Let us make in-depth study of foreign trade policy with regards to import-substitution versus export orientation.

Introduction:

Trade policy plays an important role in achieving the objectives of rapid economic growth and self-reliance.

It is on the basis of these static and dynamic gains of trade that case for free trade or liberalisation of trade was bas been built.

When a country specialises on the basis of its comparative cost or production efficiency and export and import accordingly, it enables it to make optimum use and allocation of its resources. As a result, output, income and welfare of its people increase. These gains emanating from trade through improved allocation of given resources of a country are generally described as static gains.

ADVERTISEMENTS:

Thus, Professor Haberler writes, “International division of labour and international trade which enable every country to specialise and to export those things which it can produce in exchange for what others can provide at a lower cost have been and still are one of the basic factors promoting economic well-being and increasing national income of every participating country”.

However, importance of trade is not confined to static gains flowing from improved allocation of the given resources. Foreign trade also promotes economic growth of a country. It is the beneficial effect of trade on economic growth that is described as dynamic gains. D.H. Robertson, described foreign trade as “an engine of growth”.

With great income and production made possible by specialisation and trade, greater servings and investment become possible and as a result higher rate of economic growth can be achieved. Through promotion of exports, a developing country can earn valuable foreign exchange which it can use for imports of capital equipment and raw materials which are so essential for economic growth.

To quote Haberler again, “The higher the level of output, the easier it is to escape the ‘vicious circle of poverty and to ‘take off into self-sustained growth’ to use the jargon of modern development theory. Hence, if trade raises the level of income, it also, promotes economic development”.

ADVERTISEMENTS:

Elaborating how trade promotes growth he emphasises the following factors:

1. Through foreign trade developing countries can get material resources such as capital equipment, machinery and raw materials which are so essential for industrial growth.

2. The developing countries through trade can import and use superior technology which has been invented in advanced developed countries and is embodied in the machines, capital equipment which they import.

3. Foreign trade enables the transmission of technical know how, skills, managerial talents to the developing countries.

India’s Trade Policy of Import Substitution:

ADVERTISEMENTS:

As we began our planning for development, the two options were open to us with regarded to our foreign trade policy. First, we should lay stress on export promotion in our strategy of development for accelerating economic growth. The second option was to adopt import-substitution as a major element of our trade policy.

Note that the second policy of import-substitution does not emphasize the role of foreign trade for accelerating economic growth. In fact, the policy of import-substitution was adopted in view of the perceived bleak prospects of raising India’s exports. When exports could not be increased substantially, we could not pay for imports on a large scale.

Therefore, India’s strategy of industrialisation was based on substitution of imports rather than export-oriented trade policy. The policy of import-substitution for promoting growth was also thought to be quite feasible in view of India’s vast domestic market.

It is clear from above that India adopted the policy of import substitution because of what is now called export-pessimism. In fact, in the fifties and sixties export pessimism characterized the thinking of the most development economists. For example, Raul Prebisch postulated that the terms of trade of developing countries have a tendency to deteriorate over time regardless of the policies of developing countries.

Prebisch’s postulate was based on three grounds. First, demand for primary products which under-developed countries were exporting were income inelastic. Second, technological progress that was taking place in developed countries was of the nature that saved the use of raw materials which underdeveloped countries were exporting.

Third, because of the prevailing monopolies in the manufacturing industries of the developed countries, the prices of their manufactured products was relatively higher than the prices of primary and agricultural products whose production and sale were being done under competitive conditions. Thus, according to Prebish, export expansion by developing countries were quite unprofitable.

Similarly, R. Nurkse, another pioneer in development economics believed that for the newly emerging countries like India foreign trade could no longer serve as ‘engine of growth’. Nurkse’s export pessimism arose from his belief that foreign market could not absorb imports on a sufficient scale as developing countries accelerated their process of economic growth.

In view of this external environment, Nurkse concluded that in order to accelerate growth developing countries should undertake a balanced pattern of investment in a number of different industries so that they can generate mutual demand for each other’s product leading to the expansion in size of hone market.

To quote Nurkse, “When developing countries face difficulties in exporting both traditional and new exports, import-substitution strategy may be adopted by them as an escape route from stagnation”. Nurkse further writes, “International trade cannot now be an effective engine of ‘economic growth’ and in the strategy of growth, underdeveloped countries have of necessity to lay emphasis on ‘balanced growth’ – a coordinated development of local industries in accordance with the growth and structure of domestic demand”

ADVERTISEMENTS:

It is interesting to note here that our present Prime Minister Dr. Manmohan Singh was perhaps the first economist who challenged this export pessimism of early development economists, especially in the context of India. On the basis of his empirical findings about the export-potential of the Indian economy, he concluded that it was not easy to meet the increase in import requirements in raising the rate of economic growth by any other means but export promotion.

Arguing the case for export-orientation of strategy of development he writes, “whatever the development strategy the function of international trade as a supplier of “material means indispensable for development’ is likely to retain its importance for most underdeveloped countries in their quest for higher rates of economic growth…Imports, however, have to be paid for either by current export earnings or by withdrawal from reserves of foreign exchange or by a fresh capital inflows.

The withdrawal from reserves is not unlimited process,..capital inflows ultimately lead to higher service charges and repayment obligations. In the long run, therefore, the import capacity of an economy and its ability to utilize the above mentioned benefits of international trade is crucially dependent on its export capacity.

But Dr. Manmohan Singh not only highlighted the need for export promotion for accelerating economic growth but with his empirical study he demonstrated in India’s case that export promotion to meet the growing needs for imports was in fact possible and that the stagnation of India’s exports 1951-61 was partly a consequence of faulty Indian economic policies.

ADVERTISEMENTS:

Commenting on Dr. Manmohan Singh’s work Prof. Amartya Sen writes, “Rapid increase in exports would be impossible if export pessimism prevailing at that time were well-grounded”. And Professor himself answers that “with its very careful and painstaking empirical arguments, Dr. Manmohan Singh demonstrated that it was not so well grounded after all”.

Empirically, the export pessimism of the fifties (post-war period) has been proved to be untrue and unjustified. Word trade in the fifties and sixties grew faster than world income. Several developing countries used export promotion as a means of attaining a fast economic growth.

In the early 1960s Japan was the shining example of using export promotion strategy to achieve a fast rate of economic growth, beginning from a state of underdevelopment. Japanese growth experience is often described as Japanese miracle. In the later period, other success stories of achieving high growth through outward-looking strategy of development have been of Asian countries of South Korea Taiwan, China, Thailand, Singapore and Hong Kong.

Owing to their rapid economic growth in seventies and eighties they have been called ‘Asian Tigers. It is also worth mentioning that the expansion in exports of developing countries which have used export-promotion as a strategy of growth has not been confined to primary products such as fuel and agricultural products (food, agricultural raw materials). As a matter of fact, there has been significant change in the composition of exports of developing countries towards manufacturers.

ADVERTISEMENTS:

It may be noted that the fifties and early sixties free trade was opposed on political grounds also. Fears were expressed that through free trade industrial developed countries would acquire political domination, as happened in case of India. East India company of Britain which came to India for trading acquired political domination.

It may however be noted such fears of political domination through trade has now receded in the present political context. In fact, the protectionist sentiment is now stronger in the developed countries such as US and EU. There is now huge and cry in USA for protecting American jobs by banning outsourcing of business services (BPO) to India.

The success in export promotion accelerates economic growth in the country. The emergence of Japan and Germany and recently China as major economic powers has shown that their success in export expansion made them economically more independent and strong.

On the other hand, developing countries like India which followed import-substitution strategy had to face recurrent balance of payments crises and the persistence of huge external debt problem which made them more dependent on developed countries and international institutions such as IMF and World Bank.

