Normally, any Company follows the accounting norms in valuation of all the assets and liabilities, as laid down by the Institute of Chartered Accountants. Subject to these guidelines, the accounting practices vary from company to company. When a company is due to pay interest or repay the principal, these become contingent liabilities, due at specified future dates.

They are paid out of current revenues if it is interest and out of profits or Debenture Redemption Reserves fund, created for this purpose if it is repayment of principal of debt.

If the contingent liabilities are some dues to be paid to the excise, customs or income tax authorities, or other claims pending, they are shown in the Balance Sheet under Notes or Auditor’s Comments. These have to be met as they fall due for payment, and sometimes provisions are made, for them in advance by prudent companies and kept in special accounts.

Normally a company is healthy and liquid if its current assets are two times the current liabilities so that if the current assets are sold as they are, atleast 50% of the book value or market value of current assets can be realised and liabilities can be met in full. Then in the investors’ perception, the company is rated as fully solvent for current purposes.

Contingent Claim:

ADVERTISEMENTS:

Contingent claims due to options, warrants, convertible debentures and similar instruments are different from the ones referred earlier. These claims arise in the event of the holders of debt instruments opting for equity — a right or option given to them in the above instruments by the company.

Then the claim of debtor is to become owner with the following implications:

(1) Tax benefits for interest income as a deductible expense will disappear for the company with its impact on net profits.

(2) The leverage enjoyed through the debt for equity capital may also vanish to the extent that the return on total capital employed is higher than the interest burden on debt and that privilege to trade on borrowed funds will not exist.

ADVERTISEMENTS:

(3) Conversion of debt into equity will increase equity base and larger profits have to be earned for servicing this larger equity base.

(4) The cost of servicing equity is higher than servicing debt with the result that the company will have to earn larger profits through larger sales and/better profit margins.

The above factors lead to changes in capital structure, average cost of capital and profitability.

On the other hand, a company with larger equity and less debt has the following advantages:

ADVERTISEMENTS:

(1) Dividends or equity need not be paid if profits are not adequate but interest to creditors has to be paid,

(2) The riskiness of the venture will come down due to reduction of debt burden and credit rating will improve for the company,

(3) With a larger equity base, the potential for borrowing from banks and financial institutions and even from public at any future date will increase and company can expand and diversify better than before. There are thus both plus and minus points in the case of contingent claims.

Pricing of Contingent Claim:

There is no standard method of pricing of such contingent claims. But the erstwhile CCI used some guidelines for fixing the pricing of securities, particularly for equity shares. But in the case of debentures, bonds and debt instruments, they are issued at par, with a face value of Rs. 100, normally except in the cases of discount bonds or Premium Notes.

It is also laid down that if conversion facility is offered the company has to justify the premium or the price fixed to the SEBI before they are issued to the public, but no formulas are presented by the SEBI.

If such claims are partly or fully convertible into equity shares as warrants and loyalty coupons, etc., then the issue of their pricing becomes relevant. The non- convertible part of pure debt instruments is taken at par, while the convertible part is priced as per the normal pricing mechanism of equity shares.

This in essence involves first a decision on the part to be converted or the terms of the warrants such as period of time etc. The pricing of warrants and the convertible part of bonds are freely decided by the company and SEBI does not interfere, except for seeking disclosures and justifications for the premium or price fixed.

Free Market Pricing:

ADVERTISEMENTS:

The norms used by companies or merchant bankers can be set out as follows:

(1) SEBI has permitted differential pricing if the company is going for rights cum public issue, with separate prices for rights to the existing shareholders from that offered under public issue.

(2) In case of FCD, PCD etc., with convertibles or warrants pricing for convertible portion is again freely decided by the company, subject to their confidence of acceptability by the public and justification to the SEBI. The principle adopted, as in foreign markets, is what the market can bear, or what investors perceive as reasonable for investment.

(3) In practice, the price fixation is based on the past price record of the share and its future projection based on some bench marks like EPS and P/E multiple.

