Read this article to learn about the effects of MEC and the rate of interest on the volume of investment.

MEC and the rate of interest are the two important factors which affect the volume of investment and these two must be determined beforehand independently of each other.

MPC is the result of the supply price and the prospective yield of the capital asset. Rate of interest is the price paid for loanable funds and is determined, like any other price, by the demand for and supply of loanable funds.

A potential investor will go on weighing the MEC on new investment against the rate of interest. As long as MEC is more than the rate of interest investment will continue to be made, till the MEC and the rate of interest are equalized. Once the MEC becomes equated to the rate of interest, equilibrium investment is determined. Thereafter investment has to be increased, either the rate of interest should fall or MEC should increase.

ADVERTISEMENTS:

In this connection D. Dillard remarks:

“When it is recalled that employment cannot increase without an increase in investment, the propensity to consume being unchanged, the importance of the relationship of the marginal efficiency to the rate of interest for the problem of employment will be appreciated as being of the most fundamental significance.”

It is true that both MEC and the rate of interest are important determinants of investment. But Keynes’ contribution relates chiefly to the latter, as a result of his analysis we now place less emphasis than before on the rate of interest as a means of increasing the volume of investment.

The rate of interest is very important in the effective implementation of fiscal policy (specially debt management). But as a means of affecting private investment it could be of importance (as a determinant of income and employment), if the marginal efficiency schedule were highly elastic. Keynes in the General Theory attributed fluctuations to the changes in expectations and shifts in the MEC and not to the rate of interest.

ADVERTISEMENTS:

He says, “We have been accustomed in explaining the ‘crisis’ to lay stress on the rising tendency of the rate of interest under the influence of the increased demand for money both for trade and speculative purposes.

At times this factor may certainly play an aggravating and, occasionally perhaps, an initiating part. But I suggest that a more typical and often the predominant explanation of the crisis is not primarily a rise in the rate of interest, but a sudden collapse in the marginal efficiency of capital.”However, he continued to stress in the General Theory the relation of the MEC and the rate of interest as determinants of the amount of investment and hence of employment.

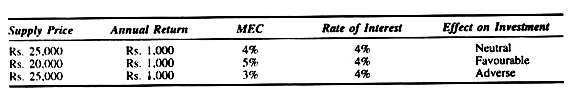

The following table depicts clearly the relationship of MEC and the rate of interest in the determination of the inducement to invest:

In this table, it is assumed that the new capital asset in question gives a constant return of Rs. 1,000 annually. The MEC and the rate of interest are given separately in separate columns, having been determined independently of each other. When MEC (4%), is equal to the rate of interest (4%), the effect on investments is neutral; when it is more, the effect is favourable and when MEC is less than the rate of interest, the effect on induced investment is unfavourable.

ADVERTISEMENTS:

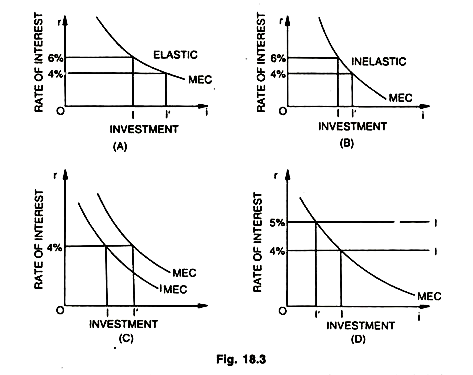

The position and shape of the investment demand schedule pay a deciding role in determining the volume of investment because it shows the extent to which the amount of investment changes as a result of changes in the rate of interest. If the demand (MEC) schedule is relatively interest-elastic, a little fall in the rate of interest will lead to a considerable increase in investment. On the other hand, if the investment demand schedule (MEC schedule) is relatively inelastic, there will be little increase in investment, though the fall in the rate of interest may be considerable.

