies, viz., more international alliances that have been formed to promote cooperative R&D activities. These are very prominent in internationally dynamic industries such as microelectronics, commercial aircraft and pharmaceuticals.

Often, when governments liberalise their economies or undertake economic reforms, there is a spontaneous international transfer of technology. Such transfer allows both product and process innovations that reduce cost per unit, improve the quality of products, and allow production .of a great variety of products.

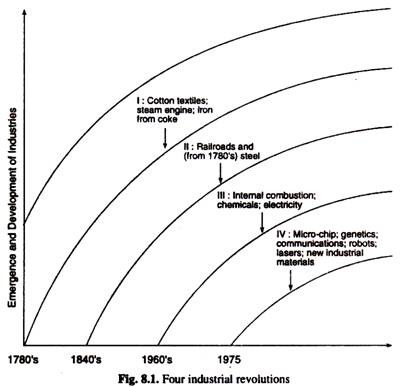

The New International Industrial Revolution:

Based on developments in science, technology and internal organisation of firms and their international networks and linkages, the forces of globalisation are so dramatic as to initiate a new international industrial revolution. The consequences of this revolution are more far reaching than the introduction of the steam engine in the 18th century or railroads in the 19th century. Fig. 8.1 illustrates four industrial revolutions.

The international economic revolution is likely to lead to high rates of growth in world output and international trade.

ADVERTISEMENTS:

At the same time two counteracting forces are likely to emerge:

1. National policies may conflict with international economic forces, resulting in trade protectionism. Expansion of world trade depends on opening of markets which, in its turn, depends on the liberalisation of trade policy.

2. Although the real forces are strong in the world economy, international monetary forces may inhibit the international economic revolution. As G. Meir has opined, “Flexible foreign exchange rates may be subject to excessive volatility and to misalignment of currencies with deteriorating effects on trade patterns and international capital movements.”

Challenge Facing Private Management [Optional]:

Most often business executive seek to achieve internal efficiency through the performance of various activities in the key functional areas, viz., production, finance, marketing and organisation. They seek to achieve as much internal efficiency as possible by lowering cost and prices.

ADVERTISEMENTS:

But this is not enough to achieve what the Harvard strategist Michael Porter calls ‘sustainable competitive advantage’. It remains narrowly confined to the internal operators of the firm, neglecting the significance of developments in the firm’s external environment. Any unanticipated (external) environmental development (shock) may hit the firm adversely, decrease profitability or even threatening the firm’s survival.

Internal efficiency must conform to external efficiency. The reason is that tomorrow’s new global economy can indeed pose costly and formidable problems. But it can also offer profitable opportunities which should not be missed.

It is necessary for management to be aware of the two dimensions of external efficiency adjusting to external shocks and exploiting opportunities. In fact, business success can be gained on a sustainable basis not by solving short-run problems but by taking advantage of long-term opportunities.

Various international economic and political developments are continually changing a firm’s external environment, e.g., the appearance of a foreign competitor; policies to remedy a country’s balance-of-payments deficit, rescheduling a country’s external debt, the emergence of transition economies from socialism, the establishment of a regional common market, a new foreign technology, rapid development in a newly industrialising country, and the policies of the International Monetary Fund and the World Bank. In truth, these changes can have even more (stronger) effect on the firm’s profit-and-loss statement than can its internal efficiency.

ADVERTISEMENTS:

It is therefore, absolutely essential for management to understand the international context in which their firm operates in order to achieve external efficiency. In the language of Gerald M. Meir once again, “External efficiency means that the firm adapts to the ever-changing international environment with appropriate response. And it does so in a timely fashion. Dynamic efficiency requires management to respond quickly and effectively to new situations.”

Static efficiency— internal and external—must be supported by dynamic efficiency. Competitive advantage depends on achieving total -efficiency—static (internal plus external) and dynamic. In order to gain sustainable competitive advantage, business executives must have a vision and a strategy that will enable them to respond with total efficiency in the new global economy.

No doubt globalisation is the management credo for the future. And all the forces underlying globalisation affect all firms in their need to achieve total efficiency. In truth, sustained success—given the pace of global change and the quality of competition—requires corporations to achieve a new degree of management flexibility.

They will have to become more sensible to changes in the global business environment and be prepared to alter tactics rapidly to achieve long-term global strategy goals. The principal strategic advantage of managing global companies today—and the hallmark of corporate survivors tomorrow—will be the capacity to manage change.

The International Trading Environment:

In today’s world, no country remains isolated. Various components of the national economy like industries, service sectors, level of income and employment, and living standard — are linked to the economies of its trading partners. This linkage takes the form of international movements of goods- and services, labour, business enterprise, investment funds, and technology. In truth, national economic policies cannot be formulated without evaluating their probable impacts on the economies of other countries.