ADVERTISEMENTS:

(4) The average of the market prices for the last three years is one criteria if it is already listed and traded.

(5) The book value and earnings per share (EPS) and projection of its future price based on P/E multiple for the industry or for comparable companies are also sometimes taken into account.

Convertible Security:

A convertible security is a bond or debenture or preferred stock that can be converted into equity of a company. The original security is a debt instrument, which can be converted into an ownership instrument, after a time. The period of holding necessary for conversion, the ratio of conversion and other terms including the price are to be laid down in the beginning itself. Once the conversion terms are stated, they cannot be altered by the company unilaterally.

The SEBI guidelines cover all the categories of convertible instruments and new financial products like warrants loyalty coupons etc.

ADVERTISEMENTS:

As per these guidelines, a company can issue three types of debentures as debt instruments, viz.:

(a) Fully Convertible Debentures:

These are fully convertible into equity in phases at predetermined times, say 6 months or 12 or 18 months etc., and the terms of conversion including the conversion price are to be spelt out in the beginning itself. The company decides the periods and prices, at which they will be converted into equity. They may be converted in instalments or all at one installment. Thus, fully convertible debentures can be converted in two instalments of 50% for 6 months hence and the other 50% at the end of 12 months or in three or more instalments such as 25% of the total each time.

If the conversion period is within 18 months, these amounts will be treated as good as equity, as per the SEBI guidelines, for the purposes of debt equity Ratio and other legal and procedural requirements since withdrawn in March 1998. They do not have to follow the guidelines applicable to debt, namely, bonds or debentures, which are not convertible. FCDs with a conversion period of more than 36 months are not permissible to be issued except under special terms. Instruments of less than 18 months have to be treated as debt and rated by Credit Rating Agencies.

(b) Partly Convertible Bonds:

These are the second category of debt which are convertible in part while the rest is non-convertible. Thus, a debt instrument can have a face value of Rs. 100 of which Rs. 60 is convertible at the end of 12 months at a specified price and in specific convertible ratio such as two equity shares for Rs. 60, each of Rs. 30, (for a share of face value of Rs. 10 and with a premium of Rs. 20). As the market price may be ruling higher than Rs. 30 per equity share, the conversion facility will appear attractive to the investors.

ADVERTISEMENTS:

During the first year, the bondholder gets interest at a fixed rate of say 14% and after that Rs. 60 out of Rs. 100 (for each bond) will become two equity shares on which dividend will be paid, if declared out of profits at the end of second year. Thus, it has the advantage of both debt and equity.

The rest of 40% will remain as debt only and will continue to get interest at the specified coupon rate of 14% for the rest of its life, until redemption. As per the Companies Act and the Rules made thereunder all debt instruments say, bonds or debentures can have a maturity period of 5 to 7 years, extendable upto nine years in some cases, after which redemption becomes compulsory. Any such non-convertible bonds can be renewed, if the company wants after maturity at the specific written consent of the investors only.

(c) Non-Convertible Bonds (NCDs):

The third category of debt instruments is the non-convertible debentures called N.C.D. (also called khokhas for the non- convertible portion). This category will have to be held until the maturity or redemption date after 5 to 9 years. It is entitled only interest per annum, payable half yearly or once in a year. This category is pure debt while the first category of fully convertible debentures is as good as equity and the second category is partly debt and partly ownership capital. All the above categories are to have specific terms, spelt out in the beginning itself before investors decide to put in their funds. No debt instrument or bond can be issued in India without redemption, under the law.

Valuation of Rights Shares:

Companies can also issue rights shares which are a right to buy the equity shares of the company given at par or a premium to the existing shareholders in a particular proportion to their holdings. Under Section 81 of Companies Act, companies issuing further capital after two years of the formation of the company or after one year of the first allotment of the shares have to offer the same as rights to the existing shareholders.