Fig. 18.3(A) shows an interest-elastic investment demand schedule. When the rate of interest falls from 6 per cent to 4 per cent, investment increases from OI to OI’. Fig. 18.3(B) shows an interest-inelastic investment demand curve. Corresponding to the same fall in the rate of interest from 6 to 4 per cent, increase in investment II’ is much less. There has been a lot of controversy on the extent of interest-elasticity of the investment demand schedule. Experience confirms the views that it tends to be interest-inelastic especially during depression.

A change in the marginal efficiency of capital or in the rate of interest, or both, induces a change in the level of investment, as shown in Fig. 18.3(C) given above. We find that a rise in the MEC of capital is accompanied by a constant rate of interest rate at 4% resulting an increase in the level of investment. Fig. 18.3(D) further describes the case of a rise in the rate of interest from 4% to 5% with no change in the MEC schedule and the level of investment falls from OI to OI’.

Short-Run Factors Affecting MEC:

There are a large number of long-run and short-run factors which influence the marginal efficiency of capital.

Among the short-run influences, the following are important:

1. Nature of Demand, Prices and Cost:

If the cost are expected to rise or prices are likely to fall and the demand for a particular product is prone to decline in future, average businessman’s expectations regarding the rate of return from any given investment will also decline, affecting the investment adversely. On the other hand, investment will get fillip, if the entrepreneur expects a fall in cost, rise in prices, and increase in a demand or a combination of these.

ADVERTISEMENTS:

2. Propensity to Consume:

Favourable short-run shifts in the propensity to consume also cause favourable shifts in investment because the demand for capital goods its (at least partly) derived from, the demand for consumer goods.

3. Change in Liquid Assets:

When an entrepreneur has a large volume of liquid assets and the different types, he is likely to take advantage of the investment opportunity that comes his way. But when the assets are not liquid or there is the fear of temporary liquidity (shortage of working capital) it often goes to inhibit the new investment.

ADVERTISEMENTS:

4. Change in Income:

Sudden changes in income caused by windfall profits or losses, tax concessions or levies also influence the marginal efficiency of capital and hence investment. It will be stimulated by a rise in income and damped by a fall in income.

5. Current State of Expectations:

Rates of return on current investment influence business expectations. Entrepreneurs often invest on the assumption that the current state of affairs will continue indefinitely. It is not possible to base expectations and hence investments on future course of events which are so uncertain. Thus, current expectations play an important part in influencing investment.

ADVERTISEMENTS:

6. Waves of Optimism, Pessimism:

Considerable importance is given to waves of optimism and pessimism in influencing the MEC and hence investment. During periods of optimism, rates of profit on future investment are unduly overestimated, while during periods of pessimism, they are badly underestimated. Periods of optimism and pessimism often refer to the results, as one would expect them to be based on political, psychological and social factors.

Long-Run Influences on MEC:

Following are the important factors which influence the marginal efficiency of capital in the long-run:

1. Population:

The rate of growth of population favourably effects investment, because the basic needs of a fast growing population require a greater amount of capital investment in fields like municipal and public utility services, residential buildings and consumer goods industries specially those producing necessities of life.

2. Development of New Territories:

ADVERTISEMENTS:

The growth and development of new territories lead to heavy investment activities of all types. There will be need to provide for additional transport facilities, residential and commercial buildings. The development of new areas and townships in India like Nangal (Punjab), Okhla (U.P.), Durgapur (W. Bengal) and Trombay (Maharashtra) has necessitated huge developmental expenditure and investment.

3. Techniques of Production:

Improvements in the techniques of production stimulate investment. Any invention or change in the technique of production, specially when it is of labour-saving type and lowers the cost of production, calls for huge investment activity. The manufacturing of steel, cars, rubber, glass, textiles, electrical goods etc., has resulted in greater technological progress and the expansion of market resulting in increased investment.

4. Supply of Capital Equipment:

The influence of population growth, expansion of territories and markets and the changes in the techniques of production depend upon the existing supply of capital equipment. If the existing plant and machinery are capable of being used to cope with the increased demand to that extent new or induced investment will not result. However, if the existing plant and machinery are fully employed, the favourable effects on investment will follow.