Certain important developments occurred in the post-Second World War period which led to growing interdependence among nations. Mention may be made in the context of the formation of the European Community (now known as the European Union) in the 1950s, the growing importance of multinational corporations in the 1960, and the increasing power in world oil markets enjoyed by the Organisation of Petroleum Exporting Countries (OPEC) in the 1970s. All these developments have resulted in the evolution of the world community into a complicated system based on a growing interdependence among nations.

ADVERTISEMENTS:

In the past decade, the world’s market-based economies have been integrated as never before. Exports and imports as a share of national output have reached unprecedented levels for most industrial nations. But foreign investment and international lending have expanded more rapidly than would trade. In spite of this, demands have grown for protection against imports. For industrial nations, protectionist pressures have been strongest during periods of rising unemployment caused by economic recession.

Moreover, developing countries often maintain that the so-called liberalised trading system called for by industrial nations works to the disadvantage of developing nations. The main reason for this is that the prices of developing nations exports have not increased as much as the prices of developing nation imports over the 20th century as a whole.

Independence among nations also applies in the case of foreign debt. Throughout the 1970s exports of manufacturers increased very fast in the middle income developing countries (such as Brazil) which achieved rapid real income growth. However, much of this success was due to the availability of loans from industrial nations.

On the basis of optimistic expectations about export earnings and interest rates, these nations borrowed excessively to finance growth. Then, due to adverse effect of global recession on export demand, high interest rates and falling oil prices, countries like Mexico and Argentina were unable to service their external debt.

The annual payments of principal arid interest exceeded their exports of goods and services. The reluctance of creditor nations to lend as much as in the past meant that debtor nations were forced to cut imports or expand exports, in spite of a worldwide recession. The failure to repay external debt resulted in international financial crisis such as the Mexican crisis of 1994 and the Thai currency crisis of 1997.

Traded in Services:

Besides the exchange of tangible goods, such as autos and oil, international trade increasingly has involved an exchange of services. Exports of services such as banking, transportation, motion pictures, tourism, insurance, advertising, engineering, construction and computer services are gaining recognition as significant contributors to the foreign sales of many nations.

ADVERTISEMENTS:

The rise of the service sector has become a global phenomenon. The commodity producing sector (manufacturing, mining, agriculture) continues to grow, but is becoming a smaller portion of an expanding economy. Singapore, for example, has a leading international airline, and South Korea is a major exporter of engineering and construction services. In January 1995, world trade in services has been brought under surveillance of General Agreement on Trade in Services (GATS).

GATS is a part of the World Trade Organisation (WTO). The service sector is labour intensive and so capable of generating jobs to the millions of people. While developed nations have comparative advantage relative efficiency in the capital and technology intensive services, developing countries like India possess relative advantage in labour-intensive services like computer software, health care, legal counselling, tourism, construction and engineering services.

Theoretical Foundations of International Trade [Optional]:

In the past five decades or so there has occurred fundamental changes in the volume, composition and terms of international trade. These changes have virtually transformed the world economy in the post Second World War period. In order to understand the causes and significance of such changes, we have to analyse the dynamics of comparative advantage.

The theory of comparative advantage suggests that when a country specialises according to its own line of comparative cost structure, it achieves an efficient allocation of resources and hence an increase in its real national income. International specialisation is simply the division of labour among nations which leads to greater productivity.

Like that of a firm, the size of its market is a clear determinant of the variety of products that it produces and its realisation of economies of scale. An economy that specialises and exports to the world market can gain higher productivity and greater real national income than if its production were limited to only the narrow domestic market — as the East Asian high- performing economies have clearly demonstrated.

If a business firm has to gain a competitive advantage, it has to locate its various activities geographically in accordance with the comparative advantage of different countries. Corporate management must therefore be aware of the sources of comparative advantage and anticipate how comparative advantage keeps on changing over time.

i. Labour Productivity:

ADVERTISEMENTS:

The Richardian theory of comparative cost (advantage) provides the basis of trade between two countries from the supply side. The theory predicts that labour productivity and the wage rate determine unit labour cost and this, in its turn, is a major determinant of a country’s comparative advantage. Ricardo is credited with demonstrating the result that the two countries can derive benefit from trade if relative costs of production of goods (e.g., cost of good X divided by cost of good Y) differ between two goods before trade.

ii. Factor Proportions:

The modern theory of comparative advantage, known as the Heckscher-Ohlin (H O) theory focuses on differences in factor proportions as the main source of comparative advantage among nations. The theory has highlighted the importance of factor proportions in the production of different products in different countries.

The basic determinant of a country’s comparative advantage is relative factor endowment, i.e., its relative factor supplies of natural resources, labour, and capital (the inputs necessary for production). This difference is sufficient for mutually beneficial trade among nations, even if all the countries have the same tastes (demand conditions), same technology (production functions) and no economies of scale in production.