The premium used to be fixed on the basis of the average book value of the company and post-tax earning capacity of the shares normally capitalised at 15% and even at 8% if the market price is substantially higher than the fair price. The average of the two prices worked out on the basis of book value and the earning capitalisation model is accepted.

ADVERTISEMENTS:

If earnings for share is Rs. 3 and capitalisation rate is 15%, then the fair price is 3/15 × 100 = 20 according to the earnings capitalisation formula. The price on the basis of book value is, say, Rs. 30.’ Then the average of these two prices Rs. 20 and Rs. 30, namely, Rs. 25 is taken as the fair price for fixing the premium (namely, Rs. 15 on a share with the face value of Rs. 10)2.

The rights are quoted in the market. The price of the rights will depend on the ratio on which they are issued.

If the ratio is 1:3 and the market price is Rs. 50, then valuation of rights is done as follows:

Let the premium be Rs. 15, then-

The value of one right is Rs. 44 – 25 = 19 which is got for three shares (Rs. 6.33 for one existing share).

ADVERTISEMENTS:

Rights can be issued only if authorised by a special resolution of the company. The company making the rights has to inform the existing shareholders as to the use to which the additional funds are put, the future earning capacity of the company and other financial indicators such as sales, estimated gross profit or loss, etc. This information would enable the shareholders to decide to opt for the rights or not.

Preference Shares:

Preference shares are of a hybrid category having ownership rights like equity and also a fixed income like creditor capital. They have preferred rights for payment of dividend, along with arrears, if any, if such provision is made in the articles of association.

They are paid their fixed dividend before any dividend is declared to the equity-holders. Besides they have also similar preferential right over equity to payment of capital and their share of assets in the event of winding up of the company. This right is, however, subject to the claims of creditors.

This instrument is suitable to some investors who would like to take some risk but not as much as equity-holders as but more than debenture-owners. They get an income which may, however, fluctuate depending upon the profits of the company but fixed, if profits are adequate to service all preference and equity-holders. They may also get back their capital after a fixed period like debentures as per the present law.

The return on preference shares is fixed by the Government at 14% since April 1987 although some companies offer a higher or lower rate with the permission of the government. The preference shareholders do not enjoy any voting rights except in respect of resolution affecting their rights or when their dividends due are in arrears for the past two financial years.

ADVERTISEMENTS:

There are various types of preference shares like redeemable and non-redeemable, cumulative and non-cumulative, participating and non-participating and convertible and non-convertible.

Preference shares are redeemable generally after 10 to 12 years and for this purpose, the company is required to provide for transfer out of profits a sum to the reserves called Capital Redemption Reserve. If there is no provision to redeem these shares, they are non-redeemable. As these non-redeemable shares were not popular, they were abolished by the Companies Amendment Act of 1988.

Preference shares which have a right to receive dividends in a cumulative fashion are called cumulative preference shares. These enjoy the right to receive dividends in all the years in which the dividends are skipped, as profits were inadequate in those years.

The fixed dividend on preference shares should be paid later in a cumulative way when profits are adequate before any dividends are declared for equity-holders. Those which have no such right are called non-cumulative preference shares.

Preference shares are convertible, if there is a provision for their conversion into equity after a specified period in a particular ratio to the existing equity shares. Preference shares may not be convertible if no such provision is made. Preference shares are participating, if they can share in profits in excess of a guaranteed fixed return, if such a provision is made in the Articles of the company and specify the level of profitability such as an equity dividend of 20%. If these are not so participative, they are called non-participating.

CCP:

A new instrument called cumulative convertible preference shares was introduced by the government in 1985, the features of which are as follows:

(1) The CCPs can be issued by any public limited company to raise finance for new projects, expansion and diversification, etc.

(2) The amount of issue of CCP will be to the extent of the equity issue to the public for subscription.

(3) The dividend payable is fixed at 10%.

(4) The entire issue of CCP would be convertible into equity shares between three and five years.