Import-Substitution:

For at least up to 1980, India adopted a trade strategy of import substitution. The choice of this policy was based on export pessimism which led the Indian planners to believe that export earnings of India cannot be increased. The choice of this inward-looking strategy was further strengthened by the vast size of Indian domestic market.

To implement this trade policy of import-substitution the imports of several commodities into India were banned and quantitative restrictions on some other commodities were imposed. Besides, to give protection to the domestic industries, customs duties were levied on a number of commodities to discourage their imports by raising their prices.

ADVERTISEMENTS:

The customs duties levied in India on certain commodities were as high as 200 per cent or 150 per cent which were one of the highest in the world. In addition to these. The import- licensing was used so as to regulate the quantities of some essential goods and raw materials that could be imported and accordingly licences for import quotas were issued by the Government.

A scheme of import licensing in case of certain commodities was introduced under which imports were permitted to the extent that domestic production fell short of domestic demand. Further, stringent foreign exchange regulations were introduced and foreign exchange was released to the holders of import licences for importing specific commodities.

It may be noted that India’s policy of import substitution was indiscriminate and also continued for quite a long period. This is unlike some other countries such as Japan and South Korea which adopted import substitution only for some period of time and that too in case of selected commodities for which they had potential comparative advantage.

Results of Import-Substitution Policy:

However, it may be noted that policy of import substitution contributed significantly to industrial growth between 1956-66. But several weaknesses of the policy of import substitution became evident during the course of time. First, the policy makers- underestimated the possibilities of expansion in exports.

As in the path-breaking study about the trends in exports, Dr. Manmohan Singh found that a lot of export possibilities was lost due to faulty trade policies. As a result, India’s share of world exports declined from about 2 per cent in 1951 to about 0.53 per cent in 1992.

ADVERTISEMENTS:

Second, policy of import substitution underestimated the import-intensity of import substitution process itself. Growth of import-substituting industries required large quantities of imports of capital goods machines, raw materials etc.

As a consequence, whereas imports increased substantially there was no adequate growth in exports resulting in balance of payment problems. In 1966 we had to devalue the rupee to promote exports and discourage imports in order to solve balance of payments problem. However, 1966 devaluation did not succeed in improving the trade deficit.

It may be noted that deficit in balance of payments which arose mainly due to import-substitution policy forced Indian policy makers to make some changes in attitude towards exports. Accordingly, in the third plan period (1961-66) and the fourth plan period (1969-74) several export promotion measures (including devaluation of 1966) were taken.

However, as has been correctly pointed out by C. Rangarajan that “Until the end of 1970s, exports were primarily regarded as a source of foreign exchange rather than as an efficient means of allocating resources. Import substitution remained the basic premise of the development strategy”.

Since import-substituting industrialisation was pursued regardless of comparative cost considerations, inefficiencies crept into the system resulting in the Indian economy becoming increasingly high-cost economy. This high cost and inefficiency in production was an important reason for poor export performance despite the various incentives and concessions given by the Government for export promotion.

Export-Promotion Measures in the Eighties:

In the early eighties because of the deficits in balance of payments export-promotion measures “acquired great urgency”. A committee headed by P.L. Tandon made a large number of recommendations for export-promotion in January 1991.

ADVERTISEMENTS:

Promotional measures for exports taken in the eighties are:

1. Incentives scheme to promote exports was launched which provided for imports of raw materials, machinery and capital equipment and accessories against exports. This schemes we called Replenishment (Rep.) Scheme which was later replaced by Exim Scrip’s.

Exim scripts:

Exim scripts equivalent to the 30 per cent value of their exports were given to the exporters. These Exim scripts could be even sold in the market at premium. Exim scripts entitled exporters to import a certain amount of materials and machinery for expanding exports. Thus, ‘import-liberalisation for export promotion’ became the focus of trade policy.

2. Fiscal concessions for export promotion were given. The important fiscal concession was the introduction of ‘duty drawback scheme’ under which taxes paid on materials used in the manufacture of goods for export were refunded. Besides a good proportion of profits or income earned from exports was exempted from income tax. Further a 5-year tax holiday was provided to the units set up in Special Exporting Zones (SEZ) for financing exports.

3. Liberal credit facilities at concessional rates of interest were given by the commercial banks to exporters.

ADVERTISEMENTS:

4. Bilateral Trade Agreements with some countries were made to step up exports.

5. In the later half of eighties the ‘exchange entitlement’ scheme was introduced to enable exporters to utilize a part of their foreign exchange earnings for the purpose of market development.

6. Cash Compensatory Scheme. A scheme of providing cash assistance to the exporters was started. Under this scheme cash assistance was given to the exporters to compensate them for the taxes paid by them on the imported inputs used by them for the production of exported goods. This was in fact a form of export subsidy paid for providing incentives to the exporters.

7. In the later half of eighties quota system in case of several commodities was replaced by tariffs. This liberalised imports further on the one hand and provided revenue to Government on the other.

It is evident from above that in the eighties, especially in the later half of eighties, a more liberal trade policy was adopted to promote exports on the one hand and to provide for imports of capital goods and technology so as to enable India to obtain benefits from international trade.

It needs to be emphasized that liberalisation of trade policy in the eighties was in view of the mounting deficits in balance of payments as a consequence of pure import substitution policy followed earlier. In 1981 IMF had also advised India to use export promotion and not export restrictions as the strategy for reducing deficit in balance of payments.

India’s Trade Policy since 1991: Import Liberalisation and Export Orientation: A General Review:

There was a severe economic crisis in 1991. This economic crisis had its root in persistent deficits in balance of payments in the last several years. Gulf war of 1990 added to the problem as it resulted in shooting up of oil prices which required enhanced spending in terms of foreign exchange.

By March 1991, current account deficit in balance of payments reached a record level of about 10 billion US dollars or over 3 per cent of our GDP. Exports were declining. Foreign borrowing in last several years raised the ratio of short-term debit to foreign exchange reserves to an extremely high level of 146.5 per cent. Foreign debit reserve ratio rose to a peak of 35.5 per cent.

As result, our foreign exchange reserves dwindled to a merge amount which was hardly adequate to meet only a few weeks imports. A default on payments for the first time in our history became a distinct possibility in June 1991. Foreign capital was flying from India. No one was willing to lend us any more.

The severe economic crisis of 1991 forced us to make drastic reforms in trade policy. Fortunately, Dr. Manmohan Singh was appointed as Finance Minister. Since then many far-reaching reforms in trade policy have been undertaken. Though some liberalisation of trade policy was undertaken in the eighties, a truly liberalized trade policy was adopted from 1991 onward.

The liberalisation of trade policy in India is characterized by two important features:

1. Import liberalisation and

2. Export-orientation of trade policy.

This new trade policy has accelerated India’s transition to a globally oriented economy by stimulating exports and facilitating imports of essential inputs and capital goods. The steps were taken to promote exports by removing anti export bias in the earlier policy.

This policy of import liberalisation and export-orientation was in fact the policy that was recommended by IMF and World Bank the solve the balance of payments problem facing the developing countries and to accelerate rate of economic growth. We explain below this trade policy in some detail.

Import Liberalisation:

The first important reform in India’s trade policy has been the elimination of quantitative restrictions in a phased manner on most of intermediate and capital goods since 1991. Secondly, prior to 1991 imports were regulated by means of positive list of freely importable items. Instead, since 1992 as a part of trade policy reforms only a short negative list of imports is subject to regulations by Government. Other goods can be imported, subject of course on payment of duty.

Abolition of Licensing:

Prior to 1991 a large number of goods was subject to import-licencing restrictions. Now, most of the items of imports have been put on Open General Licence (OGL). That is, for their imports prior approval or license from any authority is not required. Thus, License – Permit Raj regarding imports has been done away with.

