Let us learn about Terms of Trade (TOT). After reading this article you will learn about: 1. The Concept of Terms of Trade 2. Gains from Trade.

The Concept of Terms of Trade:

Specialization and exchange benefit all the trading partners. Because of complete specialization in the production of the commodities in which countries have comparative advantages—as suggested by Ricardo, global production becomes larger. Now if every country trades with each other, every country will gain from such exchanges.

However, such gain from specialization and exchange depends on the terms of trade (TOT). It refers to the quantity of imports that exports buy. It is measured by the ratio of export price to import price. It is the ratio at which a country can export or sell domestic goods for imported goods.

Let PX be the price of export good and Pm be the price of import good. Thus the (barter or commodity) TOT are defined as PX/Pm.

ADVERTISEMENTS:

In the real world, where countries export and import a large number of goods, TOT are computed as an index number:

T0T = index of export prices/index of import prices × 100

or, TOT = PX/Pm × 100

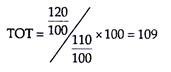

To calculate the index of export and import prices, we choose a base year and the current period. A base period index of export and import price is 100. Thus, TOT for the base year is 100. Suppose, export price index rises to 120 and import price index rises to 110.

ADVERTISEMENTS:

Thus,

TOT rise to 109. This means that a unit of exports will buy 9 p.c. more imports than the old TOT. TOT thus improves. A fall in the TOT, on the other hand, implies unfavourable TOT in the sense that the country concerned will now use more exports to buy the same quantity of imports.

On which factors the TOT depend? Answer to this question was unknown to Ricardo. In other words, Ricardo could not locate the exact TOT at which trade takes place. This is because of the fact that Ricardo concentrated on the cost or supply side of production and ignored demand conditions.

ADVERTISEMENTS:

Anyway, Ricardo suggested that the TOT would settle in-between two domestic cost ratios. We explain first the Ricardian notion of TOT and then Mill’s concept of reciprocal demand.

Let us assume that the internal or domestic cost ratio in country A is 1 X for 1.5 Y, and, in country B, it is 1 X for 2 Y. This domestic cost ratio suggests that country A has a comparative advantage in X while country B has a comparative advantage in Y.

Thus, A and B will trade with each other. But what would be the TOT at which both will trade? Ricardo argued that international TOT would lie somewhere between 1: 1.5 and 1: 2 and both the countries would stand to gain.

It was J. S. Mill who successfully determined the exact TOT by introducing the concept of reciprocal demand. In other words, actual TOT depends on the relative prices of X and Y after trade takes place. These relative prices will depend upon the strength and elasticity of each country’s demand for the other country’s product or upon reciprocal demand.

If the TOT lie very close to 1: 1.5, then country A would gain very little and she would not offer much X for export. However, at this TOT, country B would gain quite a large amount since it would demand more X by offering less Y. Consequently, country B’s demand for imports of X would exceed country A’s supply of exports of X, and so the price of X in terms of Y would rise.

As the TOT rises to 1: 1.6; 1: 1.7, etc., country A offers more X to buy more Y, while country B demands less Y to buy X. In this way, a particular TOT would prevail at which the value of each country’s export equals its value of imports. In this way, reciprocal demand is equated in the two countries at the international TOT.

Thus, TOT lies between the upper and lower limits of domestic cost ratios of two countries. Equilibrium or international TOT brings equality between export and import. At the equilibrium TOT, world output equals world consumption. But the gains to both the countries need to be equal. However, more favourable the TOT to any country, greater is the welfare of the country.

A tariff imposed on importables may bring TOT in favour of the tariff-imposing country. However, if the tariff rate exceeds the optimum tariff rate, gains from trade may reduce even though TOT may be favourable. Thus, a favourable TOT does not necessarily increase welfare of a nation. Still then, TOT must not be adverse.

Gains from Trade:

Nations—developed or underdeveloped— trade with each other because trade is mutually beneficial. In other words, the basic motivation of trade is the gain or benefit that accrues to nations. In the case of autarky or isolation, benefits of international division of labour do not flow between nations. It is advantageous for all the countries of the world to engage in international trade.

