Let us make an in-depth study of the IS-Curve:- 1. Subject Matter of the IS-Curve 2. Shifting of the IS Curve 3. The Slope and Position of the IS Curve.

Subject Matter of the IS-Curve:

The AS’-curve is concerned with interest-induced changes in aggregate demand.

The investment function is of great importance to Keynesian theory.

If investment depends upon the real rate of interest, it is clear that the government can change aggregate demand readily through change in the rate of interest. If the level of employment is considered too low it can be remedied by lowering the real rate of interest.

ADVERTISEMENTS:

A reduction in the real rate of interest will induce an increase in investment and hence an increase in the level of aggregate demand. Producers will then respond to the increase in demand by increasing their output, which in turn will require that they increase their level of employment.

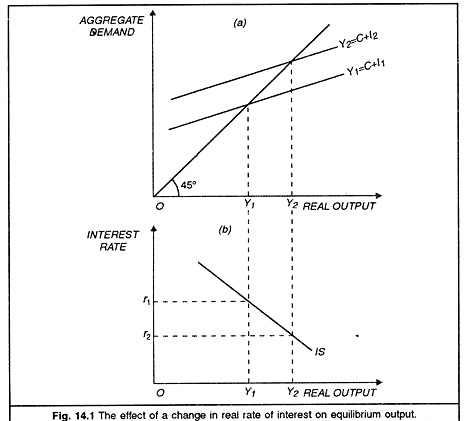

A decrease in the real rate of interest from r1 to r2 will increase investment demand. This is shown in Figure 14.1 (a) as an increase in aggregate demand from C + I1 to C + I2. The increase in aggregate demand causes the equilibrium level of output in the product market to increase from the real amount Y1 to the real amount Y2.

The relationship between the real rates of interest and the corresponding equilibrium levels of the real output in the product market is called the IS curve. For the real interest rate r1 the equilibrium level of real output is Y1. When the real rate of interest is reduced to r2, real investment demand increases and the equilibrium level of real output increases to Y2.

These equilibrium relationships are shown on the IS curve in figure 14.1 (b). At lower real rates of interest, aggregate demand is increased through increases in investment demand and the equilibrium level of output will be higher. Since the IS curve shows all possible equilibrium positions in the product market, it tells the authorities exactly what real rate of interest is required to achieve any desired level of output and employment.

Shifting of the IS Curve:

In deriving the IS curve we have assumed that producer expectations do not change. In other words, we have assumed that investors have not had cause to revise their estimations of the real net revenues expected from capital goods. This assumption is questionable. In his General Theory, Keynes had clearly stated that the investment function was dependent upon investor expectations of net revenues.

To predict the net real revenue from capital goods, investors must predict not only what can be sold on the markets for the product, but also how much will be spent on other factors of production involved in producing the product and on changes in the general price level. Since these net real revenues are predicted for some time in the future, there obviously is a great deal of uncertainty involved. As investor expectations change, the demand for capital goods will change.

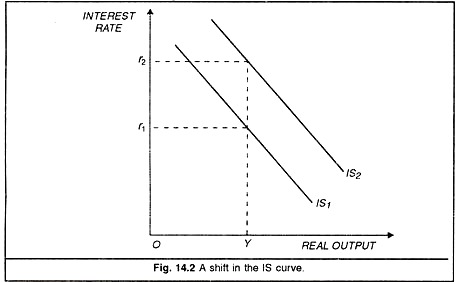

If investors have improved expectations, the demand for capital goods would increase, causing an increase in investment demand for any real rate of interest. The result is a shift in the aggregate demand function and in the IS curve. The IS function will shift out from IS1 to IS2, as shown in figure 14.2. With this shift the real rate of interest required to keep the level of real output at Y will change from r1 to r2. As expectations about the future change, it will be necessary for the monetary authorities to change the real rate of interest continually to maintain the desired level of output.

Even if we assume that it is a simple task for the monetary authorities to change the rate of interest, it is not necessarily advisable to change the rate continually; changing the rate of interest seems likely to increase, rather than decrease, the amount of instability in the economy.

ADVERTISEMENTS:

Keynes had stressed that the investment demand schedule is very unstable owing mainly to instability of the MEC. He was, therefore, very skeptical of the degree to which the economy could be stabilized by changing the real rate of interest. Instead, Keynes advocated that monetary policy should be supplemented by a fiscal policy which tries to stabilise the amount of real investment.

The Slope and Position of the IS Curve:

The IS curve is negatively sloped because a higher level of the interest rate reduces investment spending, thereby reducing aggregate demand and thus the equilibrium level of income. The steepness of the curve depends on how sensitive investment spending is to changes in the interest rate, and also on the multiplier (K). If investment spending is very sensitive to interest rate, then a given change in the interest rate produces a large change in aggregate demand, and thus shifts the aggregate demand curve up by a large distance.

A large shift in the aggregate demands schedule produces a correspondingly large change in the equilibrium level of income. If a given change in the interest rate produces a large change in income, the IS curve is very flat. This is the case if investment is very sensitive to changes in interest rate. On the opposite, if the investment spending is not much sensitive to changes in the interest rate, the IS curve is relatively steep.

Now, we already know that changes in investment spending bring about changes in income depending upon the value of multiplier. If investment spending is very sensitive to changes in interest rate, the value of multiplier is large and hence the change in income is also large which leads to flattening of the IS curve. On the opposite, if the investment spending is relatively insensitive to changes in the rate of interest, the IS curve is steep because of the lower value of the multiplier.

Given that the slope of the IS curve depends on the multiplier; fiscal policy can affect that slope. The multiplier is affected by the tax rate: an increase in the tax rate reduces the multiplier and that makes the IS curve steeper.

How about the position of the IS curve? How does the IS curve shift? The answer is through an increase in investment spending. If investment expenditure increases, income increases multiplier (K) times the change in investment. This shifts the IS curve horizontally by a distance equal to the multiplier times the change in autonomous spending.

Accordingly, an increase in government purchases or transfer payments will shift the IS curve out to the right, the extent of the shift depending on the size of the multiplier. A reduction in transfer payments or in government purchases shifts the IS curve to the left.