These issues have not proved popular with the companies as the dividend on their shares is not a tax deductible item as in the case of interest on debentures. Besides, the dividend of 10% for the first 3 to 5 years has not proved attractive to investors.

But preference shares as a class are attractive to institutions and individuals in the high income brackets as the dividend income on them is tax exempt under Section 80L unlike interest income on debentures and company deposits. But companies themselves do not find these preference shares as an attractive alternative to raise funds, except in the special conditions when the company is unable to raise funds from fresh equities from the public or in the form of rights.

Legal Provisions for Valuation of Securities:

The Companies Act provides for issue of debentures, warrants and other bearer certificates, under Sections 114 to 120. These instruments may provide for an entitlement to the holder a specified number of equity shares. If these debentures or bonds are not convertible into equity or are not converted, the debenture or bondholder has no voting rights in the company and does not become an owner.

But debenture-holders are represented by the debenture Trustee in the meetings of equity-holders (AGM or EGM). They are entitled under the Act, for asking for transfers and for Copies of Annual Reports. In respect of registers to be maintained under Sections 15 and 152 of the Companies Act, the debenture-holders are treated alike as shareholders. The closures of registers, the procedure for transfers of debentures are all similar to those of equity shares.

The SEBI has also laid down that in the event of declaration of bonus by a company with convertible debentures or bonds, due for conversion within 12 months, provision has to be made to protect the rights of such holders to equity and subsequently to bonus, declared during the year. Convertible bonds thus enjoy some specific privileges and incentives.

Norms for N.C.D. of Non-Convertible Portion of P.C.D:

These are pure debt instruments and are governed by norms of issue laid by SEBI. Briefly all debentures are to be credit rated for risk element involved and the capacity of the company to redeem the principal and service the creditors with interest etc.

These debt instruments can be issued subject to the following conditions:

(a) They are to be compulsorily redeemed. Debentures issued for working capital should not exceed 20% of total current Assets.

(b) Debt to equity ratio should normally be 2:1 ratio, except for some capital- intensive projects.

(c) They are creditors of the company and cannot therefore attend the AGMs of the company. But their interests are protected under a debenture Trust Deed.

(d) All debt or debenture issues should be covered by a Trust Deed and a debenture Trustee is appointed to operate under the Trust Deed, which governs the relations of the company and debenture-holders. The Trust Deed and debenture Trustee have to be approved by the SEBI.

(e) The company has to complete the above formalities within 6 months from the date of allotment of debentures and/or dispatch of debenture certificates.

(f) The company has to create a Debenture Redemption Reserve Fund (DRR), out of the profits of the company, after the commercial production started these reserves should reach a stage of 50% of the total debenture amount, before it can be used to redeem the debentures. Besides, their use can be started for repayment purposes, after the company has already redeemed at least 10% of the outstanding amount due from out of the current profits.

Conversion Value:

Conversion value of a convertible security is the conversion ratio of the security, times the market price, per share. Conversion price is the price at which the debenture will be converted into equity. If it is a convertible debenture, it has to be compulsorily converted at the specific price and time which should have been specified in the terms of issue.

If the present market price of TELO is Rs. 260 and the conversion price is fixed at Rs. 250, the premium on conversion is Rs. 10 (260 – 250). The minimum period of holding or conversion time is fixed at the beginning of issue and normally converted on allotment, six months hence etc. If the actual price is Rs. 280 in the market, the investor gains a premium of Rs. 280 – 250 = Rs. 30 per share. If the debenture amount is Rs. 500 and is to be converted into equity shares at Rs. 250 each, two equity shares will be allotted to him and his total premium is Rs. 60 per debenture.

If the debenture is a convertible one, the right to call before conversion by the company is not given, but the call provision may be incorporated in case of N.C.D. or bonds.

In the case of NCD, or non-convertible bond, the company is allowed to offer a premium upto 5%, on the face value, at the time of redemption, as an incentive for holding the debenture until maturity.