Tariff Reduction:

An important step towards import liberalisation has been reduction in import-duties to eliminate protection given to domestic industries from foreign competition. The maximum import duty which was as high as around 150 per cent was reduced to 110 per cent in 1992-93. This was further reduced to 85 per cent in 1993-94, to 65 per cent in 1994-95 and to 50 per cent in 1950-96 Now, in 2004-05 average customs duty has been reduced to 20 per cent only.

Empirical evidence shows reduction in protection increases efficiency and productivity in the domestic industries as it exposes them to foreign competition.

Liberalisation of imports of gold and Silver:

Another significant import liberalisation has been that imports of gold and silver have been liberalized. This has helped in printing smuggling of these metals.

Critique of Import Liberalisation:

It may be noted that fears were expressed about import liberalisation both by certain politicians and economists, especially with leftist leanings. They contended that import liberalisation would kill domestic industries as they would not be able to compete with the cheap foreign products.

This would lead to closure of a large number of industrial units, especially small scale industries, Besides, they claimed that the large-scale imports would require substantial foreign exchange resources. Thus, according to them import liberalisation would worsen the balance of payments problem rather than solving it.

Even a reputed economist. Dr. Bimal Jalan, a former Governor of Reserve Bank of India, expressed reservations about the policy of import liberalisation and pointed out that it would be highly risky for the Indian economy, Writing in 1991, he says, “given the balance of payments constraints operating now, and the financing operations currently available, import- liberalisation as strategy does not seem to be feasible option over the next few years. This pragmatic view is not dependent on the theoretical validity (or otherwise) of the liberalisation argument. By implication, import liberalisation would have the effect of raising, even in the short sun, the ratio of import to GDP. This may not be undesirable in itself, but it would require larger inflows of external capital in the next few years and this is not available on appropriate terms. Past experience shows that further commercial borrowing to finance import liberalisation …would also be undesirable, given the high level of external debt. In this situation, import liberalisation would be unduly risky and could lead a repetition of the unfortunate experiences of several other developing countries.”

However, in actual experience, these fears about import-liberalisation leading to adverse consequences have not proved to be true.

Export-Orientation of Trade Policy:

Along with import liberalization, export-orientation was also given to India’s trade policy pursued since 1991. In other words, for the first time greater emphasis was placed on export promotion in our trade policy by removing anti-export bias of our earlier policy.

Some economists describe it out-ward looking strategy was adopted since 1991 in place of inward-looking strategy of import-subtraction followed earlier. We explain below the various export-promotion measures taken to give export-orientation to trade policy.

1. Reduction in customs duties to end anti-export bias:

Prior to 1991 costumes duties of India were the highest in the world and were levied to promote import substitution. These very high customs duties provided a high degree of protection to domestic industries. In actual practice, the high degree of protection lowers efficiency and is not conducive to optimum use and allocation of resources.

In the absence of competition from imported products, the prices of domestic goods were high and this served to induce import substitution but worked against promotion for exports. Since prices of products in international markets were lower, it was not profitable to produce for export.

Therefore to remove this anti-export bias and promote the growth of exports, customs duties were reduced and in 2004-05, average rate of customs duties have been reduced to 20 per cent.

Devaluation or Rupee:

Another important step to promote exports was devaluation of rupee by 20 per cent in July 1991. Devaluation lowered the prices of our exports and gave an important boost to them. Prior to 1991 rupee currency was overvalued and to ensure growth in exports to make some foreign exchange earning, export subsidy in the form of cash compensatory scheme was provided to exporters. Therefore, along with devaluation cash compensation scheme was withdrawn.

Market Determined Exchange Rate: Convertibility of Rupee:

After two years, in 1993, exchange rate of rupee was made market determined, that is, exchange rate of rupee with foreign currencies were left to be determined by demand for and supply of rupee and other currencies. This implies that rupee can appreciate or depreciate in terms of other currencies every day depending on demand and supply conditions.

This flexible exchange rate works to some extent to correct disequilibrium in the balance of payments. However, it is worth mentioning that exchange rate though determined by demand for and supply of foreign exchange can be influenced by RBI through buying and selling of dollars or other foreign currencies. Therefore, present exchange rate system is more correctly described as managed float.

It may be noted that over a period of time since 1993, exchange rate of rupee has declined, that is, rupee has depreciated. This has tended to promote exports and discourage imports. In addition to the introduction of market determined exchange rate rupee has been made convertible on current account of balance of payments, that is, importers can now get their rupees converted into dollars and exporters can sell their dollars for rupees at market-determined exchange rate.

Thus, convertibility of rupee has facilitated imports and exports and has contributed to the globalization of the Indian economy.

3. Liberalisation of control over exports:

Through continuous review and revisions during the last 12 years controls on exports has been liberalised to the extent that now all goods may be exported without any restriction except the few items mentioned in the negative list of exports.

The items in the negative list of exports are regulated because of strategic considerations, environmental and ecological grounds, essential domestic requirements, employment generation and on account of socio-cultural heritage.

4. Duty-free import of capital goods for use in production for exports:

A significant export- promoting measure is that capital goods meant to be used for production of exportable products can be imported free of customs duty. There are two windows to fulfill export obligation on FOB (free on board) and NFE (net foreign exchange basis).

5. Advance licences for imports against exports:

Advance licences which are used to import specified raw materials without payment of any customs duty against confirmed export order and/or letter of credit have been made transferable after export obligation has been fulfilled.

6. Exemption from tax and credit subsidies:

Profits or incomes from exports are completely exempt from income taxes. Besides, exporters are provided preferential access to credit from banks. Concessional rates of interest are charged for pre-ship and post-ship credit to exporters.

7. The Duty Drawback Scheme:

In this important scheme of providing incentives to exporters customs duty and excise duty paid on inputs which are used for production of exports are reimbursed to exporters.

8. Incentive to exports of services:

In an attempt to provide massive thrust to export of services EXIM Policy 2003-04 has introduced duty free import facility for the service sector units having a minimum foreign exchange earnings of Rs. 10 lakes. The scheme is likely to provide a major boost to export of services like health care, entertainment, professional services and tourism.

9. Small-scale industries (SSI) reservations have been withdrawn from a large number of items so that a large-scale producers can produce these terms cheaply and export them.

Case for Export Orientation:

The export orientation of trade policy (or outward-looking growth strategy) is believed to have many advantages and is regarded as superior to import-substitution policy. We explain some of these advantages below.

First, it has been pointed out that export-oriented trade policy is conducive to more efficient use and allocation of resources. Jagdish Bhawati has emphasized the efficiency gain of export promoting trade strategy.

He is of view that export orientation and import liberalization trade strategy will ensure domestic resource allocation closer to efficient production of goods in accordance with comparative cost of a country. According to him, such a trade strategy will not lead to profit-seeking unproductive activities.

An important advantage of export-oriented strategy arises from economies of scale which can be reaped more effectively. As a result, cost per unit of output rises which will tend to lower prices of export. Lower export prices will help in significant expansion in exports and enable us to earn more foreign exchange.

As export demand or market size for a good expands this will lead to economies of scale. With adequate size of market even small-scale and medium enterprises can set up plants of optimum size to enjoy the economies of scale.

Export-oriented trade policy makes substantial contribution to economic growth by relaxing the foreign exchange constraints. Export-promoting trade policy places emphasis on industries geared towards earning foreign exchange. This helps to keep the balance of payments in equilibrium.

It has been found that import-substitution trade strategy generally causes shortage of foreign exchange and leads to the balance of payments problem, as happened in case of India in 1991. Shortage of foreign exchange and balance of payments problem lower rate of economic growth.

On the other hand, export-oriented trade policy does not have to face the problem of shortage of foreign exchange and is therefore conducive to higher rate of economic growth. Further, a significant merit of export-oriented trade policy is that it will help to achieve self-reliance, that is, self sustained growth of the Indian economy.

