The following article will help you to know how to Obtain Equilibrium of Economy using IS and LM Curve.

Equilibrium in the economy occurs when both the money market and the product market are simultaneously in equilibrium.

These two large markets interact, and the adjustments that occur in either of the markets will induce adjustments in the other market.

For example, if product market conditions change and this alters the level of real output, the demand for real money balances will change inducing adjustments in the market real rate of interest.

ADVERTISEMENTS:

Similarly, if conditions in the money market change, causing an adjustment in the market real rate of interest, the level of investment demand will change. This change in the level of aggregate demand will then induce a change in the level of real output in the product market. The interaction between these two markets can be analysed with the use of the IS and LM curves.

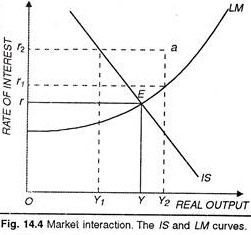

The IS curve represents the relationship between the level of real output and the real interest rate, which generates equilibrium in the money market. These curves, for given levels of government expenditure, taxation, net exports, prices, and anticipated rate of price change are shown in Figure 14.4. Any changes in the conditions that are assumed given for these two curves would be shown as shifts in either the IS or the LM curve.

Suppose that the economy was initially at a real interest rate of r2 and a level of real output of Y2. This is shown by position a in Figure 14.4. At a, both the product market and the money market are out of equilibrium. For the real interest rate of r2 there is not sufficient aggregate demand for real output to sustain the real income level of Y2.

Equilibrium in the product market for a real interest rate of r2 would occur at the level of real output Y1. At point a there is a deficiency of aggregate demand. The unintended inventory accumulation will induce producers to cut back on their production. As a result, real income and employment will decline.

ADVERTISEMENTS:

Similarly, at the real income level of Y2, the real interest rate of r2 is too high for equilibrium in the money market. At point a there is an excess supply of real money balances. Credit conditions will change as individuals attempt to remove these excess holdings of real money balances by acquiring additional bonds, and the market real rate of interest will decline.

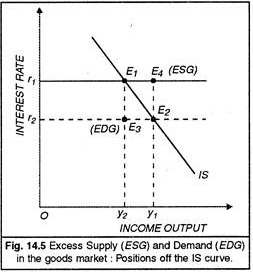

Points off the IS Curve:

Let us now try to understand as to what happens when the economy is in disequilibrium, say on a point off the IS curve. In Figure 14.5, we have the points E3 and E4 which are not on the IS curve. At these points, the goods market is not in equilibrium. So, what is the position of the goods market? Take the point E3. This point is to the left of the IS curve. The economy’s output implied in this combination is shown by the level and the rate of interest r2. At the r2 level of the rate of interest, the real demand for output is that shown by Y2 which means an excess demand for goods (EDG) at the point E3.

The economy will tend to go to the position E2. Likewise, at the point E4, the level of output implied is Y2 with the real rate of interest at the level. Since this point is off the IS curve, it shows disequilibrium in the goods market. At the rate of interest shown by r1, people are prepared to purchase only Y1 level of output while the actual output associated with E4 is Y2. So, there is excess supply of goods at the point E4. The economy will tend to go to the position E1 so as to restore the goods market equilibrium.

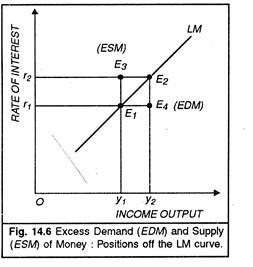

Points off the LM Curve:

We know that the money (assets) market is in equilibrium when the output and rate of interest are such as to equate the demand for money with the supply of money. In Fig. 14.6, the points E1 and E2 show the equilibrium positions of the money market with appropriate combinations of output and the real rate of interest. Now, what happens if the economy is on the point E3 or at the point E4? The point E3 is to the left of the LM curve.

At this high rate of interest r1 associated with E3, there is excess amount of money supply (ESM). This is clear from the fact that the money supply implied in E3 can support the output Y2 while the rate of interest associated with E3can support the output Y1 only. As a result the rate of interest will have to fall to induce higher investment and demand for money to eliminate the excess supply of money.

Likewise, we can argue the position of the point E4 which is to the right of the LM curve. This point combines r1 rate of interest with Y2 level of income. Now this combination is not maintainable because it shows excess demand for money on the part of households and firms.

The money supply available is that shown by E1 while the demand for money as originating from the output Y2 is that shown by E4. Clearly, there is excess demand for money which will have to be adjusted by changes in the rate of interest and output at the same time.