Conversion Premium:

Convertibles enjoy the benefit of a premium on conversion. If market price is say Rs. 280 and conversion price is Rs. 250, the premium enjoyed is Rs. 30. If suppose the market price has fallen to Rs. 220, there is no incentive to holders of convertibles on conversion. To offset such contingencies SEBI has permitted conversion only at an incentive price and not at a disincentive. Thus, whatever the market price, a company can offer conversion at the book value/ face value or at a discount of Rs. 20 or so on market price.

In some cases, the option of Call and Put is given to the holders of convertibles, if the period of conversion is after 36 months. Compulsion of conversion is only provided for, if it is made immediately on allotment, so that the market price and intrinsic value of share are all known and the premium on conversion is ensured.

For all conversions, after the allotments, substantial discounts are provided for in the conversion terms. If the debenture is NCD, provision for buy back at face value through a financial institution or a lead bank is made, so that investors do not lose in the capital value of bond due to fall in its price, after allotment.

Brigham’s Model on Convertible Bonds:

The risk-return features of convertible bonds vary widely. The factors which influence them are the coupon rate until conversion, number of years to convertibility and the expected market discount rate. Bondholder invests in the bond as a hedge against risk for the time being until conversion and appreciation on conversion. The return which the bondholder expects is the discount rate which equates the sum of the annual interest payment till the year of conversion and the terminal conversion value in year (N).

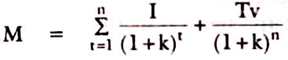

The equation for the Bond price if it is convertible is-

M = Price of bond

Tv = Conversion value if converted

I = Interest received yearly

n = Number of years of holding (t = 1 to n)

k= Discount rate expected

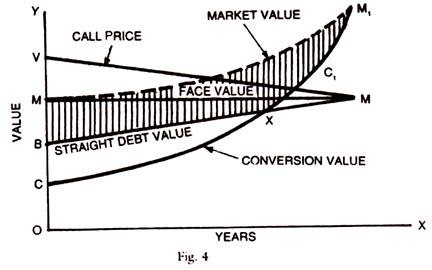

This is graphically explained by Brigham, as shown below:

Take 12% convertible debenture of Tatas — 14% Market Return

MM = Face value =100

B × M = Straight Debt value

M is Maturity Date

MM, Market Price

C × C1 is conversion value of convertible bond. It is assumed that equity stock price of the corresponding bond is growing at a constant price and C × C1 rises accordingly every year, until bond is called for conversion — MM, is the market price of bond, and this will rise with time in a similar manner as conversion value, C × C1, but the latter rises faster as time approaches for call or conversion.

Premium is shown by the shaded area say B × M, (as shown in the graph).

VM is the call price to be paid if the company redeems before maturity and not converted. VM line falls, as it approaches maturity and joins M, on the final date and disappears. Call price is more than the face value, to give incentive for the bondholder to surrender bonds before maturity and not converted. VM line falls, as it approaches maturity and as maturity approaches, the difference narrows down to zero on the date of maturity. On the call date, market value and conversion value become the same. If the bond is not called, it is paid at maturity or converted into stock. Both these alternatives are not as good as call.

The decline in call premium shows VM is downward sloping.

Premium is shown by the shaded area in the graph, Bx, or straight debt value. The premium on the bond will disappear, if it is to be called or if it is converted. The graph shows that the conversion value goes sharply up, as it approaches the conversion time (M1).

In practice premium on conversion from bond to equity will offset the lower interest rate offered on convertible bonds and hence they are more attractive than bonds which are not convertible.

It will thus be seen that there is no simple formula for fixation of price for warrants, loyalty coupons and incentives offered by companies, selling debt instruments to public. Some salient features can however, be stated. First, the warrant will entitle the holder to equity shares at a price lower than the market price — allowing a conversion premium. Second, warrant gives an option to the holder to buy the shares or for a specified amount of money. These warrants have only rights and no obligations and will not put the holder to any loss. It has only incentive value and disincentive is not allowed as per the SEBI guidelines.