As a matter of fact, import substitution strategy was adopted in India with the belief that through it we will achieve self reliance. But the policy underestimated the import intensity of import-substitution process. Import-substitution strategy substantially increased our import requirements for equipment and raw materials.

This necessitated a large amount of foreign exchange which could not be earned sufficiently through exports. Thus, far from helping to do away with foreign assistance import-substitution strategy increased our dependence on foreign capital inflows.

Export-oriented trade policy coupled with liberalized foreign investment will enable us to earn adequate foreign exchange to solve our balance of payments problem and ensure self-sustained economic growth. Above all, several studies have found a highly positive relation between growth of national income and expansion in export.

However, as Balassa has promoted out that for relation between export-orientation and economic growth initial conditions matter a lot. These initial conditions include resource endowment, expansion opportunities of trade, stock of technical knowledge. No doubt, these initial condition are important for determining economic growth.

However, trade policy is certainly important for providing incentives for expansion of exports for availing of the opportunities thrown up by international trade. This will lead to the optimum use and allocation of material resources which will stimulate economic growth.

Foreign Trade Policy, 2004-09:

After every five years Government reviews its export and import policy in view of the changes in international economic situation. The foreign trade policy or what is also called export-import (EXIM) policy relates to promotion of exports and regulation of imports so as note only to overcome trade deficit but also to promote economic growth.

UPA-1 Government announced its foreign trade policy for a five year period (2004-09) on August 31,2004. This new trade policy carries further the process of trade liberalisation. Exemptions and incentives given in the earlier 2002-07, and Mini Exim Policy 2004 have not been changed and new incentives for promotion of exports have been provided.

We explain below the various provisions of this new trade policy. Mr. Kamal Nath, our present Commerce Minister claims that the new trade policy was not just Export-Import (EXIM) policy but it goes beyond that.

According to him, new foreign trade policy is an effective instrument of accelerating economic growth and employment generation through exports. An important feature of new trade policy is that it seeks to eliminate taxes and duties from exports so as to make exports more competitive.

According to it, ‘we have to export goods and services and not taxes’. The Duty Exemption Pass Book scheme which allows exporters to claim exemption from excise duties and relief on customs duties has been continued for now, but it will be replaced with an effective scheme in line with WTO commitments.

Foreign Trade Target: Doubling of India’s Share in World Trade in Five Years (2004-09):

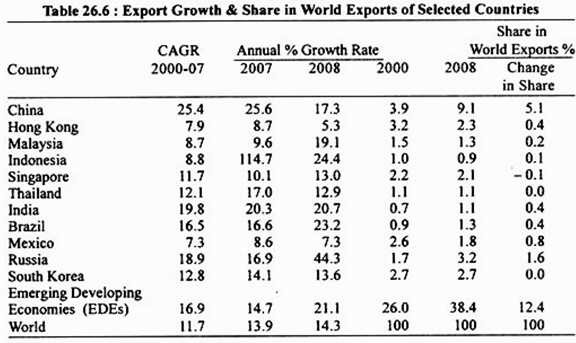

The new foreign trade policy aims to double India’s share of world merchandise trade in the next five years. As shown in Table 26.6 in India’s share in World export was just 0.8 per cent as compared to 5.9 per cent of China. Thus China has surged ahead of India in expanding its share of world trade.

The new trade policy seeks to raise India’s shore in world exports to 1.5 per cent by 2009.In the past the Indian Government had set target of capturing 1 per cent of global exports. So the target of achieving 1.5 per cent shares in five years in world exports is a very ambitious target.

In absolute term this implies raising India’s exports from 61.9 billion US dollars to 195 billion by 2009. This means 21 per cent compound annual growth in exports. This is based on the assumption that world trade will grow at 10 per cent per annum.

Focus on Employment Generation through Export Strategy:

In line with the UPA Government’s priority to employment generation foreign trade policy also focuses on employment generation through an appropriate export Strategy. Employment opportunities will increase as a result of expansion of agricultural exports for which new policy provides special incentives.

Other sectors identified for employment-generation and export-promotion include handlooms, handicrafts, gems and jewellery, and leather and footwear, apart from services. Non-IT service sectors on which the policy focuses are tourism, health care and education. At present, merchandise exports are valued at over $70 billion, while services contribute more than $50 billion.

Focus on Agro-exports to boost export growth:

The new five-year Foreign Trade Policy moots a special package to boost agro-exports by offering fiscal incentives to exporters. It includes launching a special farm produce scheme called Vishesh Krishi Upaj Yojana (VKUY) to promote the export of fruits, vegetables, flowers and minor forest produce and their value-added products and permission for duty-free import of capital goods for installation anywhere in the agri-export

zones (AEZs).

The procedures for the import of seeds, bulbs, tubers and planting material and the export of plant portion, derivatives and extracts have been liberalized. The measure is expected to help facilitate the production of export-worthy agricultural products. It will also help boost the export of medicinal plants and herbal products.

Exemption of Exports from Service Tax:

A significant measure to promote exports is that exports of all goods and services have been exempted from 10 per cent service tax and 2 per cent cess on it. Export Oriented Units (EOUs) have also been given exemption from service tax in proportion of their exported goods and services.

To accelerate services export, the foreign trade policy has also provided sops-in terms of duty free entitlement — to individual service providers (who earn forex of at least Rs. 5 lakh), other service providers (who earn forex of at least Rs. 10 lakh) of 10% of the foreign exchange earned by them.

The foreign trade policy announcement on service tax exemption for all goods and services exported including those from the domestic tariff area (DTA) – will be available on 161 tradable services.

This list of all 161 tradable services covered under the General Agreement on Trade in Services (GATS) where such payment of services is received in free forex, according to the policy document. As of now, the announcement is statement of fact because all payments received by Indian service providers in foreign exchange are currently exempt from service tax.

Promoting Exports of Services:

Recognising the key role of the service sector in the economy, the foreign trade policy has unveiled the ‘Served from India’ scheme to accelerate growth in service exports. The scheme aims at creating a brand instantly recognized and respected world over. The earlier DFEC (Duty Free Entitlement Certificate) scheme has been revamped and recast into the new scheme.

Individual service providers who earn foreign exchange of at least Rs. 5 lakh, and other service providers with forex earnings of at least Rs. 10 lakh, will be eligible for a duty credit entitlement of 10 per cent of total forex earned by them.

Apart from setting up the export promotion council, the policy has announced two other major initiatives to boost services exports. The government would promote establishment of a common facility centres for home-based service providers. To boost exports, a new scheme ‘ Target Plus’ has been introduced. With this exporters who achieve quantum growth would be entitled to substantially higher duty-free credit based on incremental exports.

New Export-Promotion Schemes:

In the new foreign trade policy, three new schemes have been introduced and others revamped to boost exports. No existing export-promotion scheme has been withdrawn. A new scheme named ‘served from India’ has been launched to popularise non-IT services in line with the existing’ Made in India’ scheme to promote export of Indian goods.

Similarly, a Vishesh Krishi Upaj Yojana has been announced to promote export of fruits, vegetables, flowers, minor forest produce and their value-added products. A’ Target Plus’ scheme has also been announced.

Another new scheme ‘Free Trade and Warehousing Zones (FTWZ) has been introduced to improve trade related infrastructure. Foreign direct investment would be permitted up to 100 per cent in the development and establishment of the zones and their infrastructural facilities. Each zone would have a minimum outlay of Rs. 100 crores and five lakh square metres of built-up area. These units will quality for all benefits applicable for special economic zones.

Target Plus Scheme to promote exports:

A new scheme call “Target Plus” has been launched to accelerate export growth. Under this scheme special incentives have been provided to all exporters who exceed the normal export target growth of 16% fixed by the commerce ministry for 2004-05. For instance if a firm shows a 25% growth in exports it will get duty free credit totaling 10% of the value of incremental exports.

