There are two fundamental macro-economic principles viz., the multiplier and the acceleration. J.M. Keynes who developed the multiplier, ignored the effects of induced investment. According to Paul Samuelson, in the long run, the effect of an increase in spending world not stop with the effect of an increase in spending world not stop with the multiplier expansion of income, as Keynes has pointed out, for this higher income level would, in turn, have implications for other parts of the economy. An increase in national output or income will lead to an increase in investment. Such investment, which depends on national income or its rate of change, is called induced investment.

In reality, we observe that a business firm’s decision to make new investment depends on the rate of change of sales (demand for its product) or of output, because the demand for capital goods is a derived demand.

Thus, anything, which increases consumer demand (or demand for consumption goods like textiles) such an increase in per capita income will always be beneficial to the capital goods producing industry (such as textile producing machineries). In other words, aggregate investment depends not on the absolute level of output but on the rate of change of national income or output.

Let us suppose an investment of Rs 100 crore leads to an increase in national income of Rs 500 crore. However, with this multiple increase in income, business firms might very well decide to proceed with another round of increased investment spending, that they could supply the output needed by an economy in which national income has just increased.

ADVERTISEMENTS:

This is the process of induced investment, which depends on the rate of change of output or of sales: Ip = f (ΔY), where Ip is induced private investment which depends on (i.e., is a function of) change(s) in national income (ΔY).

The Acceleration Principle:

The implications of induced investment become very clear when we study the acceleration principle. The principle refers to the relationship between increase in total output (income) and the additional investment spending that occurs due to such output (income) increase.

In short, the acceleration principle explains why the increase in national income often results in a more than proportionate increase in investment spending and why the amount of investment studying depends not on the absolute level of business activity but on whether that level is increasing or decreasing.

So, a change in national income or output induces (or leads to) a change in investment. However, a small change in national income or output leads to an accelerated change in investment. The accelerator principle, developed by J.M. Clark, refers to the accelerated effect on investment of a small change in the demand for or output (sales) of consumption goods.

Assumptions:

ADVERTISEMENTS:

The acceleration principle is based on three main consumption:

1. First, investment has both autonomous and induced components.

2. Investment depends not on the absolute level of output or demand but on the rate of increase in NNP or in total demand.

If the rate of increase is growing, investment spending will increase; if the rate of income is stable, investment will be constant; if the rate of increase declines, investment will fall.

ADVERTISEMENTS:

3. The acceleration principle also emphasises the extreme volatility of investment as compared with other components of aggregate demand. It suggests that any percentage change in aggregate demand may result in much larger percentage changes in investment spending.

Illustration of the Principle:

In producing output (whether shoes or cars or clothing) firms seek to use that stock of capital (machines, inventories, plants) that allows the most profitable operation of the firm. The acceleration principle is based on the idea that an increase in demand for consumer goods (food, clothing, furniture) produces a far greater increase in demand for producer or capital goods (food processing equipment, looms, and lathes).

Net investment in the addition to the stock of capital, but the stock of capital needs to grow only if the level of output or sales increases. The relationship between capital and output illustrates this point. For example, if for every Re 1 of output the economy requires 50 paise worth of capital, the capital/output ratio would be 2.

The capital/output ratio (K/Y) is the value of capital (K) needed to produce a given level of output divided by the value of that output (Y).

If the capital/output ratio remains steady (and capital is fully utilised), capital must increase for the economy to produce more output. With a capital/output ratio of 2, for example, a Rs 10 crores increase in output would require a Rs 20 crores increase in capital. Because investment in the increase in capital (I = DK), investment must also depend upon the rate of increase in output.

With a fixed capital/output ratio of 2, the relationship between investment and output is:

1 = 2 ΔY

or I = K/Y × Δ Y

This equation illustrates the accelerator principle of investment: investment will increase only if the national income or output increases. If output is high but fails to increase in a particular year, investment will fall to zero. If output declines, there will be net disinvestment as business firms will allow their capital stock to depreciate without replacement.

