The following points highlight the three things to know investment criteria.

Things to Know # 1. Subject-Matter:

Investment criterion means the criteria or the guidelines according to which the Planning Authority distributes the total amount of the community’s investible funds into different channels. The main problem is to distribute the investible funds in the different sectors of the economy.

According to Prof. Oscar Lange, “The problem of an underdeveloped country is not merely one of assuring sufficient productive investment but also of directing that productive investment in such channels as will provide for the most rapid growth of productive power of national economy”.

The investment criterion implies pick and choose policy. The aggregate volume of investment to be undertaken becomes, meaningful when expressed in terms of concrete investment projects. The programming aspect of investment planning is an important problem of planning in underdeveloped countries.

ADVERTISEMENTS:

In underdeveloped countries the investible resources are very much limited according to their increasing needs. Therefore, the planners have to decide regarding the distribution of resources between industry and agriculture, capital goods and consumer goods industries, public sector and private sector. The flow of investment resources in these different sector is influenced by political, social and economic factors.

Allocation of investment resources becomes a difficult task due to the existence of a number of development objectives. These objectives may be conflicting in the short run and hence there are no simple criteria for fixing up the investment priorities.

According to Meier and Baldwin, it is difficult to establish a satisfactory criterion for best allocation of investment because alternative investment criterion will affect total output differently, a certain investment criterion may be more relevant for maximizing output over a different time period.

Moreover, the allocation of investment will affect not only total output but also the supply and distribution of the labour forces, social and cultural conditions, growth and quality of the population, tastes and technological progress.

Things to Know # 2. Meaning of Investment Criteria:

According to Meier, “Investment criteria refers to the problem of determining the best utilisation of investment resources to minimize capital intensity, to maximize social marginal productivity of capital and employment absorption.”

Things to Know # 3. Objectives of Factor Allocation of Investment:

The primary objective of a developing economy is to secure a greater and faster increase in its income from its available resources.

Therefore, the objectives of investment criteria are summarized below:

(i) Equal distribution of income and wealth.

(ii) Balanced and rapid growth of the economy.

ADVERTISEMENTS:

(iii) To raise the gross and national product and per capita income.

(iv) Proper allocation of existing resources.

(v) Efforts to correct the balance of payment.

(vi) All-round development of the country.

(vii) To keep watch the interest of the future generation.

Things to Know # 4. Practical Application of Investment Criteria:

Out of the various investment criteria discussed, it is difficult to suggest any one criterion of the allocation of investment resources in underdeveloped countries. Since the problems facing these countries are manifold any one criterion can only have limited application. Hence the choice of a suitable criterion will very much depend upon the circumstances prevailing in a country and the problems with which it is faced.

In addition to that the practical application of the investment criteria may be limited due to the following factors:

(i) It is difficult to define correctly the objectives of an investment policy. There may be various conflicting objectives and it may be difficult to choose the most desirable ones.

(ii) The principles of investment recommended by different writers are defective as theories. It is doubtful whether a sound theory can be laid down in respect of the complicated problems of investment.

ADVERTISEMENTS:

(iii) The investment criteria generally fail because of the various non-measurable aspects of investment projects.

Despite all these difficulties the investment criteria have to serve an important purpose in programming resource allocation in underdeveloped countries including India. In the words of Prof. Meier and Baldwin, “The criteria depend ultimately on broad economic and social objectives. It is necessary to consider not only the existing amounts and quantity of factor supply but also various repercussions of the project-the effect on national income over different time periods. Conditions of market demand, ability to realize economies of scale, length of gestation period, the effects on the distribution of income and level of per capita income and balance of requirements.”

Things to Know # 5. Types of Investment Criteria:

1. Social Marginal Productivity Criteria:

This theory was put forward by Hollis B. Chenery. Social Marginal Productivity of Investment may be defined as the return to the private investor plus the net contribution of the investment to the national product. According to this criterion, the projects must be ranked according to their social value, determine the marginal project from the total funds and exclude all lower- ranking projects.

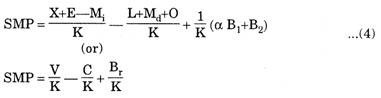

In order to measure social marginal product (SMP) Chenery used the following method:

ADVERTISEMENTS:

Let the welfare function be U = f (Y, B, D,….) …(1)

Where Y = effect on income,

B, effect on balance of payments,

D = effect on distribution of income, and

ADVERTISEMENTS:

U = index of social welfare.