The duty free credit entitlement goes up to 15% of incremental exports if exports grow by 100% during the year. This is expected to provide incentives to exporters to achieve a quantum growth in exports. But past experience has shown that such schemes also get misused widely.

Establishment of Bio-Technology Parks:

Taking note of the significance of biotechnology, the new policy has announced the establishment of biotechnology parks, which will get all the facilities of 100 per cent export oriented unit. In this regard sectors with significant export and employment potential in semi-urban and rural areas have been identified.

Restrictions on Imports of Second-Hand Capital Goods Waived:

For the first time all capital goods regardless of age are made freely importable without any actual user condition or requirement of minimum residual life. Free imports of second hand machinery is expected to bring down the cost of investment and strengthening the forces of industrial restructuring. However free imports does not apply to computer and laptops.

Free Transferability of DFECC (Duty Free Entitlement Credit Certificates):

The main improvement in the DFECC scheme is that the portion related to agriculture exports zones is freely transferable. These will make incentive attractive and give push to the AEZs. (Agriculture Export Zones).

The DFECC for normal exports, which varies from 5 to 15% of export value depending upon export growth rate, is a non-stater mainly because of the actual user condition and restriction on transferability of the entitlement. Unless the negotiability of the entitlement is improved, the scheme will not take off.

Evaluation of New Foreign Trade Policy, 2004-09:

Chambers of Commerce and Industry have welcomed the new foreign trade policy. According to CII president Sunil Kant Munjal, “The foreign trade policy is forward looking’. It presents schemes to develop exports across all sectors of the economy, sets a target of doubling India’s share in global trade and presents a vision of India as a ‘global hub’ for manufacturing, trading and services”.

In view of India’s increasing integration with the global market, there is a need for a more integrated approach to foreign trade policy. The chamber said it is looking forward to interacting with the Board of Trade which is expected to play a greater role in developing foreign trade related initiatives.

FICCI president Y.K Modi said, “This policy not only encompasses the entire export chain but takes cognizance of India’s export competitiveness against the background of bilateral and multilateral trade processes that India has entered into.”

The chamber has appreciated the commerce minister’s statement that Indian exports can be competitive only if the current practice of exporting local taxes is put to an end. The proposed Service Export Promotion Council and the ‘Served from India’ scheme will help even non-IT services like entertainment, medical tourism, accounting services, financial services to realise their greater potential.

Assocham president Mahendra K Sanghi said it is a good idea to set up free trade warehouse zones through which service exports will be encouraged. The duty free import of capital goods for agriculture exporters and permitting 100% FDI in the Free Trade Zones are good measures to boost India’s agricultural exports.

According to S.S.H Rehman, chairman, CII tourism council, “We welcome the maintenance of the duty free entitlement scheme of imports of professional equipment and consumables including liquor, amounting to the average of the previous 3 years +earnings in foreign exchange, in respect of hotels”.

The step of enhancing the entitlement for stand alone restaurants to 20% is also positive. PHDCCI president Ravi Wig said the emphasis on a partnership approach between industry and government for doubling India’s merchandise exports in the next five years is a positive step. Further, the thrust on promotion of agri-products would lead to substantial foreign exchange earnings as well as employment generation.

The new foreign trade policy seeks to double India’s share of global exports from today’s 0.8% to 1.5% in the next five years. To do that, the policy exempts all exports from the new service tax, allows unlimited foreign investment in free trade and warehousing zones, provides incentives for biotech parks and scrapped restrictions on imports of used capital goods.

To boost exports, some imported inputs necessary for exporting industries have been made duty-free. There is a scheme to boost foreign sales of value-added farm products, fruits and flowers. None of this is earthshaking; they’re workmanlike ideas which could speed up exports to some extent.

Though services exports are growing at a scorching rate and are expected to continue at this pace for many years, India needs to boost manufacture exports. To do that the entire structure of indirect taxes, which penalizes manufacturing, has to be overhauled.

Instead of taxing manufactures with a host of Central and State-level taxes like excise, octroi, sales tax and so on, whose fiscal impact cascades into high prices and loss of competitiveness. There is urgent need for replacing this with a single-rate value-added tax (VAT).

Further, instead of charging different tariff rates for different imports at relatively high rates compared to global standards, the government should shift to a single reasonable tariff rate for all imports. This has two important benefits. First, it will cut out all procedural complications and most of the red tape that goes with trade.

It will also minimise the graft, rent-seeking and policing, inevitable in a multiple-rate system. Finally, the key to a competitive economy is its investment regime. There’s no reason why India cannot implement a liberal foreign investment policy that allows 100% investment in most sectors, and curbs it in a few areas that are deemed too sensitive for foreign funding.

The growth of trade is linked intimately with the health of the economy. History shows that countries with clear, investor-friendly policies do better than those that cripple businesses with red tape and taxes.

In our view the prime driver of exports in a globalizing economy has to be competitiveness and not promotion. And competitiveness is created by a range of factors, very few of which are in the commerce minister’s control. True, promotion of exports is not irrelevant and to that extent, the new thrust given to export of agriculture, handicrafts, leather, gems and jewellery, and services is welcome.

However, it is inexplicable that the one sector in which India’s export opportunity is going to zoom in the near future, that is textiles, has been virtually ignored, except for some leftover concessions for garments. Besides, in our view the lifting of restrictions on imports of second hand capital goods will have an adverse effect on the domestic capital goods industries.

Annual Supplement (2006) to Foreign Trade Policy:

In its annual supplement in April, 2006 to foreign trade policy, 2004-09, the Commerce Minister proposed a series of important trade initiatives to put India’s exports on a trajectory of quantum growth and create two million new jobs in the export sector by 2009-10.

India’s merchandise exports crossed 100 billion US dollars and touched 101 billion US $ in the fiscal year 2005-06, that is, 25 per cent growth on the top of 26 per cent growth achieved last year (2004-05). The target for the current year, 2006-07 is the achieve 20 per cent growth rate in exports. If our exports continue to maintain this 20 per cent or above growth rate, then the export target of 150 billion US dollars in 2008-09 is quite achievable.

In the fiscal year 2005-06, as against the exports of 101 billion US dollars, merchandise imports have been estimated at 140 billion US $ (which includes imports of 43 billion US $ of petroleum oil alone).

In this annual supplement to foreign trade policy the two new schemes namely, Focus Product Scheme and Focus Market Scheme have been announced, especially for the objective of creating employment opportunities in semi urban and rural areas. These two schemes will replace the Target Plus Scheme which has been abolished.

Some details of these two schemes are:

Focus Product Scheme:

Under the focus product scheme a duty-free credit facility at 2.5 per cent of FOB (Free on Board) value of exports will be provided on 50 per cent of the export turnover of notified products such as fish and leather, stationery items, sports goods, toys and handlooms and handicrafts. This will encourage exports and since these products are labour-intensive, their growth will generate a large number of employment opportunities.

Focus Market Scheme:

This focus market scheme offers a similar incentive for all products exported to notified countries which may include Africa and Latin America.

It has been estimated that above two schemes would not involve much loss of revenue for the government.

Stimulus to Exports of Gem and Jewelry:

In this annual supplement to foreign trade policy, favourable policy measures have been announced that will not only help boost exports by 20-25 per cent but will also pave the way for increased FDI in India. An important policy measure in this regard has been the reduction in value-addition norms of exports of gold and silver which have been brought down from 7 per cent to 4.5 per cent. Increase of gold and silver prices over the past few years had made the present value-addition criteria on exports of gold and silver jewellery unrealistic.

Further, the foreign trade policy has allowed re-import of rejected jewellery subject to refund of duty exemption benefits on inputs only not the duty on entire jewellery. On several occasions exporters used to face the dilemma of unsold jewellery in foreign markets because of changing designs and other such factors. The new initiative well help exporters to overcome this problem as now jewellery export would be possible on consignment basis.