ADVERTISEMENTS:

However, the gains from trade can never be the same for all the trading nations. Some countries may reap a larger gain compared to others. Thus, gains from trade may be inequitable but what is true is that “some trade is better than no trade”.

In simple words, gain from trade refers to extra production and consumption effects that countries can achieve through international trade. These gains are, thus, of two types: gain from exchange and gain from specialization in production.

The idea of gains from trade was at the core of the classical theory of international trade propounded by Adam Smith and David Ricardo. According to Smith, the gains from trade arise form the advantages of division of labour and specialization—both at the national and international level. Such advantages arise, according to Smith, due to the absolute differences in costs.

Ricardo goes a step further. He says that trade contributes “to increase the mass of commodities, and therefore, the sum of enjoyments…” Ricardo adds that the gain from trade consists in the saving of cost resulting from obtaining the imported goods through trade instead of domestic production.

ADVERTISEMENTS:

Ricardo’s comparative cost thesis may be applied to establish the existence of gains from trade. In other words, gain from trade depends on the comparative cost conditions. Comparative cost doctrine suggests that trade can provide benefit to all countries if they specialize in the production of those goods and, hence, export them in which they have comparative advantage.

A country, thus, specializes in production and export in accordance with its comparative advantage. Ricardo’s trading nations acquire complete specialization in production.

As a result, global output becomes larger than under autarky. Trade also enables each country to consume more than under isolation. Thus, there is a production gain and a consumption gain arising out of international trade. Such cannot be reaped in the absence of trade.

However, in determining the exact volume of gains from trade, Ricardo’s doctrine is incomplete. For this, what is required is the determination of the actual terms of trade or exchange rate at which trade would take place.

ADVERTISEMENTS:

The rate at which one commodity (say, export good) is exchanged for another commodity (say, import good) is called terms of trade. Or what import the export buys is called TOT. Of course, export (and, hence, import) varies with the change in TOT.

This concept of TOT was introduced in the literature by J. S. Mill by introducing the concept of reciprocal demand. By reciprocal demand we mean demand of each country for the other’s goods. On the basis of the principle of reciprocal demand, Mill determined a final TOT at which trade between two nations takes place.

At the final TOT, goods demanded by one country are equal to the goods demanded by the other or one country’s supply or the export of good must equal the other country’s demand for that good. Thus, TOT is an index of measuring a country’s gain from trade.

As a result, if a poor, small, less developed country (LDC) trades with a large, rich, developed country’s (DC) autarkic or domestic cost ratio, then the LDC will acquire all the gains from trade. If the actual TOT lies between two domestic cost ratios then gains from trade will accrue to both the countries.

However, gains from trade depend on the:

(i) Relative strengths of elasticity of demand for export and import goods;

ADVERTISEMENTS:

(ii) Size of the country

(iii) Changes in technology

(iv) Supply of goods traded

In general, greater the inelasticity in the foreign demand for exports and greater the elasticity of foreign demand for imports, greater will be the gains from trade.

Further, trade leads to increased competition. Competition enhances efficiency. LDCs gain largely in this competitive world. Improved research and technology of developed world flow in these countries. Openness to trade supports technological upgrading via learning. Evidence on learning and technological up-gradation is observed in many activities, mainly in the manufacturing and service sectors.

Larger output and productivity increases indeed can occur not only in the manufacturing sector, but also in other sectors in which technological upgrading of the advanced countries is embodied. In addition, variety of products becomes available to consumers. All these suggest that ‘trade is an engine of growth’.

ADVERTISEMENTS:

However, gains from trade can never be unambiguous for all the countries. Sometimes, TOT may turn adverse against poor LDCs. Further, trade policy is often designed by the advanced countries in such a way that it reduces benefits of the LDCs from trade.

Possibly due to this fact it is said that free trade is better than restricted trade. Of course, restricted trade has merits too. By imposing a tariff, a poor country can even improve its TOT and, hence, can obtain benefits from trade.