Theory of Comparative Costs of International Trade!

The fundamental cause of international specialisation and hence international trade is the difference in costs of production.

It is the relative differences in costs which determine the products to be produced by different countries. Considering climatic conditions, availability of mineral and other resources and differences in costs arising from them, every country seems to be better suited for the production of certain articles rather than for others.

A country tends to specialise in the production of those goods for which it has got relative or comparative advantage. A country can produce numerous goods. But it will not produce all of them since it will simply not be paying to do so. It will be much better if after comparing the costs of the various articles that it can produce, it selects those in which the comparative costs are lower or in which it enjoys relative advantage.

ADVERTISEMENTS:

It will be to the advantage of each country as well as of the world as a whole that each country specialises in the production of those commodities for which it has comparative advantage. In this way the productive resources of the country and of the whole world will be optimally utilised.

The theory of comparative costs is simply an application of the principle of division of labour to different countries. An individual can do a number of jobs but he cannot do them all alike. Take the case of a doctor. Undoubtedly, he can do the dispensing work better than his dispenser.

But still he employs a dispenser, and he himself specialises in examining the patients. He knows that the time which he will spend in dispensing can be more remuneratively employed by examining patients. The work of dispensing can be done by a low-paid person, while he can earn much more as a doctor.

Similarly, a professor may be able to teach his own son who is reading in a lower class much better than any school teacher. But if the hour that he devotes to the teaching of his son is devoted to coaching of a student for the degree examination, he will get much more payment than he has to pay a tutor whom he may employ for coaching his son.

ADVERTISEMENTS:

This specialisation is very gainful. This is the application of the theory of comparative costs to the case of individuals. Each individual compares the cost and the income of the various jobs that he could take up and of these he selects that one which is most profitable.

Now, let us see how this principle applies to international specialisation. The fundamental cause as to why international specialisation occurs is the differences in costs, which result from the differences in the availability of the amount and the quality of resources, the prices of these resources or factors and the method of their use. Considering the differences in costs of producing different goods, every country seems to be better suited for the production of certain goods rather than the others.

A country tends to specialise in the production of those goods in which it has got comparative advantage or lower comparative cost. A country can produce many goods. But it will not produce all of them since it will simply not be paying to do so. It will be much better if after comparing the costs of the various goods which it can produce it selects those in which the comparative costs are lower or in which it enjoys comparative advantage.

It will be to the advantage of each country as well as of the world as a whole that each country specialises in the production of those commodities for which it has comparative advantage. In this way the productive resources of the country will be optimally utilised. It is worth mentioning that specialisation necessitates trade or exchange of goods with other countries.

ADVERTISEMENTS:

Under specialisation, a H country will import a good it does not produce and exports the good in which it specialises. The advantage of having a country specialise in the production of the good which it can produce more efficiently and exporting some of it in exchange for the imports of the good it can produce relatively less efficiently is that such specialisation increases the total supply of goods. In this way both countries are able to increase their level of consumption beyond what is possible in the absence of specialisation.

Let us take two countries U.S.A. and India and two goods, wheat and cloth. We shall explain what would be the basis of trade between these two countries and how the two would gain from specializing and trading with each other on the basis of comparative advantage or comparative cost.

In order to simplify our analysis, we make the following assumptions:

1. There are no transport costs between the two countries.

2. Conditions of perfect competition prevail in both countries.

3. Labour is the only resource of production and prices of products are equal to their relative labour costs.

4. There is free trade between the countries.

Specialisation and Trade with Comparative Advantage:

When each country has an absolute advantage over the other in the production of a commodity, the gain from specialisation and trading between countries is quite obvious. However, a pertinent question is if the U.S.A. can produce both the commodities wheat and cloth more efficiently than India, would she gain from specialisation and trading with India.

In fact, it was this question which was raised by David Ricardo, a classical economist, who put forward the theory of comparative costs (advantage) as an explanation of the potential gain from international trade. Let us illustrate the theory of comparative cost (or comparative advantage) with a numerical example. Taking two countries, two commodities model as used by Ricardo we give in table 23.3 labour requirements per unit of cloth and wheat in the U.S.A. and India.

It will be seen from Table 23.3 that U.S.A. is more efficient (or has absolute advantage) in the production of both wheat and cloth. To produce one unit of wheat the U.S.A. requires 3 man-hours, while India requires 12 man-hours. In case of cloth, to produce one unit of it 6 hours of labour are needed in the USA, while 9 hours are needed in India.

It is thus evident that the U.S.A. is more efficient in the production of both the commodities as it produces them at a lower labour cost than India. That is, U.S.A. has an absolute advantage in the production of both the commodities. However, Ricardo argued that the two countries can still gain from specializing and trading between them if they produce according to their comparative advantage.