Beside, the permission to export cut and polished precious and semi-precious stones for treatment and subsequent re-import within a period of 120 days has been given. This will enhance the quality of these products and afford higher value in the international market. The idea behind these steps is to prevent India’s gems and jewellery business from shifting to Dubai. Boosting the gems and jewellery sector would create more jobs in smaller centres such as Surat.

Boost to Auto Sector:

To provide stimulus to the auto sector, foreign trade policy seeks to promote India as an auto component hub, import of cars for R & D purposes will be allowed without going the expensive homologation. This will enable import of new model cars for testing components.

The Videsh Krishi Upaj and Gram Yojana (VKUGY):

In the new foreign trade policy, the Videsh Krishi Upaj Yojana (VKUY) has been replaced by the Videsh Krishi Upaj and Gram Yojana (VKUGY) under which gram udyog products will also be entitled for a customs duty credit of 5 per cent of free- on-board (FOB) value of exports made after April 2006.

Duty Free Authorisation Scheme:

Besides, in the new foreign trade policy a new duty free authorisation scheme has been introduced with effect from May 1, 2006 with combined features of Advance License Scheme (ALS) and Duty Free Replenishment Certificate (DFRC). DFRC scheme has been discontinued with effect from April 30, 2006 while the advance.

Duty Drawback and DEPB Rates:

It has been decided to include service tax and fringe benefit tax (FBT) under the export promotion schemes such as Duty Drawback and Duty Entitlement Pass Book Scheme (DEPB) which will be notified later in year 2006. Revenue loss to the government on this count will be around Rs. 800 crores.

EPCG Scheme Made Flexible:

The Export Promotion Capital Goods Scheme which allows import of capital goods at a concessional customs duty of 5 per cent has been made more flexible. In this regard export obligation period has been extended to a maximum of 12 years. These changes would help genuine exporters who were unable to fulfill the export obligation due to changed market conditions.

Evaluation of Annual Foreign Trade Policy (2006):

It has been claimed by the Commerce Minister that the growth of exports at the rate of 26 per cent in 2004-05 and 25 per cent in 2005-06 shows the success of foreign trade policy, 2004-09. As a matter of fact, our exports have grown at more than 20 per cent in the last four years (2002-06).

Of course, foreign trade policy to promote exports pursued in the past some years has contributed to such robust growth in exports. However, many other things account for such robust growth in our exports, apart from the trade policy. Macroeconomic stability, gradual elimination of the anti-export bias in our economic policy built up by huge tariff barriers in the past, increasing confidence of India producers, availability of imported inputs at nearly global prices, availability of relatively cheap finance are some other factors that that have boosted the competitiveness of Indian exports. The ability of Indian goods and services to gain market-share abroad is ultimately a function of the competitiveness of Indian producers.

If momentum of export growth of over 20 per cent per annum is maintained, then India’s aim to double its share in global trade from 0.8 per cent to 1.5 per cent by the end of present foreign trade policy period (i.e. by 2008-09) appears to be achievable.

For expanding production of goods and services for export, producers need efficient infrastructure, flexible and less restrictive labour laws, and reforms in the complicated tax structure. Thus, in addition to efficient infrastructure Indian exporters urgently need a full fledged goods and service tax and abolition of all cascading, non VAT commodity taxes like Octoi, entry tax and turnover tax if export target of 150 billion US $ by 2008-09 is to be achieved. The more difficult goal is the generation of an additional two million jobs in the export sector. Trade Policy measures by Government in 2008-09.

Foreign Trade Policy, 2009-14:

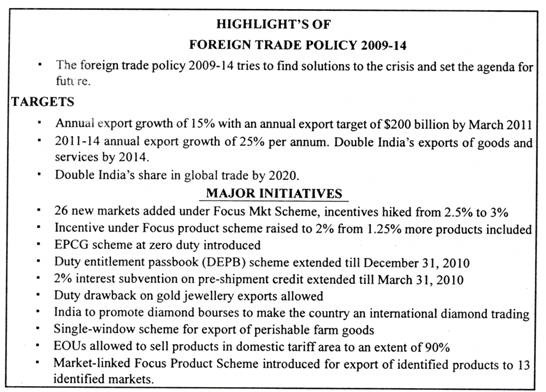

Against the fall in exports for the last 10 months, (October 2008 to July 2009) the Government announced its foreign trade policy for 2009-14 on August 27, 2009. Due to the global slowdown, some countries have resorted to protectionist measures posing barrier to free trade which has aggravated the problem for Indian exporters.

The Government’s short-term goal through this foreign trade was to reverse the declining trend of exports and provide support to the export sectors that have been hit badly by recession in the developed world. The Government does not expect immediate outlook for exports to improve and pegged export growth for the year 2009-10 at 3 per cent.

But for 2010-11 it has set the target of 15 per cent growth in exports and an ambitious $ 200 billion target for exports to be achieved by March 2011. In the remaining three years 2011-14 it expected to return to high growth path for exports at 25 per cent per annum. It set the target of doubling our exports of goods and services by March 2014.

Its long-term aim is to double India’s share of global goods and services exports by 2020, that is from 1.64 per cent in 2008-09 to 3.28 per cent in 2019-20. By and large the new foreign trade policy is similar to the previous one for the period 2004-09 and has the same promotion measures, but with some additional incentives.

Duty free imports for labour-intensive sectors:

An import measure of the new foreign trade policy is allowing duty-free imports of capital goods required for the manufacture of export goods as against the existing 3 per cent duty. These labour intensive sectors include engineering, electronics, basic chemicals and pharmaceuticals, apparel and textiles, plastics as well as leather and leather products.

This incentive under the Export Promotion Capital Goods (EPCG) scheme will be applicable until-March 31, 2010. Besides, the period of export obligation for importing capital goods free of import duty has been extended to 12 years.

Further, the other sectors in addition to the above have also been allowed to import capital goods under EPCG scheme at a concessional duty of 3 per cent. In their case too the period of export obligation has been expended to 12 years.

The objective has been to increase the productivity of the export-industries through technological up-gradation by importing required capital goods. This will help our exporters to increase the share of world exports.

Extension of Duty Entitlement Passbook Scheme (DEPBS):

Foreign trade policy for 2009- 14 has also extended the Duty Entitlement Passbook Scheme (DEPBS) until December 2010. Under this scheme exporters obtain a refund on a proportion of indirect taxes paid by them. Since this scheme is not WTO compliant alternative scheme is being worked out.

Expansion of Focus Markets Scheme (FMS):

As India’s existing export markets are reeling under recession, the new foreign trade policy has expanded its Focus Market Scheme (FMS) to 26 more markets, 16 in Latin America and 10 in Africa and IS countries (Common Wealth of Independent States). The new policy has also increased the incentive under this scheme to the exporters from 2.5 per cent to 3 per cent of the value of the exports if they cater to these markets.

Explaining the policy the commerce Minister, Mr. Anand Sharma said, “We cannot remain oblivious to declining demand in the developed world and we need to set in motion strategies and policy measures which will catalyze the growth of exports.”

At present, exports to Europe, US and Japan amount to 36%, 18% and 16%, respectively, of India’s total exports of $ 168 billion in 2008-09. Due to global recession, India’s exports have declined by almost 30% in the last 10 months. This forced the government to induce exporters to sell in new markets.

More Incentives and Greater Coverage for Focus Product Scheme (FPS):

While the incentive available under the Focus Market Scheme (MS) has been raised from 2.5 to 3 per cent, that under the Focus Products Scheme (FPS) has been raised from 1.25 to 2 per cent. Engineering products such as agricultural machinery, parts of trailers, sewing machines, hand tools, garden tools, musical instruments, clocks and watches and railway locomotives, value-added plastic products, jute and sisal products, technical textiles, green technology products such as wind mills and wind turbines, electrically operated vehicles, project goods, and certain electronic items have been included in Focus Product Scheme (FPS).