Then increment in U corresponding to a given increment in investment can be written as:

This implies, the increase in SMP is the sum of the effects of a change in income, balance of payments portion, distribution of income etc. For simple explanation, all other variables are ignored excepting Y and B to express SMP.

Accordingly:

SMP = ∆U = ∆Y + r∆B … (3)

ADVERTISEMENTS:

Mathematically, “r” represents an amount of increase in national income which would be equivalent to an improvement of one unit in the balance of payments under specified conditions. Therefore, r measures the average over-valuation of the domestic currency, at the existing rates of exchange.

If r=0, balance of payments is in equilibrium, if r is positive (>0), the domestic currency is overvalued and if r is negative (<0) the domestic currency is undervalued. In underdeveloped countries r may be appreciably greater than zero because of the relative inelasticity of imports and exports.

This follows:

Where all variables (except B1 and K) are annual flows:

SMP = Average annual increment in national income from marginal unit of investment in a given productive use;

ADVERTISEMENTS:

K = Increment to Capital (Investment),

X = Increased market value of output,

E = Added value of output due to external economies,

M1 = Cost of imported materials.

V = Social value added domestically, i.e., V = X+E—Mi

L = Labour cost,

ADVERTISEMENTS:

Mi = Cost of domestic materials,

O = Cost of overheads,

C = Total cost of domestic factors = L + Md + O.

Br = Total balance of payments effect = αB1 + B2

α = current amortization and interest rate on current borrowings,

B1 = Effect of investment on balance of payments.

ADVERTISEMENTS:

B2 = Effect of operation on balance of payments.

Thus, the social marginal product is divided into three elements, viz.:

(a) Value added in the domestic economy for unit of investment;

(b) Total operating costs per unit of investment; and

(c) Balance of payments premium per unit of investment.

Equation (5) can be expressed as

SMP = (V/K) (V-C/V) + Br/K ….(6)

SMP is thus the product of the percentage margin of social value over cost (V-C/V) and the rate of capital turnover plus the balance of payments premium. This form of equation shows that a decrease in the rate of capital turnover may be offset by a proportionate increase in the value margin and vice-versa.

Limitations:

(1) It presupposes the attainment of an optimal income distribution by purely fiscal means.

(2) The concept is vague. It is less definite than the private profit criterion although it is more generally applicable.

(3) The market prices do not exactly reflect social values and as such, quantitative assessment of the costs and benefits arising out of investment is extremely difficult;

(4) It is difficult to measure the costs of a larger number of items which contribute to the total cost of a project;

(5) It is pointed out that the effect of an investment on balance of payments arises not only from the cost incurred in connection with installation and operation of the plant but also on the availability of foreign loans, their expected flow over time and conditions of repayment;

(6) This criterion does not consider structural interdependence and the nature and value of external economies.

(7) SMP criterion helps in the maximization of output that can be attributed to the current investment effort but it does not take into consideration as to what happens to the final product during any period, which in turn, influences the investment rate in future.

(8) Harvey Leibenstein criticizes that it does not emphasize the need for generating the forces of economic development in an underdeveloped country. According to him, the object should be to maximize the amount of capital per worker and improve the quality of labour force.

2. Capital Turnover Criterion or Capital Intensity Criterion:

J.J. Polak and N.S. Buchanan have propounded this criterion. This criterion is based on capital-output ratio, i.e., K/Y of a project. In those countries where capital is scarce, funds should be invested in those projects which have the lowest capital intensity.

This criterion is also used in its reverse form and then it is called capital—turnover criterion. According to this criterion, those projects should be selected which have a high rate of capital turnover or low capital output ratio.

Since capital is scarce in underdeveloped countries, those projects should be chosen which yield maximum output per unit of capital invested, i.e., where the capital—turnover is the highest. Quick yielding projects with low capital intensity are also desirable because they make it possible for the scarce capital resources to be released soon for investment in other projects.

Such projects also generate more employment which may be very desirable in the context of underdeveloped countries.

Criticism:

This present criterion has been criticised on the following grounds:

(1) The difficulty arises in estimating capital -output ratio in poor countries and comparing it with that of advanced countries due to lack of data. Hence, any criterion based on capital output ratio is likely to create practical difficulties.

(2) This criterion does not take into account the element of time. A particular project may be less capital intensive in the short run but may turn out to be more capital intensive in the long run.