It will be seen from above table that the U.S.A. is four times more efficient in the production of wheat as compared to India, while its efficiency in the production of cloth is 1.5 times greater than India. Thus, while U.S.A. has absolute advantage in the production of both wheat and cloth, it has a comparative advantage in the production of wheat.

On the other hand, India is less efficient in the production of both wheat and cloth, its inefficiency is comparatively less in cloth. India is said to have comparative advantage in the production of cloth. Both the countries will be better off if the U.S.A. specialises in the production of wheat and exports it to India for import of cloth and India specialises in the production of cloth and exports it to the U.S.A. and import wheat from it.

ADVERTISEMENTS:

It might appear that the U.S.A. which can produce both wheat and cloth more efficiently than India has nothing to gain by trading with India which is comparatively inefficient in the production of both wheat and cloth. Even though the U.S.A. is more efficient in the production of both wheat and cloth, she will still gain by having specialisation and trading with India.

Let us see how the two countries will gain if they specialise and trade on the lines of comparative advantage. In the absence of trade between the U.S.A. and India, depending on their labour costs one unit of wheat will be exchanged for 0.5 units of cloth in the U.S.A. and 1.33 units of cloth in India.

When the U.S.A. and India specialise in wheat and cloth respectively and trade takes place between them, the U.S.A. will gain if it has to give less than can get more than 0.5 units of cloth from India for one unit of wheat and India will gain if it 1.33 units of cloth to the U.S.A. for import of one unit of wheat.

Hence any exchange ratio between 0.5 and 1.33 units of cloth against one unit of wheat represents a gain for both the countries. The actual exchange rate settled between them will be determined by the reciprocal demand of the two countries for wheat and cloth.

ADVERTISEMENTS:

Now, the question is what will be the source of gain from specialisation in the present case. The answer to this is that whereas the U.S.A. has an absolute advantage in the production of both wheat and cloth, its margin of advantage is greater in case of wheat as compared to cloth.

Likewise, although India has absolute disadvantage in the production of both wheat and cloth, the extent of its disadvantage is less in case of cloth. Thus, with increases U.S.A. specialising in the production of wheat and India in cloth, through reallocation of labour between wheat and cloth, the total production will increase.

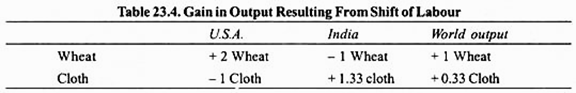

How does the total joint output of the two countries increases if U.S.A. specialises in wheat for which it has comparative advantage and India in cloth for which it enjoys comparative advantage ? We show below in Table 23.4 the gain in wheat output that occurs when U.S.A. shifts its labour resources by reducing the production of cloth by one unit and India shifts its labour to cloth by reducing the production of wheat by one unit (the above data of man-hours cost of wheat and cloth are used).

It will be seen from Table 23.3 and 23.4 that if U.S. A. reduces the production of cloth by one unit 6 man-hours of labour will be released and if these are used for the production of wheat it will gain 2 units of wheat production. On the other hand, if India reduces production of one unit of wheat, 12 hours of labour will be released which on using for cloth production will result in gain of 1.33 units of cloth.

It will be seen from Table 23.4 that total world output (i.e. joint output of the two countries) will rise by 1 unit of wheat and 0.33 units of cloth as a result of the above shift of man-hours to the products of their comparative advantage.

ADVERTISEMENTS:

Thus, specialisation, according to the comparative advantage, would lead to the increase in production of both wheat and cloth and the two countries would gain from trading with each other by exporting the goods in which they specialize.

Comparative Cost Theory: Opportunity Cost Approach:

Comparative cost theory explained above is based upon labour theory of value. But this labour theory of value has been abandoned by the modern economists. However, comparative cost theory is still believed to be valid and important basis of international trade. The labour theory of value does not hold good because the wages of labour are not brought to equality throughout the country.

Further, labour is not homogeneous and the wages of different non-competing groups do not tend to be equal at least in the short run. Another serious objection against labour theory of value has been that goods are not produced by labour alone but by various combinations of different factors of production, land, labour and capital.

Therefore, to compare the values of the two commodities by taking into account only their labour content would give a wrong view of the relative values because one commodity may require more capital than labour, another may require more land than labour. Therefore, variable proportions of factors used in the production of different commodities make the labour theory of value inapplicable in determining comparative cost of commodities.

Therefore, a noted economist Haberler has explained comparative cost doctrine in terms of opportunity costs. The opportunity cost of a commodity, say wheat, is amount of another commodity, say cloth, which a country has to give up to produce an additional unit of wheat.

Thus opportunity cost measures the ratio of marginal costs of the two commodities. In the explanation of comparative cost theory, the concept of opportunity cost is generally illustrated through production possibility curve.