Export of products like pharmaceuticals, synthetic textile fabrics, value-added rubber products, value-added plastic goods, textile made-ups, knitted and crocheted fabrics, glass products, certain iron and steel products and certain articles of aluminum would be eligible for FMS if exports are made to 13 identified markets (Algeria, Egypt, Kenya, Nigeria, South Africa, Tanzania, Brazil, Mexico, Ukraine, Vietnam, Cambodia, Australia and New Zealand).

Market-linked FPS benefits have also been extended for export to more new markets for certain products. These products include auto components, motor cars, bicycles and parts, and apparel, among others.

Extension of other Export Booster Schemes:

The other booster schemes, which were announced earlier, will also continue under the new foreign trade policy. Some of the such schemes are 2 percentage points interest subvention on pre-shipment credit and enhanced insurance coverage through Export Credit Guarantee Corporation (ECGC). These measures will now continue till March 31,2010.

ECGC provides a range of credit risks insurance cover to exporters against loss in exports of goods and services. It also provides guarantees to banks and financial institutions to enable exporters to obtain better facilities from them.

Incentives to Gems and Jewellery:

The $ 27 billion Indian gems and jewellery sector which contributes 13% to India total exports, has received a host of incentives, including input duty refunds (under duty drawback scheme) on gold jewellery export and setting up of diamond bourses to make the country diamond-trading hub.

“It shall be our endevaour to make India an international diamond- trading hub and we plan to establish diamond bourses in the coming years,” commerce minister Anand Sharma said unveiling the new Foreign Trade Policy.

The Rs. 80,000 crore diamond cutting & polishing industry that has an 80% global market share has suffered heavily because of the recession in the world’s largest diamond markets, the US and Europe. Surat, the diamond city, saw more than 3,000 units shutting down with around 4 lakh workers losing jobs in Gujarat alone.

Relief for Export-oriented Units (EOUs):

EOUs can sell 90% of the output in domestic market instead of 75%. But over a period of 75% of the production has to be exported.

Measures to Reduce Transaction Costs:

With a view to boost exports, the government initiated several measures to rationalise procedures and reduce transaction costs in its new foreign trade policy (FIP), announced today. Following the demand of industry, the application and redemption forms under the Export Promotion Capital Goods (EPCG) scheme have been simplified.

The maximum fee charged on authorisation or licence applications on schemes like focus product, focus market, market access initiative and market development assistance, has been slashed to Rs. 1 lakh from Rs. 1.5 lakh (manual applications) and to Rs. 50,000 from Rs. 75,000 (for electronic applications). No fee shall now be charged for granting incentives under the schemes which deals with export incentives of foreign trade policy.

The government has extended the time within which exporters can convert shipping bills from one export scheme to another, from one month to three months. An inter-ministerial committee would also be formed to resolve issues of exporters.

In order to reduce transaction costs, dispatch of imported goods directly from the port to the site has been allowed under the Advance Authorisation Scheme for deemed supplies. At present, duty-free imported goods could be taken only to the manufacturing unit of the authorisation holder or its supporting manufacturer.

To facilitate duty-free import of samples by exporters, number of samples or pieces has been increased from the existing 15 to 50. Customs clearance of such samples shall be based on declarations given by the importers with regard to the limit of value and quantity of samples.

The government has also allowed disposal of manufacturing wastes, after payment of the excise duty. Besides, automobile firms, which have their own R&D centres, would be allowed free import of petrol and diesel up to 5 kl.

The commerce and industry ministry is also promoting the use of electronic systems with initiatives like electronic data interface (EDI) ports, electronic message exchange between Customs and the Directorate General of Foreign Trade.

Evaluation of Foreign Trade Policy, 2009-14:

The various sops and incentives to the exporters in the new foreign trade policy is expected to arrest shrinking exports. The dynamic policy initiatives announced by the Government in the new foreign trade policy towards expansion and diversification of export markets, technological upgrade increased flexibility and procedural simplifications will help our exporters retain market share, and will hopefully reverse the declining trend in our exports.

The extension of the DEPB (Duty Entitlement Passbook) scheme, expansion of the focus market scheme (FMS) to 26 new countries, extension of interest subvention and zero duty on capital goods imports under the Export Promotion Credit Guarantee (EPCG) scheme are measures which will help revive exports and protect employment.

The emphasis on reducing transaction costs and simplifying trade and tax procedures in the new foreign trade policy would help enhance the competitiveness of Indian exports and would specially benefit small and medium sized exporters. The micro, small and medium enterprises, or MSMEs, are in need of technological upgrade in order to be cost-effective and competitive in international markets.

The technological up-gradation Scheme, by providing imports of capital goods for certain sectors under EPCG at zero per cent duty will help. The new policy initiatives relating to import of capital goods are, indeed, timely. The EPCG (Export Promotion Capital Goods) scheme has really been benefiting the upgrade and modernisation of India’s export manufacturing sector and the new incentive of giving access at zero duty would certainly help the beneficiary sectors such as engineering and electronic products, pharmaceuticals and chemicals, apparels and textiles, leather and leather products.

These are sectors where India enjoys a comparative advantage and the zero-duty capital goods import facility should go a long way in speeding up the process of technology upgrade.

The new foreign trade policy has taken important measures to diversify our export market and offset the inherent disadvantage for our exporters in the emerging markets of Africa, Latin America, Oceania such as credit risk, higher transaction costs etc. through appropriate policy instruments.

The policy focuses on the immediate objective of reversing the decline in exports and for that purpose provides support and incentives to the exporters. But in our view, the new foreign trade policy lacks the long-term strategic vision and does not provide any new approach on how India’s share of world trade can double by 2020, given the competition that India faces from China which has already raised its share of total world trade to 10 per cent while India’s share is still only 1.6 per cent.

It would not be easy for our exporters to be weaned off the Western developed countries (where little can be done till demand there revives) by diversifying exports to Africa and Latin America where purchasing power of the people is quite small. In our view Asia itself presents a long opportunity for our exports. Therefore, the bilateral agreements made by our Government with Asian and South Korea are appropriate steps to expand our exports.

To revive exports in the immediate future, the new foreign trade policy has rightly increased the incentives under the time tested export-promotion schemes which in the past contributed to export growth and has made an attempt to diversify markets for our exports. But long-term strategy to double our share of world export by 2020 is lacking in our foreign trade policy for 2010-14.

Trade Policy Measures in 2009-10 and 2010-11 to Check Inflation:

Trade policy measures taken by the Government and the RBI in 2009-10 and 2010-11 focused on reviving exports and export-related employment. The Government followed a mix of policy measures including fiscal incentives, institutional changes, procedural rationalization and enhanced market access to the world and diversification of export markets, improvement in infrastructure related to exports; bringing down transaction costs and providing full refund of all indirect taxes and levies were there major areas of focus.

Some of the trade policy measures to check inflation during 2009-10 and 2010-11 in the country are the following:

1. Import duties reduced to zero for rice, wheat, pulses, edible oils (crude), butter and ghee to 7.8 per cent for refined and hydrogenated oils and vegetable oils.

2. Import of raw sugar allowed at zero duty under open general licence (OGL).

3. Import of white/refined sugar allowed. The facility was extended up to 31 December 2010 without any quantitative,

4. Levy obligation in respect of raw sugar and white/refined sugar removed.

5. Export of basmati rice, edible oils, except coconut oil and forest-based oil and pulses (Kabuli Chana), banned.

6. Minimum export price (MEP) used to regulate exports of onions (at $ 1200 per tonne for Dec. 2010) and Basmati rice ($ 900 PMT) were fixed.

