Let us make an in-depth study of Investment:- 1. Importance of Investment 2. Types of Investment.

Meaning and Importance of Investment:

The level of income, output and employment in an economy depends upon effective demand, which, in turn, depends upon expenditures on consumption goods and investment goods (Y= C + I).

Consumption depends upon the propensity to consume, which, we have learnt, is more or less stable in the short period and is less than unity.

Greater reliance therefore, has to be placed on the other constituent of income-investment. Out of the two components (consumption and investment) of income, consumption being stable, fluctuations in effective demand (income) are to be traced to fluctuations in investment. Investment, thus, comes to play a strategic role in determining the level of income, output and employment at a time.

ADVERTISEMENTS:

We can establish the importance of investment in another way also. In order to maintain an equilibrium level of income (Y = C +I), consumption expenditures plus investment expenditures must equal the total income (Y); but according to the Psychological Law of Consumption given by Keynes, as income increases, consumption also increases but by less than the increment in income. This means that a part of the increment in income is not spent i. e. is saved.

The saving must be invested to bridge the gap between the increase in income and consumption. If this gap is not plugged through an increase in investment expenditure, the result would be an unintended increase in the stocks of goods (inventories), which in turn, would lead to depression and mass unemployment. Hence, investment rules the roost.

In Keynes’ economics investment means real investment i.e. investment in the building of new machines, new factory buildings, roads, bridges and other forms of productive capital stock of the community, including increase in inventories. It does not include the purchase of existing stocks, shares and securities, which constitute merely an exchange of money from one person to another.

Such an investment is merely financial investment and does not affect the level of employment in an economy. An investment is termed real investment only when it leads to an increase in the demand for human and physical resources resulting in an increase in their employment.

Types of Investment:

Investment may be private investment or public investment; it may be induced or autonomous. Induced investment is that investment which changes with a change in income that is why it is called income-elastic. In a free-enterprise capitalist economy, investment arc induced by profit-motive.

ADVERTISEMENTS:

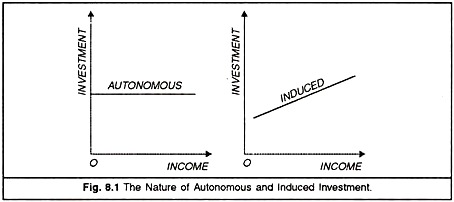

Such investment is very responsive to changes in income, i.e. induced investment increases as income increases. The shape of the induced investment curve, therefore, is upward sloping, indicating a rise in income.

According to Hicks, investment is of two types, induced as described above, and autonomous. Autonomous investment is independent of variations in output. It is independent of profit considerations. Generally, it is public investment. Explaining the types of autonomous investment, Hicks remarks: “Public investment, investment which occurs in direct response to inventions and much of the long range investment (as Mr. Harrod calls it) which is only expected to pay for itself over a long period, all of these can be regarded as autonomous investment.” Autonomous investment is not sensitive to changes in income.

In other words, it is independent of income changes and is not guided or induced by profit-motive only. Autonomous investments are peculiar of a war or a planned economy; for example, expenditures on arms and equipment to strengthen the defence of India may be called autonomous investment as it is incurred irrespective of the level of income or profits. In the diagram on the left-hand side given below, the curve of autonomous investment is represented by a straight line running from left to right and parallel to the horizontal income axis.

ADVERTISEMENTS:

The panel on the right hand side given below shows the induced investment curve as rising from left upwards to the right. Thus, the distinction between induced and autonomous investment is shown in the diagrams above: the autonomous investment remaining unchanged with income and the induced investment rising with income.