Constant Opportunity Costs:

ADVERTISEMENTS:

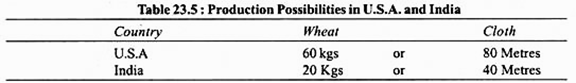

We shall first explain the case when opportunity costs of the commodities in each country have been assumed to be constant. Suppose, with given resources, India can produce 20 kgs. of wheat or 40 meters of cloth, whereas with the same resources, the U.S.A. can produce 60 kgs of wheat and 80 metres of cloth. This is given in the Table 23.5.

From these production possibilities, it follows that U.S.A. is more efficient in the production of both wheat and cloth. However, in case of wheat its efficiency is three times greater and in case of cloth two times greater as compared to India. From these production possibilities we can calculate the opportunity cost of wheat and cloth in the two countries.

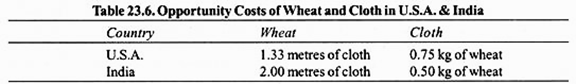

In U.S.A. opportunity cost of 60 kg. of wheat is 80 metres of cloth, that is, 1 kg. of wheat has opportunity cost of 80/60 or 1.33 metres of cloth. Likewise, 80 metres of cloth in U.S.A. has the opportunity cost of 60 kg. of wheat, that is, 1 metre of cloth has the opportunity cost of 0.75 kg. of wheat in U.S.A.

In India one kg. of wheat has the opportunity cost of 2 metres of cloth and one metre of cloth has 0.50 kg. of wheat. In Table 23.6 opportunity costs of the two countries are given.

It is evident from the above table that in U.S.A. opportunity cost of wheat is less than that of India, while in India opportunity cost of cloth is less than that of U.S.A. These opportunity costs reflect comparative advantage. Thus, it would be to the advantage of U.S.A. to specialise in the production of wheat and of India in the production of cloth.

ADVERTISEMENTS:

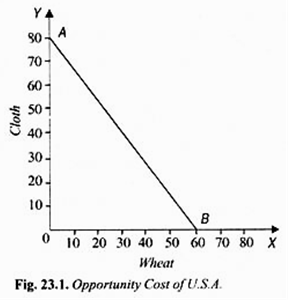

Production possibilities between wheat and cloth of U.S.A. has been show in Fig. 23.1 where on the X-axis wheat and on the Y-axis cloth have been measured, Now, line AB represents the production possibility curve in India between wheat and cloth.

As constant costs are assumed, a straight line production possibility curve has been drawn. Similarly, in Fig. 23.2 production possibility curve between wheat and cloth of India is CD. In order to explain the comparative cost theory and the gain from trade we have to superimpose the production possibility curve of one country over that of the other.

It will be seen from the slopes of the production possibility curves of the two countries that while India can produce cloth at the lower comparative cost, the U.S.A. can produce wheat at a comparatively cheaper cost. Therefore, it would be advantageous for India and U.S.A. to specialise in cloth and wheat respectively.

This can be shown by superimposing the opportunity cost curve CD of India over the opportunity cost of U.S.A., in such a way that point D is joined with point B of U.S.A. This has been shown in Figure 23.3 the product possibility. Now, suppose that before trade U.S.A. is producing and consuming at point E on her production possibility curve AB.

The slope of the production possibility curve AB shows the comparative cost ratio of the two commodities in U.S.A. If U.S.A. can trade with another country, say India, at a different price-ratio than this, it will then gain from the trade. It will be seen from Fig. 23.3 that the product possibility curve AB of U.S.A. lies India’s production possibility curve C’D’.

ADVERTISEMENTS:

The terms of trade which will be settled between the two will lie between the production possibility curve CD’ of India and the production possibility curve AB of U.S.A. Suppose, D’T’ is the terms of trade line showing the price ratio settled between the two countries. Since U.S.A. has a comparative advantage in the production of wheat it will specialise in wheat and would produce OB or 60 units of wheat, whereas India has comparative advantage in the production of cloth and will specialise in cloth production.

After trade the equilibrium of U.S. A. would lie at some point on the terms of the trade line D’T, depending upon its demand for goods. Suppose R is such point on the terms of trade line D’T. Thus U.S.A. would now get the combination of the goods indicated by point R for its consumption while it would be producing only wheat.

It will be seen From Fig. 23.3 that U.S.A. would gain from specialisation and trade as point R lies at a higher level than point E. At point R, U.S.A. would be consuming more of both wheat and cloth than at point E which is the position before trade. At point R, U.S.A. would be exporting RS amount of wheat and would be getting in return for it SD’ amount of cloth from India. Similarly, it can be shown that India will also gain from specializing in cloth and exchanging it for wheat with U.S.A.