(3) The supplementary benefits conferred by a project have not been taken into account while laying down this criterion. It is possible that a project may be more capital intensive but it confers important supplementary benefits on the economy which may outweigh its high capital cost. Thus the projects with low capital-output ratio have also got their importance for a developing economy.

(4) The employment argument in favour of less capital intensive projects does not hold good. A more capital-intensive project can also contribute substantially in providing more employment in the long-run.

(5) Labour intensive projects may generate more employment but they tend to reduce productivity. Hence, capital intensive projects are also quite important for underdeveloped countries if the level of output is to be raised substantially.

(6) The maximization of employment argument implied in this concept may hold good in short run. A capital intensive project may absorb little labour to start with, but may maximize the amount of labour per unit of investment in the long run.

(7) These techniques often produce sub-standard projects such products are often subsidised by Govt., and entail high social costs.

(8) The supplementary benefits of a project are not taken into consideration. It is possible that a project may be more capital intensive but it confers important supplementary benefits on the economy which may outweigh its high capital cost. Thus the projects with low capital output ratio have greater importance for developing economy.

3. Reinvestment Criteria or Criteria of Investment for Accelerated Growth:

Walter Galenson and Harvey Leibenstein introduced the concept of marginal per capita reinvestment quotient criterion for investment in the underdeveloped countries. The rate of investment per unit of capital invested is given by

r = p – ew/ c …(1)

Where p=output per machine; e=number of workers for machine; w = real wage rate; c = cost per machine and r = rate of reinvestment per unit of capital.

This model explains the employment provided by any combination of men and machines through the following equation:

Where E = Total employment

It is assumed that I = P—W … (3),

i.e., the total amount invested in any period is the difference between the total gross value added (P=Np) and the real compensation paid to labour (Ew) Then:

I = P—Ew …(4)

I = NP—Ew …(5)

I = Np — eNw = N(p— ew) …(6)

Net investment I = cost per machine (c) multiplied AN, the increase in number of machines,

Is given by (∆N/N) and is equal to the rate of reinvestment for unit of capital i.e.,

r = ∆N/N = P — ew/c …(9)

This criterion is thus designed to take into account the influence of choice of projects on the rate of capital accumulation. If we assume that all profits are reinvested while all wages are consumed, this reinvestment quotient is nothing but the rate of profit. This reinvestment quotient is likely to be higher in capital intensive than in labour intensive projects.

Criticism:

This criterion focuses its attention on the maximization of the current rate of investment so that the economy could grow at a rapid rate in the years to come but it fails to take into account the reality of the situation in the LDC’s.

Its main shortcomings are as follows:

1. This criterion would have adverse effect on income distribution and employment. In many countries reduction of income disparities and unemployment are the main objectives of planning so this criterion cannot be adopted in these countries.

2. It is against the principle of marginal productivity of capital. As the amount of capital is increased in successive doses and offers a point where its productivity starts declining and hence there is fall in output per capita.

3. It does not consider the effect of balance of payments on investment. In an under developed economy there is an acute scarcity of capital goods which have to be imported and they worsen the already tight balance of payments position.

4. It neglects the importance of consumption; rather it advocates its curtailment. But current consumption may be more important than future consumption and the reinvestible surplus may have to be cut down in the interest of the community. The ignorance of consumer goods sector in favour of capital goods sector brings serious consequences both for economy and the state.

5. Adoption of highly capital intensive techniques may create certain practical difficulties in underdeveloped countries. These countries are generally short of capital and due to this it is not possible for them to concentrate on capital intensive project. Shortage of skilled manpower and entrepreneurial ability may create another difficulty.

6. Capital deepening of investment does not ensure the best utilization of the available capital resources. It may result in such an inefficient allocation of capital resources that the increase in income may be very small.

7. Growth rate cannot be maximized by choosing the investment which has higher re-investible profit per unit of capital. Prof. A.K. Sen points out that a mere choice of investment with a higher reinvestment quotient cannot ensure a higher rate of economic growth. The surplus may be large per unit of capital but if the propensity to consume of the people engaged in the production goes up, investible surplus is adversely affected.

8. This criterion violates the social welfare objectives of a developing economy. The adoption of this criterion will lead to the concentration of wealth in the hands of the profit earning class. It also results in the displacement of labour which is against the basic norms of a developing society.

9. The use of reinvestment criterion perpetuates the problem of unequal distribution of income in such economies. There is greater degree of unequal distribution of income between the wage earners and capitalists and between those who obtain immediate employment and those who are left unabsorbed.

