Investment Multiplier and Income: Meaning and Relationship with MPC, MPS!

(a) Meaning:

Investment increases productive capacity which, in turn, raises the level of output, employment and income.

When investment increases by a certain amount, aggregate income increases by a multiple of that investment.

This multiple is called multiplier. Investment multiplier shows a relationship between initial increment in investment and the resulting increment in national income.

ADVERTISEMENTS:

It is a measure of change in national income caused by change in investment. Thus, it explains the relationship between increase in investment and the resultant increase in income. For example, if an increase in investment of Rs 50 crore causes an increase in national income of Rs 300 crore, then value of multiplier would be 6 (= 300 ÷ 50).

This equals increase in income divided by increase in investment. The implication of K = 6 is that for any level of change in investment in the economy income will change 6 times of investment amount. Multiplier (K), thus, is the ratio of increase in national income (∆Y) due to an increase in investment (∆I). Put in symbols:

K = ∆y/∆I or ∆Y = K x ∆I

Where K = Investment multiplier, ∆Y = change in income, ∆I = change in investment.

ADVERTISEMENTS:

Investment multiplier indicates the multiplying effect of investment on income.

Remember, the value of multiplier determines the rate of growth in the economy A higher value of multiplier will attain a higher level of income and growth.

Working of Multiplier:

This can be further clarified with the help of an example. Mind, multiplier works through consumption. How? The concept of multiplier is based on the assumption that expenditure of one person is another person’s income, e.g., expenditure of A is income of B; B’s expenditure is income of C; C’s expenditure is income of D and so on until spending becomes zero.

ADVERTISEMENTS:

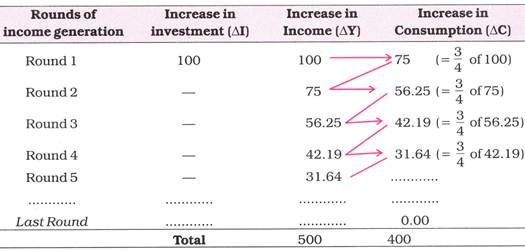

Suppose, government invests Rs 100 crore in establishment of a fertilizer factory .The first impact of this new investment will be that the income of employees engaged in this factory will go up by Rs 100 crore. If their marginal propensity to consume (MPC) is 3/4th or 75%, they will spend Rs 75 crore (3/4th of 100) on new consumption goods.

This is not the end of the story. The producers of these goods will have an extra income of Rs 75 crore. If MPC of producers is also 3/4th, they in their turn will spend Rs 56.25 crore (3/4 of 75). So, this process will go on, with each round of expenditure being 3/4th of the previous round and in this way the production and national income will go on increasing round after round. The process of increase in income stops when change in income becomes equal to change in saving.

The process of working of multiplier is further illustrated in the following table. This is based on the assumption that initial increase in investment = Rs 100 crore and MPC = 75% (or 3/4th).

The above table clearly shows that Initial increase in investment of Rs 100 crore has resulted in an increase of additional income of Rs 400 crore, i.e., the resultant increase in income is multiple of initial increase in investment.

Thus, in this case Multiplier (K) = 400/100 = 4 or K = ∆Y/∆I. Keeping in view the significance of concept of investment multiplier, Keynes suggested that in the situations of unemployment and depression, government should Increase volume of its investment in public utility works to give quick start to economy.

Graphic Presentation of Multiplier:

The effect of multiplier can be illustrated with the help of the following graphical Fig. 8.12. Here OX measures national income and OY saving and investment. Saving curve SS intersects original investment curve II at E. At the equilibrium point of E, saving and investment are equal and income is Rs 300 crore. But when investment is increased by RS 10 crore, the new Investment curve l1l1 intersects saving curve SS at E1.

At the new equilibrium point E1, national income is Rs 340 crore. This shows that with investment increase of RS 10 crore, national income has increased by RS 40 crore. The increase in investment is shown by a small arrow whereas increase in national income is shown by a long arrow. This indicates that national income has increased by four times the increase in investment, i.e., Value of K is = 40/10 = 4

(b) Relationship of K with MPC and MPS:

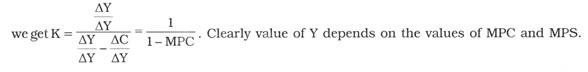

Since multiplier indicates the effects of change in investment (∆I) on change in income (∆Y), therefore, K = ∆Y/∆I = ∆Y/∆Y/∆C. By dividing by ∆Y

Clearly value of Y depends on the values of MPC and MPS.

Symbolically:

ADVERTISEMENTS:

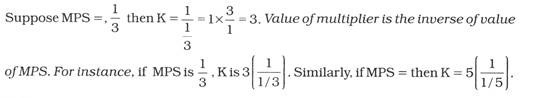

K = 1/1-MPC = 1/MPS

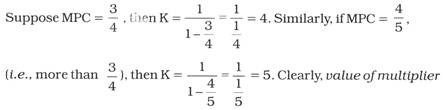

(i) There is direct relationship between K and MFC. If MPC is high, K will also be high but if MPC is low, K will also be small as proved in the following examples.

has gone up from 4 to 5. Thus, K varies directly with value of MPC. In short, higher the value of MPC, higher will be the value of multiplier. Lower the value of MPC, lower will be the value of multiplier (K).

ADVERTISEMENTS:

(ii) There is inverse relationship between K and MPS. If MPS is high, K will be low but if MPS is low, K will be high as proved in the following examples.

Minimum and Maximum Value of Multiplier:

Value of K depends upon value of MPC or MPS. We know that MPC cannot be negative, it can be at the most zero (minimum value) and maximum value can be 1.

(i) Minimum value of multiplier is 1 because minimum value of MPC can be zero.

(ii) Maximum value of multiplier may be – (infinity) because maximum value of MPC can be 1.

ADVERTISEMENTS:

Symbolically: K = 1/1-MPC = 1/1-1 = 1/0 = Infinity (∞)

Between these two extremes (1 and infinity), value of multiplier varies depending upon value of MPC.