ADVERTISEMENTS:

Thus, investment in an economy depends not on the level of income but on how fast output — or the level of business sales — is rising or falling. To raise investment, output not only has to grow; it has to grow by increasing rate.

The accelerator principle of investment is that investment depends upon the growth of output and implies that investment will be unstable. Investment will fall simply because output grows at a slower rate. For investment just to remain stable, output growth must be constant rate.

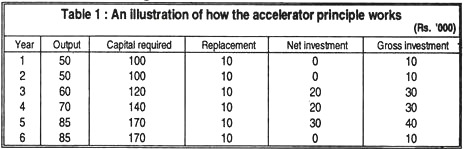

Let us consider a simple example. Table 1 shows that (induced) investment depends on changes in output. Or, in other words, a change in output or sales induces a change in investment.

The Accelerator:

ADVERTISEMENTS:

We assume that the capital-output ratio is 2:1, i.e., two units of capital are required to produce one unit of output. The name acceleration principle is given since net investment depends upon the acceleration or deceleration of output.

Importance:

The acceleration principle can work in both directions.

As Samuelson puts it:

“Should sales now drop below a certain level, gross investment would drop away to nothing for a long time; in fact, the firm might want to disinvest by selling off some of the machinery. On the contrary a tremendous increase in investment spending is possible as a result of a moderate increase in consumption sales”.

ADVERTISEMENTS:

According to the acceleration principle, “consumption has to keep on increasing in order for investment to stand still”.

The acceleration principle makes the following two predictions:

1. Investment spending will fluctuate more sharply (widely) than demand for consumer (final) goods.

2. Investment spending can start to decline even when sales are rising (though at a slower rate that before).

These two phenomena contain the seeds of business cycles. They together explain why a private enterprise economy is inherently unstable. When an industry gradually reaches its capacity level of output, a continued increase in aggregate demand will bring about an accelerated increase in investment spending.

Even before capacity output is reached, the continuation of that condition can set the acceleration principle in motion. The enlarged induced investment spending adds to aggregate effective demand and causes a further rise in national income through the multiplier.

ADVERTISEMENTS:

However, like the multiplier the accelerator can work in both the directions. Thus, once a rise in aggregate demand begins to slacken, however, the operation of the acceleration principle can cause investment spending to decline. This, in its turn, will slow the growth of aggregate demand still further and can set the stage for a general downturn in business activity.

Qualifications:

The acceleration principle, however, only provides a partial explanation of investment demand. Investment is also governed by present and future profits. Future profits are the main rationale for investment and they figure extensively in the evaluation of investment projects. It seems that any analysis of investment demand must include both profits and the acceleration principle, or some variant of it.

Certain qualifications will have to be introduced in the simple acceleration theory:

1. Lags:

Investment lags behind the change in income. That is, planned investment for the third quarter (made in the second quarter) is based on the actual change between the first and second quarters, rather than the forecast change between the second and third quarters.

2. Business outlook:

ADVERTISEMENTS:

Secondly, if the general business outlook is optimistic, businesses will be more inclined to think that an output increase will be permanent so they will more inclined to invest, than if the business outlook is pessimistic.

3. Capacity limits:

When a rapid rise in output leads to large planned investment, there are often physical limits to the rate at which actual investment can take place. The industries which produce capital goods themselves have capacity limitations.

4. Profile:

Business firms usually prefer to expand internally, by using their own funds. Therefore, we could expect profits to be a factor in the determination of investment. Investment usually varies directly with profits.

5. Inventories:

ADVERTISEMENTS:

Business investment in plant and equipment mainly depends on profit prospects and the rate of interest at which money is borrowed to purchase an asset. Usually, inventory investment (i.e., investment in stocks of goods held by business to even out delivery and sales) varies proportionately with sales and output and, thus, fits the simple accelerator model.

However, as Lipsey has pointed out, “the main insight which the accelerator theory provides is the emphasis on the role of net investment as a disequilibrium phenomenon — something that occurs when the stock of capital differs from what firms and households would like it to be”.