So long as there are relative resource differences — with some countries being relatively abundant in labour, while others are relatively abundant in capital or natural resources — there will be differences in relative costs and prices, thereby giving the foundation for trade based on comparative advantage.

The difference in relative commodity prices among nations are based on differences in relative factor resources that are, in their turn, based on differences in relative factor endowments. If India’s relatively abundant factor is labour, then wages will relatively low, and India will then have a comparative advantage in labour-intensive products. A firm that specialises in the production of such (labour-intensive) products will also have a competitive advantage.

For example, the Philippines exports labour- intensive products such as textiles, clothing and footwear; Indonesia exports land-intensive products such as oil or timber; the USA exports Capital-intensive and skilled labour-intensive products such as chemicals, machinery and aircraft.

iii. Product Life Cycle:

ADVERTISEMENTS:

Nations have a comparative advantage in industries in which their firms gain a lead in technology, thereby allowing the creation of new products or product improvements. Innovations based on new technology initially give a country a temporary monopoly position and easy access to foreign markets.

American manufacturers have been technological leaders in aerospace, electrical machinery, chemicals, transportation equipment and non-electrical machinery. For a period of time, the innovating industry may enjoy an export monopoly as long as there is an imitation lag in other countries. But sooner or later the technological gap is narrowed—the imitative lag is overcome, and other countries may then acquire a comparative advantage in the product.

In general, a product life cycle occurs. This is based not only on technology, but also on the changing mix of other inputs and different stages of the product’s life.

The determinants of the trade structure may change so much over time that a country that initially imported a product begins to substitute home-competing production for the import, becomes more efficient in its import-substitution production, and ultimately acquires a comparative advantage for the mature product based on its lower costs of production.

Moreover, comparative advantage changes as a country’s factor endowment evolves over time. ‘A country that is initially labour abundant may become more plentifully endowed with capital. South Korea and Taiwan, e.g., have now reached a stage where labour is relatively scarce, and cheap labour has disappeared. At the same time capital accumulation has been rapid and exports have diversified in direction of products which are more capital intensive.

In the more developed countries, the evolution of factor endowments increasingly favours capital-intensive and research-intensive products. Over time labour skills are upgraded, R&D efforts become more expensive, and there is technological progress. In essence, new factors of production are created.

iv. Economies of Scale:

When monopolistic competition exists, comparative advantage arises through the differentiation of products and realisation of economies of scale in production. There would exist a basis of trade between countries with similar factor endowments when imperfect competition results in differentiated products or increasing returns to scale. These conditions explain intra-industry trade (e.g., the exchange for cars for cars or computers for computers) unlike the inter-industry trade that is explained by the Richardian or H-O theories (wine for cloth or labour-intensive for capital-intensive products).

A sizable and growing proportion of international trade today is inter-industry trade, about 25% of world trade. This type of two-way trade is similar, but not identical, products is determined by R & D expenditures and innovative that differentiate products. As G M Meir has commented: “The trade of manufactures against manufacturing (accounting for some 60% of world trade) is closely related to differences in technology among countries and their economies of scale in production.

The dynamic quality of intra-industry trade and trade in manufactures underlies many of the changes in the composition of trade over time especially in trade among the advanced industrial nations. The developed industrial countries that among themselves tend to have more similar factor endowments and hence more intra- industry trade, while the LDCs trading with the more industrialised countries tend to have different factor proportions and conduct mainly inter-industry trade”.

v. Dynamic Gains from made:

According to the theories of comparative advantage the static gains from trade arise due to increase in each country’s real income based on efficient international resource allocation; these are once-and-for-all gains. But dynamic gains from trade arise during the process of economic growth. In truth, static gains arise as a result of reallocating resources in accordance with comparative advantage. Such gains get reflected in once-over change to a higher level of real income. In contrast, the dynamic gains from trade lead to higher rate of growth of per capita real income over time.

The direct (static) advantage (benefit) of foreign trade is that it results in a more efficient employment of the productive forces of the world. But indirect (dynamic) benefits of trade are also equally important. One significant economic benefit of foreign trade is the tendency for every expansion of the market to improve the process of production.

A country which produces for a larger market than its own can introduce a more extended division of labour; can make greater use of machinery and improvements in the processes of production. The opening of an economy sometimes works as a sort of industrial revolution by developing and utilising its latent resources.