10. O. Eckestein is of the view that instead of depending on the reinvestment criterion for planned investment, it may be better to use fiscal measures to attain an income distribution which will yield sufficient savings for purpose of investment.

11. The contention that highly capital intensive processes have a large investment potential does not appear to be correct. A highly capital intensive industry like the iron and steel will not yield output until several years have lapsed.

4. Time Series Criterion:

This criterion was put forward by Prof. A.K. Sen. According to him, time factor is an important factor in the choice of techniques. If the capital output ratio and the rate of savings, the time path of two techniques can be drawn. It can be found out which of the techniques yields the highest returns over time horizon.

For that, a time horizon is fixed up and returns for both the projects for different years are calculated. On the basis of this we can find out a period of recovery for any pair of techniques. In choosing the technique we compare this period of recovery with the period we are ready to take into account.

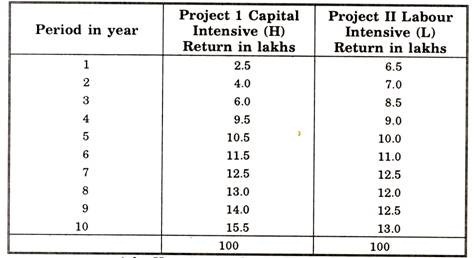

Suppose that there are two projects H and L and time horizon is ten years at the end of which total returns in each case are 100 million.

The returns of the H project are less in comparison to project L over the first six years while in the remaining four years the returns of H rise more than the project L. Since the total returns are the same for both the projects, the overall position is one of indifference.

The point to be noted is that whether the initial loss in output by adopting a capital intensive projects recovered within the period of ten years or not. The time taken by the capital intensive technique to overcome its initial deficiency in output over the labour intensive technique is called the period of recovery.

This is explained with the help of diagram given below:

In diagram I, H and L curves show the flow of real output during a given time horizon with two techniques. The period ON is the period of recovery which makes the area DAD1 = area FAf1.

Thus for any pair of techniques a period of recovery can be found. In the selection of techniques the period of recovery should be compared with the period we already taken into account. If it is found that period of recovery is longer i.e. if within the time horizon the loss in output by adopting technique H is not recovered by excess of output we should choose technique L and vice-versa.

If there is some conflict between present and future, the choice will depend on the time discounted use.

Limitations:

Prof. A.K. Sen himself admits some of the limitations of this criterion:

1. It is arbitrary to fix up time horizon of ten years. There is no specific law on the basis of which period of recovery for a particular project can be fixed up.

2. It is not possible to derive the time series for all times to come. Therefore, the planning period has to be definitely fixed but this creates some serious problems. When the time limit is about to end, labour intensive technique might be selected in order to inflate the quality of output and thus capital formation is neglected.

3. The factors like technological change, wage rate, propensity to consume etc. on which the study of time series depends may all be changing and make the forecasting of future investment.

5. Balance of Payments Criterion:

The balance of payments effect of investment projects is important in case of underdeveloped countries. According to this criterion the allocation of investment should be done to minimize the adverse effect on balance of payments. Balance of payments difficulties of underdeveloped countries are due to the fact that they are heavily dependent on foreign countries for their capital equipment.

They also require foreign exchange for import of materials for keeping this equipment

into operation.

Buchanan had called this type of imports as the direct drain on foreign exchange. The rise in income due to investment and industrialisation leads to imports of consumer’s goods. These are called circulation drain on foreign exchange. On the basis of the effect on the balance of payment.

Polak divides investment into three categories:

(i) Investment, yielding goods which add to the exports of a country or replacing goods formerly imported. The next effect of such an investment will be to create export surplus.

(ii) Investment, replacing goods previously sold in the country or exported from the country; the effect of this sort of investment on balance of payments will be neutral.

(iii) Investment, which would result in addition of goods to those sold in the country and in excess at demand. Such an investment will have a negative effect on the balance of payments.

The first two types of investment should be preferred because they will have a favourable effect on balance of payments. The third type may be avoided. Thus according to this criterion investment projects with least bad effects on the balance of payments must be chosen.

Limitations:

The concept of payment criterion is subject to following drawbacks:

1. Investment may raise real incomes without increasing money incomes which can be spent on imports here and fear of increased imports there only when money incomes rise.

2. If money incomes rise along with real incomes, import may not rise.

3. The investment may also lead to less imports rather than investments of first type.