7. Export of onions (all varieties) including Bangalore rose onions and Krishna puram onions, fresh or chilled, frozen, provisionally prepared or dried (but excluding onion-cut and sliced or broken in powder form) not permitted with effect from 22 December 2010 and until further orders.

8. Full exemption from basic customs duty provided to onions and shallots with effect from 21st December 2010. Consequently these items are exempt from special duty of 4 per cent and education cess. The exemption is open-ended and does not carry a validity clause prescribing a terminal date, and secondary and higher education cess.

The Important Foreign Trade Policy Measures, 2012-13:

Budget Related:

1. Imports of equipment for initial setting up or substantial expansion of fertilizer projects fully exempted from basic customs duty of 5 per cent for a period of three years up to 31 March 2015; and basic customs duty on some water- soluble fertilizers and liquid fertilizers other than urea reduced from 7.5 per cent to 5 per cent and from 5 per cent to 2.5 percent.

2. Concessional import duty available for installation of mechanized Handling Systems and Pallet Racking Systems in mandis or warehouses extended for horticulture produce.

3. Full exemption from basic customs duty for coal-mining projects.

4. Basic customs duty on plant and machinery imported for setting up or substantial expansion of iron ore pellet plants or iron are beneficiation plants reduced from 7.5 per cent to 2.5 per cent.

5. Full exemption from basic customs duty of 5 per cent for automatic shuttle-less looms and reduction in basic customs duty on wool waste and wool tops from 15 per cent to 5 per cent.

6. Basic customs duty increased on standard gold bars; gold coins of purity exceeding 99.5 per cent and platinum from 2 per cent to 4 per cent and on non-standard gold from 5 per cent to 10 per cent.

Credit Related:

1. In November 2011, the RBI increased the all-in cost ceilings for External Commercial Borrowings (ECBs) increased to 350 basis points (bps) over 6-months Libor/Euro Libor/Euribor for a maturity period between three and five years and 500 bps over 6 Months Libor/Euro Libor/Euribor for a maturity period more than five years. Accordingly, the all-in cost ceiling on trade credits has also been increased to 350 bps over 6-months Libor/Euro Libor/Euribor until 31 March 2013.

2. With effect from 5 May 2012, banks were allowed to determine their interest rates on export credit in foreign currency with the objective of increasing the availability of funds to exporters.

3. On 18 June 2012, the RBI enhanced the eligible limit of the export credit refinance (ECR) facility for scheduled banks (excluding regional rural banks [RRB]) from 15 per cent of the outstanding export credit eligible for refinance to 50 per cent, with effect from 30 June 2012.

The objective was to provide additional liquidity support to banks of over Rs. 300 billion. The rate of interest charged on the ECR facility was retained at the prevailing repo rate under the liquidity adjustment facility (LAF).

The 2 per cent Interest Subvention Scheme, earlier meant only for handlooms, handicrafts, carpets, and SMEs, was extended on 1 April 2012 to 31 March 2013 for labour-intensive sectors also, viz. toys, sports goods, processed agricultural products, and readymade garments. This was further extended up-to 31 March 2014and 134 tariff lines of engineering goods were also included in the scheme.

Foreign Trade Policy Measures in 2012-13:

1. Incentive on Incremental Exports:

Incentives to be granted on incremental exports made during the period January- March 2013 over the base period January-March 2012. The incentive to be granted to an Importer and Exporter Code (IEC) holder at the rate of 2 per cent on incremental growth of exports made to the USA, Europe, and Asian countries during this particular quarter, i.e. January-March 2013.

2. Export Promotion Capital Goods (EPCG) Scheme:

Zero Duty EPCG Scheme extended up to 31st March 2013 and its scope enlarged. Export obligation under this scheme to be 25 per cent of the normal export obligation for export of products from north-eastern states and export of specified products through notified Land Customs Stations of the northeastern region provided additional incentive to the extent of 1 per cent of Free on Board (FOB) value of exports.

3. Support for Export of Green Technology Products:

To promote exports of 16 identified green technology products, export obligation for manufacturing of these products under the EPCG Scheme reduced to 75 per cent of the normal export obligation.

4. Support for Infrastructure for the Agriculture Sector:

Status holders exporting products under ITC (HS) (both inclusive) are getting Duty Credit Scrip equivalent to 10 per cent of FOB value of agricultural products so exported. Import of 14 specified equipment’s had been notified for setting up of pack- houses besides import of capital goods and equipment for cold storage units, pack-houses, etc.

5. Incentives for Promoting Investment in Labour-intensive Sectors:

Status holders issued status holders incentive scrip (SHIS) to import capital goods for promoting investment in up-gradation of technology of some specified labour- intensive sectors like leather, textile and jute, handicrafts, engineering, plastics and basic chemicals. Up to 10 per cent of the value of these scrip’s will be allowed to be utilized to import components and spares of capital goods imported

6. Market and Product Diversification:

Seven new markets have been added to the Focus Market Scheme (FMS) and seven to the Special Focus Market Scheme (Special FMS). Forty-six new items have been added to the Market Linked Focus Product Scheme (MLFPS). The MLFPS has been extended till 31 March 2013 for exports to the USA and EU in respect of items falling under.

Around 100 new items have been added to the Focus Product Scheme (FPS) list. Three new items have been added to the Vishesh Krishi and Gram Udyog Yojana (VK.GUY). Additional measures announced as trade facilitation measures by widening and deepening of export incentives, 2012 to be made effective from 01.01.2013. These include addition of 5 new markets to FMS, one new market to Special FMS, 62 new items to MLFPS and 102 new items to FPS.

7. Simplification of Procedures:

Import under advance authorization (AA) permitted at any of the Electronic Data Interchange (EDI) ports, irrespective of the EDI port in which the AA has been registered. There would be no requirement of Telegraphic Release Advice (TT{A). Export shipments from Delhi and Mumbai through post, courier, or e-Commerce to be entitled for export benefits under the FTP.

8. New ‘e-BRC’ Initiative:

A major EDI initiative the ‘e-BRC’ launched which would herald electronic transmission of foreign exchange realization from the respective banks to the Directorate General of Foreign Trade (DGFT) server on a daily basis. The exporter will not be required to make any request to the bank for issuance of a bank export and realization certificate (BRC).

Exports Policy Changes in 2013-14:

To give boost to exports which contracted by 1.76 per cent in 2012-13 to $ 300.6 billion, the government in its annual exports policy for 2013-14 announced several incentives. These include easier land requirement norms, simpler exit options, cheaper credit and tax breaks for import of machinery.

The highlights of the export policy changes for SEZs in 2013-14 are the following:

1. The new rules for SEZs will allow IT firms to claim tax breaks by moving offshore work to such duty-free enclaves. The earlier requirement of minimum 10-hectares for such campuses has been done away with

2. IT SEZs can now be set up if the these are spread across at least 100,000 square metres in seven major cities including Mumbai, Delhi and NCR, Chennai, Hyderabad, Bangalore, Pune and Kolkata.

3. For category B cities, IT companies can set up SEZs even in a smaller built-up area of 50,000 square metres and for remaining cities in only 25,000 square metres. IT firms allowed to set up SEZs in campuses as small as 2500 square metres.

4. Minimum land area requirement halved to 500 hectares for multipurpose SEZs and to 50 hectares for sector-specific ones.

5. Ownership transfer of SEZ unit sales has been permitted.

6. Export Promotion Capital Goods scheme, which allows exporters to import machinery and capital goods at zero duty, was extended beyond March 2013 and would be applicable to all sectors.

It follows from above the package of export-policy reforms was meant to revive investor incentives for SEZs. It has been realised that SEZs have not realised their full potential.

IT industry body Nasscom welcomed these reforms in export policy and was delighted to note that the government has recognized that IT exports as a key growth driver for India’s exports.