According to Prof. Hla Myint a country’s foreign trade sector raises the productivity of its resources and acts as a dynamic force in the economy. In his view, trade widens the extent of the market and the scope of the division of labour, permits a greater use of machinery, stimulates innovations, overcomes technical indivisibilities, raises the productivity of labour, and generally enables the trading country to enjoy increasing returns and further growth. Further gains arise from trade in ideas and cultural goods which are known as educative effect of trade.

vi. Comparative Advantage and Competitive Advantage

Under free trade, a country should import those commodities in which it has a comparative disadvantage. A domestic firm that then competes with these imports is unlikely to have a competitive advantage. Its costs will be very high or there will be greater demand for imports due to non- price factors such as style, quality or service. Due to lack of a competitive edge against imports, the domestic firm may seek protection through import restrictions (through the use of such instruments of import as tariffs, quotas, etc.)

The competitive advantage of a firm depends on where it locates its various activities. If one global firm, called Multinational Corporation, locates its various activities in different countries according to each country’s comparative advantage, it then achieves competitive advantage as well.

No doubt the main reason for locating an activity in a particular nation is factor costs. But competitive advantages also arise from dispersing activities to several or many nations to perform R&D, gain access to a specialised local skills, or develop relationships with private customers.

As M Porter observes, “one of the potent advantages of the global firm is that it can spread activities to reflect different preferred locations. Thus, components can be made in Taiwan, software written in India, and basic R&D performed in Silicon Valley, for example.” Intra-firm trade (i.e., imports from a firm’s own subsidiaries abroad) characterises many multinational firms.

Consequences of Increased Openness:

International economic interdependence has several implications for the domestic economy.

The following points may be noted in this context:

1. Inflation:

Opening the economy to foreign trade tends to curtail inflationary pressures at home. Increased foreign competition presents wages from rising above productivity levels and thus acts as a safeguard against cost-push inflation. Due to foreign competition, the demand for domestic products falls. As a result, some workers became unemployed and unions are forced to accept low wages in order to protect the jobs of its existing workers. In general business cycles may be transmitted from country to country through price mechanism as also through income effect.

2. Crowding-in Effect:

Budget deficits are expected to lead to increased money demand and higher interest rates. Since firms find it more expensive to borrow from the open market in order to undertake investment projects, they are likely to decrease their investment spending. Such crowding out can be reduced or eliminated through increased openness.

3. Shock Absorber (Built-in Stabiliser):

Increased openness makes the domestic economy vulnerable to disturbances initiated overseas, as seen in the oil crisis of the 1970s. But increased openness also helps to dissipate the disturbances that occur in the domestic economy. In times of domestic recession, the rest of the world may operate like a sink into which excess domestic output can be poured. Conversely, the output of the rest of the world may satisfy domestic consumption in periods of shortages.

4. Conduct of Fiscal Policy:

Greater openness also affects fiscal policy (taxes and government spending). Let us suppose domestic residents spend more on imports out of each rupee of income earned. An expansionary fiscal policy, which increases the income and spending of domestic residents, will be transmitted overseas via increased imports more quickly, thus lessening the fiscal policy’s impact on the domestic demand.

Recent Trade Liberalisation and Growth in Developing Countries:

Since the early 1980s, many developing countries that had followed an import-substitution industrialisation strategy for more than three decades (1945-79) gradually started liberalising trade and adopt an outward orientation. The reforms were the result of the debt crisis which started in 1982 and the proven success of the outward-oriented prices adopted by some developing countries.

During the 1980 and early 1990s some developing countries in Latin America, Africa and Asia adopted various trade-liberalising measures. The common elements of trade reforms included a drastic reduction and simplification in average tariff rates and quantitative import restrictions (wuotas). These, in their turn, resulted in a much higher degree of openness, as measured by the sum of exports plus imports as a ratio of GDP, a sharp increase in the ratio of manufacturers in total exports and higher rates of growth for the liberalising countries.

The World Bank had greatly facilitated the planning and carrying out of trade liberalisation programmes with technical assistance and loans. It lends heavily to developing countries for the purpose of implementing structural of sectoral reforms.

Existing reforms were consolidated and further reforms were encouraged by the fact that countries have joined the General Agreement on Tariffs and Trade (GATT) and that the Uruguay Round was successfully concluded. These are likely to increase factor productivity and economic growth in developing countries in the future.

Protectionism in Developing Countries:

For many developed countries the 1980s marked the beginning of a period of slow growth and large unemployment. So they were forced to increase the level of protection to some of their large industries (such as textiles, steel, shipbuilding, .consumer electronic goods, television sets, shoes and various other goods) against imports from developing countries. These were industries in which the developing countries had gained or were gaining sustainable comparative advantage. This new protectionism was largely directed against the manufactured exports of the newly industrialised economies (NIEs), viz., Hong Kong, Korea, Singapore and Taiwan.

If the trend toward increased protectionism had continued, it could have led to a revival of export pessimism and a return to inward-looking policies in developing countries. However, the Uruguay Round was successfully completed in December 1993, which called for reductions in trade restrictions and protectionism, from which developing countries were likely to derive some benefits.