It may be noted that in case of constant opportunity costs, there is complete specialisation, that is, of the two goods a country produces only one commodity, that is, either wheat or cloth after specialisation and trade.

Comparative Cost Theory: Increasing Opportunity Costs:

In the above analysis of opportunity cost version of the comparative cost theory we have assumed that opportunity costs are constant. The constancy of opportunity costs implies that the various resources are equally suitable for the production of each of the two goods.

However, this does not represent the real situation, where all resources do not produce equally well both of the two commodities. Some resources may be equally suitable for the production of both wheat and cloth but all resources are not of this kind. Resources such as land, villagers trained for the art of agriculture, are more suited for the production of wheat.

On the other hand, resources such as spindles, looms, technicians are suitable for producing cloth. When resources are not equally efficient in the production of the two commodities we may have the situation of increasing costs. In case of increasing opportunity costs, the production possibility curve instead of being a straight line is concave to the origin, as shown in Figure 23.4.

This indicates as we shift resources from the production of wheat to the production of cloth, marginal opportunity cost of cloth (that is, the amount of wheat forgone for a unit of cloth) goes on increasing and vice versa.

Under conditions of increasing opportunity costs, the production possibility curve is not identical with a price curve as in case of constant opportunity costs. The domestic price-ratio (that is, the rate of which two goods would be exchanged in the absence of trade) are not determined by the production possibility curve alone. Instead, this domestic exchange rate is determined by the production possibilities (i.e. supply or cost conditions) and the demand for the goods.

In the equilibrium situation, the two goods would be produced in such quantities where:

MRTCW = PC/PW

where

MRTCW stands for marginal rate of transformation between the two goods

PC denotes price of cloth

Pw denotes price of wheat.

In Figure 23.4 suppose the price-ratio line between wheat and cloth, as determined by demand and supply conditions, is pp’. The production equilibrium in the absence of trade will be reached at point R where the price line is tangent to the production possibility curve so that the marginal rate of transformation between the two goods is equal to the price ratio between them.

Now, if foreign trade possibilities are such that price of cloth is relatively more in foreign market than at home, it would be advantageous for the country to enter into trade and increase the production of cloth and reduce that of wheat.

Suppose the price-ratio line in the foreign market (or what is also called terms of trade line) is given by the price line tt in Figure 23.4. It will be seen from this figure that slope of the price- ratio line tt indicates higher price for cloth and lower one for wheat as compared to domestic price-ratio line pp’ since according to tt more wheat can be obtained for a given amount of cloth.

Given these trade possibilities, it would be advantageous for India to increase the production of cloth, (or so to say specialise in cloth) by shifting to it some resources from wheat. With price-ratio (or terms of trade) line tt, India would be in equilibrium at point R’ where its production possibilities curve AB is tangent to the terms of trade line tt.

However, the consumption of two goods in a country depends on the tastes or demand pattern for the goods. In the modern international trade theory, tastes or demand for goods in a country are shown through the medium of community indifference curves, the use of which we are avoiding at this stage.

It will suffice to mention here that consumption of the two goods in India would take place at a certain point on the terms of trade line tt to the left of point R, say at point C. Of course, this consumption point C would be determined by the demand conditions in India.

With production at R’ and consumption at C in India after it enters into trade with U.S.A. it follows that India would produce OH( = JR’) of cloth, OJ( or HR’) of wheat, and would consume OG (or WC) of cloth and OW (= GC) of wheat. Further India will export QR’ of cloth and import QC of wheat. It is evident from Figure 23.4 that trade has enabled India to consume more of both cloth and wheat than it could produce at home with its own production possibilities.

It is noteworthy that unlike in case of constant opportunity costs, in case of increasing opportunity costs, specialisation is not likely to be complete. This is because of the occurrence of diminishing returns or increasing costs as the production of one commodity is stepped up at the expense of the other commodity.

When production of cloth is expanded productive resources less suited to the production of cloth are drawn into that industry. This raises per unit cost of cloth. On the other hand, as more factors of production are drawn from wheat for allocating them to the production of cloth, per unit cost of wheat falls.

The opposite will happen in the trading partner who will increase the production of wheat and reduce that of cloth by shifting resources out of the latter into the former. Cost ratios in the two countries may become equal before either country completely specialises in the production of a single commodity.

The law of comparative costs when freed from the labour theory of value and expressed in terms of opportunity costs is still believed to be true by the modern economists. In a two-commodity world when one country can produce both of them at a lower cost than another, it will pay to it to specialise in the production of a commodity which it can produce at comparatively lower cost and import the other commodity for which it has a comparatively higher costs.

It gains from trade as it is able to get a higher price for the commodity in which it specialises because of its relatively lower cost of production and also because it pays a relatively lower price for the commodity for which its efficiency is relatively not so high.